Introduction

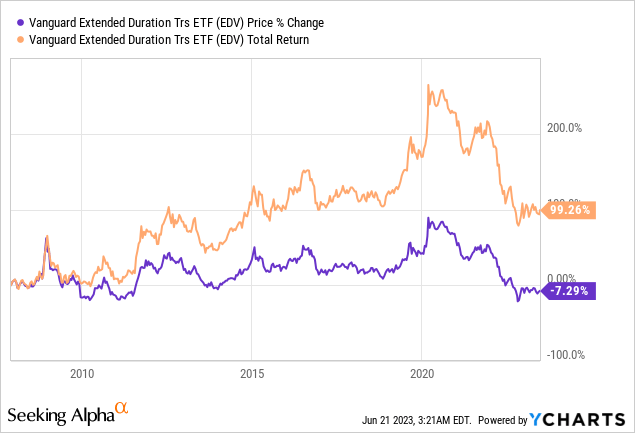

U.S. treasuries had fallen sharply in 2022 and has since been range-bounding in 2023. Should investors start investing now? In this article, we will analyze Vanguard Extended Duration Treasury ETF (NYSEARCA:EDV) and provide our insights and recommendations.

ETF Overview

EDV invests in extended duration U.S. treasuries. It has an average duration of 24.4 years. The fund has been in a rangebound since the beginning of this year. We are likely towards the end of this rate hike cycle as inflation is gradually cooling down albeit at a slower pace than we’d like. Therefore, the impact of rate hike on EDV’s fund price should be less severe than 2022. On the other hand, in this macroeconomic uncertain environment, EDV’s fund price should be much more resilient than other types of funds as U.S. treasuries are often perceived as risk-free assets. Therefore, we think investors with a long-term investment horizon should start accumulating shares of EDV as upside risk outweighs downside risk.

YCharts

Fund Analysis

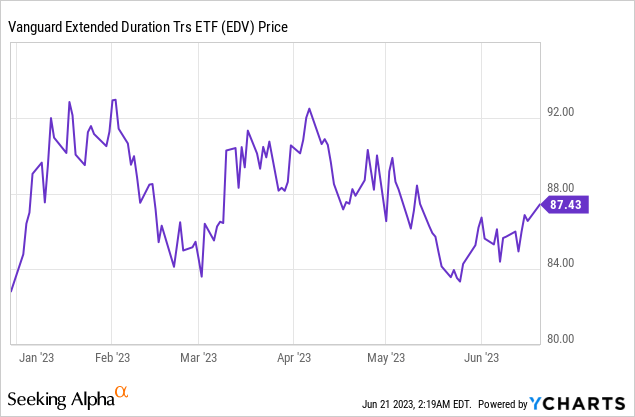

EDV has been in a rangebound in H1 2023

Following a disastrous 2022 due to the Federal Reserve’s aggressive rate hikes, the bond market is now much more stabilized in 2023. EDV is not without exception. In fact, it has lost nearly 51% of its fund price since reaching the peak in late 2020. However, EDV’s fund price has been in a rangebound in 2023. As can be seen from the chart below, EDV’s fund price has been in the range of about $84 and $92 for most of the first half of 2023.

YCharts

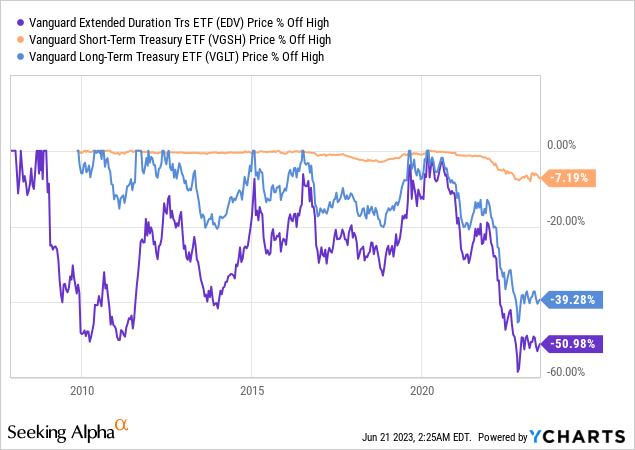

EDV is more sensitive to rate changes than shorter duration treasuries

Below is a chart that compares EDV with Vanguard Short-Term Treasury ETF (VGSH) and Vanguard Long-Term Treasury ETF (VGLT). Both 3 funds have suffered prices decline since reaching the peak in late 2020. The primary reason of the decline was due to the Federal Reserve’s aggressive rate hikes in 2022. As can be seen from the chart below, EDV’s decline of nearly 51% was worse than VGLT’s decline of 39.3% and much more severe than VGSH’s decline of 7.2%.

One may wonder why EDV suffered a much greater loss than its shorter duration peers VGLT and VGSH. The reason is simple. Longer duration treasuries typically are much more rate sensitive than shorter duration treasuries. The average duration of treasuries in EDV’s portfolio is 24.4 years. This duration is significant longer than VGLT’s 16.0 years and VGSH’s 1.9 years. This explains why EDV was much more volatile in the past two years than its shorter duration peers VGLT and VGSH.

YCharts

Will rate continue to rise?

As we have just mentioned, EDV’s significant price decline was primarily due to the Federal Reserve’s aggressive rate hike to combat inflation last year. While inflation has gradually cool-down, it is still far from the Federal Reserve’s long-term target of about 2%. Therefore, the Federal Reserve is likely to continue to keep the rate elevated for a lengthy period. However, we do not believe the Federal Reserve needs to raise the rate much higher from the current level in the second half of 2023 as it usually takes about 6 ~ 12 months for the effect of monetary policy to take effect and ripple through the economy. Therefore, inflation should continue to cool-down gradually.

Investors should not worry about an economic recession

While many people are concerned that there will be a recession coming in late 2023 or early 2024, we do not think investors of EDV need to be worried. This is because U.S. treasuries are perceived as risk-free assets. In fact, the U.S. government has one of the best credit ratings in the world. Unlike other types of bonds (e.g. corporate bonds, high yield bonds) that typically underperform when the market is in a panic mode (e.g. during the outbreak of COVID-19) or in the midst of a recession, many capitals will move from other types of bonds or equities and invest in U.S. treasuries to seek safety. Since EDV’s portfolio only includes U.S. treasuries, we do not perceive any risks during an economic recession.

Investors should start accumulating EDV

EDV’s current 30-day SEC yield is about 4% right now. This is quite attractive. Given that we may be very close to the end of this rate hike cycle, investors may wonder whether this is a good time to start investing. Our recommendation is yes, especially if you have a long-term investment horizon. While there may still be some downside risks as the Federal Reserve may still raise the rate higher in the near-term, we are likely near the end of this rate hike cycle as we have seen inflation gradually coming down. As inflation continue to fall, the Federal Reserve will eventually have the room to lower the rate. Even if inflation is persistently higher longer and triggers a recession, money will flow from other assets towards U.S. treasuries. Therefore, we think it is pretty safe for investors to gradually accumulate EDV now and enjoy this attractive 4%-yielding interest income.

Investor Takeaway

EDV’s portfolio of extended duration treasuries is quite safe even in times of economic uncertainties. We think investors should take advantage of EDV’s attractive yield right now and start accumulating shares especially that its upside risk appears to outweigh its downside risk.

Read the full article here