Recommendation

My recommendation to go long EverCommerce (NASDAQ:EVCM) stock at $6.60 have played out well with the stock up ~100% at one point just few weeks ago. I continue to stay with my buy recommendation after the solid 1Q performance. Payments revenue grew by 37%, fueling the strength in subscription and transaction revenue, and total payment volume grew by 17%, to an annualized $11.1billion. Given that payments revenue is net-accountable at a gross margin of 95% for EVCM, this performance is impressive and will have a significant impact on the bottom line. Long term, I remain confident that EVCM growth will be robust, as the management is taking steps to streamline all its offering by combining different components into a single offering, which should reduce the go-to-market friction. Finally, I see the upcoming catalyst for the stock would be better visibility on the company re-accelerating revenue to its historical levels (20+%).

Growth

EverCommerce’s 1Q23 results beat consensus estimates on the strength of strong execution in spite of a continuing unstable business climate. Despite the fact that the demand environment is still a drag on Marketing Solutions, I believe that EVCM’s SMB customer base is in good shape, as evidenced by the 15% growth in Subscription revenue, which further emphasizes the mission-critical nature of EVCM’s core business solutions. As the macro environment turns for the better, I expect growth to accelerate. While this is encouraging, the 37% increase in Payments revenue from customers who use multiple solutions is the real story here. To me, this is compelling evidence that the company is making good on the cross-sell opportunity that EVCM can use to help it capitalize on the long-term growth of the digital payments market. This should lead to better unit economics, customer loyalty, and increased revenue.

Management maintained their FY23 revenue guidance of 11%, which is well below their goal of 20% growth, primarily due to the continued decline of Marketing Solutions. I note this could turn from a headwind to a tailwind when the macro improves. In terms of the broader environment, management has observed that while home services are doing well, health services have slowed down a bit, and the fitness aspect of fitness and wellness remains somewhat challenging. To be more specific, management’s outlook hasn’t changed much from where the company was looking as it left 2H22 of last year. In which, I believe the performance for EVCM so far has been better than expected, and should exceed the bleak expectations management had in 2H22.

As such, I believe the guidance might be too conservative. Moreover, the EBITDA margin target for FY23 was maintained at 20%. In light of the, the promising margin upside from high margin payment revenue, and the ongoing emphasis on cost cutting, I think an EBITDA margin expansion of 100 basis points is still conservative. I believe the 2Q23 results will shine more lights on this, and if gross margin continues to expand due to the fast growing payments, I believe the market will look past guidance to adjust their estimates to better reflect the margin increase.

Payments

With over 685 thousand users, EVCM has a massive potential customer base for its payment revenues. To put this in perspective, EVCM is currently processing $11.1 billion in annualized TPV, which the company estimates to be less than 10% of the total penetration of the market. Remember that the gross margin on payment revenue is 95%, while the gross margin on EVCM consolidated revenue is 65% (LTM). Therefore, going forward, the incremental margin is extremely high and consequential. If my guess about EVCM’s take rate on TPV of 10 bps is correct, then the company would bring in $11 million in revenue and have a gross profit of $10.5 million, offsetting half of the EBIT loss as of LTM 1Q23. As more TPV is processed by EVCM, of course, this becomes more feasible. This $10.5 million has the potential to explode into a massive sum in a few years, given the 37% year-over-year growth in Payment revenue in 1Q23. I anticipate that EVCM will continue to monetize customers who have already purchased a business management solution by bundling payments together, thereby driving enormous profitability. EVCM has already demonstrated their ability to cross-sell, as such I believe there is a high chance of this succeeding.

Valuation

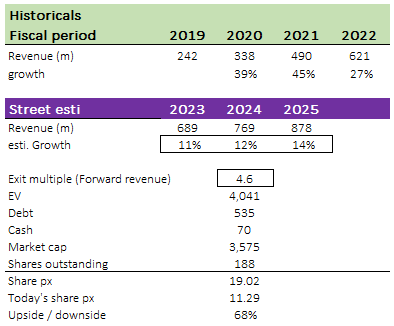

Based on my model, I believe the upside for EVCM stock remains significant (my price target has not changed significantly since my previous post). I still believe EVCM is worth $19 per share if multiples return to historical levels and growth gradually accelerates to the mid-teens by FY25. I expect EVCM to continue growing rapidly as it gains market share in the SMB space.

Model

Risks

The dynamic nature of the software solutions industry makes it difficult to cope with changing customer needs or the introduction of new products and services. Also, the low start-up costs for companies that want to offer software solutions will bring in a lot of competitors, both big and small. With both new and old competitors who have different financial and technological resources, EVCM may be slower to respond to changes in the market or with customers than its competitors.

Summary

EVCM solid 1Q performance, with significant growth in payments revenue, subscription revenue, and total payment volume, reinforces my confidence in its long-term growth prospects. The management’s efforts to streamline offerings and capitalize on the cross-sell opportunity in the digital payments market are expected to drive better unit economics and increased revenue. Although the guidance for FY23 revenue growth is conservative, I believe the company’s performance has exceeded expectations so far and the margin expansion potential is promising.

Read the full article here