Dycom Industries, Inc. (NYSE:DY) has recently experienced a surge in growth due to solid earnings and guidance. Despite the rise in share price, I maintain a strong conviction that Dycom is an excellent investment opportunity. This belief stems from several factors, including the company’s proficient allocation of free cash flow, reliable guidance, robust financial position, undervaluation based on my discounted cash flow analysis, and the diversification of its revenue streams, particularly in the energy sector. Considering these aspects, Dycom presents itself as a compelling option for investment.

Business Overview

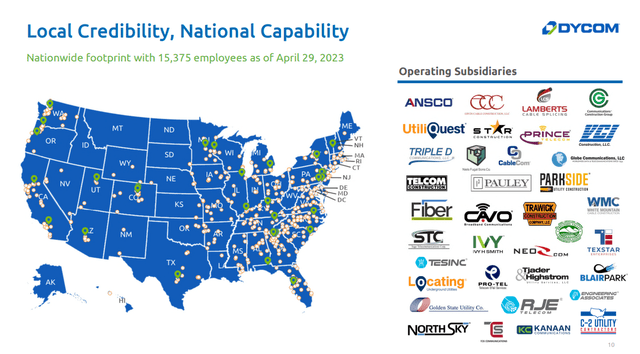

Dycom Industries, Inc. is a US-based business that specializes in offering contractual services to the communications infrastructure and utilities industries. They offer engineering, building, maintenance, and installation services to a range of clients. Here is a condensed and revised version:

In the US, Dycom Industries provides specialist contracting services to the utilities and telecommunications industries. They offer engineering, building, upkeep, and installation services for wireless networks, customer-premises equipment, and coaxial, copper, and fiber optic cable systems. For electric and gas utilities, they also offer site testing, underground facility location, and construction services.

Dycom Overview (Investor Presentation)

Financials

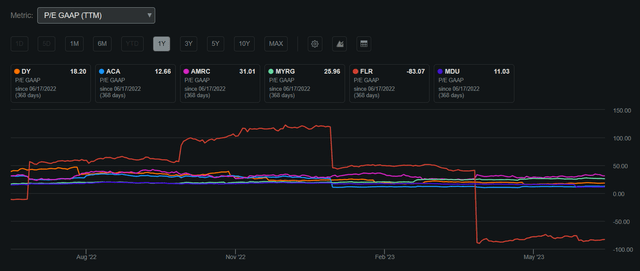

Dycom Industries has a market capitalization of $3.1 billion and a robust return on invested capital of 11%. Its stock price is currently at $105.95, which is slightly above its 200-day moving average of $97.93. With a GAAP P/E of 18.2, Dycom is priced lower than many of its industry peers. This indicates a potential value opportunity, as discussed in the valuation section of the article below.

Dycom 1Y P/E GAAP Compared to Peers (Seeking Alpha)

Even though Dycom Industries does not pay dividends to its shareholders, this fact enables the business to strategically use its free cash flow in order to outperform rivals and accelerate its growth trajectory. A testament to Dycom’s capacity to produce sizable returns on the capital spent in its operations is the company’s solid return on invested capital of 11%.

By effectively utilizing its FCF, Dycom can seize opportunities for expansion and invest in key areas that fuel its growth. This approach enables the company to maintain a competitive edge and capitalize on favorable market conditions when FCF surplus is available. Dycom’s strong ROIC further enhances its growth potential by generating substantial returns on each dollar invested in its business operations.

Dycom Industries has also implemented a stock repurchase program as part of its strategy to boost shareholder value and build upon its already impressive growth trajectory. By repurchasing its own shares from the market, Dycom aims to provide additional benefits and returns to its investors.

Dycom Annual Shares Outstanding (Trading View) Dycom Share Performance (Seeking Alpha)

Earnings

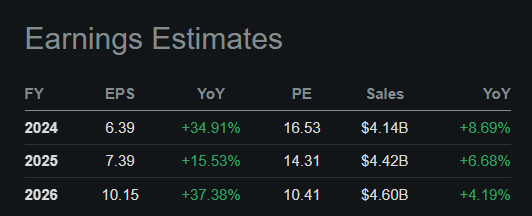

Despite the prevailing economic challenges, Dycom has delivered an outstanding performance in Q1 2024, surpassing market expectations in both revenue and earnings. The company’s earnings per share came in at $1.73, surpassing estimates by an impressive $1.00, while its revenue reached $1.05 billion, exceeding projections by a substantial $109.78 million. This remarkable achievement reflects Dycom’s ability to outperform and seize opportunities in any environment.

I believe this success will only continue into the future due to the company’s ability to diversify its operations, creating stability in its revenues. Diversification will only amplify Dycom’s success due to the opportunity of entering into renewables which will position Dycom for long-term growth.

