The world is sleepwalking towards a destructive energy price spike that could create a resurgence in inflation, weaken consumption, and pummel broad equity and bond markets.

This could result in yet another bad year for the traditional balanced portfolio.

I believe investors should prepare for this outcome by diversifying a portion of their traditional stocks-bonds allocation into more resilient hedges, including oil stocks.

Worsening Supply-Demand Imbalance

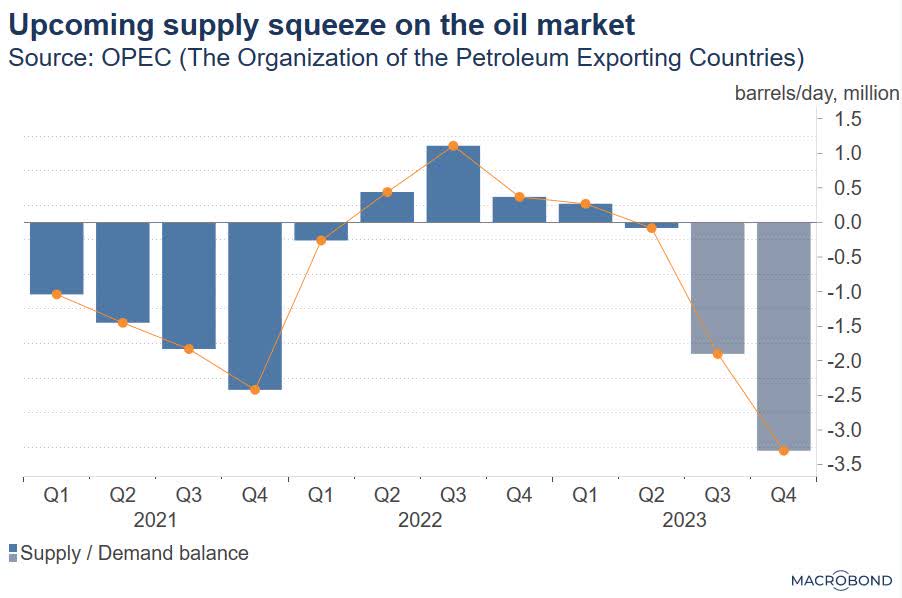

The energy market is approaching a significant imbalance, both in the short term and long term. According to OPEC’s latest forecasts, the world could see a 3.3 million barrel daily shortfall by Q4 of this year.

Supply deficit in the oil market (Macrobond)

Collaborative production cuts by Saudi Arabia and Russia have successfully removed supply from the market, and these cuts are expected to continue. This has driven West Texas Intermediate up 33% since June.

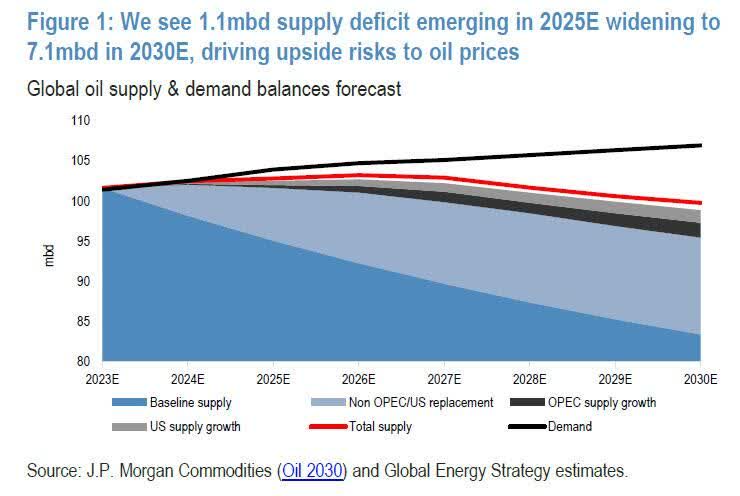

Longer term, the situation is expected to worsen.

JPMorgan is forecasting the oil production shortfall to reach a record-breaking 7 million barrels daily by 2030.

Long term oil market supply-demand imbalance (JPMorgan)

The rationale behind this prediction is as follows:

- Higher rates are reducing capital investment and exploration, extending the underinvestment trend that began in 2015.

