Today, easyJet (OTCQX:EJTTF, OTCQX:ESYJY) just released its trading update for the quarter ended in June. Here at the Lab, we have long waited for “a Summer Season Rebound,” and easyJet is finally delivering. Before going into the details, we see support from the company’s load factor evolution and the CEO’s latest words. Our buy rating is supported by 1) consumers’ willingness to spend more on travel & entertainment despite inflation, 2) a zero debt balance sheet target, and 3) new aircraft to expand the company’s profitability. In addition, with the latest update, easyJet also confirmed a 163 new aircraft order with delivery estimated in 2028. Here at the Lab, we are forecasting a CAPEX plan of €16 billion over the period. The new aircraft will consume 20% less fuel and have a 4% additional passenger capacity.

Q3 results

Despite the good news with a plan to hit new profit records for the summer thanks to higher ticket prices and record booking, the company warned about ‘unprecedented’ air traffic control disruption. This is why the company’s stock price is down by 2% at the time of writing.

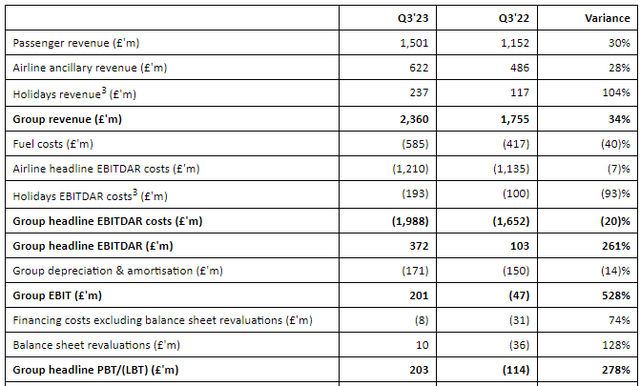

In detail, the company delivered a record £203 million pre-tax profit in Q3, beating analyst forecasts, as travel demand continued to recover despite ongoing strikes that have caused only limited disruption. Here at the Lab, we are confident that European airlines will deliver substantial gains, as bookings levels are now similar to 2019.

The company improved profit by £317 million, given that easyJet reported a negative performance of £114 million last year. Q3 turnover reached £2.36 billion, slightly beating consensus expectations of £2.3 billion. This was supported by higher revenue per passenger per seat (up by 24%) and solid performance per ancillary passenger (up by 22%). There was a positive one of currency development for £2 million and a better non-cash financing cost given a weaker USD for approximately £10 million.

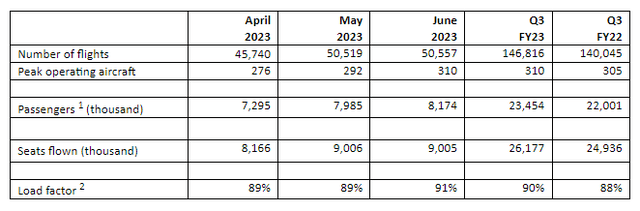

What is critical to report is that ex-fuel, 2H 2023 guidance is better than expected, with the company’s forecast at +10% on revenue per passenger. These are the CEO’s words: “We continue to see good momentum as we move into Q4, where we will be operating over 160,000 flights and expect to deliver another record PBT performance. This winter, we are adding more than 15% capacity and seeing bookings ahead of last year.” As already mentioned, we report positively on easyJet’s load factor evolution. The company is increasing performance on a monthly sequential basis.

load factor evolution

Source: easyJet trading update

The Q4 outcome expectations are over £100 million, with bookings for winter already over 100%. The company’s 77% fuel costs are hedged in H2 2023, with 58% and 29% in H1 and H2 2024, respectively. Oil prices are also stabilizing, so this might be a positive surprise for easyJet’s cost per seat. As reported by the CEO, this winter, the company is adding more than 15% of capacity.

easyJet Q3 Financials in a Snap

Conclusion and Valuation

In line with our buy rating, the company repaid $950 million of debt in Q3, leading to a minus £1.2bn debt reduction over the financial year. Winter is coming, and it seems that easyJet is seeing good booking momentum. We confirm our estimates of easyJet’s medium-term goals to grow capacity to 105 million passengers annually. Our FY 2024 estimate led easyJet turnover at £8.2 billion with an EBIT profit margin of 8% (unchanged). Following the latest trading update, we feel we were right to be ahead of Wall Street, which gave us more confidence in easyJet’s future. Therefore, we decided to leave unchanged our target price set a target price of 560p per share. Aside from the usual risk already emphasized in our initiation of coverage, we should report that the Italian Antitrust Authority launched an investigation against Ryanair, ITA, Wizz Air, and easyJet to establish whether they have distorted competition by increasing air ticket prices during the 2022 Christmas holidays. Litigation risk is an additional downside for easyJet.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

Read the full article here