ProShares UltraPro Dow30 ETF (NYSEARCA:UDOW) is one of the most popular instruments to trade in bullish market conditions. Its daily 3X leverage factor on the Dow Jones is a source of drift, which may be positive or negative. It must be closely monitored to detect changes in the drift regime. This article explains what “drift” means, quantifies it in more than 20 leveraged exchange-traded funds (“ETFs”), and shows historical data on UDOW.

Why do leveraged ETFs drift?

Leveraged ETFs often underperform their underlying index leveraged by the same factor. The decay has essentially four reasons: beta-slippage, roll yield, tracking errors, management costs. Beta-slippage is the main reason in equity leveraged ETFs. To understand what is beta-slippage, imagine a very volatile asset that goes up 25% one day and down 20% the day after. A perfect double leveraged ETF goes up 50% the first day and down 40% the second day. On the close of the second day, the underlying asset is back to its initial price:

(1 + 0.25) x (1 – 0.2) = 1

And the perfect leveraged ETF?

(1 + 0.5) x (1 – 0.4) = 0.9

Nothing has changed for the underlying asset, and the ETF price is down 10%. It is not a scam, just the normal behavior of a leveraged and rebalanced portfolio. A good news: in a trending market, beta-slippage can be positive. If the underlying index goes up 10% two days in a row, on the second day, it is up 21%:

(1 + 0.1) * (1 + 0.1) = 1.21

The perfect 2x leveraged ETFs is up 44%:

(1 + 0.2) * (1 + 0.2) = 1.44

Beta-slippage is path-dependent. If the underlying index gains 50% on day 1 and loses 33.33% on day 2, it is back to its initial value, like in the first example. However, the 2x ETF loses one third of its value, instead of 10% in the first case:

(1 + 1) x (1 – 0.6667) = 0.6667

Without a demonstration, it shows that the higher the volatility, the higher the decay. Hence, its name: “beta” is a statistical measure of volatility. However, it is a bit misleading because the decay cannot be calculated from beta.

Monthly and yearly drift watchlist

There is no standard or universally recognized definition for the drift of a leveraged ETF. Some are quite complicated. Mine is simple and based on the difference between the leveraged ETF performance and Ñ times the performance of the underlying index on a given time interval, if Ñ is the leveraging factor. Most of the time, this factor defines a daily objective relative to an underlying index. However, some dividend-oriented leveraged products have been defined with a monthly objective (mostly defunct ETNs issued by Credit Suisse and UBS: CEFL, BDCL, SDYL, MLPQ, MORL…).

First, let’s start by defining “Return”: it is the return of a leveraged ETF in a given time interval, including dividends. “IndexReturn” is the return of a non-leveraged ETF on the same underlying asset in the same time interval, including dividends. “Abs” is the absolute value operator. My “Drift” is the drift of a leveraged ETF normalized to the underlying index exposure in a time interval. It is calculated as follows:

Drift = (Return – (IndexReturn x Ñ))/ Abs(Ñ)

“Decay” means negative drift. “Month” stands for 21 trading days, “year” for 252 trading days.

