Traditional Defensive Sectors Have Not Proved Defensive Recently

The recent market environment has proved especially challenging for a lot of stocks typically viewed as defensive such as Utilities (XLU) and Consumer Staples (XLP). Typically during market sell-offs, these are two sectors that tend to outperform due to their defensive nature. However, in the most recent sell-off that has not been the case as the sharp increase in interest rates has led to sell-off in interest rate sensitive stocks such as Utilities. Additionally, Consumer Staple stocks have sold off due to fears that the new weight loss drugs such as Ozempic, Wegovy, and Mounjaro will lead to changes in consumer behavior which may result in less demand for unhealthy products sold by companies such as Coca-Cola (KO), Hershey (HSY), and many others.

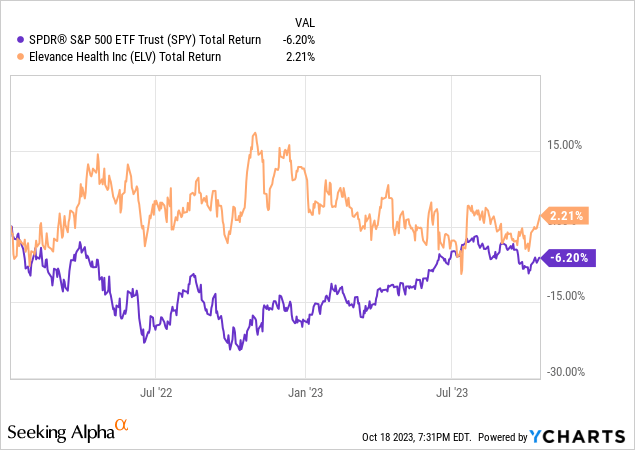

Given the challenges faced by these traditional defensive sectors, investors with limited risk tolerance should look to diversify into other defensive equities. Elevance Health (NYSE:ELV), which has outperformed the S&P 500 by ~8.5% since the index reached an all-time high on January 3, 2022, represents an excellent defensive investment opportunity at current levels.

Business Overview

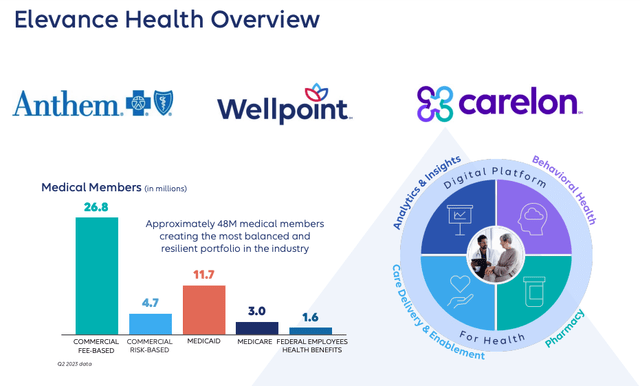

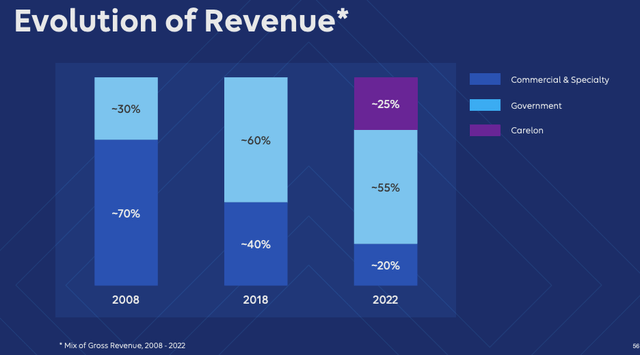

ELV is a leading health insurance provider serving more than 47 million members in the U.S. and is the largest single provider of Blue Cross Blue Shield Plans having licenses in 14 states. ELV operates in three segments: Health Benefits, Carelon, and Corporate & Other. The health benefits business is comprised of commercial and government segments. The government business makes up 55% of FY22 revenue and commercial markets make up 20% of FY22 revenue. The remaining 25% of revenue comes from Carelon which consists of Carelon Services and CarelonRx. CarelonRx is a primary benefit manager and contributes ~70% of the entire Carelon segment revenue.

