As geopolitical risks continue to increase and the issue of energy security once again becomes a topic of paramount importance, investors are rightfully once again turning their eyes towards the Oil & Gas sector.

EOG Resources, Inc. (NYSE:EOG) is one of the long-term opportunities in the sector which offers both a higher risk-reward ratio of an upstream player and a strategy aimed at taking advantage of cyclical movements (more on that later).

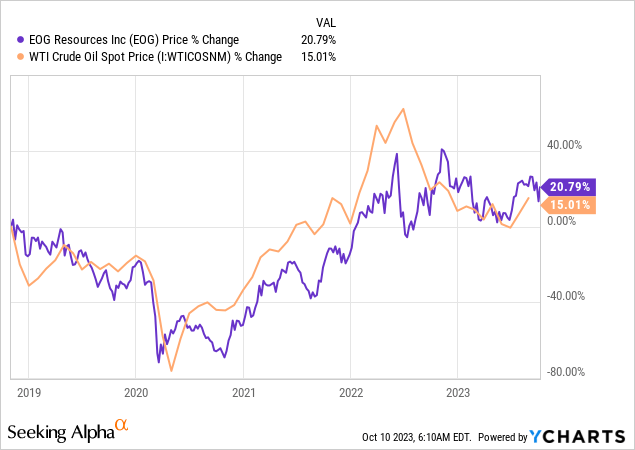

As with any E&P company, EOG’s share price is closely related to the price of crude oil (CL1:COM) in the medium term.

Finding a successful investment vehicle in the sector, however, goes beyond the assumption that oil prices would continue to increase. What is key for long-term success is sticking with high-margin producers that are both able to grow production, but at the same time are not overcommitting during cyclical upswings.

A High-Margin Producer

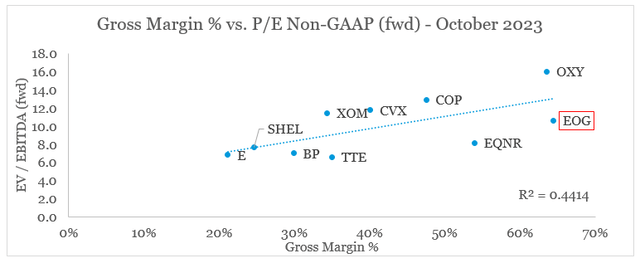

High-margin producers in the sector are rewarded with significantly higher multiples, regardless of whether we are talking about upstream players or fully integrated Oil & Gas Majors.

In the graph below, we can see this clearly illustrated when we plot EOG’s peers based on their gross margins and forward Price-to-Earnings multiples.

prepared by the author, using data from Seeking Alpha

What we also notice is that even though EOG is the highest gross margin producer from the group above, the company is trading at far lower earnings multiple to Occidental Petroleum (OXY), ConocoPhillips (COP) and the large integrated companies – Exxon Mobil (XOM) and Chevron (CVX).

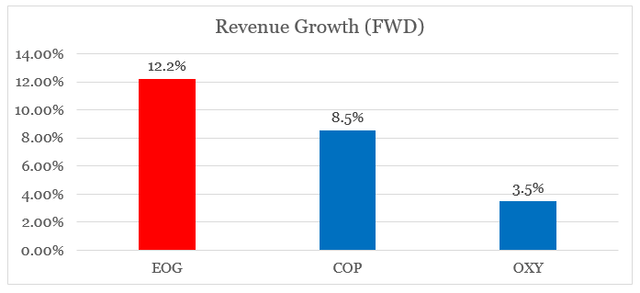

Although I would avoid making a direct comparison to XOM and CVX, which have significant competitive advantages that I covered previously (see here and here), I would note that EOG is also expected to grow at higher rates than the other two E&P peers.

prepared by the author, using data from Seeking Alpha

This creates an opportunity for EOG to outperform its peers, even in the unlikely event of oil prices falling over the coming year.

