Thesis

The Limited Duration Income Fund (NYSE:EVV) is a fixed income CEF from the Eaton Vance family. The vehicle contains a multitude of fixed income instruments, but leveraged loans, MBS bonds and HY credit represent the main sleeves here. We owned this name a while back and thought to revisit it in light of our bullish MBS thesis. We have written a number of articles expressing our bullish Agency MBS view:

- BKT: It Is Time To Buy Agency MBS Bonds (CEF Structure)

- SPMB: It Is Probably Time To Start Buying Agencies (ETF Structure)

- VMBS: Agency Mortgages, A Top Idea From JPMorgan (ETF Structure)

Furthermore, the JP Morgan FICC Research team has now deemed Agency MBS bonds as a top fixed income recommendation:

Recession remained our base case,” Bob Michele, chief investment officer and head of the Global Fixed Income, Currency & Commodities Group at J.P. Morgan Asset Management, said in a note. “While the central banks are committed to bringing inflation down to 2% and willing to sacrifice the economy to get to that level, the group appreciated that it is taking longer to work through several years of accumulated policy stimulus.” Nevertheless, leading indicators continue to see a recession as the most likely outcome.

Taking into consideration the outlook for more central bank rate hikes and the inverted yield curve, “agency mortgage-backed were our top pick,” Michele said. “While the technicals of Fed balance sheet runoff, FDIC selling, and lower bank demand are challenging, valuations are at their cheapest level since the height of the global financial crisis.

This CEF has a 30% leverage ratio on top of its assets, but its duration is very low:

Duration (Fund Fact Sheet)

That has served it well in a rising rates environment, but will slightly hamper it in an aggressively decreasing rates environment. We are not there yet though in terms of lower rates.

What is very interesting about this name is its close correlation with BKT (recommended above) until the start of the rates tightening environment:

BKT Correlation (Seeking Alpha)

This is due to several factors, one of them being the high Agency MBS bucket present in EVV. As discussed before, Agency MBS are AAA assets that are collateralized by mortgage bonds, and usually trade at a wider spread to Treasuries. If an investor thinks Treasuries have peaked or are close to peaking, then MBS bonds also become an attractive asset class since they will be closely correlated with Treasury returns.

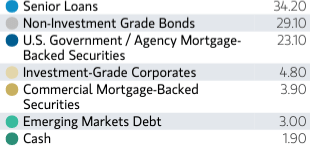

Holdings

The fund has three main sleeves:

Holdings (Fund Fact Sheet)

The Agency Mortgage Backed Securities one is the main focus for us. Leveraged loans have performed admirably, and have a very low duration, however it is the MBS sleeve that is going to benefit from a capital appreciation when rates move lower.

Furthermore, in the case of a credit spread spike (which we expect), the fund will do better than other CEFs due to this AAA bucket. As high yield moves lower, treasury yields should contract, thus giving the fund a ‘hedge’.

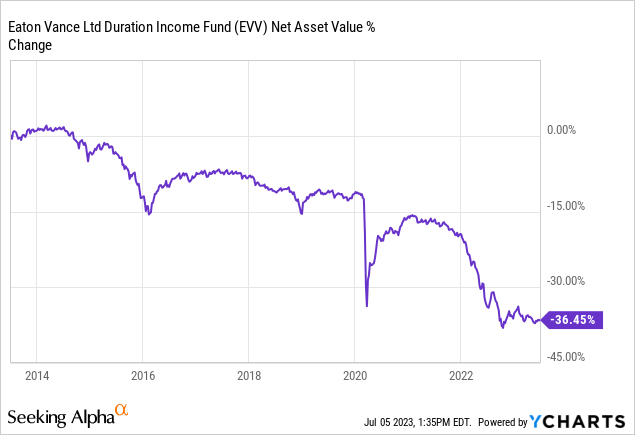

History of Overdistribution

The only aspect of this fund we are not too keen on is its propensity to overdistribute. The fund had a $0.1/share monthly distribution which was cut this year to $0.078/share. Irrespective, given its asset composition and high fees, the actual yield on the underlying assets is roughly 6.5%, despite its ‘stated’ 10% yield. The fund is though straightforward that it does not make 10%:

The Distribution Rate is based on the Fund’s last regular distribution per share in the period (annualized) divided by the Fund’s NAV or market price at the end of the period. The Fund’s distributions in any period may be more or less than the net return earned by the Fund on its investments, and therefore should not be used as a measure of performance or confused with “yield” or “income.” Distributions in excess of Fund returns may include a return of capital which, over time, will cause the Fund’s net assets and net asset value per share to erode.

This is clearly visible through its historic NAV performance:

Conclusion

EVV is a fixed income CEF with a multi-asset build. The vehicle has three main sleeves: leveraged loans, Agency MBS bonds and high yield bonds. We are mostly interested in its Agency MBS bond holdings and believe this is a great asset class to own right now. Through its build, the fund has a low duration, and its MBS sleeve will provide a hedge when the market moves to a risk-off mode. Furthermore, in 2024 when the forward curve shows us lower rates, the MBS sleeve will contribute capital gains to the structure. The only drawback for this name is its propensity to overdistribute. Pencil in an actual underlying assets yield of around 6.5% here versus the 10% the fund distributes. Investors looking for yield with a low standard deviation of returns should consider EVV, but be mindful of the ROC aspect. Leveraged MBS is hard to find, and EVV had a very nicely correlated return with BKT prior to the monetary tightening cycle.

Read the full article here