Elevance Health Presentation Elevance Health Presentation

Recession Resilient Business

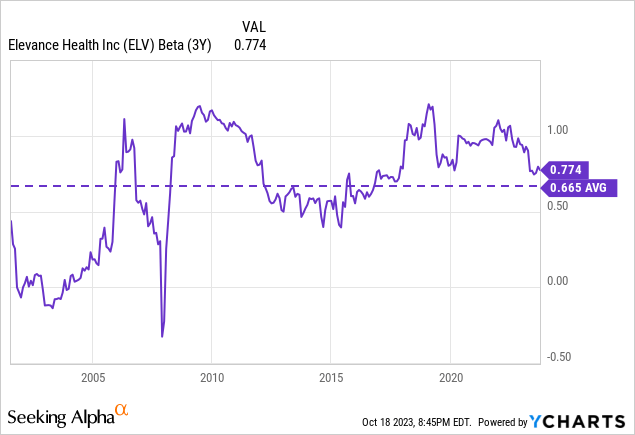

ELV’s business is recession resilient as most people will require health insurance regardless of economic conditions. While the commercial business may experience a decline in a recession, the government business tends to be more stable. As shown by the chart below, the recession resilient nature of the business can be seen in the relatively strong EPS performance during the three most recent recessions. Additionally, the realized average beta of 0.66 serves as additional confirmation that ELV is less economically sensitive than most companies.

Competitive Advantage

ELV’s competitive advantage comes in part due to its large scale. ELV controls an estimated 10% of the health insurance market in the U.S. and is the second largest health insurance company in the U.S. after UnitedHealth (UNH). Competitive advantages due to scale include both increased bargaining power with healthcare providers as well as larger provider networks for members. Moreover, ELV benefits from its leading position in the Blue Cross Blue Shield Association (“BCBSA”). The BCBSA network insures 1 in 3 Americans which is more than any other insurer. 1.7 million doctors and hospitals contract with BCBSA which is also more than any other insurer. The BCBSA has operations in all 50 states and each member is able to utilize other BCBS provider networks and discounts when any BCBSA member travels outside of the state their policy is written in. ELV’s strong position in BCBSA gives it a competitive advantage when competing for very large multi-state mandates.

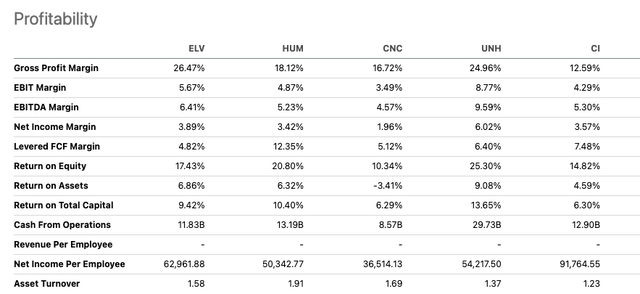

As shown by the table below ELV scores favorably relative to peers on a number of key margin metrics including gross profit margin (highest among the group), EBITDA margin (second only to UNH), and net income margin (second only to UNH).

