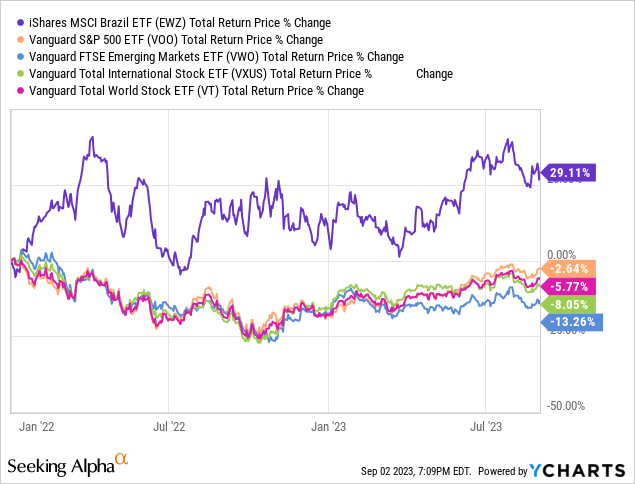

Latin American equities have been one of the few emerging market equity segments to see strong returns these past few years. The iShares MSCI Brazil Capped ETF (NYSEARCA:EWZ), a simple Brazilian equity index ETF, is no exception, with the fund strongly outperforming the S&P 500 since early 2022. EWZ has outperformed since I last covered the fund too, although only slightly so.

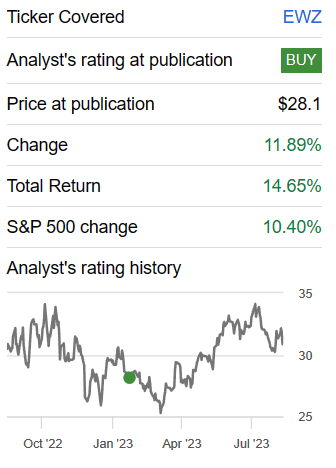

EWZ Previous Article

EWZ Previous Article

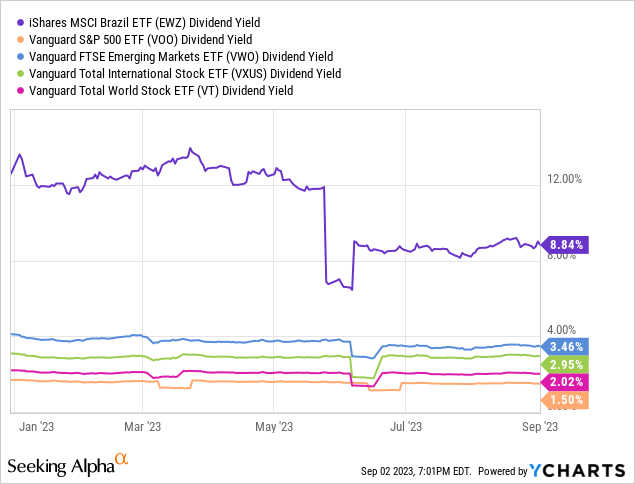

Although market conditions have changed, EWZ’s investment thesis and benefits remain broadly similar. The fund offers investors a strong, fully-covered 8.8% dividend yield, an incredibly cheap valuation, and strong momentum. The fund is a buy, but only appropriate for more aggressive investors, in my opinion at least.

EWZ – Basics

- Investment Manager: BlackRock

- Underlying Index: MSCI Brazil 25/50 Index

- Expense Ratio: 0.58%

- Dividend Yield: 8.84%

EWZ – Overview

EWZ is an equity index ETF, tracking the MSCI Brazil 25/50 Index. Said index invests in the largest, most relevant Brazilian equities, subject to a basic set of inclusion criteria. It is a market-cap-weighted index, with security caps meant to ensure a modicum of diversification, as well as compliance with regulatory standards.

