Investment Thesis

Enovix Corporation (NASDAQ:ENVX) announced an important milestone. The company signals that it’s been awarded a significant contract with the U.S. Army for its batteries. Enovix isn’t the only company awarded this contract. But it is 1 out of 4 companies chosen.

I believe this is an important catalyst for the stock. And that in the next several months, as we get closer to 2024, Enovix will be better placed to highlight the progress at its Fab 2 facility in Malaysia.

Rapid Recap

In my previous analysis, I stated that (emphasis added):

Enovix is a pre-revenue business. That means that it’s not yet generating revenues and isn’t expected to start reporting revenues until 2024.

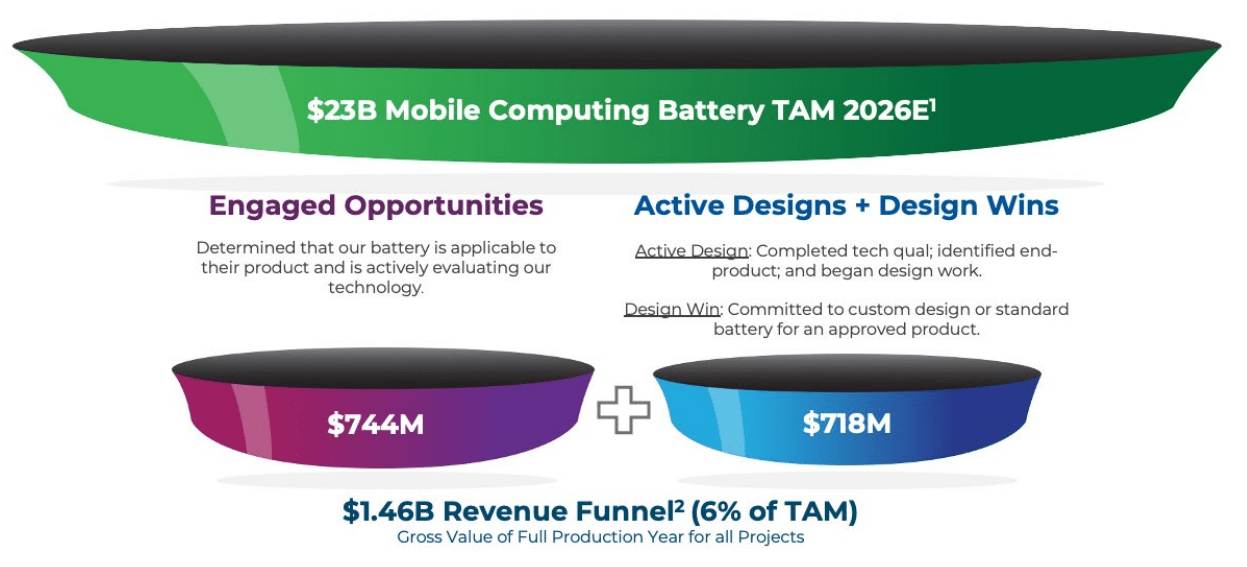

[…] The business is running at full speed, while raising funds, to produce millions of batteries for top tier 1 tech businesses. Presently, leading global OEMs (original equipment manufacturer) customers are trialing the batteries and their rollout is expected to start slowly.

ENVX presentation

I believe this gets readers up to speed with some of the main drivers of Enovix. This business is not generating any revenues at this moment in time.

I base my thesis on the expectation that Enovix chairman Thurman (”TJ”) Rodgers – who holds a significant amount of shares, has about $300 million worth of capital on the line and was instrumental in turning around Enphase Energy (ENPH), a company that sells solar panel energy solutions – knows exactly what sort of batteries make commercial sense to sell.

My thesis is not more complicated than this. For now, all we have to go on are occasional news bits signaling the company’s progress as we wait for 2024, when the business will ramp up its revenues.

With that in mind, let’s discuss the latest news from Enovix.

A Purposeful Step in the Right Direction

Enovix’s BrakeFlow batteries provide more energy density than traditional lithium-ion batteries.

Enovix declares that their BrakeFlow batteries have the potential to nearly double the energy density of the current CWB cells (Conformal Wearable Battery).

This announcement is an important milestone for the company.

Recall, Enovix needs to ramp up production between now and 2024. Once Enovix has ramp-up production, then they work towards maximizing their yields. This means, the number of working batteries per 1,000 units.

And once they are running at maximum capacity and with high yields, then they are able to collect orders from tier-1 OEMs.

Because the OEMs (one OEM that is highlighted by Enovix is Samsung), won’t contract for batteries to install in their devices until they can be assured that Enovix has enough deep battery inventory to meet Samsung’s demand. It’s a chicken and egg situation. If you build it, they’ll come. But if you don’t build it, they can’t come.

Nonetheless this provides evidence that Enovix is not just a story stock. But its batteries are winning purchase orders from the U.S. Army.

Again, to be clear, I don’t make the case that this is the holy grail for Enovix. I do contend that this illustrates that there are end-users that are able to validate and are willing to enter into a commercial contract for Enovix’s batteries.

Succinctly put, this agreement offers a proof-of-concept as the program with the U.S. Army progresses toward full-volume production.

Profitability Profile in 2026

ENVX remains on track for the first production at its Fab2 facility of the Gen2 Autoline in April ’24. From that point, there will be rapid growth in revenues.

Enovix’s long-term prospects aim for 50% gross margins and 30% EBIT margins.

More specifically, Enovix should get to around $380 million of revenues in 2026 and see about 30% EBIT margins, meaning around $100 million and more in operating profits.

This puts the stock priced at 25x forward (hypothetical) operating profits. Not sales, but actual profits. That being said, these profits are still 3 years out.

Meaning that between now and then, investors should continue to look toward different milestones. The big one is at the start of 2024 when its Malaysian production ramps up.

The Bottom Line

Enovix Corporation achieved a significant milestone by securing a contract with the U.S. Army for its batteries. This contract represents a crucial catalyst for Enovix’s stock.

In the coming months leading up to 2024, Enovix will have the opportunity to showcase the progress made at its Fab 2 facility in Malaysia.

While Enovix is currently a pre-revenue business, its chairman’s substantial investment and successful track record in the industry instill confidence in the company’s battery technology.

The recent announcement about Enovix’s BrakeFlow batteries, offering higher energy density than traditional lithium-ion batteries, adds further validation to their commercial potential.

This milestone, combined with Enovix’s anticipated production ramp-up and growth projections, signifies a purposeful step in the right direction for the company’s profitability and market positioning.

Enovix Corporation stock is priced around 25x forward operating profits. If they pull it off, they’ll be growing very fast into 2026.

Read the full article here