Seeking Alpha

History of Delivering Strong Results

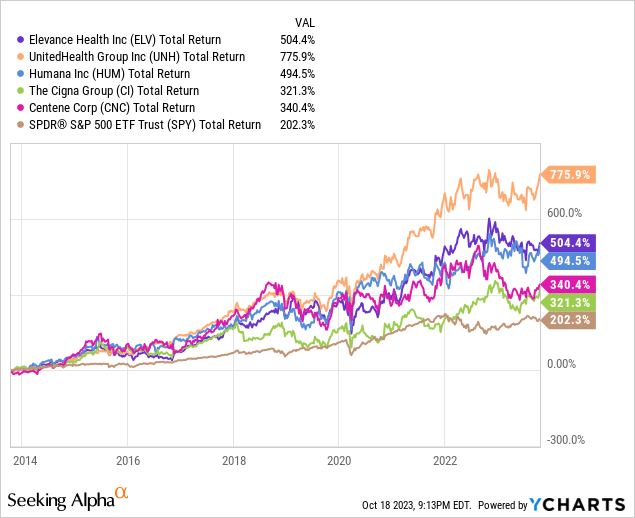

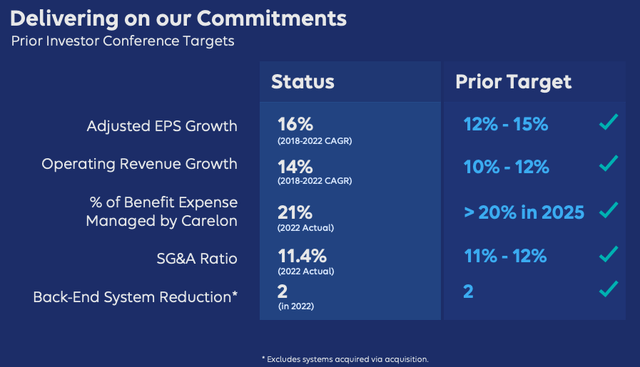

ELV has a long history of delivering strong financial results including a 16% EPS growth CAGR (2018-2022) which has resulted in strong returns for equity holders. Over the past 10 years, ELV stock has returned 504% compared to just 202% for the S&P 500. The only peer that ELV has underperformed over the past 10 years is UNH. This performance is particularly impressive given the mature nature of the industry and high degree of government regulation.

Elevance Investor Presentation Elevance Investor Presentation

Strong Q3 2023 Results

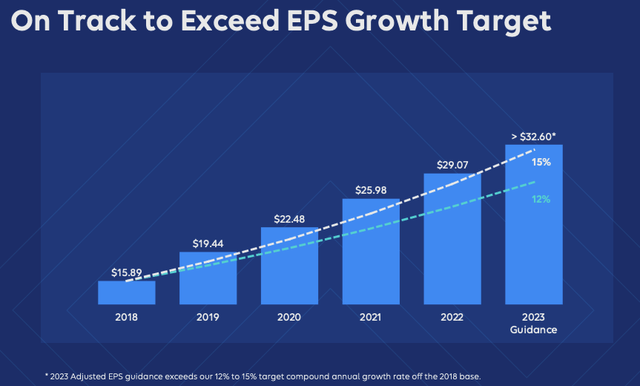

On October 18, 2023 ELV reported strong Q3 results which easily surpassed analyst expectations. ELV earned $8.99 per share compared to analyst estimates of $8.46 per share. The good news did not stop there as ELV also raised FY2023 guidance for EPS to be greater than $33 per share vs a previous outlook of greater than $32.85. In response to the strong report, ELV shares initially traded higher up to $482.5 per share before closing at $469.31 (up less than 1% on the day.)

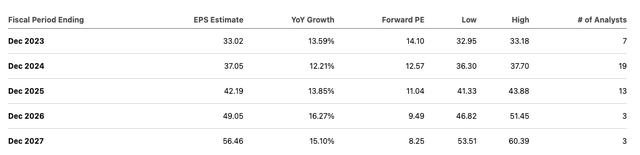

Long-Term Growth Forecast

ELV believes it will be able to grow earnings at a 12-15% CAGR through 2027. Given the company’s strong historical performance (i.e., 16% EPS CAGR from 2018-2022) I believe this is a growth rate that will be achieved. As shown below, this is a view that is shared by Wall Street with analysts expecting mid double digit EPS growth through 2027.