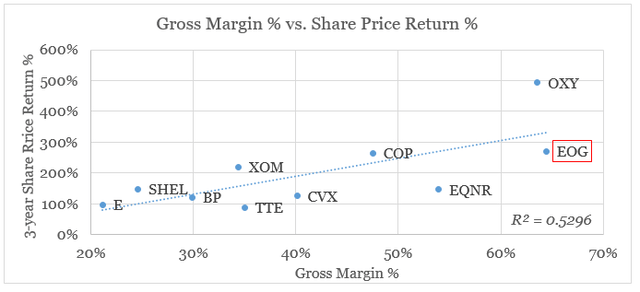

What is also important to note here is that gross margin is also a good predictor of share price returns during bull markets for energy-related commodities. Ideally, we should be using gross margins from 3-years ago to inform the share price returns for the following 3-year period, but even if not the, graph below speaks for itself.

prepared by the author, using data from Seeking Alpha

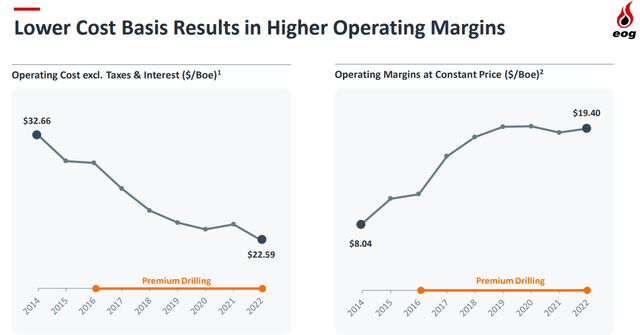

Management decisions to forgo certain growth opportunities and focus on high-margin projects across the United States have also resulted in significant improvements in EOG’s operating margins.

EOG Resources Q2 2023 Investor Presentation

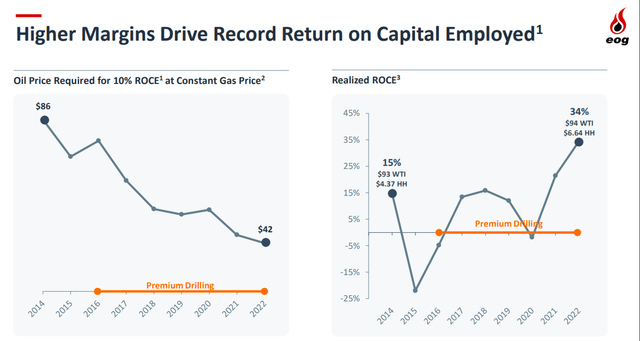

Thus, the oil price needed to achieve a return on capital employed of above 10% has fallen consistently for the past decade. The company now achieves nearly twice as high ROCE for the same price of oil as it used to back in 2014.

EOG Resources Q2 2023 Investor Presentation

All that significantly limits EOG’s downside risk relative to some of its peers in the upstream space. At the same time, it creates a significant upside in the event of a prolonged period of elevated oil & gas prices.

Countercyclical Capital Allocation

The process of capital allocation and EOG is another very important consideration for long-term shareholders.

First and foremost, EOG is growing organically and does not rely on M&A deals to the extent that its peers do. On one hand, this reduces the risk of shareholder destruction during cyclical peaks, when companies tend to overpay significantly for their targets. On the other hand, however, it reduces the company’s growth profile over the long-term.

The latter is not much of a problem for EOG, as the company is well-diversified in the United States, with a presence in a number of underdeveloped regions, such as Utica, Powder River Basin, and Dorado.

EOG Resources Annual Report 2022

EOG’s management has also recently indicated that they will be looking for relatively small and high quality bolt-on acquisitions in these regions which makes sense as M&A activity in the sector is heating up.

And as Ken said, we’re still looking to put on low-cost, high-quality bolt-on opportunities in some of those plays.

Source: EOG Resources Q2 2023 Earnings Transcript (emphasis added).

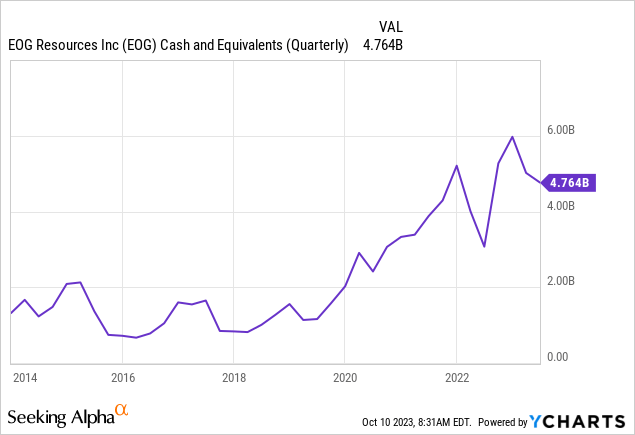

It is also consistent with EOG’s large cash pile, which is an important competitive advantage in a highly cyclical industry when debt financing costs are rising.

