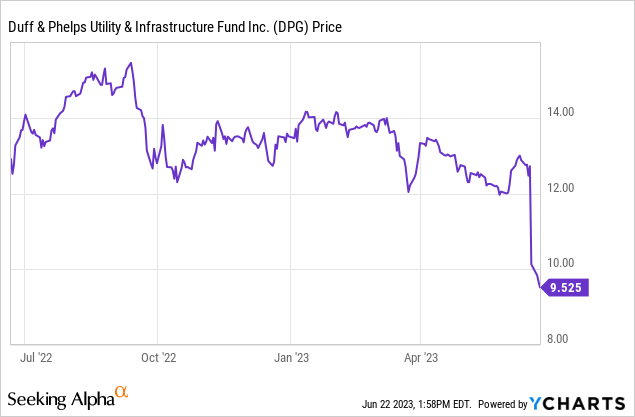

Duff & Phelps is a popular fund manager in utility and infrastructure equity CEFs though it shocked everyone last week when the Duff & Phelps Utility & Infrastructure Fund (NYSE:DPG), $9.50 real time market price, -1.7%, cut its distribution by -40% last Thursday when the fund reached a relatively high 12.5% NAV yield due to a difficult environment for utility stocks.

As a result, DPG dropped -20.4% last Friday and is still in free fall as shareholders have lost confidence and have abandoned the fund. As of 2 EST PM today, DPG has dropped to as low as $9.42 and will probably be around a -15% discount after today.

Here’s a 1-year MKT price of DPG:

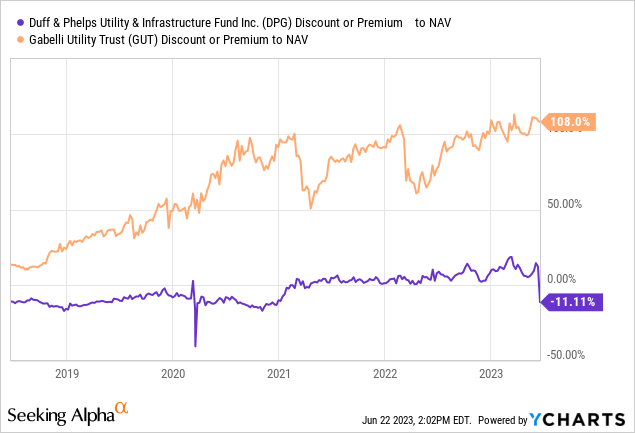

On the other hand, another utility focused CEF, the Gabelli Utility Trust (GUT), $6.87 current market price, can somehow maintain a +110% market price premium, with an 18.4% NAV yield.

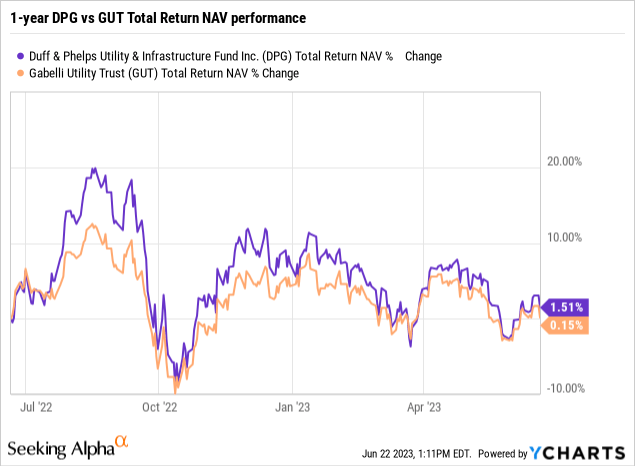

Does this make any sense whatsoever? Both funds focus in the same utility sectors and stocks and what they don’t overlap in tends to be some of their smaller sector weightings.

As a result, both DPG and GUT have had very similar NAV total return performances over the past year.

