Energy Income Performance

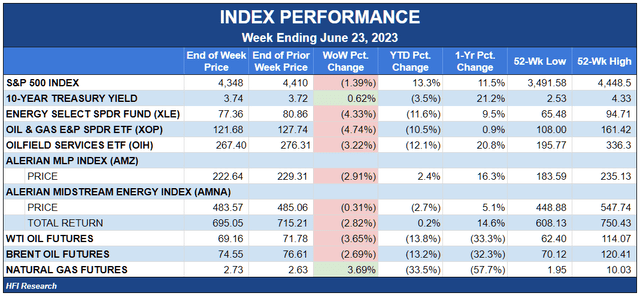

The energy sector got clobbered this week, as the S&P 500 (SP500) fell 1.4% and WTI dropped 3.7%. The sector as captured by the XLE (XLE) fell 4.3%, while E&Ps (XOP) were down 4.7%, and oilfield services (OIH) dropped 3.2%. Midstream held up comparatively well, ending the week down 2.9%.

HFI Research

The S&P 500 pulled 1.4% back after a furious run higher over the past month in response to a slower rate of inflation and a mildly less hawkish Fed.

As for oil, the week’s price action was a head-scratcher given the declining inventories in the U.S., the most visible part of the global market. News about increased Iranian supply was the ostensible culprit, but the fact of the matter is that the 750,000 barrels per day of “new” Iranian supply had actually been circulating all year, disguised through tanker movements as originating from Malaysia. These “shadow” barrels had not been counted in the IEA’s supply/demand balances. The fact that the additional 136.5 million Iranian barrels that have been brought to market in the first half haven’t triggered a larger oversupply than currently exists is remarkable. It suggests that global oil demand is higher than consensus estimates.

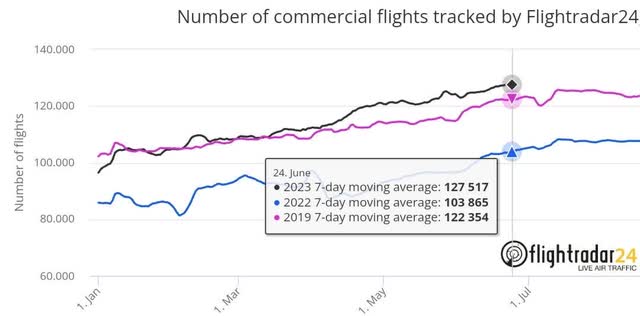

Recent data, such as the number of commercial flights globally, also support this conclusion. Flights are up 22.8% above 2022 levels and are 4.2% above pre-pandemic levels in 2019.

Twitter

Source: Jorge Arjona, Twitter, June 25, 2023.

In such a bearish environment for oil—where prices fall, reinforcing negative sentiment among speculators and further emboldening bearish traders to push prices lower—it’s important to reference physical oil market indicators. At the moment, the most important indicator, time spreads, is at odds with a bullish oil price thesis. This week, near-month time spreads fell into contango, indicating a bearish near-term oversupply that flies in the face of our bullish thesis that higher demand and lower supply will create a large supply deficit in the second half of the year.

Historically, time spreads have been one of the most reliable physical market indicators. But at the moment, it’s difficult to determine how much emphasis they should be given in our analysis, particularly when they contradict second-half supply/demand balances that are so massive and so obviously bullish that they’re embraced by virtually every prominent barrel counter. We believe the near-term time spread weakness is a symptom of an illiquid futures market dominated by funds seeking to express a bearish view on the global economy. The weakness likely reflects a loose physical market, but not one so overburdened with supply that excess barrels can’t be removed over several months by the supply deficit expected in the second half. Whatever the cause of time-spread weakness, the situation bears close monitoring.

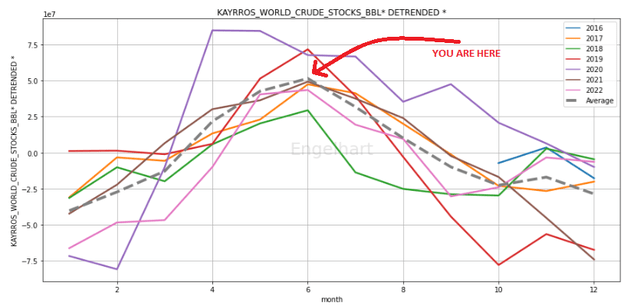

We maintain our view that inventory draws will throw the oil market into a steep supply deficit over the next few months. Consistent inventory draws over the second half would be in keeping with the market’s experience over the past few years, as shown in this chart tweeted by the oil trader, Lefert Clement.

