Empire State Realty (NYSE:ESRT) has gained over 15% since my prior update in June. At that time, I reiterated my bullish position due to their stronger capital structure and the continued strength of their observatory operations at their namesake Empire State Building (“ESB”). I also raised my concerns relating to the Canadian wildfires and outlined its downside risk on visitation to the ESB.

Shares nevertheless have rallied past my price target of $8. Recently, the stock was closer to the $9 mark. But it has since pulled back on broader market weakness. Given the rally thus far and the current trading price, I view shares as properly valued, though I would be more bullish upon a deeper pullback in the stock, perhaps into the $7.25-$7.50/share range.

ESRT Key Stock Metrics

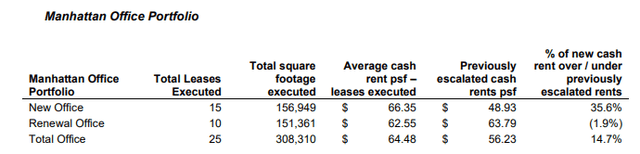

In ESRT’s most recent earnings release, ESRT reported over 336K SF of leasing activity, 308K SF of which was attributable to their Manhattan office properties. On their total signings, ESRT achieved combined spreads of 10.1%, with 14.7% spreads in their Manhattan portfolio on the back of new rent spreads of 35.6%.

ESRT Q2FY23 Earnings Release – Leasing Summary Of Manhattan Office Portfolio

The total activity carried the leased rate on their Manhattan portfolio to 91.6%. This represented a sequential increase of 90 basis points (“bps”) and a YOY increase of 330bps. Notably, the activity marked their sixth consecutive quarter of positive absorption and the eighth consecutive with positive leasing spreads.

During the quarter, ESRT had several notable signings for terms more than 10 years. This demonstrates the continuing draw of their office properties, more than 95% of which have been redeveloped and are fully modernized and amenitized.

Looking ahead, ESRT still has nearly +$60M of initial cash rent to be recognized from pending commencements and free rent burn-off. Additionally, their known non-renewals for the remainder of the year, at 191K SF, are not viewed as a concern, given current absorption rates.

Why Is ESRT Stock Outperforming?

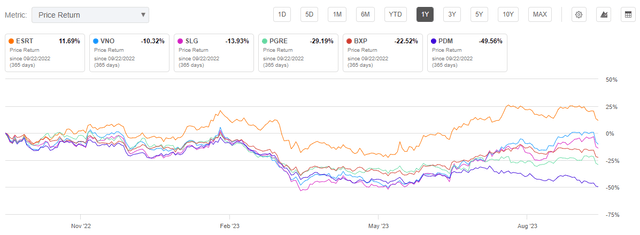

ESRT is starkly outperforming their peer set, which I consider their NYC-based peers of Vornado (VNO), SL Green (SLG), and Paramount Group (PGRE), as well as Boston Properties (BXP), which is larger but has a strong Northeastern presence, and Piedmont Realty (PDM), which is of a more comparable size.

In the past year, shares in ESRT are up over 11.5%, while their peer group is down double-digits, with PDM down nearly 50%.

Seeking Alpha – ESRT 1-YR Share Price Performance Relative To Peers

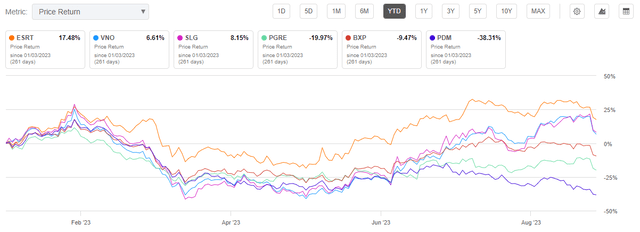

A few competitors, such as VNO and SLG, are positive on a YTD timeframe, but ESRT’s returns are still more than double that of their peers.

