Investment Thesis

Etsy, Inc. (NASDAQ:ETSY) has doubled its active buyer base to nearly 100 million across its marketplaces and has grown its number of sellers almost three times, with similar growth seen in gross merchandise sales (GMS). I expect ETSY to outpace overall e-commerce growth even in a challenging macro environment and revenue to grow even faster as the company offers more features to sellers. The company’s acquisition of Reverb and Depop could enhance its position in the rapidly expanding secondhand clothing and musical instruments resale markets, but there may be short-term financial challenges due to lower EBITDA margins and take rates. I believe the stock is trading at a historically low multiple, and hence I maintain that the stock remains a long-term buy at current levels.

Positives from Q1 Results

Etsy’s first quarter gross merchandise sales and revenue were consistent with expectations and slightly exceeded the Street’s estimates by 3%, according to the consensus of StreetAccount. The number of active buyers in the last 12 months has increased compared to the previous quarter and year, and this is due to better customer retention rates. The company’s take rate, which measures its revenue as a percentage of sales, has also increased by almost 3 percentage points compared to the previous year, mainly due to improvements in its services segment. Etsy’s Depop platform has seen an increase in the rate of successful transactions due to improved product search features. The company continues to generate strong free cash flow, which is mostly being used for share buybacks, which have remained at around $150 million for the third consecutive quarter. Etsy’s second-quarter GMS guidance suggests that there could be some growth improvement. The company’s plans to hire for roles related to artificial intelligence and trust/safety may have a negative impact on margins, but these moves are expected to be beneficial in the long term.

Increasing Traction Can Drive Penetration

Etsy has established a strong customer base of almost 90 million active buyers on its marketplace, reflecting the company’s healthy position in the market. However, analyzing customers by their gender and other characteristics reveals where Etsy has gained good traction and where there’s room to grow. In the US and UK, Etsy’s two largest markets, more than 46 million women aged 18 and over, have made purchases on the platform in the past year, which is a penetration rate of approximately 30% for that demographic. Among this group, 58% made multiple purchases, indicating their loyalty to the platform. Interestingly, a similar mix of women buys across two or more categories on Etsy. While Etsy’s appeal isn’t limited to female customers, approximately 15 million men in the US and UK (10% penetration rate) have also shopped on the platform in the past year, and this group is increasingly engaging with the platform. In 2021, 35% of new US buyers were men, suggesting that the platform is becoming more appealing to a male audience. Although the rate of adoption and purchase frequency of male users is uncertain, it’s worth noting that 15 million US/UK men aged 18 and over alone is larger than many other e-commerce marketplaces or vertical-specific e-commerce retailers, which often have fewer than 10 million active customers. Although it’s unclear whether rate of adoption and purchase frequency of male users will approach that of the comparable female cohort, this is clear evidence of the traction the Etsy platform is garnering.

Etsy’s Market Opportunity Is Vast

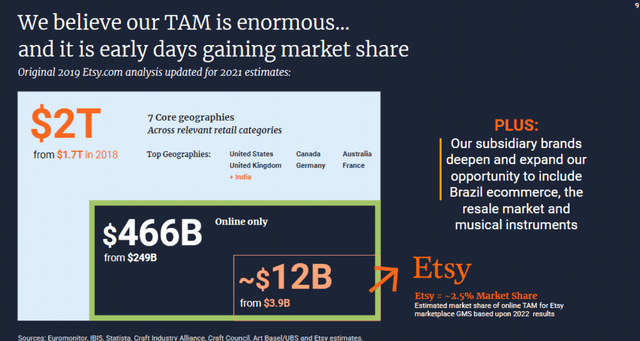

Etsy has ample runway to expand its reach within its total and online addressable markets, now over $2 trillion and $466 billion, respectively. That’s above its 2018 estimates of $1.7 trillion and $249 billion, aided by the acceleration in digital shopping, growth in new and noncore categories through the pandemic and a move into its seventh market, India. Etsy generated over $13 billion in GMS in 2022, and even as it reaches above $17 billion in 2025, it still would capture only a very small piece of the total addressable market. That leaves plenty of room to target a decade of double-digit expansion. Etsy’s market-share gains are likely to come by adding buyers and sellers across its seven regions and a broadening array of products within its six core categories.

Company Presentation

Tapping Secondhand Marketplaces to Build a Unique Portfolio

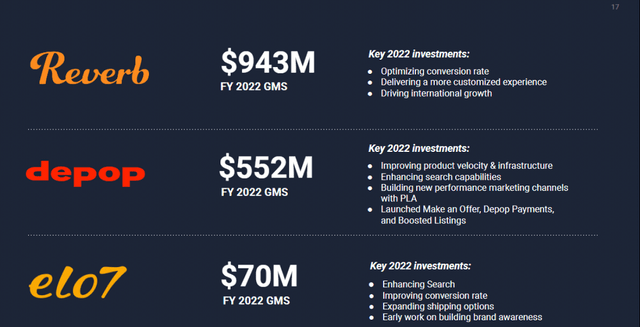

Etsy’s diversification into resale makes sense, as it’s a magnet for highly coveted younger shoppers, with an inventory-light model using technologies and platforms the company already owns. The 2019 Reverb purchase provided access to musical-instrument resales, while the 2021 Depop acquisition could lift Etsy’s share in fast-growing secondhand clothing.

