Investment thesis

Based on my analysis, being a leading global company in energy storage and power solutions for industrial applications did not help EnerSys (NYSE:ENS) to build a strong pricing power. The company’s profitability metrics are in secular decline, and the recent sudden improvement in margins should not mislead investors as it mostly happened due to tailwinds related to governmental clean energy incentives. Despite energy storage being an apparent beneficiary of the secular shift to clean energy, ENS also did not demonstrate impressive revenue growth over the past decade. That said, I do not see strength in the company’s business model, and it seems that the management is in its comfort zone and not seeking to boost revenue growth organically. Moreover, my valuation analysis suggests the stock is fairly valued with very limited upside potential. All in all, I assign ENS stock a “Hold” rating.

Company information

EnerSys offers energy storage and power solutions for industrial applications. ENS designs manufactures and distributes energy systems solutions, motive power batteries, specialty batteries, battery chargers, power equipment, battery accessories, and outdoor thermal equipment enclosure solutions for a global customer base.

The company’s fiscal year ends on March 31, and it operates via three reportable segments: Energy Systems, Motive Power, and Specialty. According to the latest 10-K report, Energy Systems and Motive Power generated almost 86% of total sales during FY2023.

ENS’s latest 10-K report

Financials

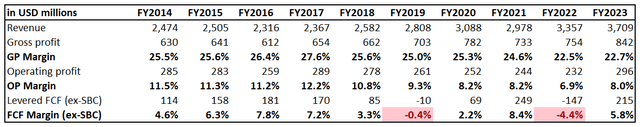

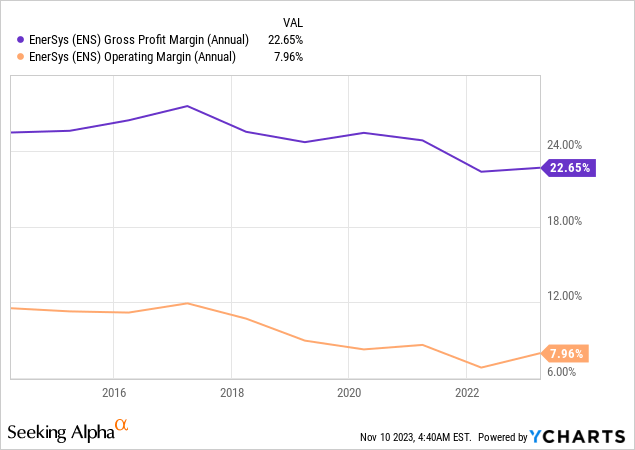

The company’s financial performance over the last decade has been decent, though I see several warning trends. Despite decent revenue growth with a 4.6% CAGR over the past decade, profitability metrics are relatively far from their peaks.

Author’s calculations

While the fact that the latest fiscal year’s profitability metrics are far from peaks might be okay in the current harsh macro environment, I do not like the overall trend of shrinking profitability despite revenue growth. A secular decline in profitability usually indicates that the company’s offerings are getting commoditized, which might be a red flag for potential investors.

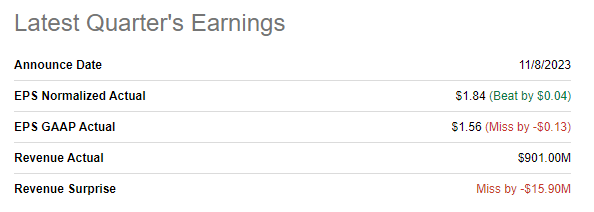

But two quarters of FY 2024 have already been reported, and there might be improvements in profitability dynamics, so let me zoom in. The latest quarterly earnings were released on November 8, when the company missed revenue consensus estimates but outnumbered the adjusted EPS forecast.

Seeking Alpha

Revenue was flat YoY and demonstrated a slight sequential decline due to seasonality. Despite revenue being flat, profitability metrics improved notably YoY. The operating margin expanded substantially from 6.6% to 10.6% due to the strength in gross margin. According to the management, the notably improved profitability occurred thanks to several factors, including external tailwinds and internal improvements. The Federal Inflation Reduction Act [IRA], which aims to boost the speed of transition to clean energy and also touches on energy storage, was an apparent strong tailwind for ENS. Incentives from the Federal government in the form of tax credits were a solid factor for ENS’s profitability improvement—decreased pressure on the supply chain and improved price mix. The latest successful quarter allowed ENS to generate almost $127 million in free cash flow [FCF], which was a solid contribution to the company’s balance sheet.