- Higher capital costs are raising breakevens elevating the marginal cost of oil.

- Diversion of investment away from fossil fuels in anticipation of peak demand is pushing capital allocation away from capex investment to stock buybacks and dividend increases.

As a result, JPMorgan sees production shortfalls continuing, leading to higher for longer oil prices with upside price risk to $150bbl.

Commodity Capex (Topdown Charts)

Oil Inventories Are Tight

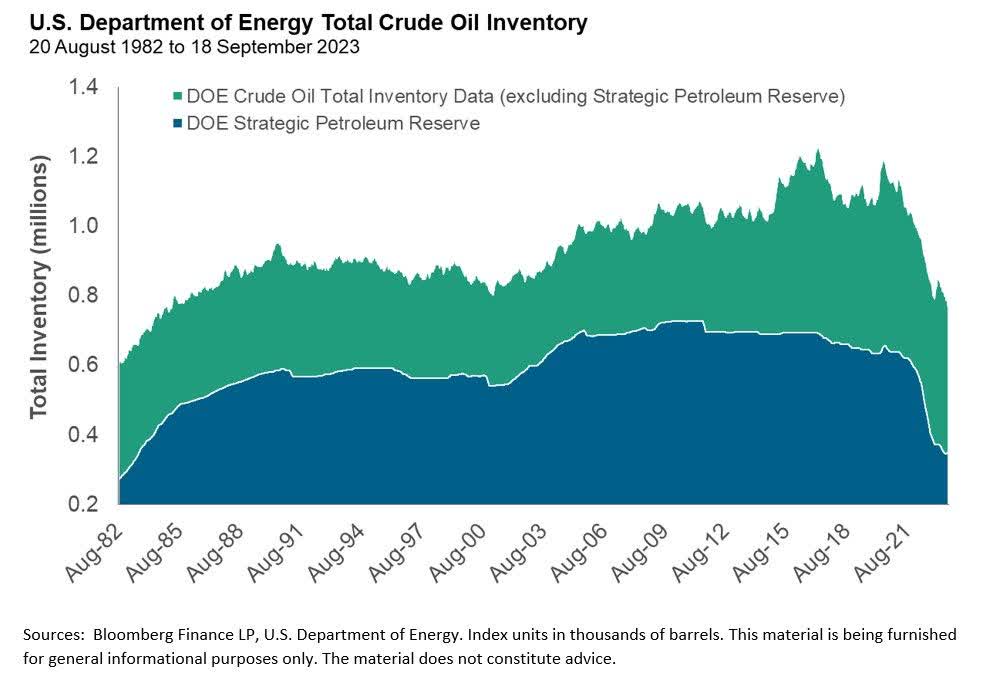

Oftentimes, the gap between oil supply and demand is filled by tapping into reserves. Today, unfortunately, oil reserves are significantly depleted.

The depletion of the US Strategic Petroleum Reserve (SPR) is well telegraphed. Since its peak, about half of the reserve has been released in a political effort to contain inflationary pressures.

Less known, overall inventories (excluding the SPR) are also down significantly. Combined, this increases market sensitivity (i.e., oil price sensitivity) to supply-demand imbalances.

Moreover, any entity wishing to rebuild reserves must now do so at higher prices. This reduces the likelihood of replenishing oil inventories.

Total crude oil inventory (Bloomberg Finance, U.S. Department of Energy)

In contrast, China continues to aggressively stockpile oil (China’s oil reserves hit 3.69 billion metric tons in 2022).