Twitter

Source: Lefert Clement, Twitter, June 22, 2023.

We expect the supply deficit to eliminate the current oil surplus, flip near-month time spreads into backwardation, and send WTI toward the $90 per barrel range by year-end. Energy stocks would outperform mightily if even a fraction of inventory draws occur and WTI rises to $80 per barrel.

Energy Stocks Lag

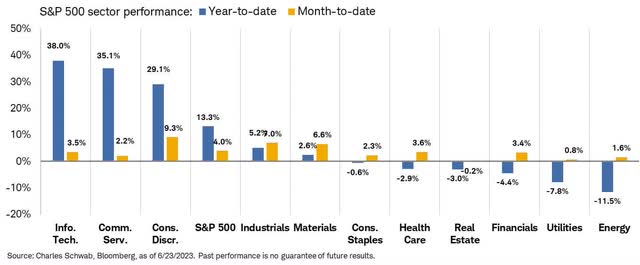

The energy sector continues to lag the broader market. Year-to-date, its performance is negative 11.5% versus the S&P 500’s 13.3% return. Energy sector performance remains the weakest among all S&P sectors, as shown in the chart below.

Twitter

Source: Liz Ann Sonders, Twitter, June 23, 2023.

The energy sector’s underperformance has sent energy stocks to levels that imply that the high profitability and return on capital the sector achieved in 2022 was a one-off event and that the sector’s profits and return on capital will revert to the 2014-2019 average, which is low by historical standards. This view ignores dramatic balance sheet improvements and sector-wide capex discipline that is likely to keep the energy sector’s profits and return on capital elevated far above the cyclically low levels implied by current stock prices.

Over time, share prices will revert not to a historical, arbitrarily-selected average that depicts cyclical lows but to levels that reflect current profitability and the longer-term outlook.

Oil prices will receive support as shale production plateaus over the next few years and as OPEC remains actively involved in managing supply. On the company level, disciplined spending and clean balance sheets will bolster profitability relative to the industry’s multi-decade average. This combination of factors makes high-quality companies that are well-situated on the oil value chain attractive long-term buys at today’s depressed equity prices. And as the stock market more accurately prices the sector’s longer-term prospects, we expect its current 4% weighting in the S&P 500 to more than double over the next few years.

News of the Week

Equitrans Midstream Corporation (ETRN) won approval for its final permit to begin construction on its Mountain Valley Pipeline. Management expects the pipeline to enter service in early 2024. The MVP will enable the Appalachian natural gas basins to increase production. Higher production and lower natural gas prices are a win for domestic consumers and industry, while the higher supply will facilitate increased LNG exports to countries in dire need due to their hasty energy transitions. ETRN shares had already run up in expectation of the news. They traded 4.0% lower this week. We would get interested in the shares if they fell into the mid-$8.50s range.

Enbridge Inc. (ENB) suffered a setback in its bid to keep its Line 5 running through Michigan. A federal judge ruled that the company has three years to shut down parts of Line 5 that cross certain land owned by the Bad River Band of Lake Superior Chippewa. The judge also ruled that the company must pay the reservation $5 million for trespassing. The ruling came in response to the tribe’s claim that Line 5 is at risk of being exposed by erosion and rupturing on their land. The judge found that a rupture is not imminent, but that the pipeline should be shut down nonetheless. A Line 5 shutdown would reduce the flows of light crude and natural gas liquids through Michigan, increasing costs and decreasing supply to the state’s residents. The loss of natural gas liquids supply could be a disaster during the winter months. We rate ENB as a hold, but we’d avoid adding to the shares as the company has had to lower rates on its Mainline system due to competition with the Trans Mountain Expansion. The impact of the lower rates will be negative for the company’s cash flows, though the extent remains to be seen.

Capital Markets Activity

June 22. Pembina (PBA) closed on an offering of $500 million of senior unsecured medium-term notes. The offering was conducted in three tranches. The first tranche consisted of $300 million of Series 19 Notes that have a fixed coupon of 5.72% and mature in 2026. The second consisted of $100 million of Series 5 Notes that have a fixed coupon of 3.54% and expire in 2025. The third tranche consisted of $100 million of Series 6 Notes that have a fixed coupon of 4.24% and mature in 2027.

Read the full article here