Introduction

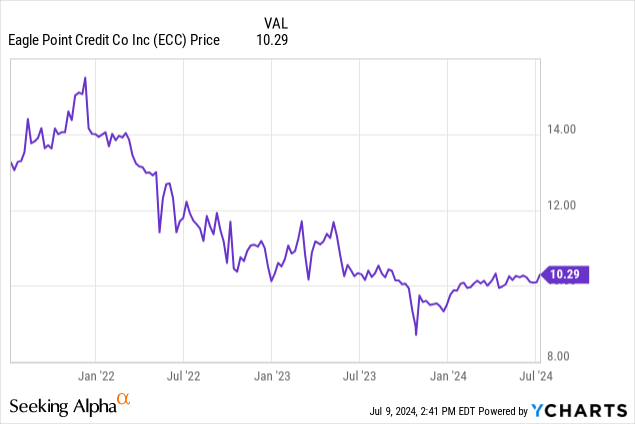

I have recently been increasing my exposure to the more senior securities in the capital stack of CLO CEFs. In a recent article I discussed a series of preferred shares issued by Priority Income Fund (OTC:PRIF) and as the term preferred shares of that CLO-equity focused CEF yielded 8.75% to maturity, I wanted to have a look at another CLO Equity heavy CEF. Eagle Point Credit Company (NYSE:ECC) is the CLO Equity heavy sibling of Eagle Point Income (EIC) which predominantly focuses on CLO debt.

In this article I will predominantly focus on the term preferreds and baby bonds issued by Eagle Point Credit, mainly because I want to reduce the risk and I’m more than happy to accept a lower return to compensate for the lower risk.

The preferred dividends and term notes enjoy good coverage ratios

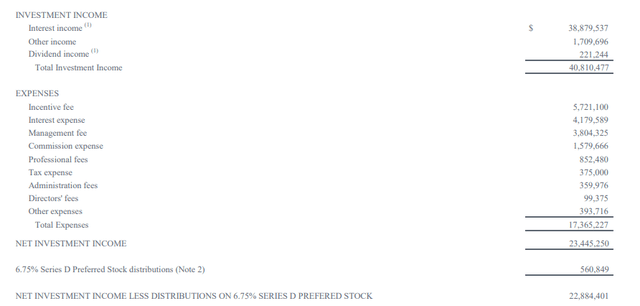

In the first quarter of this year, Eagle Point Credit reported a total investment income of $40.8M and total expenses of $17.4M for a net investment income of $23.4M. As you can see below, the interest expenses and term preferred dividends are included in the operating expenses, except for the Series D preferred shares as those don’t have a firm maturity date.

ECC Investor Relations

The image above is important as it clearly shows the net investment income before taking the preferred dividends and the interest expenses into account was approximately $27.6M and ECC needed less than 1/6 th of that amount to cover the payments on the term preferred shares as well as the baby bonds. This also means the CEF can easily cover in excess $20M per quarter in losses on its investment portfolio before jeopardizing the preferred dividends and interest payments. Considering the total investment portfolio is less than $1B, I dare to say the owners of the preferred securities and debt securities should be well-shielded from potential defaults in the portfolio. While investing in CLO equity is inherently riskier than investing in CLO debt, the current returns on ECC’s positions should be sufficient to absorb the impact of above-average default rates.

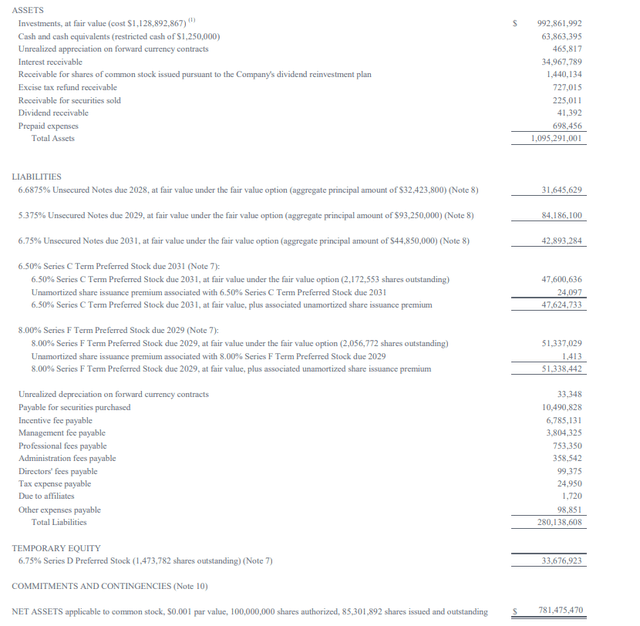

And this brings us to the balance sheet. As you can see below, the total size of the balance sheet is almost $1.1B with just $280M in liabilities and an additional $34M in perpetual preferred shares. The total amount of net assets attributable to the common equity holders of ECC was $781.5M and that will be the first buffer in case things go south. Of the $993M in investments, $725M consisted of CLO Equity tranches.