Inflation Is Everywhere And Always An Energy Phenomenon

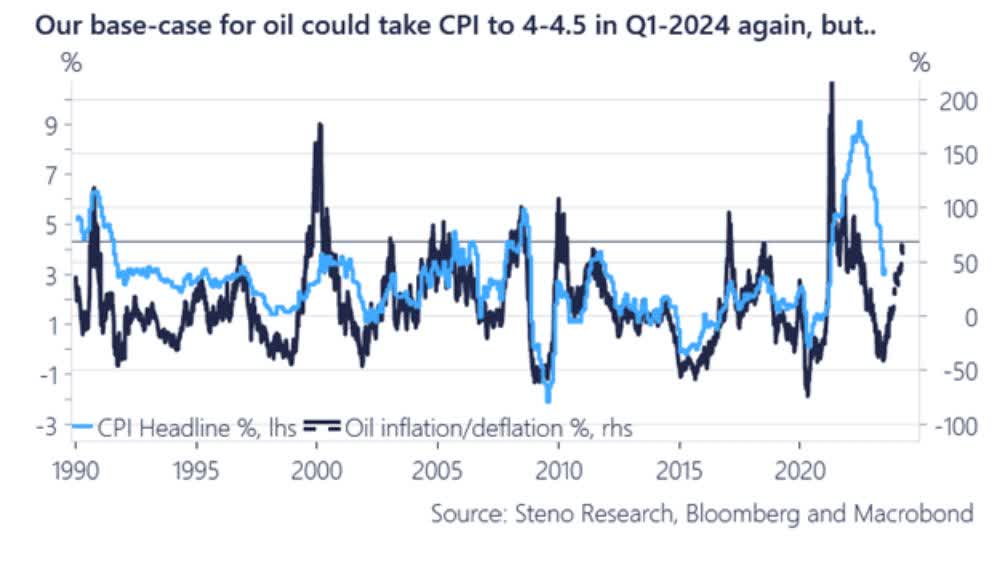

Continued pressure on inventories may drive further upside in oil prices and a resurgence of energy inflation. – Sébastien Page, Head of Global Multi-Asset and Chief Investment Officer at T. Rowe Price

Milton Friedman once famously said, “inflation is always and everywhere a monetary phenomenon.” Coming out of the pandemic, it is clear that Friedman was partially correct. I believe money supply must be viewed in the context of physical scarcity. Scarcity of labor, products or resources.

Energy is the single-most important input into the production and distribution of goods and services. Everything from the food we grow to the goods we transport is affected by the cost of energy.

For this reason, higher energy costs caused by supply-demand imbalances will feed into the prices of goods and services across the economy. The correlation between oil price changes and headline inflation is high. After lags, high headline inflation feeds into core prices as higher raw materials prices, electricity expenses, and transportation costs are passed onto the price of finished goods.

Long story short: while periods of volatility are expected, long-run inflation will remain above the Fed’s 2% target.

Oil – CPI correlation (Steno Research, Bloomberg, Macrobond)

The Supply-Demand Imbalance Could Be Weaponized

Tight oil supplies and depleted inventories can be exploited for geopolitical gain. As the world becomes multi-polar and the West drifts away from China and Russia, this is especially important.

While the West has sanctioned Russian oil exports in response to the Ukraine invasion, Russia has successfully strengthened ties with China and India. Moreover, contrary to what many believe, Russia is still a significant supplier of oil and gas to the EU.

Visual Capitalist

It doesn’t require a huge stretch of the imagination to see a scenario in which Russia exploits tight global supply to gain leverage over the West. It hypothetically could do so by removing another 2-4 million barrels from the market. This would cause oil prices to skyrocket in response, pushing a teetering US economy into the depths of recession.

Presidencies are lost at the gas pump. With a US election coming soon, it is not inconceivable that Russia uses this tactic to affect the outcome.

China and India – key Russian allies – would suffer if caught off guard. It is possible, however, that they may be co-conspirators working together to ensure adequate oil imports while pushing a mutual enemy to its knees.

Whether this is a conspiracy theory or not is irrelevant. It is simply a risk that investors (and the general public) must face. The probability may be low, but it is far higher today due to escalating tensions and the proxy war over Ukraine.

