Unlock the Editor’s Digest for free

Roula Khalaf, Editor of the FT, selects her favourite stories in this weekly newsletter.

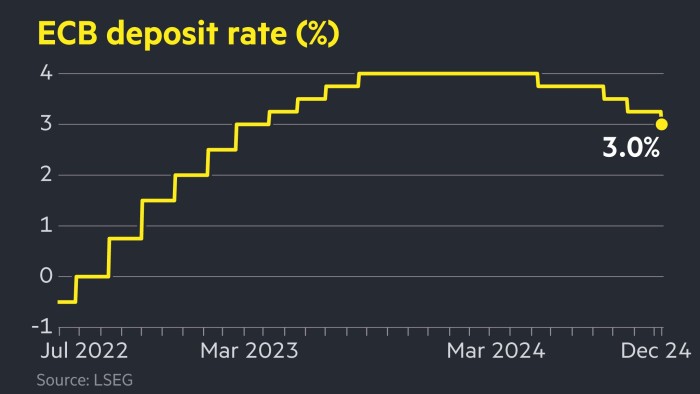

The European Central Bank has cut interest rates by a quarter point to 3 per cent, as it watered down its hawkish language and warned that growth would be weaker than it had previously forecast.

The ECB’s cut — its fourth reduction in borrowing costs since June — takes the central bank’s benchmark deposit rate to its lowest level since March 2023.

It came as the ECB warned that the Eurozone economy would grow just 1.1 per cent in 2025, down from its September estimate of 1.3 per cent.

The ECB dropped its commitment to “keep policy rates sufficiently restrictive for as long as necessary” to bring down inflation in line with its 2 per cent target. Instead it stressed that the “effects of restrictive monetary policy” would be “gradually fading” over time.

Pointing to the more dovish tone of the release, Deutsche Bank economist Mark Wall said: “The door has been opened more clearly to further cuts.”

The ECB also cut its growth forecast for 2026 by one percentage point to

1.4 per cent and is even more pessimistic for 2027, when it expects just 1.3 per cent of GDP growth.

It is expecting headline inflation of 2.1 per cent in 2025, 1.9 per cent in 2026 and 2.1 per cent in 2027.

“The risks are tilted towards the ECB having to do more, not less, to support the economy in 2025,” said Dean Turner, chief Eurozone economist at UBS Global Wealth Management.

But he cautioned that “this is more likely to result in further cuts later in 2025 rather than larger moves in the near term”.

Investors anticipate that the ECB will cut rates more than the US Federal Reserve next year, given that growth in the Eurozone is widely expected to lag behind that of the US.

The currency area’s export-heavy economy is also vulnerable to president-elect Donald Trump’s threat to impose sweeping tariffs of up to 20 per cent on all US imports.

“Gradual easing is the message,” said Mariano Cena, senior European economist at Barclays.

Traders in swaps markets largely kept their bets unchanged after the decision. They expect the ECB to carry out a further five quarter-point cuts by next September, which would take the deposit rate to 1.75 per cent.

Swaps markets are pricing in around 0.75 percentage points of cuts from the US Federal Reserve over the same time period, which would bring the target range down to between 3.75 and 4 per cent.

The euro was unchanged at $1.049 in early trading after the widely anticipated reduction.

Earlier in the day, the Swiss National Bank halved its main policy rate to 0.5 per cent, a bigger-than-expected cut.

Read the full article here