Thesis

We recently covered the John Hancock Hedged Equity & Income Fund (HEQ), which we described as “weak”, and encouraged investors to have a look at Eaton Vance Tax-Managed Global Diversified Equity Income Fund (NYSE:EXG) instead for global equity dividend yield. We have covered this name over 14 months ago, so we are going to revisit this CEF, its performance, composition and forward.

Performance

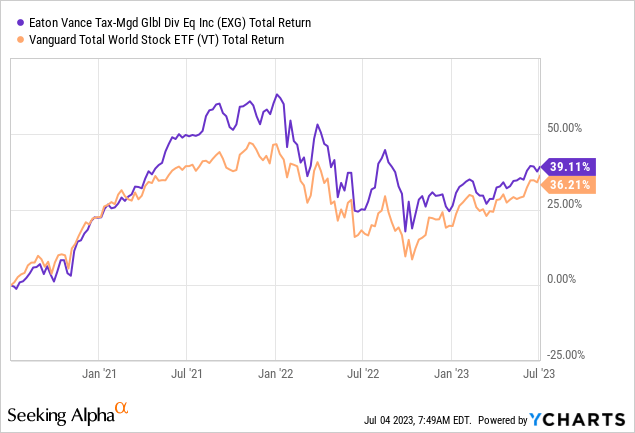

Given its underlying equity risk factor, this CEF was not spared a drawdown last year:

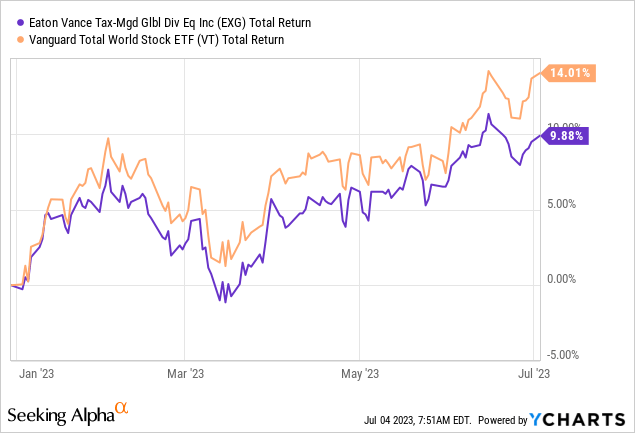

EXG is a rare breed that actually outperforms simple vanilla ETFs in the space. We can see how the CEF has done better in the past three years than the vanilla Vanguard Total World Stock ETF (VT). The fund sells call options on roughly half its portfolio, which has helped it buffer some of the downside during the 2022 onslaught. In a sustained market rally like in 2023 though, the fund underperforms given it has sold some of its upside:

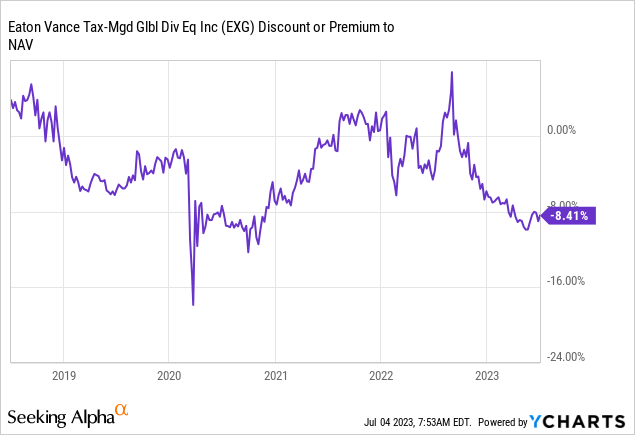

Premium/Discount to NAV

It is interesting to notice the CEF moving back to a very wide discount to NAV:

Unlike some other CEFs which exhibit a high beta to market risk-on/risk-off moves, this CEF has basically seen its discount widen ever since the October 2022 market sell-off. It is a particular feature that will revert during the next market cycle/market bull.

We can observe the same pattern occurring after the Covid market meltdown, with the fund steadily recording tighter discounts to net asset value, for the vehicle to actually move to a premium in 2022.