Seeking Alpha

The company’s balance sheet is in good shape, with a prudent leverage ratio and solid liquidity metrics. A major part of the debt is long-term, which is also a good sign for investors. The company’s solid financial position allows it to pay dividends to shareholders. However, the 1.1% forward dividend yield is insignificant, and the 1.4% dividend CAGR has not been impressive over the last five years either. Overall, I like it when management tends to more prudent capital; sometimes, cautious capital allocation might also indicate a lot of ideas to drive long-term revenue growth. And it seems to be the case for ENS, as its profitability metrics are stagnating from the secular point of view. The temporary boost in profitability should not mislead investors because the IRA was a catalyst, not the operating excellence of ENS. I prefer to be bullish about the companies that can drive revenue growth and profitability expansion by themselves and not due to artificial governmental incentives. Organic growth is more sustainable and signals a higher quality of management.

While the global energy storage market is forecasted to compound at a decent 8.4% CAGR by 2030, I think that ENS’s long-term prospects are not as bright. According to the company’s 10-K report, ENS is the world’s leader in energy storage and power solutions for industrial applications. However, the company’s less-than-modest revenue growth over the past decade and stagnating profitability metrics suggest that the market has become increasingly commoditized, and ENS does not have pricing power. And it is not surprising given the massive secular shift to clean energy, where efficient energy storage is as necessary as energy generation. Therefore, I expect more companies to enter the market and that the competition will continue to intensify. With no pricing power, it would be difficult for ENS to protect its market share over the long term without sacrificing profitability.

Valuation

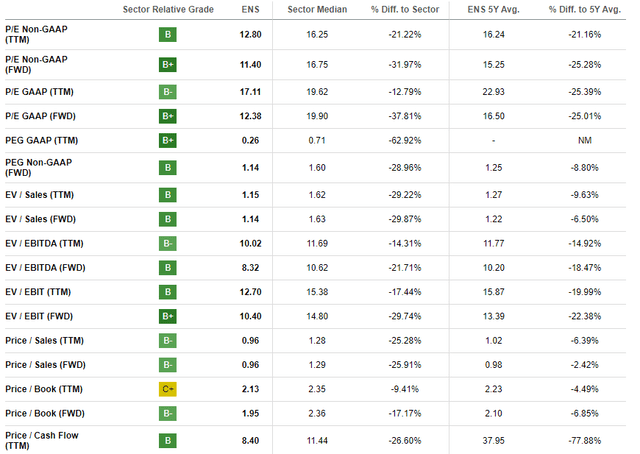

The stock rallied 16% year-to-date, which is an outperformance compared to the broader U.S. market. The current valuation ratios of ENS look attractive compared to the sector median and historical averages. This might indicate undervaluation.

Seeking Alpha

I want to proceed with the discounted cash flow [DCF] simulation. I use a 10% WACC for discounting and implement a 5% revenue CAGR for the years beyond the revenue consensus estimates coverage. I use a 4.1% FCF margin, which is the last decade’s average ex-stock-based compensation [ex-SBC] for my base year, and expect a ten basis points yearly expansion.

Author’s calculations

According to my DCF simulation, the business’s fair value is very close to the current market cap. That said, the stock looks perfectly fairly valued at the current levels, according to the DCF approach.

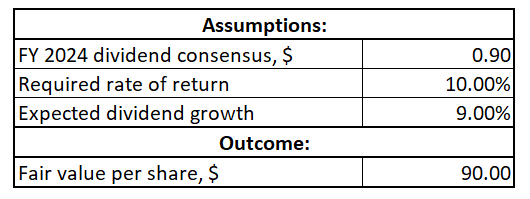

Last but not least, let me also value the stock with the help of the dividend discount model [DDM]. I use the same 10% WACC as a required rate of return. Dividend consensus estimates forecast a $0.9 payout in FY2025, which I also incorporate into my DDM calculations. From the long-term perspective, ENS demonstrated stellar dividend growth with above 11% CAGR over the next decade. That said, I think that the 9% dividend growth rate I selected is conservative enough.

Author’s calculations

According to DDM, the stock’s fair price is $90. This indicates a 7% upside potential from the DDM point of view. Summarizing all of the parts of my valuation analysis, I believe that ENS is fairly valued with a modest single-digit upside potential.

Risks to my cautious statement

New governmental incentives in clean energy and energy storage or expansion of the IRA might be a solid catalyst for the stock price. Sentiment plays a significant role in the stock market over the short term, and any rumors regarding new incentives favoring ENS will likely add a lot of optimism to investors who might start buying the stock heavily.

As a strong market player with vast experience in the industry, ENS might be an acquisition target for larger players who are building clean energy ecosystems. Acquisition news usually has a massive positive effect on the stocks of the companies acquired, which also might be a strong catalyst for the ENS stock price to have a rapid spike.

Bottom line

To conclude, ENS is a “Hold”. The company’s financial performance over the last decade suggests that the industry is commoditizing and EnerSys has no pricing power to pass on inflationary factors to customers. The valuation also does not look attractive to me.

Read the full article here