Risk comes from not knowing what you’re doing. – Warren Buffett.

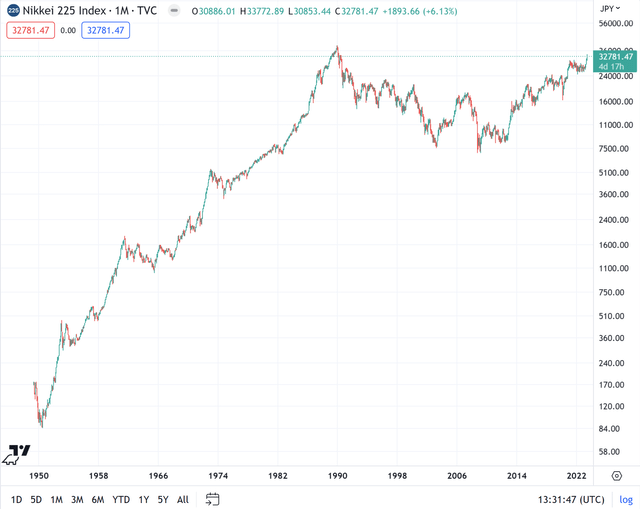

Japan’s stock market, characterized by the Nikkei 225 Index (NKY:IND), has been on a tear, reaching levels not seen since the infamous asset bubble of the late 1980s. That’s a long time for “buy and hold” to have proven itself for investors, and despite a lot of excitement, I remain skeptical that the move can last very long term given demographics and debt.

TradingView.com

Historical Context: The 1989 Peak and the Lost Decade(s)

In the late 1980s, Japan experienced an economic bubble where real estate and stock market prices were greatly inflated. By December 1989, the Nikkei 225, Japan’s premier market index, reached an all-time high of 38,915.87. This was a result of a 15-year climb that put Japan at the center of the global economic map. However, in 1990, the market fell dramatically marking the end of the so-called bubble economy.

The burst of the Japanese asset price bubble resulted in a massive accumulation of non-performing assets loans (NPL), causing financial difficulties for many institutions. This marked the beginning of what many call Japan’s lost decade, that ended up lasting for 3 decades (and may yet be 4). The Nikkei 225 has yet to surpass its 1989 high-water mark, but it’s getting pretty close and many are arguing a breakout is imminent.

The Current Rally: A 33-Year High

Fast forward to 2023, and suddenly Japan is the darling of Asia’s stock markets. The Nikkei has outperformed the S&P 500 (SP500), showing solid gains when measured in both local currency and U.S. dollars. This rally is largely attributed to a confluence of positive factors including strong corporate earnings, and Warren Buffet’s vote of confidence via his investments in Japan’s five biggest trading houses.

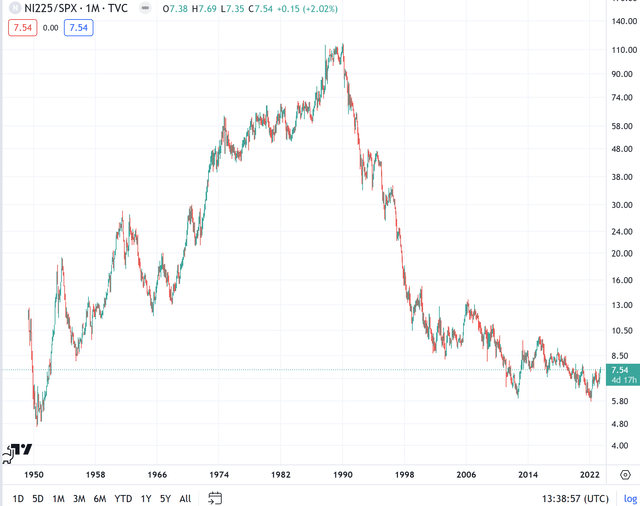

I tend to prefer investment in laggards because the biggest returns don’t come in the middle of an existing trend. The biggest returns come at the turn of the trend. From that perspective. one can argue that this could be the start of a secular period of outperformance relative to the S&P 500 (SPX). The relative price ratio of the Nikkei to the S&P 500 does look like it could have hit a meaningful longer-term low.

TradingView

Key Drivers of The Rally

Strong Corporate Earnings and Market Reforms

One of the significant factors contributing to the rally has been the string of robust corporate results. Pro-market reforms pushing companies to improve shareholder returns have also played a crucial role. Japanese companies have long hoarded cash, reaching $2.5 trillion, offering little return in a country where interest rates on cash remain below zero.