Seeking Alpha

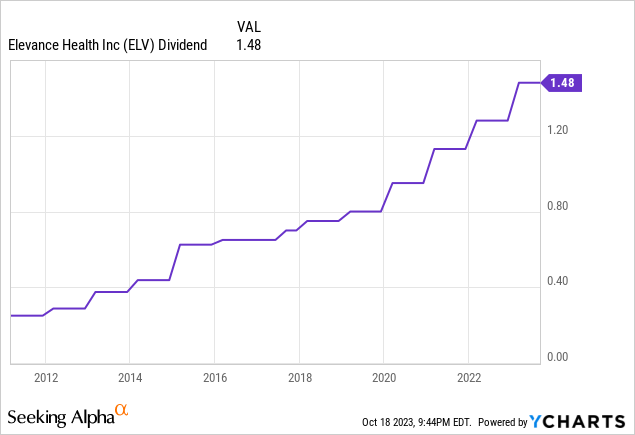

Shareholder Friendly Capital Allocation

ELV has returned significant amounts of capital to shareholders via increasing dividends and share repurchases. Going forward, ELV expects to spend roughly 20% of Free Cash Flow on dividends, 30% on share repurchases, and the remaining 50% on reinvestment and M&A.

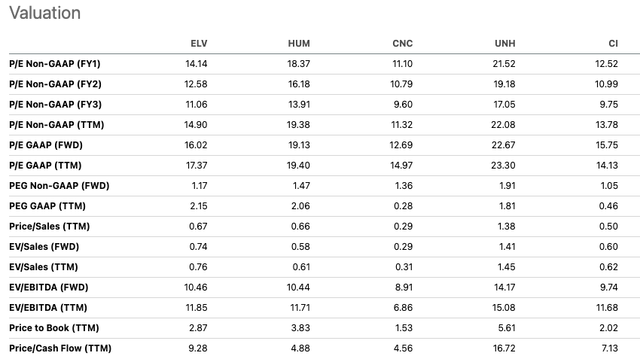

Valuation

If you have gotten to this part of the article you may think that ELV must be trading at a premium valuation due to the combination of a strong competitive advantage, recession resilient business, strong historical growth, and strong growth forecast. However, this is not the case as ELV trades at a forward pe ratio of just 12.5x compared to 17.9x for the S&P 500. Given ELV’s expected growth rate of ~13% this means ELV is trading at a forward PEG ratio of just 0.96x compared to 1.49x for the S&P 500 assuming a 12% growth rate. On a trailing basis, ELV trades at ~17.5x which is just slightly above the historical average of 14.9x. While some might argue that ELV is currently trading at a high valuation relative to its historic average, that view fails to consider the fact that ELV has vastly outperformed the S&P 500 historically and thus the stock was significantly undervalued during most previous time periods. Furthermore, as shown by the table below, ELV is trading at an attractive valuation relative to peers with a forward PE ratio of 12.5x compared to 19x for UNH and 16x for HUM.

Seeking Alpha

Risks To Consider

The largest risk that ELV faces is some sort of government reform that disrupts the wonderful business than ELV currently has. Healthcare reform can take many different forms but arguably the most significant change would be a nationalization of the health insurance system. While this risk of radical change is always there in the future, this risk is very low right now given the current political climate. A higher probability, though less catastrophic risk for ELV, would be government reform that leads to increased levels of competition and allows smaller players to compete with the likes of ELV and UNH. Another important risk to consider regarding ELV is the potential for the disruption of the PBM business. This risk appears somewhat elevated given the recent news that CVS Health lost a major PBM contract with Blue Cross Blue Shield of California to Amazon and Mark Cuban Cost Plus Drug Company. However, there has not been significant follow through and, for now, that major contract loss appears to be an isolated situation.

Conclusion

The investment setup around ELV is characterized by the rare combination of strong competitive advantages, limited sensitivity to economic weakness, high growth, and below market valuations. ELV also confirmed a strong operating environment with its Q3 beat and raise earnings release yet the stock did not move up as much as I would have expected.

While government regulatory changes remains a risk, I believe this risk is significantly mitigated in the near-term given political focus on other issues such as the wars in Ukraine and Israel as well as relations with China. Additionally, given the current fiscal situation the U.S. is facing I believe the potential for a significant increase in government run healthcare plans is the lowest it has been in a long time.

For these reasons, I believe ELV represents a high conviction buying opportunity at current levels. I believe ELV has the potential to serve an important role in portfolios as a key defensive holding given the fact that other traditional defensive stocks such as Utilities and Consumer Staples have lost their defensive properties in the current market.

Read the full article here