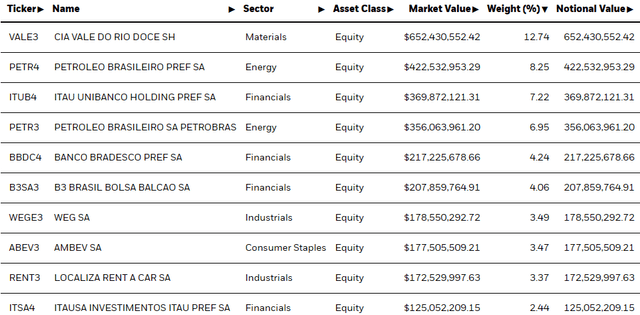

EWZ currently invests in 47 different companies, encompassing approximately 85% of the Brazilian public equities market by market cap. It is an incredibly concentrated fund, with the fund’s top ten holdings accounting for over 55% of its portfolio:

BlackRock

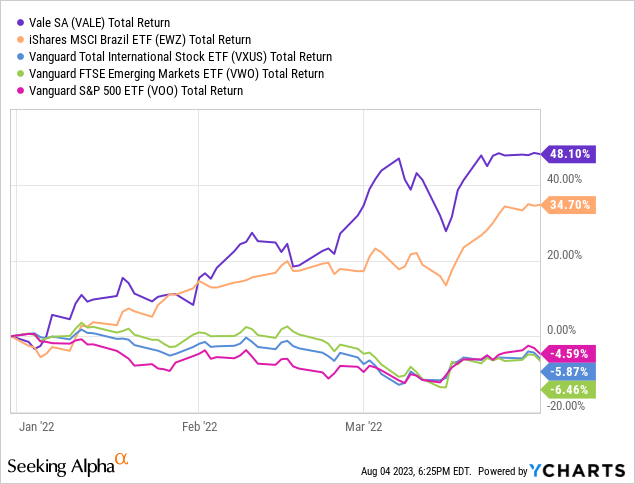

Portfolio diversification increases risk, volatility, and means fund performance is strongly dependent on the performance of its top 2-3 holdings. Expect significant gains and outperformance if the fund’s largest holding, iron-ore producer Vale (VALE), outperforms. This was the case in 1Q2022, during which iron ore prices skyrocketed:

Data by YCharts

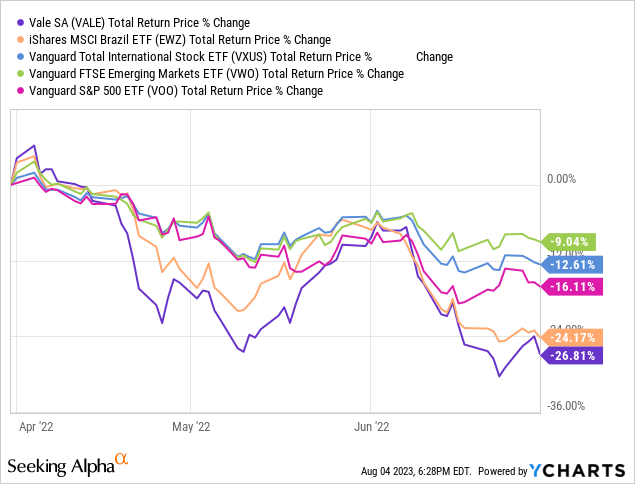

Expect significant losses and underperformance if Value underperforms, as was the case in 2Q2022, during which the market clawed back some of the gains above:

Data by YCharts

In both cases above, although EWZ was impacted by broader market trends, Vale’s performance was decisive, and meant the fund sometimes performed quite differently than broader emerging market equity funds. Look back at the graph for 1Q2022, and you’ll see that EWZ posted significant gains even as emerging market equity indexes posted sizable losses. EWZ is concentrated enough that fund performance could markedly differ from that of broader equity indexes, an important consideration for investors.

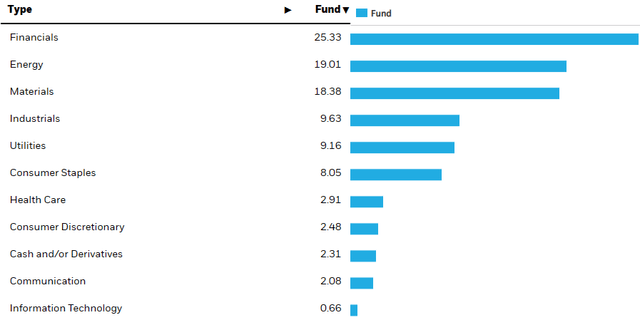

EWZ provides investors with some diversification within its investment niche, with the fund investing in most relevant industry segments:

