We have covered Energy Transfer LP (NYSE:ET) previously. On our last coverage we pointed out how ET had taken advantage of the short term memory of investors to stray back to its glory days of big capex and big growth plans. We did still rate it as Hold and put a $12.00 price target on the stock. Since then the stock has meandered around that mark and not given advantage to the bulls or the bears.

Seeking Alpha

The common shares investment merits have not changed materially since then. The distribution increases have rained down but so have additional capex ideas and purchases. We want to focus here on the preferred shares where the yields are about to reset to far higher levels.

The Preferred Shares

ET has three listed preferred shares.

1) Energy Transfer LP 7.375% Preferred Series C (NYSE:ET.PC)

2) Energy Transfer LP 7.625% Preferred Series D (NYSE:ET.PD)

3) Energy Transfer LP 7.60% Preferred Series E (NYSE:ET.PE)

All 3 are currently on a fixed rate with their coupons stated in their description. Because they all are under par, your yield today is higher than the stated coupon. However, we are about to see a drastic divergence in their payouts very soon.

All three of these are callable and the Series C is now less than a week away from the date.

On and after May 15, 2023, distributions on the Series C Preferred Units will accumulate for each distribution period at a percentage of the $25.00 liquidation preference equal to an annual floating rate of the three-month LIBOR plus a spread of 4.530% per annum.

On and after August 15, 2023, distributions on the Series D Preferred Units will accumulate for each distribution period at a percentage of the $25.00 liquidation preference equal to an annual floating rate of the three-month LIBOR plus a spread of 4.738% per annum.

On and after May 15, 2024, distributions on the Series E Preferred Units will accumulate for each distribution period at a percentage of the $25.00 liquidation preference equal to an annual floating rate of the three-month LIBOR plus a spread of 5.161% per annum.

Source: Preferred Stock Channel

With LIBOR more or less becoming history, there might be some confusion as to how this resets. We have seen other firms already start using SOFR for their preferred share pricing. But whichever way it goes you can expect a big bump. With the current interest rates you can expect about 9.75% of total par yield for ET.PC. That works out to 10.2% annually on the current price of $23.90.

ET.PD resets a little later and has a slightly higher spread. The current price of $23.45, a small discount to ET.PC, suggests a couple of things. Investors are valuing current income a lot more than what will happen within 3 months. While ET.PC will pay a higher distribution over the next 3 months, after that, ET.PD will catch up and always be ahead. Paying 45 cents extra for the ET.PC makes no sense at this point. You will only collect about 15 cents extra in distributions for the quarter ahead and then always collect less. One could argue that investors are speculating on a redemption. While that is certainly possible, it would make little sense for ET to redeem ET.PC in isolation. If they had to redeem just one it would be ET.PD. The one with the higher spread.

While comparing those two gives us a clear winner in ET.PD, the last series has another interesting surprise. ET.PE sports the highest spread out of the 3 and is now the cheapest. At $22.90 it trades a whole $1.00 below ET.PC. Part of this is of course the higher rate which flows through to ET.PC. Those preferred shares will pay 15 cents more per quarter right away. But a year from now, ET.PE gets shifted to a floating rate and that yield should be higher than what ET.PC will generate at that time. Using the same interest rates as we did for ET.PC, the yield on par turns to 10.38% for ET.PE. With the lower price in place, you get a 11.3% yield on the current price.

Verdict

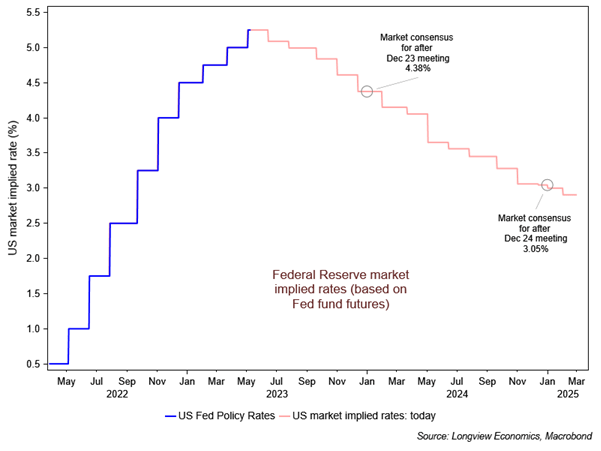

The bond market has been kicking and screaming every step of the way on the staircase up. Keep in mind that in late 2021, investment grade bonds yielded 2.07% for 10 year maturities and expectations were for Fed funds futures to average under 2% for all time periods. That goes to show how “smart” the bond market is.

Today again, the idea is that we will get rapid rate cuts as illustrated in the chart below.

Longview Economics Twitter

Assuming this is correct, and ET’s management believes this, they are unlikely to call ET.PC and ET.PD. They probably would not even call ET.PE. But if they had to call one, they would wait and take out ET.PE with the highest spread.

From an investor standpoint, ET.PE gives you a 1 year yield of 8.29% on current price (7.6% on par). Assuming the futures curve is correct, you would get a boost as you move to floating in May 2024, and then settle down at around 8.25% on par around the end of next year. That would mean 8.29% yield for one year and then around 9% floating after that.

ET.PE also gives you a very solid upside in case we get what we call a passive aggressive Fed. That would be a Federal Reserve that stops hiking right away but refuses to cut despite GDP weakness as inflation pressures remain strong. Such a scenario could see ET.PE getting called in one year, netting 17.5% returns ($1.90 in distributions plus $2.10 upside to par, on $22.90 investment). While we don’t believe anyone should hitch all their hopes and dreams on a passive aggressive Fed, we think having some plays that benefit in such a scenario should make up part of a fixed income portfolio. We have ET.PE for that.

Please note that this is not financial advice. It may seem like it, sound like it, but surprisingly, it is not. Investors are expected to do their own due diligence and consult with a professional who knows their objectives and constraints.

Read the full article here