The iShares MSCI Denmark ETF (BATS:EDEN) is a value-weighted ETF containing prominent Danish equities, with a large weighting to Novo Nordisk (NVO). The Danish stock market has gathered a lot of market cap through significant consumer brands, but mainly through prominent pharma companies, with some utilities sprinkled in there as well. The exposures are definitely of quality, but they come at a price. Don’t trust the iShares provided PE ratio, it’s a lot higher just going off the main allocations, but maybe that’s alright for investors who are looking for quality at any price.

EDEN Breakdown

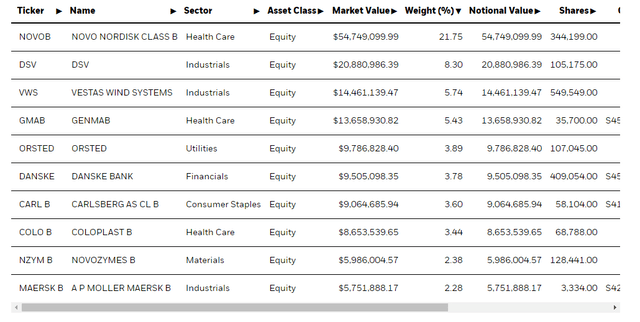

Let’s start with some of the company’s primary holdings:

EDEN Top Holdings (iShares.com)

Novo Nordisk is a great example of the sort of quality that drives EDEN performance. They are growing rapidly thanks to a shift away from insulin-based diabetes care to their new set of therapies built on GLP-1. These are beginning to dominate the mix. Otherwise, obesity care medication is number two. Major demographic forces and public health forces support these markets, and the revenues are recurring. No major patent expiries on the immediate horizon. Typical markers of quality for a 31x PE, which is not expensive considering the growth rates, but is also not a bargain.

Otherwise exposures include DSV which is logistics, some renewable utility and renewable generation plays, and then more pharma related exposures in Genmab (GMAB).

Healthcare exposures are 38% of the overall ETF, followed by industrial at 26% including some of the renewable generation picks, and then consumer staples and financials after that which are going to have a presence in every economy. Consumer staples includes beverage exposures like Carlsberg (OTCPK:CABGY).

Bottom Line

Because there are a lot of foreign holdings the expense ratios are a little high at 0.53%. Moreover, the given PE ratio is around 11x, which we think is an error considering 40% of the ETFs allocations from the top 5 all have PEs well above 20x. We think it’s because some stocks with negative earnings are perverting the average PE figure, including Vestas (OTCPK:VWDRY). The real valuation indicator comes from the yield at 1.3%, which is pretty compressed due to relatively high valuations and heavy company reinvestment to grow into those valuations.

Ultimately, stocks like Novo Nordisk which alone has a 22% allocation are not undervalued, and are being appraised for their long patent horizons, leadership in highly profitable pharma verticals, and economics that are strong relative to its already resilient and cash generative sector. However, these are major international pharma players that have been fully appraised by markets. There isn’t likely to be a valuation edge, but if you want to make a quality bet with recession resistance from pharma, it’s not a bad pick.

Thanks to our global coverage we’ve ramped up our global macro commentary on our marketplace service here on Seeking Alpha, The Value Lab. We focus on long-only value ideas, where we try to find international mispriced equities and target a portfolio yield of about 4%. We’ve done really well for ourselves over the last 5 years, but it took getting our hands dirty in international markets. If you are a value-investor, serious about protecting your wealth, us at the Value Lab might be of inspiration. Give our no-strings-attached free trial a try to see if it’s for you.

Read the full article here