So how is it that DPG, with a high 12.5% NAV yield as of last week, felt the need to have to cut its distribution and is now at a much more reasonable and achievable 7.5% NAV yield, but yet GAMCO doesn’t cut GUT’s distribution even at an astronomically higher 18.4% NAV yield?

Here’s a three-year Premium/Discount chart of DPG and GUT:

It’s one of the most inexplicable valuation differences I’ve ever seen among CEFs that focus in similar sectors, made even more ridiculous by the fact that both funds have a lot of overlap in their portfolios, especially in utility stocks which make up their highest sector exposure in each fund.

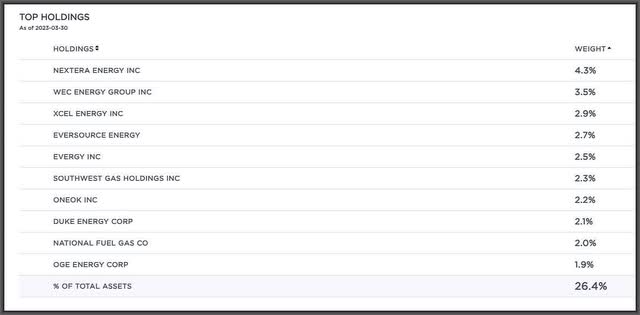

Here are GUT’s top 10 holdings as of 3/30/23:

Gabelli

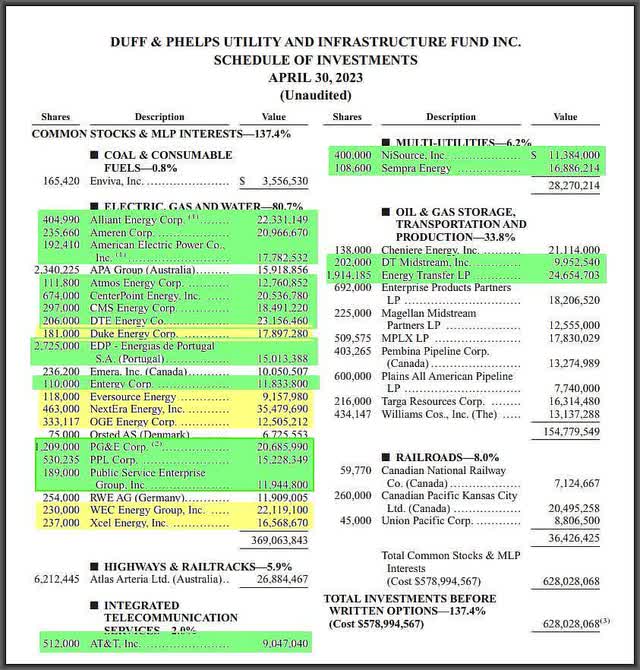

And here are all of DPG’s holdings as of 4/30/23:

Duff & Phelps

Yellow represents top 10 holdings of GUT that are also owned by DPG and there are a total of six, including NextEra Energy (NEE), which is the top holding in both funds and WEC Energy (WEC), which is in both fund’s top 10 holdings.

Then green represents companies that are owned in both funds, many of which are large positions as well. I didn’t calculate the total percentage overlap, but it is undoubtedly a large percentage.

Note: I’m not showing all of GUT’s positions since it covers several pages but if you are interested in seeing all of GUT’s holdings as of first quarter 2023, click here

So the question is, why does DPG cut when GUT, which is clearly overpaying its distribution by a much higher margin, doesn’t? I can’t say what motivates GAMCO for not cutting GUT’s distribution by now, but clearly, DPG’s valuation is dramatically more attractive than GUT’s at this point.

I did not own DPG before last Thursday’s distribution cut declaration, and I waited to initiate a position until Tuesday of this week at $9.77.

That said, shareholders continue to rid themselves of shares. But I believe this is WAY overdone at this point, especially when GUT is now the fund that really should be in the crosshairs of shareholders.

I’ve added to my position in DPG as low as $9.41 today.

Read the full article here