Looking ahead, industry analysts hold promising expectations for Dycom, further underscoring its potential to reach new heights and navigate potential obstacles. This positive outlook reflects the market’s confidence in Dycom’s ability to sustain growth and create value for its stakeholders in my view.

Earnings Estimates FY 2024-2026 (Seeking Alpha)

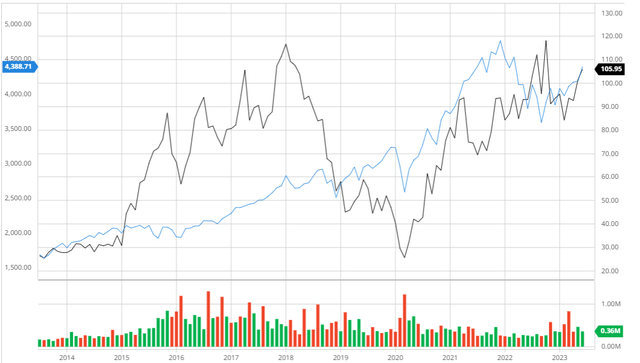

Dycom in Comparison to the Broader Market

Throughout the past decade, Dycom has consistently performed on par with the S&P 500. This underscores the company’s proficiency in efficiently allocating its free cash flow and its aptitude for seizing new opportunities, as exemplified by its rebound following the pullback experienced between 2018 and 2020.

Dycom Compared to the S&P 500 10Y (Created by author using Bar Charts)

Analyst Consensus

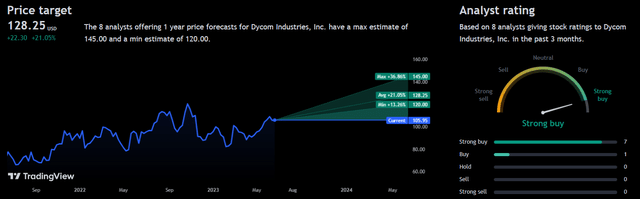

Dycom is currently rated as an average of “strong buy” by 8 analysts within the past 3 months. with an average 1Y price target of $128.25, Dycom presents a potential 21.05% upside.

Analyst Consensus (Trading View)

Balance Sheet

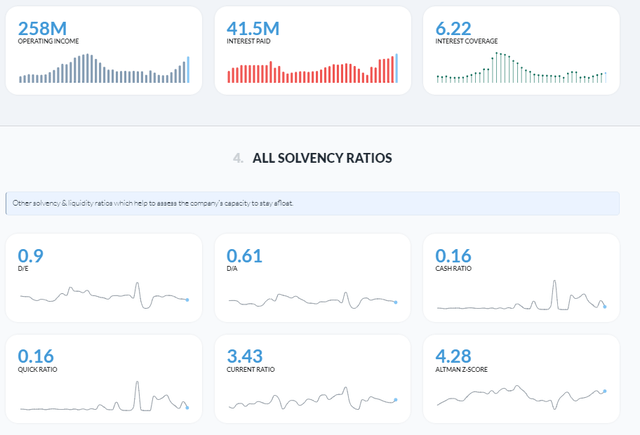

Dycom also holds a solid balance sheet with adequate liquidity to cover expenses as exemplified in the current ratio of 3.43. This enables Dycom to leverage its business model in order to foster growth if needed or fortify its balance sheet to become more resilient and avoid debt concerns in the future.

Financial Position (Alpha Spread) Dycom Solvency (Alpha Spread)

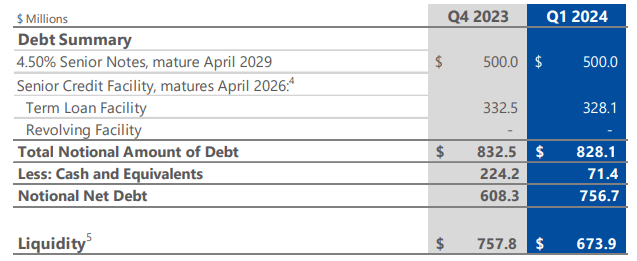

Despite having a fair amount of debt, Dycom possesses long-term maturities with comparatively low-interest rates. This advantageous financial position enables Dycom to leverage borrowed funds for new ventures and core expansion while keeping expenses relatively affordable. As a result, Dycom is able to outperform its competitors by harnessing the power of compound growth.

Dycom Debt Maturity and Liquidity (Investor Presentation)

Valuation

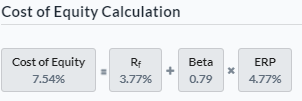

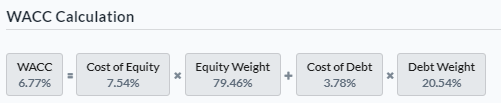

Before establishing my hypotheses and performing a discounted cash flow analysis, I considered it essential to compute Dycom’s Cost of Equity and Weighted Average Cost of Capital using the Capital Asset Pricing Model. Considering a risk-free rate of 3.77% derived from the 10-year treasury yield, my computations demonstrated that the Cost of Equity for Dycom amounted to 7.54%. This figure represents the return that investors demand in order to offset the risk involved in holding Dycom’s equity.

