Emerging markets have been adopting new technologies, which solve existing challenges, raise productivity and reflect changing consumption patterns. Learn more from Franklin Templeton Emerging Markets Equity.

Three things we’re thinking about today

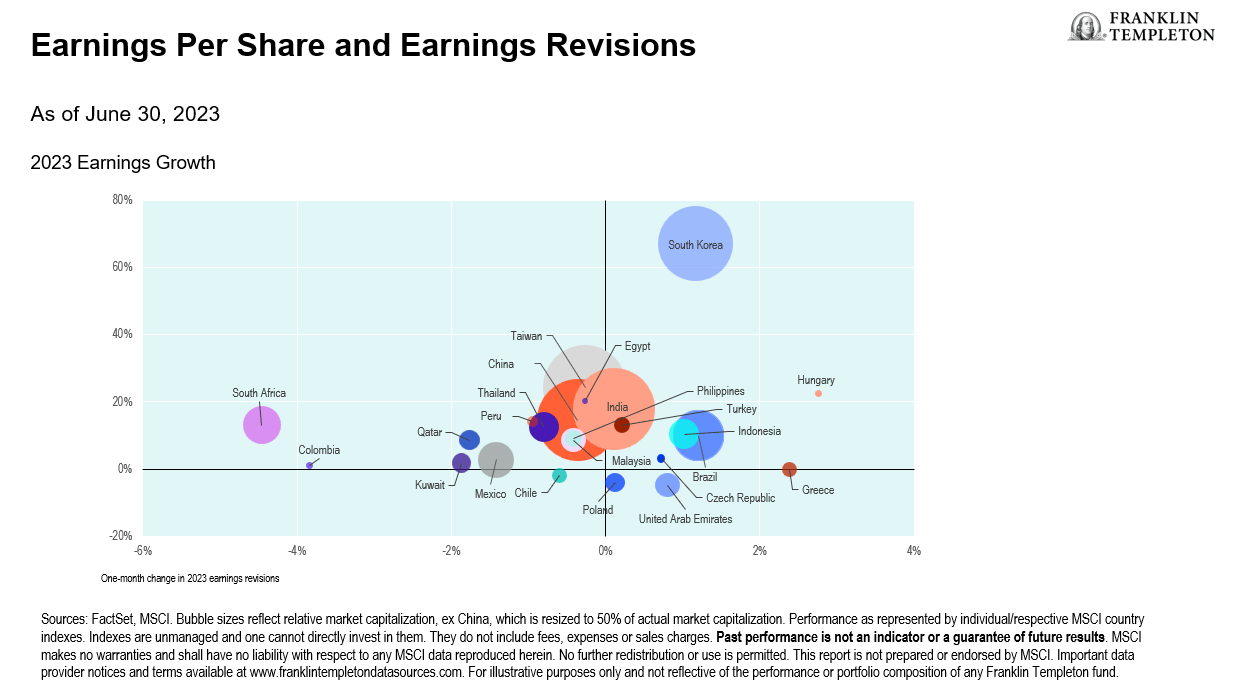

1. Broadening market breadth. During the first half of 2023, 72% of the gains and six out of the 10 largest contributors to the gains in the MSCI Emerging Markets Index were technology-related.1

This is a trend repeated in global equity indexes, as 53% of the gains and nine of the 10 largest contributors to gains in the MSCI All Country World Index came from technology-related companies.2

Looking ahead to the second half of the year, investors are questioning whether this trend will be repeated or if gains will be more broad-based. Technology companies are long-duration assets – more of their profits are in the distant future as opposed to the near term.

This makes their performance sensitive to interest-rate expectations, with falling expectations supporting their performance in the first half-period. We believe this implies interest-rate expectations, as well as other fundamental factors, could drive more broad-based gains in equity indexes in the second half of this year.

2. Oil supply and demand. The International Energy Agency (IEA) recently updated its forecasts for world oil supply and demand, highlighting that emerging markets (EMs) are expected to overtake the Organisation for Economic Cooperation and Development (OECD) as the leading oil consumer by 2028.

