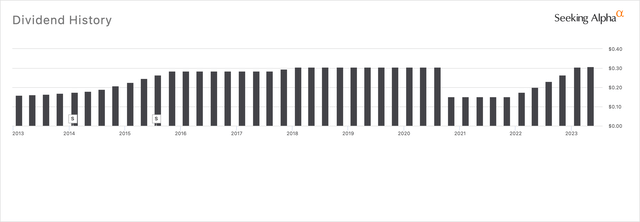

Energy Transfer (NYSE:ET) has made significant progress on multiple fronts. While many believed that the ‘end game’ was simply to restore the distribution to pre-pandemic levels of $1.22 per unit, I saw it as just the beginning. And I was proven right. The Partnership has not only achieved the $1.22 level but has actually surpassed it (more on this below).

Those who have been following me know that I had a positive outlook on the Partnership long before the pandemic hit. Even when the unit price plummeted to ~$5 during the dark days of the pandemic, I strongly advocated for investing in the Partnership, considering it an incredibly undervalued opportunity. This decision allowed me to secure an impressive yield on my investment (i.e. yield on cost) of almost 25%!

Admittedly, the pandemic caused a collapse in most sectors, with stocks plummeting across the board, dividends being suspended, and numerous companies facing the brink of collapse. However, regarding Energy Transfer many investors became excessively pessimistic, largely due to the 50% distribution cut. While nobody likes to see their dividends reduced, it was better to have some income during such dark times in history than none at all.

In my opinion, the distribution cut was a necessary evil, which, paradoxically, turned out to be a blessing in disguise. Why? Prior to the pandemic, the Partnership carried a fair amount of debt. Despite being able to afford a $1.22 distribution per unit, it struggled to generate sufficient cash flow to cover all corporate needs after distribution payments. This was partly due to the high capital expenditures required for growth. This made it difficult to pay down debt, among other things.

Therefore, alongside reducing the distribution, the Partnership also made aggressive cuts to its growth CAPEX requirements. This strategic move paved the way for a new era, allowing the Partnership to generate substantial levels of free cash flow and eliminate reliance on capital markets. In essence, the partnership transitioned away from the ‘old MLP model’ characterized by high distribution payouts, low distribution coverage ratios, and excessive dependence on raising equity from unresponsive markets in times of need.

Currently, Energy Transfer is performing exceptionally well across all fronts. Operationally, the business continues to deliver outstanding performance with record volumes reported across several of ET’s segments for Q1 2023. This includes impressive performances in Midstream, Interstate, Nederland Terminal for LPG and ethane exports, Marcus Hook Terminal setting a new record for ethane exports, Oasis optimization adding more than 60,000 Mcf/d of Permian takeaway and fractionation throughput at Mont Belvieu averaged more than 1 million barrels for first time in Partnership history.

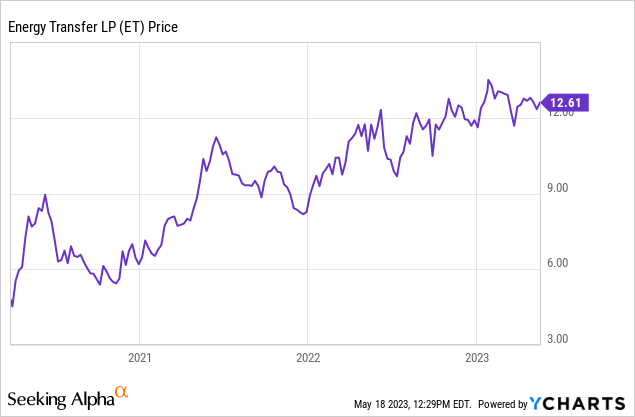

These achievements have resulted in a strong financial performance, leading to an impressive unit price recovery, nearly tripling from pandemic lows, as depicted in the graph below.

It is clear that the unit price is mirroring the remarkable recovery in the distribution, which was reduced during the pandemic.

Seeking Alpha

ET’s recently revised 2023 guidance indicates an expected Adjusted EBITDA range of $13.05 billion to $13.45 billion, alongside an anticipated growth CAPEX of approximately $2.0 billion. Based on historical trends, it is projected that this will result in an annualized DCF (Distributable Cash Flow) of over $8 billion, with excess cash flow after distributions of ~$4 billion.

In other words, the Partnership is comfortably able to cover growth CAPEX while also retaining at least $2 billion for potential acquisitions, unit repurchases, distribution increases, debt repayments, as well as other corporate priorities. For instance, Energy Transfer successfully completed the acquisition of Lotus Midstream Operations and has continued to enhance its financial strength by paying down additional debt in the first quarter of 2023. As a result, the Partnership aims to maintain a target leverage ratio range of 4-4.5x, with expectations of being at the lower end of the range in the future.

As a reflection of this strong performance, the Partnership recently increased its quarterly cash distribution from $0.305 to $0.3075 per unit, equivalent to an annualized distribution of $1.23. Despite these impressive advancements, the unit price remains depressed at ~$12.5, offering an elevated distribution yield of nearly 10%. What’s more, ET announced a new annual distribution growth rate target ranging from 3% to 5%. It’s important to note that the current S&P dividend yield is approximately 1.6%. Therefore, ET offers a yield that is more than six times higher compared to the S&P 500.

It is essential to recognize that while Energy Transfer is influenced by energy prices, it’s important to note that 90% of the Partnership’s adjusted EBITDA is derived from fee-based sources, providing a safety net against highly volatile commodity markets. Additionally, ET is actively making strides in its Alternative Energy Group, which focuses on leveraging its assets and expertise to develop projects aimed at reducing the environmental footprint. These initiatives encompass various aspects, including dual-drive compressors, carbon capture utilization and sequestration, sourcing electrical energy from renewable sources, and exploring the repurposing of extensive acreage for solar and wind projects. These initiatives will have a significant impact in the future and should be taken into account when assessing ET’s long-term prospects. However, it’s worth noting that natural gas and LNG will remain crucial for many years ahead.

In conclusion, ET is well positioned for a promising future. The Partnership has not only exceeded its pre-pandemic distribution level but has also provided guidance indicating a 3% to 5% increase in distributions. This ability to provide such guidance showcases a solid foundation and clear visibility for the business. Arguably, Energy Transfer is in its strongest financial position in its history. As previously mentioned, it is achieving record-breaking operational performance across multiple segments, with 90% of its cash flows derived from fee-based sources, thus mitigating exposure to volatile commodity markets. Moreover, the partnership is actively reducing debt and anticipates even lower debt levels than originally projected. Strategic acquisitions such as Enable Midstream Partners and Lotus Midstream Operations are also driving growth. Importantly, it has transitioned to a sustainable business model that eliminates reliance on uncertain equity capital markets, unlike the old MLP model. In fact, after covering both distributions and growth CAPEX, the Partnership will retain $2 billion for various corporate priorities, including potential acquisitions. This is a great position to be in. Despite the unit price almost tripling from pandemic lows, the distribution yield remains high at 10%, with strong coverage. I’m increasing my position at current levels and will buy more during sell-offs. The best is yet to come. Strong buy.

Read the full article here