EHang Holdings Overview

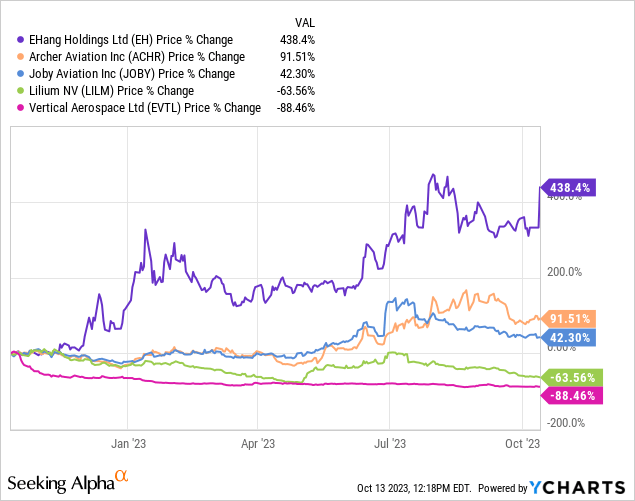

When I last covered EHang Holdings Limited (NASDAQ:EH) at the end of 2022, the Chinese autonomous aerial aircraft manufacturer was chasing certification for its EH216-S from the Civil Aviation Administration of China. Enthusiasm around certification from the Chinese equivalent of the Federal Aviation Administration later would push up the shares of EHang to highs that it has built on since then. The company is up a staggering 400% over the last 1 year, outperforming its eVTOL rivals from Vertical Aerospace (EVTL) to Joby Aviation (JOBY) by a large margin.

EHang’s current market cap at $994 million is the aggregate of the two worst-performing eVTOL tickers and has come even as stock market sentiment for Chinese companies dampened. Full certification has now been received, with the company’s shares resuming trading after a suspension in place since 9 October 2023. The certification confirms that the EH216-S’s model design fully complies with CAAC’s safety standards and airworthiness requirements.

I think EHang’s historic outperformance could repeat itself in 2024, as its peers experience a reversion to new lows on the back of their continued cash burn and lack of certification traction. The company first received CAAC certification in August 2023 for its Unmanned Aircraft Cloud System (“UACS”) for test operations. The UACS includes the functionality for managing flight plans and operators, airspace management, and integrating uncrewed aerial vehicles. The CAAC approval for UACS set an immediate backdrop for the company to launch commercial operations following the full certification of the EH216-S.

Liquidity is important also against this, with EHang raising $23 million from a South Korean entrepreneur to boost a cash and equivalents position that sat at $17.5 million at the end of its fiscal 2023 second quarter.

The China Order Pipeline

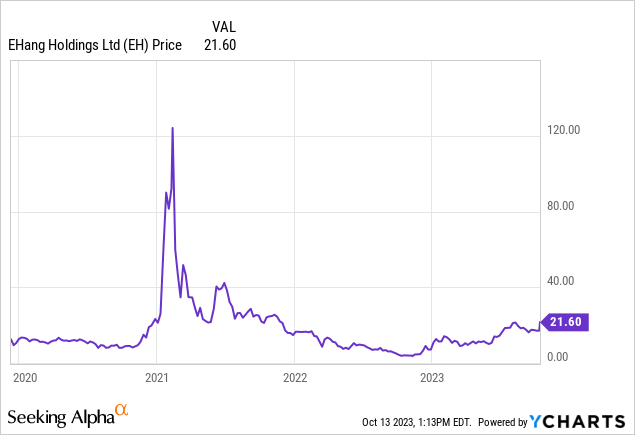

Sentiment is key in a space whose initial foundations were built around the hype of early 2021 trading. My first article on EHang was published around this time, with the ticker trading hands then for $61 per share.