|

Index |

Ñ |

Ticker |

1-month Return |

1-month Drift |

1-year Return |

1-year Drift |

|

S&P 500 |

1 |

SPY |

1.02% |

0.00% |

5.43% |

0.00% |

|

2 |

SSO |

1.38% |

-0.33% |

0.80% |

-5.03% |

|

|

-2 |

SDS |

-1.31% |

0.37% |

-13.51% |

-1.33% |

|

|

3 |

UPRO |

1.60% |

-0.49% |

-7.21% |

-7.83% |

|

|

-3 |

SPXU |

-2.31% |

0.25% |

-25.76% |

-3.16% |

|

|

ICE US20+ Tbond |

1 |

TLT |

-3.85% |

0.00% |

-11.66% |

0.00% |

|

3 |

TMF |

-12.66% |

-0.37% |

-43.99% |

-3.00% |

|

|

-3 |

TMV |

12.77% |

0.41% |

28.49% |

-2.16% |

|

|

NASDAQ 100 |

1 |

QQQ |

8.50% |

0.00% |

17.82% |

0.00% |

|

3 |

TQQQ |

25.56% |

0.02% |

18.28% |

-11.73% |

|

|

-3 |

SQQQ |

-22.00% |

1.17% |

-56.29% |

-0.94% |

|

|

DJ 30 |

1 |

DIA |

-2.87% |

0.00% |

3.30% |

0.00% |

|

3 |

UDOW |

-9.57% |

-0.32% |

-8.54% |

-6.15% |

|

|

-3 |

SDOW |

9.95% |

0.45% |

-14.75% |

-1.62% |

|

|

Russell 2000 |

1 |

IWM |

0.17% |

0.00% |

-2.39% |

0.00% |

|

3 |

TNA |

-1.17% |

-0.56% |

-29.29% |

-7.37% |

|

|

-3 |

TZA |

-0.55% |

-0.01% |

-16.51% |

-7.89% |

|

|

MSCI Emerging |

1 |

EEM |

-1.48% |

0.00% |

-5.05% |

0.00% |

|

3 |

EDC |

-5.74% |

-0.43% |

-30.61% |

-5.15% |

|

|

-3 |

EDZ |

5.09% |

0.22% |

4.25% |

-3.63% |

|

|

Gold spot |

1 |

GLD |

-1.49% |

0.00% |

5.37% |

0.00% |

|

2 |

UGL |

-3.79% |

-0.41% |

2.54% |

-4.10% |

|

|

-2 |

GLL |

3.81% |

0.42% |

-8.70% |

1.02% |

|

|

Silver spot |

1 |

SLV |

-7.39% |

0.00% |

4.87% |

0.00% |

|

2 |

AGQ |

-15.55% |

-0.39% |

-3.97% |

-6.86% |

|

|

-2 |

ZSL |

16.45% |

0.84% |

-27.14% |

-8.70% |

|

|

S&P Biotech Select |

1 |

XBI |

3.67% |

0.00% |

21.43% |

0.00% |

|

3 |

LABU |

8.62% |

-0.80% |

4.85% |

-19.81% |

|

|

-3 |

LABD |

-13.91% |

-0.97% |

-74.68% |

-3.46% |

|

|

PHLX Semicond. |

1 |

SOXX |

18.71% |

0.00% |

20.38% |

0.00% |

|

3 |

SOXL |

60.72% |

1.53% |

2.44% |

-19.57% |

|

|

-3 |

SOXS |

-44.27% |

3.95% |

-74.73% |

-4.53% |

The leveraged biotechnology ETFs, both bull – LABU – and bear – LABD – have the worst monthly decays of this list: -0.80% and -0.97%. The highest positive drift in one month is in the inverse semiconductors ETF SOXS: +3.95%, in a large loss.

The worst 1-year decays are in biotechnology with LABU and semiconductors with SOXL: -19.81% and -19.57%. The only positive drift in the same period is for the inverse leveraged gold ETF (GLL) with +1.02%.

Positive drift follows a steady trend in the underlying asset, whatever the trend direction and the ETF direction. It means positive drift may come with a gain or a loss for the ETF. For example, both bull and bear semiconductors ETFs SOXL and SOXS, respectively, show positive 1-month drifts, due to a strong rally in this industry. Negative drift comes with daily return volatility (“whipsaw”).

UDOW drift history

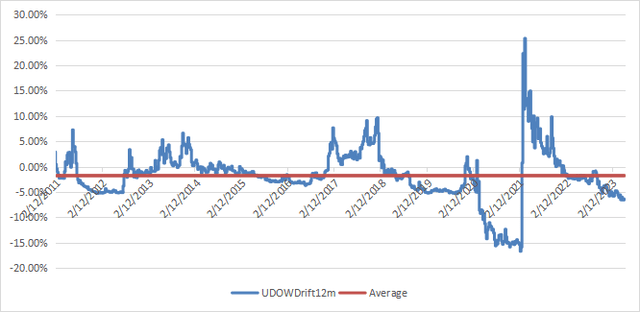

The next chart plots the 12-month drift of UDOW, starting one year after inception for calculation purposes (02/09/2011).

12-month drift of UDOW since 02/09/2011 (chart: author; data: Portfolio123)

The average 12-month drift is negative: -1.8%. It means UDOW has suffered a decay, which was dwarfed by the bullish trend. Since inception, UDOW has gained 1502% (23% annualized) with a maximum drawdown of -80%. The drift went far in negative territory in the March 2020 meltdown due to whipsaw in the index daily returns. It jumped to 25% in positive territory in April 2021, when this bad period went out of the look-back interval. The drift has been negative most of the time since January 2022 due to market volatility.

UDOW since inception, compared to the non-leveraged ETF DIA (Seeking Alpha)

It would look much worse if we could include the 2008 bear market. I don’t have the synthetic price series for UDOW before inception, but I have it for ProShares UltraPro S&P500 (UPRO). Starting in 1999, UPRO would have an annualized return inferior to the non-leveraged S&P 500 (SP500) and a maximum drawdown of -98%. As the Dow Jones has a correlation of 0.96 and a beta of 0.92 relative to the S&P 500 (based on daily returns), performance and risk metrics would be barely better for UDOW. It is a serious warning against holding it for the long-term. Some investors think leveraged ETFs will automatically recover when the market goes back up. Unfortunately, it is not the case: as I wrote in the first paragraph, the drift is path-dependent. Volatility may make losses long-lasting, or even definitive relative to an investor’s life expectancy (or just patience).

In conclusion, leveraged ETFs are only for investors and traders with a good understanding of the products behind the advertised leveraging factor. As with any ETF, read the prospectus, and if you have a doubt, stay away.

Read the full article here