Holdings

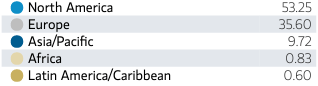

This CEF is a global equity one, with a primary North America and Europe build:

Regional Split (Fund Fact Sheet)

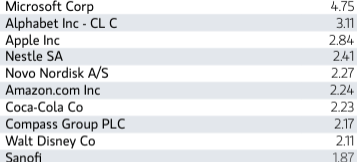

The fund has benefited from the recent trend of mega-cap outperformance, with its portfolio squarely focused on this sector. Its top holdings are well-known multi-nationals from across the globe:

Top Holdings (Fund Fact Sheet)

Mega-caps have proven extremely resilient in 2023, and in fact a handful of names from the sector have driven most of the S&P 500 gains this year.

One of the reasons driving the slight underperformance for the CEF versus a vanilla ETF this year is the structure of its options overlay:

Option Overlay (Fund Fact Sheet)

While the fund only overwrites 48% of its portfolio, it does so with only a very thin upside slice left. The ‘% out of the money’ gives us a 1% figure, meaning that if the portfolio rallies more than 1% every roughly 16 days, the fund will give up that incremental upside. The higher the figure here the more upside is left for the fund to have. Conversely, in a down market scenario, this structural feature helps the CEF buffer some of the market losses.

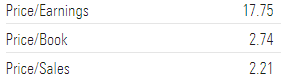

Unlike technology focused CEFs, this fund has very reasonable valuation metrics for its portfolio:

Valuation Metrics (Morningstar)

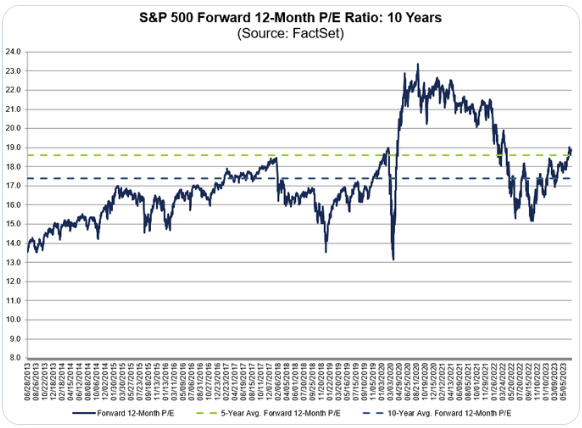

As a reminder the SPY is currently trading with a P/E of roughly 19x, when historically it has been 17x:

S&P 500 Forward P/E (Capital Partners)

When looking at this graph you always want to buy stocks when they are ‘cheap’. From a P/E stand-point that means the forward P/E ratio is below the dotted lines you see in the graph. The S&P 500 is now expensive by historic standards, pulled higher by U.S. tech mega-caps.

We cannot stress enough the importance of this valuation multiple. In most expansionary markets the bulk of market gains come from the expansion of the P/E multiple rather than from EPS. The usual bull cycle sees earnings per share increase and investors assigning higher P/E ratios on the back of optimistic views on continued earnings expansion. A high starting P/E ratio can really hamstring returns for many years to come.

What is in store for EXG going forward?

The CEF has proven itself as a reliable, robust global equity buy-write fund. Its portfolio is overweight mega-caps but not necessarily just tech mega-caps. Its valuations are on the high side but not stretched. At this point macro really comes into play. If you are of the opinion we are in a new structural bull market then the CEF is a buy, because it will do what it is supposed to, i.e. convert equity market returns into dividends.

We are however of a different opinion from a macro stand-point. We see a significant amount of greed in the market while fundamental factors such as PMIs (Purchasing Managers’ Index) and LEIs (Leading Economic Indicators) are flashing red. We think there will eventually be another market risk-off event, but timing is elusive. Nobody can time the market. From that angle EXG has the right set-up with a tight lid on the upside sold, but the fund will nonetheless lose value in correlation with the wider market.

Conclusion

EXG is a global equity buy-write CEF. The fund has done well historically and represents one of the better plays in the global equity space. The vehicle writes call options on roughly 48% of its portfolio, and gives up gains above 1% during the tenor of a call cycle, which is roughly 16 days. This CEF has done well when benchmarked against a plain vanilla ETF in the global equity space, but interestingly enough has seen its discount to NAV structurally widen since 2022. Expect this feature to revert once we enter a new true bull market. We are of the opinion we will see another severe risk-off event this year in the wider markets, so if you are already in the name Hold, while new money would do well to wait for a -10% correction here.

Read the full article here