Earthstone Energy (NYSE:ESTE) is being acquired by Permian Resources (NYSE:PR) for approximately $4.5 billion (including the assumption of net debt). This will create a combined company with approximately 300,000 BOEPD in production and over 400,000 Permian net acres. Both companies have grown substantially through acquisitions/mergers over the years.

My standalone valuation estimate for Earthstone is approximately $17 per share, while standalone Permian’s value was estimated at $12 per share a month ago. This is a ratio of 1.417 to 1. As a result, Permian’s offer of 1.446 Permian shares for 1.0 Earthstone shares appears to be reasonable to me.

Assuming that Permian can achieve most of its projected synergies from the deal, I would bump up its estimated value to approximately $13 per share. This increases to approximately $13.50 per share if it can achieve all its projected $175 million per year in post-acquisition savings.

Transaction Notes

The deal is structured as an all-stock transaction with an exchange rate of 1.446 Permian shares for 1.0 Earthstone shares. Based on Permian’s closing price from August 18, this values Earthstone at $18.64 per share.

Permian is expected to issue around 211 million shares as part of the transaction, resulting in existing Earthstone shareholders owning around 27% of the combined company. The combined company would then have 777 million outstanding shares.

Shareholders owning 49% of Permian’s and 48% of Earthstone’s outstanding shares have executed a voting and support agreement in connection with the transaction, so this deal is expected to close by the end of 2023.

Earthstone’s Standalone 2H 2023 Outlook

Earthstone expects to average approximately 125,000 BOEPD (41% oil) in 2H 2023. This includes 117,500 BOEPD (41% oil) in Q3 2023 production and 132,500 BOEPD (41% oil) in Q4 2023 production. This guidance includes 1.5 months of Novo production in Q3 2023 and the full three months of Novo production in Q4 2023.

Earthstone’s share of Novo’s production was approximately 38,000 BOEPD before, but Earthstone was expecting to allow that to fall to around 30,000 BOEPD in order to improve near-term cash flow generation.

At current high-$70s strip for the second half of 2023, Earthstone is projected to generate $950 million in revenues including hedges. Earthstone’s 2H 2023 hedges have around negative $30 million in estimated value since it has Waha basis hedges on close to 60% of its 2H 2023 natural gas production at negative $1.67 to NYMEX.

Waha differentials have narrowed significantly, resulting in projected hedging losses, but also improving realized prices for Earthstone’s natural gas (before hedges).

| Type | Units | $/Unit | $ Million |

| Oil (Barrels) | 9,430,000 | $77.00 | $726 |

| NGLs (Barrels) | 6,325,000 | $24.00 | $152 |

| Natural Gas [MCF] | 43,470,000 | $2.35 | $102 |

| Hedge Value | -$30 | ||

| Total Revenue | $950 |

Earthstone is thus expected to generate $184 million in free cash flow in 2H 2023 at current strip prices.

| Expenses | $ Million |

| Lease Operating | $207 |

| Production Taxes | $86 |

| Cash G&A | $30 |

| Cash Interest | $70 |

| Capital Expenditures | $373 |

| Total Expenses | $766 |

Earthstone’s net debt was $1 billion at the end of Q2 2023. It also had paid a $75 million deposit for the Novo acquisition. In addition to that deposit, Earthstone ended up paying approximately $860 million upon closing of the Novo acquisition after the purchase price adjustments.

This left Earthstone with $1.86 billion in net debt. Earthstone’s projected free cash flow in 2H 2023 would reduce its net debt to approximately $1.68 billion before any working capital changes. Earthstone does have a working capital deficit though, and including its working capital deficit in net debt would result its projected net debt end up at around $1.87 billion at the end of 2023.

Notes On Valuation

My latest estimated value for standalone Earthstone is approximately $17 per share in a long-term (after 2023) $75 WTI oil and $3.75 NYMEX gas environment. This is up $1.50 per share from when I looked at it in May due to improved near-term commodity prices, plus the effect of the subsequent Novo acquisition.

I had also estimated a value of approximately $12 per share for Permian Resources in late July. This results in a relative value of 1.4167 Permian shares to 1.0 Earthstone shares. Thus the deal ratio of 1.446 Permian shares for 1.0 Earthstone shares seems quite fair to me.

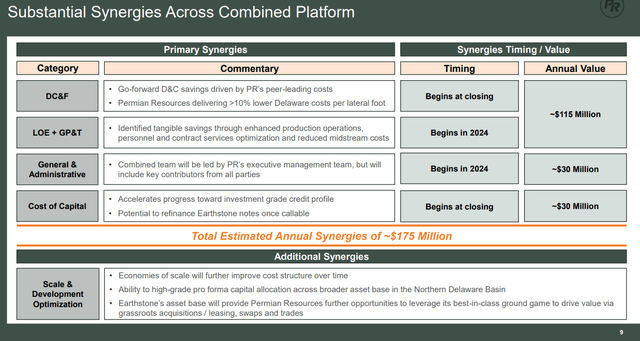

Permian anticipates total annual synergies of approximately $175 million from factors such as improved capital efficiency, reduced midstream costs and G&A reductions.

Earthstone Deal Synergies (permianres.com)

If it can achieve the majority of these savings, I’d estimate Permian’s value at approximately $13 per share in a long-term $75 WTI oil and gas environment. Achieving the full $175 million per year in savings would increase Permian’s value to around $13.50 per share.

At 1.446 Permian shares to 1.0 Earthstone share ratio, that would make Earthstone worth approximately $18.80 and $19.52 per share respectively.

Conclusion

Permian Resources is acquiring Earthstone Energy in a transaction that values it at approximately $4.5 billion and offers 1.446 Permian shares to 1.0 Earthstone shares. This appears to be a fair price given that I estimate standalone Earthstone’s value at $17 per share and standalone Permian’s value at $12 per share (a 1.417 to 1.0 ratio).

The expected savings and improved efficiencies from the deal could boost Permian’s value to approximately $13 per share (assuming the majority of savings are achieved) to $13.50 per share (assuming all $175 million per year in projected savings are achieved). This also involves my long-term commodity prices of $75 oil and $3.75 natural gas.

Thus I believe that Earthstone and Permian are both currently fairly priced for a long-term $75 oil and $3.75 natural gas commodity pricing environment.

Read the full article here