EOG’s management has also made clear that they will rely on their pristine balance sheet in the future and most importantly – will be used for counter-cyclic opportunities.

The cash on the balance sheet, we used to be opportunistic, again, and what we’ve been talking about to create shareholder value and it comes about in different ways. It’s really counter-cyclic opportunities that we look for. In 2020, we pre-purchased a lot of casing for all — at all time low pricing. (…)

But both in 2014 and 2020, we leaned-in on that balance sheet. And so, again, it’s one of the ways that we support a sustainably growing regular dividend.

Source: Barclays CEO Energy-Power Conference (emphasis added).

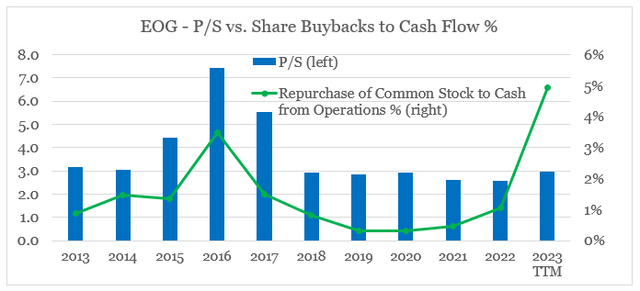

In the meantime, the amount of share buybacks as a share of the company’s all-time high cash flow from operations has reached a new high (see the green line below).

prepared by the author, using data from Seeking Alpha

Contrary to 2016, when EOG was trading at exceptionally high sales multiple, this time around the record high share buybacks are done at very low multiples. This is once again good news for long-term shareholders.

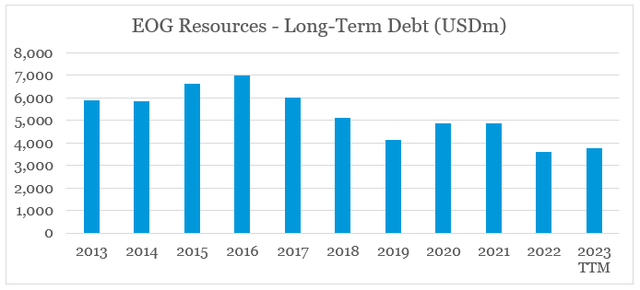

Another use of EOG’s cash flow in recent years has been the significant reduction in long-term debt. Although this could be seen as a missed opportunity to borrow more aggressively at lower rates, it significantly reduces risk for EOG shareholders.

prepared by the author, using data from Seeking Alpha

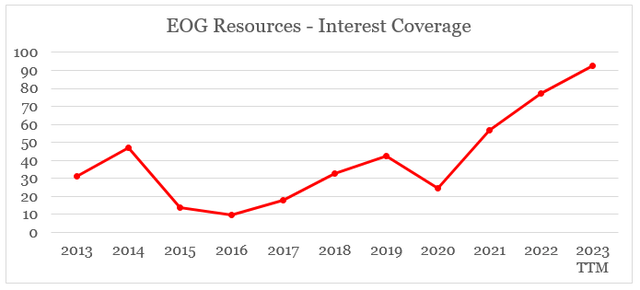

What I mean by that is the company’s interest coverage, which is now at its highest level in more than a decade (see below). In the event of a worse than currently expected economic slowdown and energy prices falling, this would allow EOG to retain its dividend and continue investing in growth opportunities.

prepared by the author, using data from Seeking Alpha

* based on EBITDA.

Conclusion

As a highly cyclical E&P company, EOG Resources, Inc. offers some important competitive advantages over the long run. Being a high margin producer allows the company to fully capitalize on cyclical upswings, while also allowing it to continue investing during market downturns. All that in combination with the pristine balance sheet and conservative capital allocation processes makes EOG one of the best long-term investment opportunities in the sector.

Read the full article here