Etsy’s 2019 purchase of Reverb, a marketplace for used musical instruments, has tapped into a $5 billion industry that’s poised to increase about 10% this year and at a mid-single-digit rate after, based on Statista forecasts. About 63% of the market’s consumers buy an instrument for fun vs for academics or as a profession, based on a Winmark report, meaning Reverb can gain buyers and sellers from this growing trend. Since brand-new musical instruments can be expensive, opening up a resale marketplace expands the category to a broader base of potential customers. In 2022, Reverb’s penetration in the global musical instrument market was less than 4%, giving it ample runway to take share. Its new exclusive partnerships with brands on the Reverb site can drive new buyers to the site, aiding sales gains.

Acquisitions Could Pressure Take Rate & Profit in the Near-Term

Etsy’s recent acquisitions of Depop and Elo7 might remain dilutive to EBITDA margin and drag on the overall take rate, but a longer-term opportunity exists to improve profitability as subsidiaries benefit from Etsy’s scale and expertise. Its three subsidiaries generally have lower take rates than the Etsy marketplace (19%), and neither Depop or Elo7 are profitable, weighing down margin. Etsy has already proven its ability to make a business profitable after acquiring Reverb in 2019, which reached break-even profitability in 2022. Applying strategic initiatives to improve search and discover, buyer and seller tools and marketing to the three subsidiaries should help spur higher take rates and help boost the overall consolidate rate.

Company Presentation

Valuation

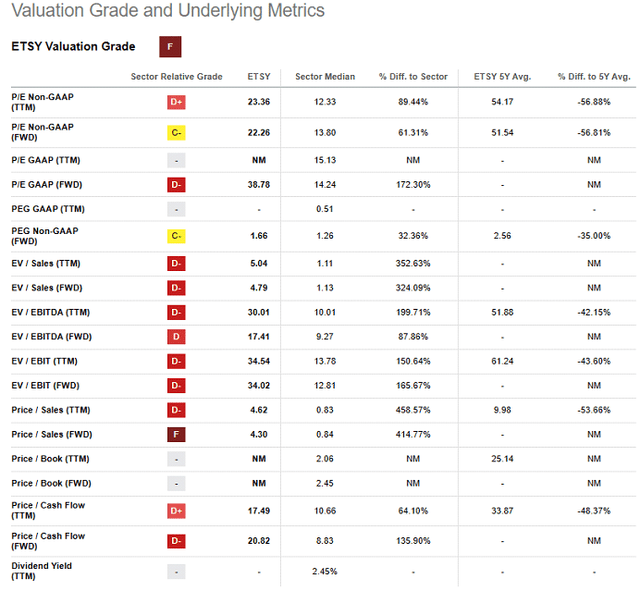

Since 2017, ETSY’s stock has traded at low multiples, which is typical for a newly public company. It then climbed for several years before peaking in August 2019. After that, shares declined modestly in FY19 before reaching new highs in 2020-2021. Unfortunately, in 2022, the stock experienced a sharp decline, which brought multiples back in line with the long-term averages, with averages from 2017 through the end of 2019 included to isolate the unique market/fundamental dynamics in 2020/2021.

From my analysis, it’s clear that ETSY is currently undervalued. With shares trading at 38x forward PE, one could argue that the stock has overshot to the downside. However, I believe that we’re now in a new environment where even pre-pandemic valuation measures may no longer be relevant when considering forward growth expectations. In light of this, I believe that structurally lower multiples are justified until I see growth materially re-accelerate. I derive a fair value of $185 using a PE multiple of 38x and 2024 EPS estimate of $4.89.

Seeking Alpha

Conclusion

Etsy has a healthy customer base of around 90 million active buyers on its marketplace. The company has surpassed its vertical-specific marketplace peers in terms of achieving a large-scale customer base, number of sellers, and gross merchandise sales. Etsy’s diversification into resale with acquisitions of Reverb and Depop could lift its share in fast-growing secondhand clothing and musical instruments resale markets. However, these acquisitions might remain dilutive to EBITDA margin and drag on the overall take rate in the near term, but the longer-term opportunity exists to improve profitability as subsidiaries benefit from Etsy’s scale and expertise. I believe the company is trading at a historically low multiple, and investors with a long time horizon should get in at current levels.

Read the full article here