To counter this, the Tokyo Stock Exchange began urging companies to pay more attention to their stock price and provide plans to boost their price-to-book (PTB) ratios. This regulatory push encourages companies to use idle cash in the form of stock buybacks and other measures to improve shareholder returns.

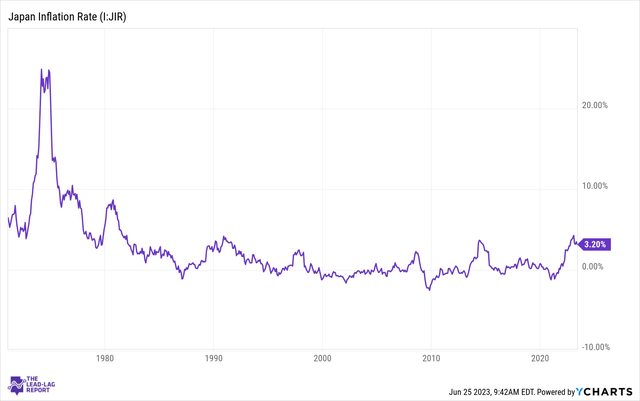

Inflation and a Weaker Yen

Another significant driver is the surge in inflation that started with the shortages and higher commodity prices of the COVID-19 pandemic. After nearly three decades of deflationary price pressures, Japan’s inflation rate has quickly climbed from near-zero levels to over 3%.

YCharts

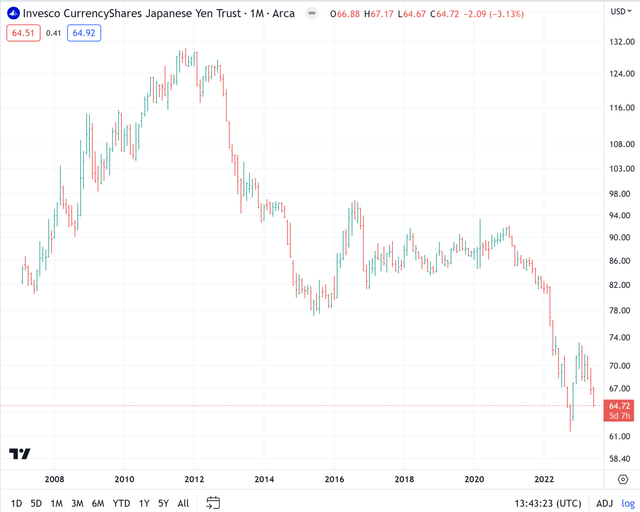

The yen (FXY) in the last two weeks seems to be in another free fall versus the dollar. A weaker currency makes the country’s exports relatively cheaper on the world market, a particular boon for a significant exporting nation like Japan. However, this can also be quite disruptive and result in significant strains if the speed of the move doesn’t slow down.

TradingView

Currency Risk Is Real

The iShares MSCI Japan ETF (NYSEARCA:EWJ) tracks the investment results of an index composed of Japanese equities and provides exposure to large and mid-sized companies in Japan. It has a diverse sector allocation with a significant exposure to the Industrials, Consumer Discretionary, and Information Technology sectors. It doesn’t quite track the Nikkei, but it does provide good exposure overall for those that believe in Japan’s potential to outperform, assuming the yen appreciates as stocks rise.

To that end, investors underestimate how large the currency impact can be on investing overseas. If we compare EWJ to the WisdomTree Japan Hedged Equity Fund ETF (NYSEARCA:DXJ), it’s clear that hedging currency has been important in this most recent surge.

TradingView

Japan’s Economic Outlook: A Structural Change?

The renewed interest in Japanese equities reflects three main considerations: relative cheap valuations, a long-awaited return of inflation, and a weakening currency. However, the key consideration for the long term will be Japan’s ability to make its economy more dynamic.

Japan faces a rapidly aging population and a shrinking labor force, not helped by the government’s restrictive stance on immigration. These demographic challenges pose enormous hurdles for Japan’s economy. Yet, despite these challenges, Japan might be able to regain some of its former standing due to heightened geopolitical tensions with China.

And let’s not forget the fact that Japan’s debt-to-GDP is solidly over 200%. It will take a lot more inflation and a lot of austerity to fix that.

Conclusion: If Allocating To Japan, Hedge Currency Risk And Be Careful

I’m conflicted on Japan here. On the one hand, I like the potential for long-term relative outperformance of Japan against the U.S. equity market, and short-term momentum is real. However, the debt headwinds make it hard to believe in Japan for anything other than a trade. If you’re considering ways of taking advantage of the momentum, factor in currency hedging to make it a pure-play on equities themselves.

And keep in mind that the Japan/U.S. price ratio could resolve itself by the U.S. stock market going down too.

Read the full article here