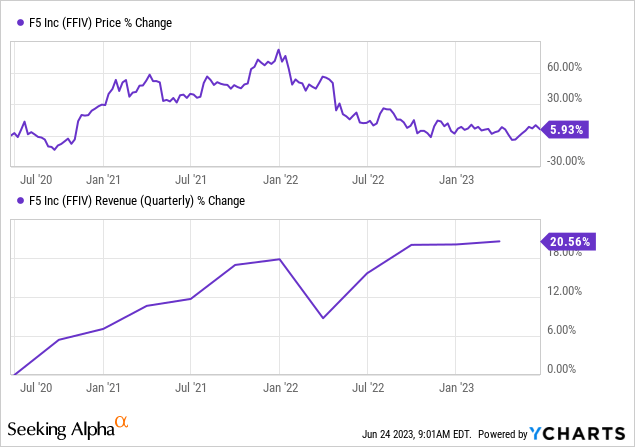

F5’s (NASDAQ:FFIV) share price is down by nearly 6% during the last three years, with the downside more pronounced since the start of 2022 coinciding with a restructuring of its services in order to capitalize on corporations outsourcing their cybersecurity services. However, this bet did not pay off as seen by the quarterly revenue regressing sharply in the first half of last year. Both the price action and growth are illustrated in the charts below.

Still, the recent progression seen during the last three quarters shows that things have improved, and my objective with this thesis is to assess the underlying reasons. Furthermore, by going through the company’s distributed cloud services portfolio and management comments in the second quarter 2023 (FQ2’23) earnings call ending in March, I will also check whether these higher sales can be sustained in the balance of this year.

I start by detailing how this company which is in the business of securing corporate networks, web, and mobile applications has been impacted by supply chain problems.

Outsourcing Bets Impacted by Supply Chain Woes

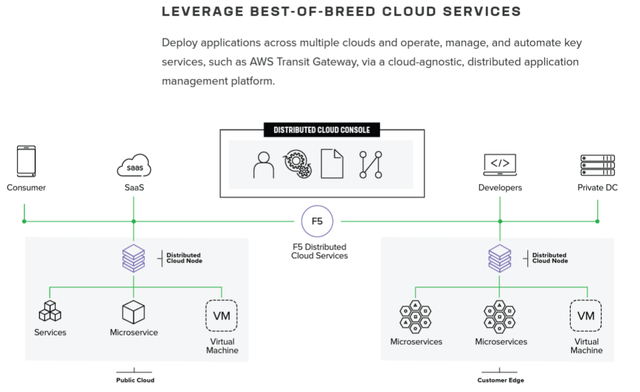

In February last year, F5 grouped its products and placed them under the Distributed Cloud Services product line. These include a collection of SaaS (Security as a Service) for the development and deployment of applications in multicloud environments and are also intended for securing IT operations.

This was in response to the growing security challenge faced by companies whose IT workloads are spread between the cloud infrastructures of Microsoft (MSFT) Azure, Amazon (AMZN), and Alphabet’s (GOOG) (GOOGL) GCP. Noteworthily, in the past, when they had their applications and databases sitting in their own on-premises data centers, things were simpler as all you had to do is install a firewall to be protected against external network threats. However, with data being spread over multi-clouds, things became more complicated.

Thus, with its Distributed Cloud Mesh which was rebranded from the VoltMesh brand following its acquisition of Volterra for $500 million in January 2021, F5 came up with a comprehensive product offering including a load balancer, a VPN (a virtual private network), routing services, DDoS protection, and other related services.

Distributed Cloud Mesh (www.f5.com)

This was a commendable strategy, but these services rely on F5’s own physical network, which means the need to produce and sell various hardware appliances in addition to software tools. The problem cropped up early in 2022 when supply chain problems impacted the ability to satisfy demand for appliances.

Subsequently, somewhat similar to Cisco (CSCO) as I had explained in a previous thesis, F5’s engineering team addressed the issue, namely through a redesign effort at the circuit board level for the company’s electronics with the objective of ousting out the hardest-to-obtain components while at the same time opening up to new suppliers, in an effort to be more diversified.

Growth is Back With Recurring Revenues

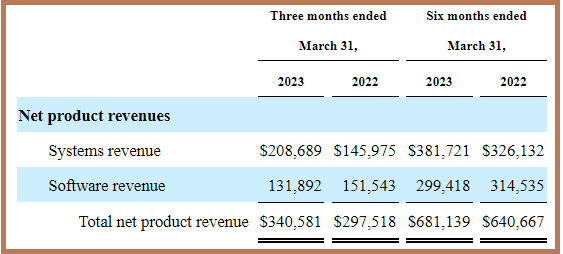

These efforts have paid off and enabled the company to fulfill delayed customer orders rapidly, resulting in Systems revenues (table below) growing by 43% year-over-year in the March quarter, while overall sales growth which also comprises software and services was up by 10.87%.