EWZ

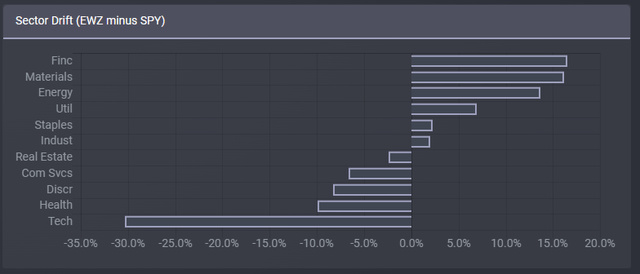

EWZ’s industry exposures differ markedly from those of the S&P 500, with the former being significantly underweight tech and health, while being overweight financials, materials, and energy.

Etfrc.com

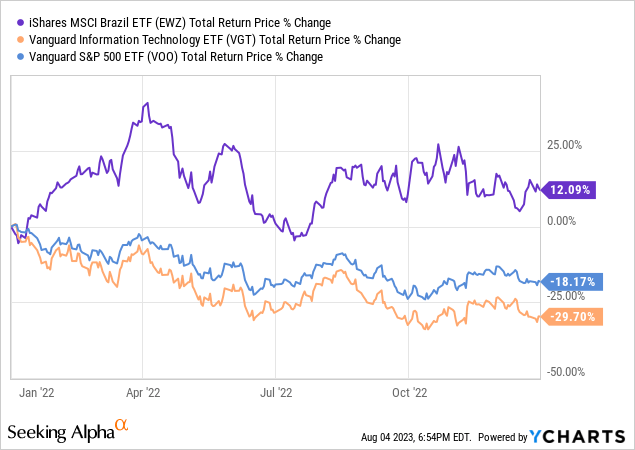

EWZ’s industry exposures impact the fund’s relative performance, with EWZ tending to underperform when tech outperforms, and vice versa. As an example, EWZ had an outstanding 2022, during which tech posted significant losses:

Data by YCharts

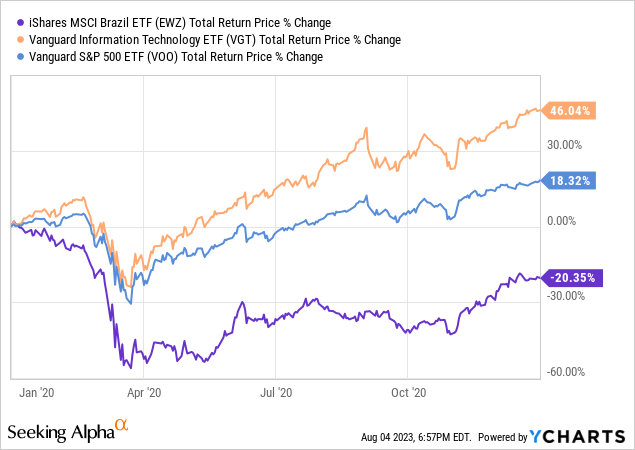

while the fund suffered significant losses and underperformance in 2020, when tech soared:

Data by YCharts

Notwithstanding the above, EWZ is still heavily impacted by fund-specific factors, including the performance of its largest holdings.

As should be clear from this section, EWZ is a very risky, concentrated investment. As such, the fund might only be appropriate for more risk-seeking investors and retirees. As the fund focuses on a relatively small market niche, Brazilian equities, I believe that position sizes should be kept small regardless.

EWZ – Investment Thesis

EWZ’s investment thesis is quite simple, and rests on the fund’s strong 8.8% dividend yield, cheap valuation, and strong momentum. Let’s have a look at these three points.