Cost of Equity Calculation (Created by author using Alpha Spread)

Using the mentioned Cost of Equity value as a starting point, I proceeded with an in-depth examination to ascertain Dycom’s Weighted Average Cost of Capital. As a result, I calculated the WACC to be 6.77%, which falls below the industry average of 10.46%. This indicates that the company’s comprehensive cost of capital, encompassing both debt and equity, is comparatively lower when compared to other companies in the same industry.

WACC Calculation (Created by author using Alpha Spread)

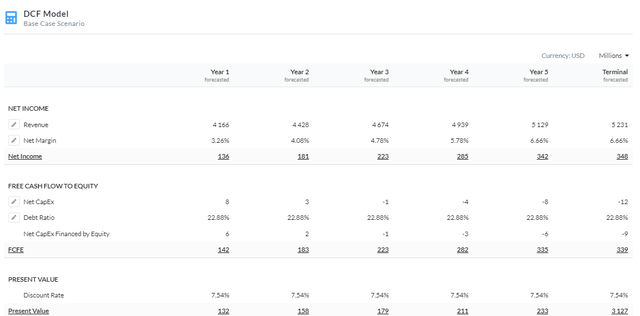

After conducting an analysis utilizing an Equity Model DCF approach, specifically examining the Free Cash Flow to Equity, I have concluded that Dycom is presently undervalued by around 23%, taking into account a fair value of approximately $137.79. This assessment was made by employing a discount rate of 7.54% over a period of 5 years. Additionally, I hold the belief that the company’s capacity to enhance its fundamental operations will result in more stable margins and further expansion in the future.

5Y Equity Model DCF Using FCFE (Created by author using Alpha Spread) Capital Structure (Created by author using Alpha Spread)

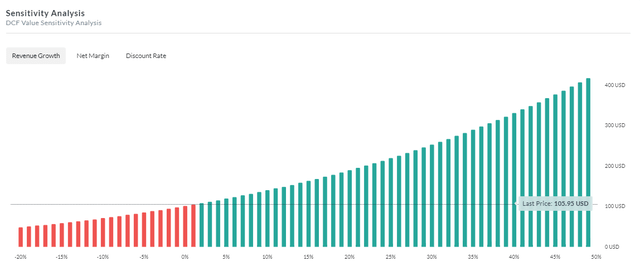

Despite the conservative assumption of a mere 2% revenue growth for Dycom in the coming years, it remains evident that the company is undervalued, considering the incorporation of the Cost of Equity discount of 7.54%. This implies that even with significantly reduced expectations, Dycom’s intrinsic value remains intact.

Sensitivity Analysis (Created by author using Alpha Spread)

Diversification of Services To Seize Opportunity

Dycom Industries is beginning to use a diversity of services strategy to increase income opportunities and lessen reliance on any one customer or market sector. By increasing the range of services it offers, it appears that Dycom hopes to attract more clients and reduce the risks brought on by changes in particular markets.

Dycom has intentionally expanded its capabilities outside of its core telecommunications infrastructure offerings to include renewable energy. They saw the necessity for infrastructure development to meet the rising demand for renewable energy projects. As a result, Dycom increased the scope of its services to incorporate infrastructure services for renewable energy sources, including solar and wind farm development, upkeep, and improvements.

Dycom has lessened its dependency on the telecommunications business and opened up new revenue sources by joining the renewable energy market. Through diversification, they have been able to capitalize on a market that is expanding quickly while utilizing their in-house project management and infrastructure development capabilities.

For instance, Dycom has experience building and maintaining solar farms, where they are responsible for installing electrical connections, solar panels, and other necessary equipment. They offer continuing upkeep and support services to guarantee solar farms work at their best for the duration of their lives.

Dycom now has the opportunity to work with a variety of clients, including utilities, independent power producers, and companies who are developing renewable energy sources. By becoming less reliant on telecommunications projects, it has increased its market reach and resiliency. With an impressive ROIC as mentioned previously, this will only enhance the company’s competitiveness in new industries as it can streamline cash flow from its larger operations to support growth.

Risks

Regulatory and Legislative Changes: Government rules and policies that affect Dycom’s operations and raise compliance costs include changes to licensing specifications, environmental regulations, and safety standards.

Project Delays and Cancellations: Dycom’s business is carrying out projects for customers, which may experience delays or cancellations. Project delays can have an effect on Dycom’s financial performance due to variables including regulatory modifications, customer budget restrictions, or unforeseen events.

Conclusion

To summarize, I believe that Dycom is currently a strong buy due to the company’s effective FCF allocation, strong guidance, solid balance sheet, undervaluation assuming my DCF figures, and diversification of revenues in the energy segment.

Read the full article here