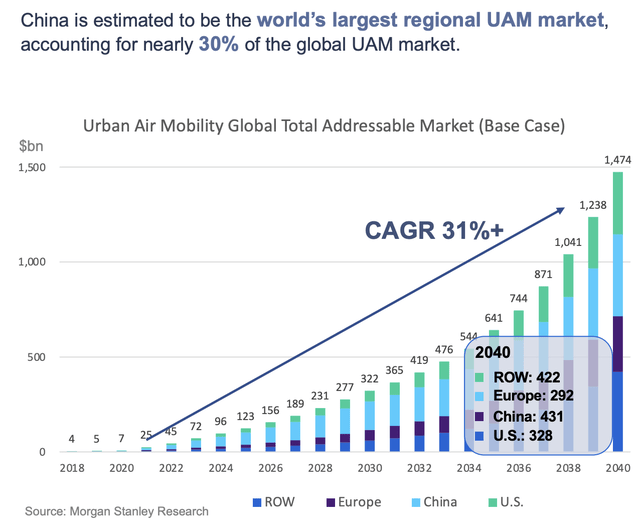

There are a few truths from the bullish camp. Firstly, China has clear leadership in the drone space with Shenzhen-based DJI being the world’s preeminent consumer drone company. Further, the Chinese authorities were indeed always keen to support a domestic company is a space that’s been frequently flagged as one of the moonshot industries of the future. eVTOLs do hold the potential to build adjacent multi-billion dollar total addressable markets, or TAMs, with EHang’s focus on deliveries, emergency response, and tourism breaking away from a sole focus on air taxi services of its peers.

The company updated shareholders during its second-quarter earnings call that its corporation framework with Xiyu Tourism, a leading tourism enterprise in China, has advanced with the establishment of a joint venture and the delivery of the first batch of five minutes of EH216-S AAV’s to the JV. The EH216-S will be used by Xiyu for low-altitude tourism and sightseeing in scenic areas in Northwestern China, including the Heavenly Lake of Tianshan, a Chinese 5A-class tourist attraction. The guidance is that the JV will operate a minimum of 120 units of the EH216-S within the next five years. This is set against a 100+ units order pipeline for the EH216-S in China and 1,200+ units of the EH216 series and VT-30 pre-orders overseas.

Commercial Implication Of Certification

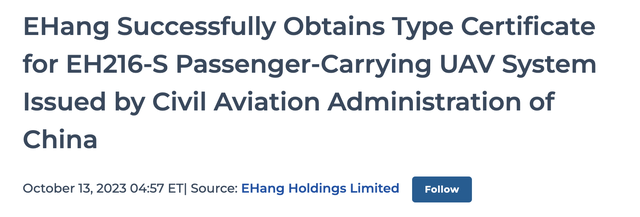

GlobeNewswire

The announcement today that the EH216-S has received permission to fly passengers in its unmanned aerial vehicle is material. It would make EHang the first public company in the space to receive any such certification from a national regulator and would come almost three years after the company submitted its application for certification in January 2021. The EH216-S underwent a number of tests over this validation process and now has a leg up over its rivals to capture market share in the fledging market for urban air mobility. Morgan Stanley (MS) in a 2018 paper; Flying Cars: Investment Implications of Urban Air Mobility, places the base case estimate of the market in 2040 at $1.5 trillion.

EHang September 2023 Investor Presentation

This has since been revised downwards to $1 trillion in a more recent paper, but the sheer size of the market emphasizes why the shares spiked more than 20% following news of the certification. The 1,200+ global order book now seems more ripe for expansion with the 40,000 test flights and tests for structural strength, flame resistance, and crashworthiness amongst other factors during EHang’s nearly 3-year long validation process that will embed a level of confidence for other new commercial partners to come onboard.

Bulls should watch for the direction of the EHang Holdings Limited order pipeline over the next few quarters for the implication of a certification that will allow the company to deliver more solid revenue figures. I’ll remain on the sidelines, though, but current shareholders should hold for commercial liftoff.

Read the full article here