Strong, Fully-Covered 8.8% Dividend Yield

EWZ currently yields 8.8%. It is a strong dividend yield, and higher than that of most broad-based equity index ETFs:

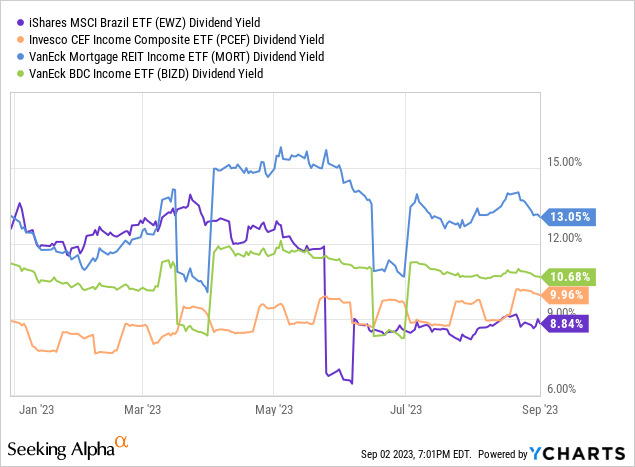

Some niche asset classes yield more, however, including CEFs, mREITs, and BDCs:

Strong dividends are almost always a benefit for a fund and its investors, and EWZ is no exception.

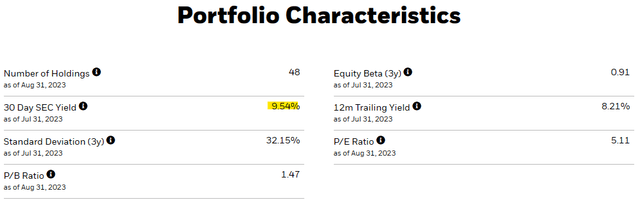

EWZ’s dividends are fully covered by underlying generation of income, as evidenced by the fund’s 9.5% SEC yield:

EWZ

Fully covered dividends tend to be safe dividends, although the situation is a bit more complicated for EWZ.

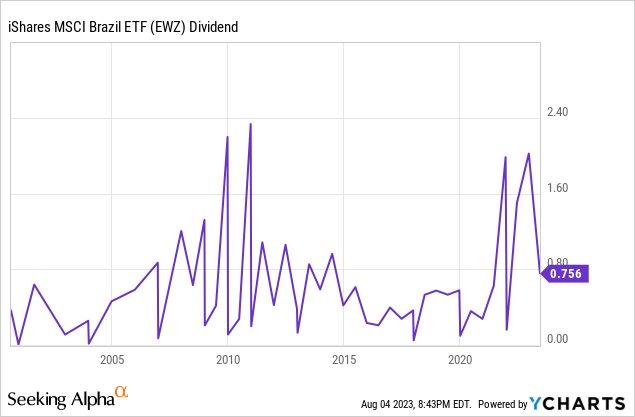

Emerging market equities sometimes have volatile dividends, as is the case for most of EWZ’s underlying holdings. Foreign currency volatility boosts dividend volatility for foreign investors, including EWZ and its investors. ETF dividends are somewhat volatile as well. This results in incredibly volatile, oscillating dividends:

Data by YCharts

As EWZ generates more than sufficient income to cover its dividends, as evidenced by its SEC yield, these should be safe, and should see positive growth moving forward. As the fund’s dividends are incredibly volatile, these might not necessarily behave as expected, or in-line with fundamentals. Perhaps dividends stagnate for months before a huge spike, as has been the case several times in the past.

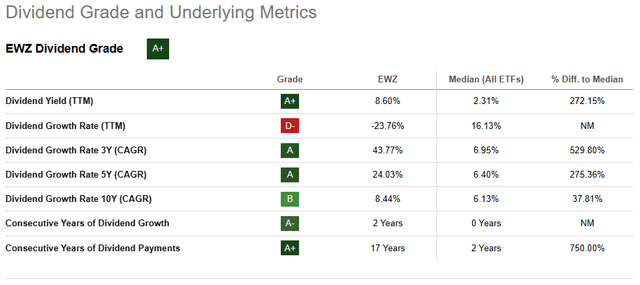

On a more positive note, the fund’s dividend growth track-record is broadly positive, if quite volatile. Dividends have grown at a healthily 8.4% CAGR this past decade, and a whopping 43.8% these past three years. On a more negative note, dividends have decreased 23.8% these past twelve months, a very sizable drop. This is partly the result of extreme dividend volatility, and partly due to abnormally large dividends in 2022. Do remember that dividends have grown long-term, and that long-term growth figures incorporate recent dividend cuts.

Seeking Alpha

EWZ’s strong, fully-covered 8.8% dividend yield and solid long-term dividend growth track-record are significant benefits for the fund and its shareholders. Dividend volatility and recent dividend cuts are important downsides in this regard as well, although I do believe that the fund’s dividends are, overall, strong.