ECC Investor Relations

Considering the total net investment income (excluding realized and unrealized gains and losses on the portfolio) represents a multiple of the total preferred dividends and interest payment requirements, and considering there is almost $800M in common equity on the balance sheet, which ranks junior to the preferred securities, I feel comfortable owning the more senior securities in the capital stack.

And of course, keep in mind there is a regulatory requirement to provide an asset coverage ratio of 200% for preferred equity and 300% for debt securities. As soon as the ratio risks dropping below that percentage, Eagle Point Credit will have to take action to remedy the situation. So while the baby bonds are ‘unsecured’, the 300% asset coverage ratio requirement provides an additional layer of safety.

Zooming on a specific baby bond and term preferred share

Eagle Point Credit currently has three series of term preferred shares and three series of baby bonds outstanding. I’m personally more interested in the baby bonds for two specific reasons: first of all, they obviously rank higher in the capital stack and will always be more senior than preferred equity. And secondly, as a foreign investor, interest payments are treated different than dividend payments. Whereas the reduced dividend tax rate of 15% levied by the USA is also valid on term preferred shares, there is no withholding tax on the dividends paid on the baby bonds. Of course, every investor’s situation can be different, so you shouldn’t hesitate to consult a tax specialist to figure out what works best for you.

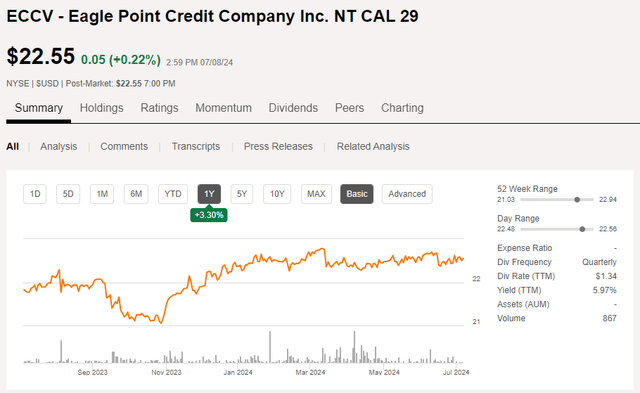

I also wanted to add duration to my portfolio so my initial focus was on the 6.75% notes maturing in 2031 which are trading with ECCW as ticker symbol, but the yield to maturity is just around 7.2%. And that’s why the 2029 notes were a bit more interesting to me. Trading with NYSE:ECCV as ticker symbol, these notes mature at the end of January 2029 and have a 5.375% coupon. At the current price of just US$22.55 per baby bond, the yield to maturity is a very respectable 8% (rounded).

Seeking Alpha

So while these baby bonds mature two years earlier than ECCW, I like the substantially higher YTM and the total return on the remaining 4.5 years will be approximately 34% (rounded) and I can reinvest the proceeds in 2029 in another security (and perhaps into the 2031 baby bonds).

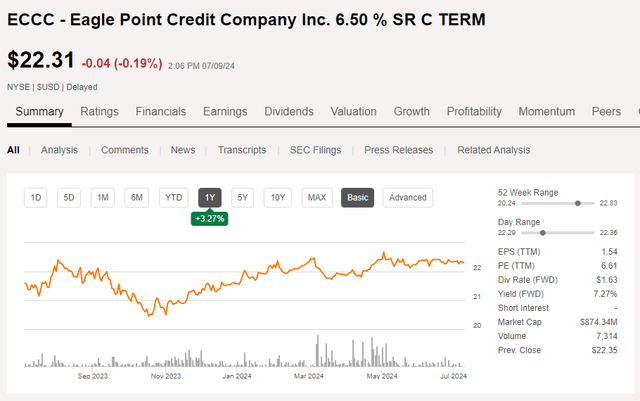

For investors interested in receiving preferred dividends rather than interest income, the 2031 term preferred stock trading with NYSE:ECCC could be an interesting solution. Trading at $22.31 per preferred share and maturing in June 2031, the yield to maturity is approximately 8.55%.

Seeking Alpha

While I would prefer an 8% yield to maturity on debt over an 8.55% yield to maturity on preferred equity, there are plenty of legitimate reasons to prefer ECCC. The maturity date is only in 2031 which results in a higher total return and a longer period of 8%+ returns, while for some investors it is more tax advantageous to collect dividends rather than interest payments.

Investment thesis

I currently have no position in Eagle Point Credit nor in any of its preferred shares or baby bonds. However, I will be looking to initiate a long position. Ideally in the baby bonds with ECCV as my preference but given the 200% asset coverage ratio requirement, I don’t mind having exposure to the preferred shares either.

Read the full article here