Seeking Alpha – ESRT YTD Share Price Performance Relative To Peers

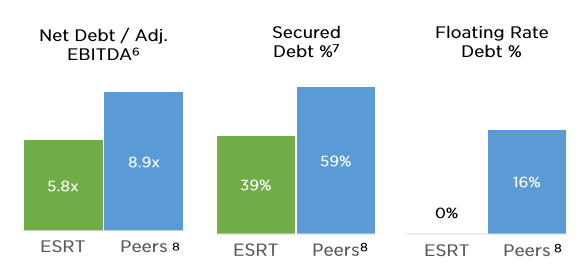

I continue to attribute the outperformance to ESRT’s more competitive debt structure. In the current rate environment, floating rate debt is seen as a significant liability due not only to the costs associated with the rising interest burden but also due to the cost of hedging the exposure. This is not an issue for ESRT, as they have no floating rate exposure.

ESRT Q2FY23 Investor Presentation – Capital Structure Of ESRT Compared To Peers

ESRT also has an overall lower debt burden, with an attractive debt ladder that calls for no maturities until November 2024 at the earliest.

Aside from the favorable debt structure, ESRT’s ESB observatory operations also provides a significant buffer against downside risks relating to their more pure-play office holdings. In addition to the observatory, ESRT has also been growing their multifamily exposure, though I don’t view this with as much enthusiasm as the observatory, which I believe carries further upside due to their still-lagging international visitation levels.

What Is The Outlook For ESRT?

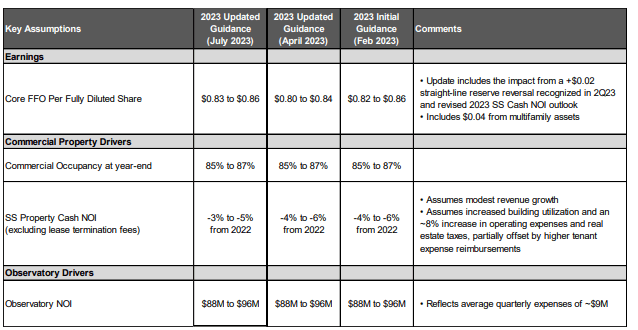

As noted in my prior coverage, ESRT had expected $0.02/share in FFO due to the reversal in their straight-line reserve. In Q2, ESRT recognized this benefit. Accordingly, this enabled a positive revision in their full-year 2023 guidance. The midpoint of core FFO is now seen at $0.845/share, up over $0.02/share from their prior midpoint.

ESRT also updated their same-store cash NOI guidance, with a favorable 100 basis point revision. This reflects expectations for higher cash rental revenue and lower property level expenses.

Expectations for their observatory operations were left unchanged, as were the forecasted year-end commercial occupancy levels. Given current leasing strength and the uninterrupted recovery in the observatory operations, I am expecting ESRT to hit their targets for the year.

ESRT Q2FY23 Investor Presentation – Summary Of Full-Year Guidance

Is ESRT Stock A Buy, Sell, Or Hold?

I remain bullish on ESRT due to the competitive edge it has over its peers in its debt structure. The complementary revenues generated by their ESB observatory operations is also a key differentiator against more pure-play office operators. The wildfire threat on visitation levels that I alluded to in my prior update didn’t appear to materially affect operations.

Looking ahead, I expect visitation at the observatory to remain aided by their top ranking in U.S. travel surveys. I also expect the gradual return of international visitation, though this may take longer than desired, due in part to COVID-related fears and hesitation.

Consistent with my prior views, I see $8/share as a fair price for the stock. At this price, ESRT commands a forward multiple of core FFO of about 9.50x. Their NYC-based peers are trading well-below that. Vornado, at 8.5x, is nearest, with SL Green at 6.7x. Other peers are even more discounted. Piedmont Office, for example, trades at just 3.3x.

With ESRT near my target price and at a healthy trading premium to their peer set, I view the stock best left on hold for now. Bearish sentiment in the overall markets has weighed on shares in recent days, perhaps more than necessary, with shares down nearly 7% over the last five trading sessions. If ESRT continues slumping, shares may be worth a revisit in the $7.25-$7.50/share level. This would give investors adequate upside potential at current risk premiums. Until then, ESRT remains worthy of a close watch from current and prospective investors.

Read the full article here