Cheap Valuation

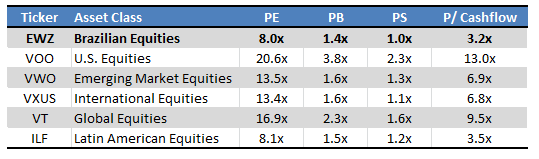

EWZ currently trades with a heavily discounted valuation, sporting a 8.3x PE ratio and 1.4x PB ratio. Both are low figures on an absolute basis, and significantly lower than those of most equity indexes. Latin American equities have similar valuations, however.

Morningstar – Chart by Author

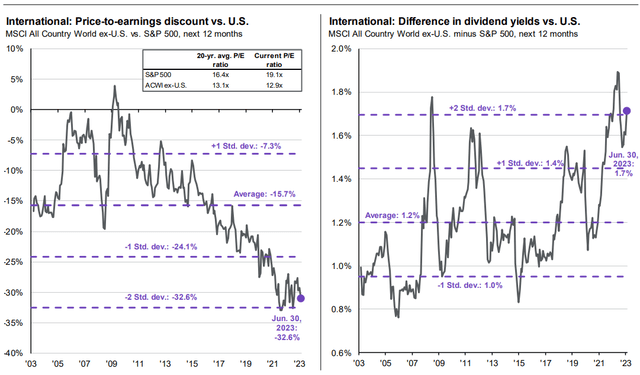

International equities tend to trade at lower prices and valuations than comparable U.S. equities, as investors are generally willing to pay premium prices for the latter. Emerging market equity prices tend to be particularly low, due to their greater risk. Importantly, valuation gaps between international and U.S. equities are much wider now than average.

JPMorgan Guide to the Markets

EWZ’s cheap price and valuation benefits investors in two key ways.

First, it boosts the fund’s dividend yield, a direct, certain benefit for investors.

Second, cheap valuations lead to significant capital gains and market-beating returns moving forward, contingent on valuations normalizing. Said gains are ultimately dependent on investor sentiment, and highly uncertain. Which brings me to my next point.

Strong Momentum

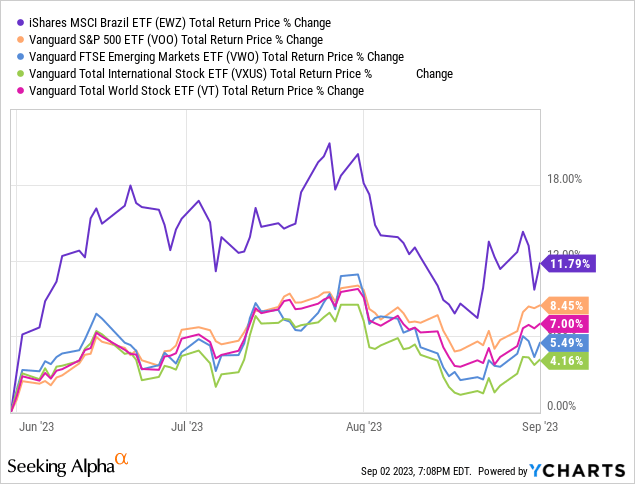

EWZ’s performance has been strong as of late, with the fund outperforming relative to most equity indexes these past three months:

Performance has been quite strong since early 2022 too, when sentiment turned bullish on cheap valued stocks, industries, and regions.

EWZ’s returns were driven by strong capital gains, product of improved investor sentiment, and the fund’s strong dividends.

EWZ’s cheap valuation supports further gains, and momentum is positive, and on the fund’s side. Under these conditions, gains could easily continue, in my opinion at least. If these stall, the fund still offers a compelling 8.8% dividend yield.

As a quick aside, although I am not currently invested in EWZ or other Brazilian equity funds, I have some investments in Colombian equities, and plan to invest quite heavily in Latin American stocks once I finish saving and paying for the down payment on a new apartment. Latin American equities look very cheap right now, and I believe they are particularly compelling investment opportunities for investors right now.

Conclusion

EWZ offers investors a strong, fully covered 8.8% dividend yield, and an incredibly cheap valuation. The fund is a buy, but only appropriate for more aggressive investors, in my opinion at least.

Read the full article here