EMs’ share of total demand is forecast to rise from 45% this year to 48% by 2028.3 The OECD’s share of total demand is forecast to decline to 42% over the same period.

Global demand for oil used in transportation is forecast to start declining after 2026, reflecting a pivot toward renewable energy and growth in electric vehicle (EV) sales.

The OECD is seen as leading the way, but it is expected to start impacting EM demand toward the end of the decade as EV sales grow and emission rules are tightened.

3. El Niño impacts. The US National Oceanic and Atmospheric Administration has confirmed the formation of an “El Niño,” a climate phenomenon that results in tropical cyclones in the Pacific, wetter conditions in South America and drier conditions in India.

During the prior El Nino in 2016, which was the strongest on record, drought conditions lowered crop yields and warmer oceans reduced fish stocks. This creates upside risks to inflation in 2024 in EMs, considering the highweight of food in the consumer price basket and the lagged effect of lower agriculture supplies on food prices.

Outlook

EMs have been adopting new technologies in the pursuit of development. These new technologies solve existing challenges, raise productivity and reflect changing consumption patterns.

Examples include e-commerce, which increases sales while providing convenience to customers; digitalization strategies within financial institutions to achieve cost and operational efficiencies; and the Internet of Things (IoT), which includes digital technologies in consumer and industrial products from smartwatches to smart manufacturing.

In our view, technology is embedded in most, if not all, sectors to maximize output and seize growth opportunities. Within the financials sector, the role of technology has brought about mobile banking, e-wallets and robo-advisors, which allow financial institutions to extend their reach to a larger pool of customers, especially those in rural areas.

In India alone, the mobile wallets market is estimated to surpass US$5 trillion in 2027, while Brazil’s leading banks have increased their technologicalinvestments in 2022. Within the consumer discretionary sector, we see the growing popularity of on-demand food and grocery delivery.

Long-term drivers of the information technology sector include rising demand for semiconductors – also known as chips – which are ubiquitous in computers, smartphones and consumer goods including automobiles.

The emergence and increasing popularity of innovations including electric vehicles, 5G (or the fifth generation of wireless technology) and artificial intelligence will support demand for semiconductors over the long term.

The dominant market share of semiconductor manufacturers in Taiwan and South Korea and chip packaging companies in China and Malaysia creates exciting investment opportunities to leverage this demand, in our view.

Emerging markets are flourishing – driven by advances in technology and increasing personal wealth. Technology has integrated itself within other sectors and industries, and we believe that it will be a key driver of global growth.

As investors, we favor technology-led growth opportunities, ranging from semiconductors to banks. We believe that our investment team’s detailed local knowledge and expertise to uncover EM investment opportunities, coupled with access to the dynamic growth potential of companies from some of the world’s fastest-advancing economies, allow us to uncover some of the most exciting opportunities across EMs.

What are the risks?

All investments involve risks, including possible loss of principal.

Equity securities are subject to price fluctuation and possible loss of principal.

Fixed income securities involve interest rate, credit, inflation and reinvestment risks, and possible loss of principal. As interest rates rise, the value of fixed income securities falls.

International investments are subject to special risks, including currency fluctuations and social, economic and political uncertainties, which could increase volatility. These risks are magnified in emerging markets.

The government’s participation in the economy is still high and, therefore, investments in China will be subject to larger regulatory risk levels compared to many other countries.

There are special risks associated with investments in China, Hong Kong and Taiwan, including less liquidity, expropriation, confiscatory taxation, international trade tensions, nationalization, and exchange control regulations and rapid inflation, all of which can negatively impact the fund. Investments in Taiwan could be adversely affected by its political and economic relationship with China.

1. FactSet, as of June 30, 2023.

2. Ibid.

3. Source: International Energy Agency, World Energy Investment 2023.

Original Post

Editor’s Note: The summary bullets for this article were chosen by Seeking Alpha editors.

Read the full article here