What This Means For Investors

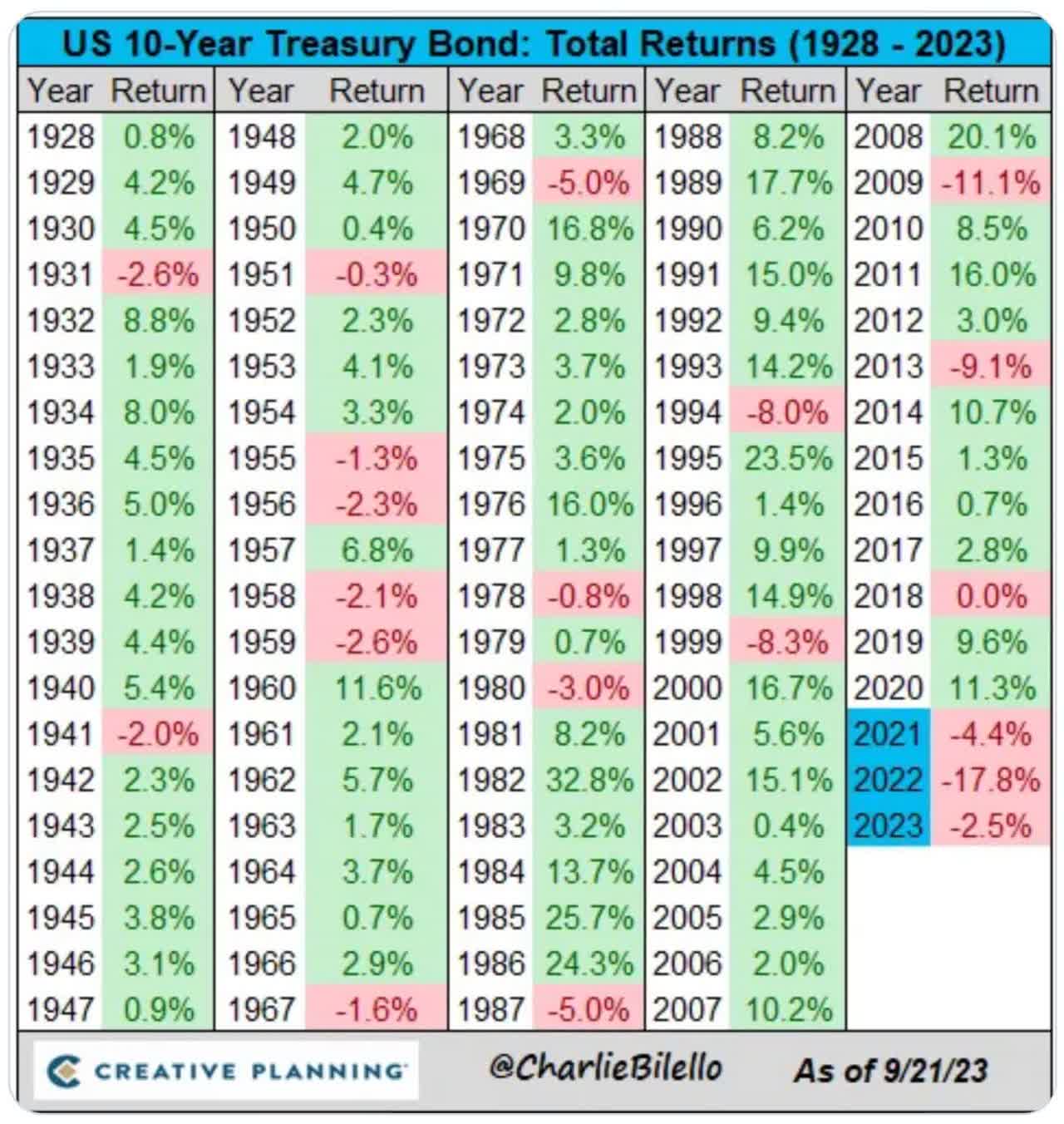

If current trends continue, the 10-year US Treasury Bond is on its way to an unprecedented third calendar year loss. The historical diversification benefits of blending stocks and bonds have failed many portfolios.

Charlie Bilello

With the 10-year yield punching solidly above 4.5%, there is a case for owning bonds today. However, there remains a risk that an oil price shock will send yields even higher.

Simultaneously, higher yields coupled with higher input prices and possibly greater risk premia could push equity prices down. The risk of another bad year for both stocks and bonds is real.

Consequently, I believe investors should consider strategically reallocating a portion of their equity and bond holdings into assets that could benefit from higher energy prices over the next several years.

Speak to a financial advisor to see what’s right for you.

Read the full article here