Back in March, I wrote that DraftKings (NASDAQ:DKNG) was a speculative bet and that while it has a big opportunity in front of it as more states legalize online sports betting, it also needs to prove that it can generate positive EBITDA and free cash flow. Since then the stock has performed well, up over 30%. Let’s catch up on the name.

Company Profile

As a reminder, DKNG is an online gambling and fantasy sports platform that offers sports betting, online casino games, and daily fantasy sports. The company operates under its namesake brand, as well as that of Golden Nugget, following an acquisition of Golden Nugget Online Gaming in 2022.

The firm generates revenue through what in the gaming industry is commonly referred to as the hold. This is basically bringing in more money than it pays out, and is achieved a few different ways depending on its offering. For its sportsbook it take a cut of the action and tries to have bets even out as to not take a side, while on the casino side it has odds that favor the casino or a set return that goes to players. With fantasy sports, it simply collects more in entry fees than it pays out.

Upward Trajectory

DKNG’s stock has been on a steady upward trajectory since my initial write-up. The stock got a nice boost after reporting Q1 earnings in May, but it was on the rise even ahead of that.

One of the main questions surrounding DKNG is when it will turn EBITDA and cash flow positive. On that front, the company made some strides in Q1, although does still have a lot of work to do.

For Q1, revenue soared 84% to $769.7 million, while adjusted EPS was a loss of -51 cents. That topped analyst expectation calling for revenue of $697.6 million and an EPS loss of -76 cents.

Adjusted EBITDA was a loss of -$226.1 million, an improvement from a loss of -$289.5 million a year ago. However, on its earnings call, the company said it expects adjusted EBITDA for Q2 to be about breakeven and to generate $150 million in EBITDA in Q4.

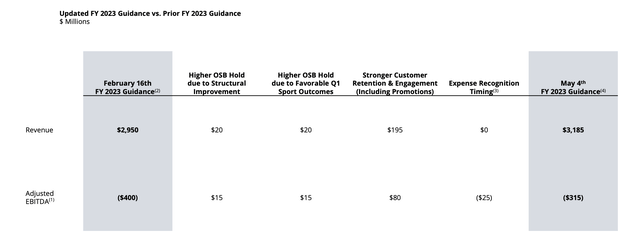

The company raised its guidance for the full year, taking its revenue forecast up to a range of $3.135-3.235 billion, representing growth of 42% at the midpoint, and above prior guidance of $2.85- $3.05 billion. It also upped its adjusted EBITDA guidance, as it now sees a loss of -$290 to -3$40 million versus prior guidance calling for a loss of -$350 million to -$450 million.

The company credited the boosted outlook to better-than-expected customer retention, acquisition, and engagement, which combined accounts for $195 million of the revenue guidance improvement and $80 million of the EBITDA improvement. It said a higher hold percentage will account for another $20 million in revenue and $15 million in adjusted EBITDA improvement versus original guidance.

Company Presentation

One area I discussed as driver for DKNG in my original write-up was launching in more states as they legalize online sports betting and casino games. While that has come to fruition, one thing that is notable is that it is acquiring customers in these states much more quickly than vintage states. At this point, there is already a lot of brand recognition in new states and built up demand by the time DKNG launches online sports betting in new states. As such, its marketing efficiency is improving and its customer acquisition costs are going down. In Q1, CAC was down nearly -30% lower year over year.

The states that DKNG has most recently launched in include Maryland, Ohio, and Massachusetts, with the latter two launching in Q1. There are other states where legalizing online gaming are still on the docket, including Georgia, North Carolina, Texas, Minnesota and Missouri. The overall tide remains in DKNG’s favor.

At a Needham conference last month, CFO Jason Park also noted that investors sometimes misunderstand how older cohorts perform over time, saying:

“I feel like this has been the single most misunderstood part of the DraftKings’ business model. How the order cohorts and therefore, older state vintages behave over time. And that’s why we provided those additional disclosures about the 2018, 2019 vintage and the 2020 and 2021 vintage states because what’s happening is pretty much what we had thought was going to happen all along, which is that you acquire a bunch of customers in the first or second year, you retain them pretty well, you’re reducing your promotional intensity into those customers because you’re investing into that customer in the first year. But you’re bringing them off of that promotional intensity in the second and third year.

“In conjunction, the hold rate is going up. So, the byproduct of all of this is that your GAAP net revenue is screaming coming into that second or third year of a state. … It flows through, depending on which one and that 60% to 80% range. And therefore, that’s why the gross margin rate improved so dramatically, too, as the state enters the second, third, fourth year of operation. And then finally, I think this again, people didn’t understand this is that the absolute marketing dollars you’re deploying into a state in its fourth, fifth, sixth year is coming down because, again, we operate on an LTV to CAC basis. So as the state matures, you’re done acquiring in that state. …. All of those factors are resulting in the very nice cash flow generation coming off of the older vintage states.”

Given the need to quickly get into states and grab market share, it isn’t surprising that DKNG has often operated at a loss. This is a scale business, and companies don’t determine when states legalize gambling. However, once established inside a state, DKNG has proven to be sticky and grow, even as states have matured. The company also continue to get older cohorts to make more bets through introducing new sports they can bet on and new types of bets.

Notably, the company is currently trying to acquire PointsBet’s U.S. business, offering $195 million in cash. PointsBet had previously accepted an offer from Fanatics to for its U.S. assets to be acquired for $150 million. Fanatics has deep pockets, so the bidding war likely isn’t over. Given that scale matters, though, any sportsbook acquisition should be more beneficial to DKNG than a company just looking to enter the space like DKNG.

Valuation

DKNG is not expected to turn EBITDA positive until 2024, when it is forecast to generate a $151.9 million in adjusted EBITDA. Analysts project adjusted EBITDA will increase to $1.16 billion in 2027. Based on 2024 estimates, it trades at 77x, while on 2027 estimates, it trades at 10x.

Revenue is forecast to grow 43% this year to $3.2 billion, getting to $6 billion in 2027.

I previously thought that DKNG would have trouble getting to the 2027 EBITDA consensus, and much of that was due to the cost side of the equation. It made notable progress reducing G&A in Q1 by over 25%. Much of that may have been stock comp, but with revenue estimates up and expenses in check, I think that number does look more achievable now if we ignore stock comp as an expense.

Conclusion

DKNG is a stock I really want to like, as the bullish thesis is pretty straight forward. The company will continue to benefit as more states legalize online sports betting and online gaming. Meanwhile, its marketing intensity should wane as legacy states mature, leading to a lot of operating leverage down the line.

At the same time, valuing a company’s adjusted EBITDA several years out is no easy task, and the company also has its fair share of stock-based comp in those numbers as well.

If I were to make a near-term bet, I’d say that DKNG hits adjusted EBITDA positive (excluding SBC) in Q2 and the stock jumps on that news. That said, for long-term oriented investors, valuation keeps me on the sidelines.

Read the full article here