SEC Filing (seekingalpha.com)

Focusing on software, these are made up of subscriptions (including SaaS) which accounted for 83% of FQ2-23’s revenue, followed by perpetual license at 17%. Now, the change in the charging model from Perpetual mode to Subscription-based has been a challenge to many software vendors as convincing clients who paid on an annual basis to switch to a per-month one has not been easy. In this respect, F5’s having more than four-fifth of its customer base in subscription mode points to a more recurring and reliable revenue stream for software, especially during periods of economic downturn.

There is also competition.

For this purpose, the Distributed Cloud Services protection approach adopted by F5 has been found appealing by customers that have embarked on either the multicloud route or hybrid cloud strategies whereby part of the IT workload is hosted in the corporate data center. Reasons can vary significantly depending on use cases, but the two main ones are to reduce complexity while increasing the level of security. Furthermore, F5 is not the only one in this field as it competes with some of the big names in virtualization like VMware (VMW), as well as database giant Oracle (ORCL) or even internet cache services provider Akamai (AKAM). These suppliers capitalize on their own fields of expertise and take advantage of the need to bridge multiple cloud infrastructures in a secure fashion.

Here, the fact that customers have waited for F5 to correct its supply chain problems instead of canceling orders and switching to the competition shows that the company’s WAF (web application firewall) remains attractive as it obtains a score of 4.6 out of 5 according to a comparison by Gartner. Another reason for customers remaining faithful to F5 is its market positioning as an independent service provider whose products integrate well with the big cloud players I mentioned earlier. To this end, the company only manages the cloud interconnections, not the basic cloud operations, which are left to the hyperscalers themselves.

Going forward, this attractiveness is likely to be tested, this time by demand concerns.

Facing Demand Issues Due to Unfavorable Macros

In this case, the sales team has witnessed “customers scrutinizing budgets and deferring spend for anything except the most urgent projects”. As a result, FQ2-FY’23’s software sales unexpectedly decreased by 13% Y-o-Y as pictured above.

Going into more detail, this could be due to the high-value (six-figure or seven-figure) software deals the company is involved in comprising projects where customers transform their IT networks instead of merely doing some product additions. Therefore, expect sales to be pressured by downsizing and possibly even losing some market share to giant Google with its Cloud Armor, especially in instances when companies opt for more incremental additions as a result of budgetary constraints and facilitated by the fact that they already use the hyperscaler’s GCP (Google Cloud Platform). According to the executives, economic headwinds should also impact Systems sales as well.

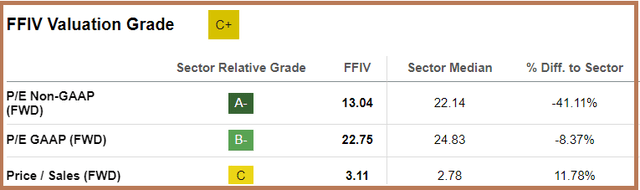

As a partial offset to the above, the company’s base of software renewals continues to grow in the second quarter as well as its managed services customer base. However, all-in-all, the expectation for FY’23 has been downgraded to low-to-mid single-digit growth compared to 9%-11% previously. In these circumstances, with a Price-to-Sales multiple that is already above the sector median by nearly 12% as shown below, the stock may not look attractive.

Valuation Metrics (seekingalpha.com)

On the other hand, those who are holding onto the stock or want to position themselves for the long-term, F5’s lower Price-to-Earnings ratios, both on a GAAP or non-GAAP basis, remain undervalued, and it is worthwhile to investigate the reasons for this.

Highly Profitable and a Long Term Investment

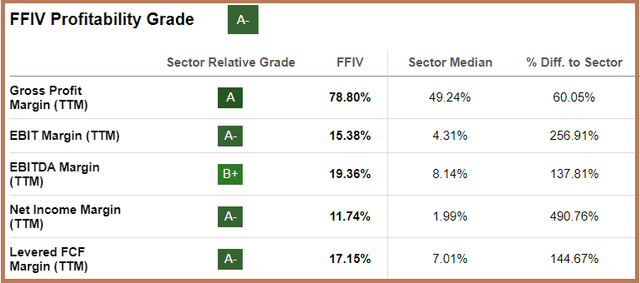

First, its gross margins of 78% are well above the average, which shows that the company has attained a high level of efficiency in the way it rolls out products and manages its platforms.

Profitability Metrics (seekingalpha.com)

Second, the company exercises a high level of discipline as to costs, going to the point of reducing its headcount by around 9% until customer spending resumes. It has also scaled down on traveling and reduced bonuses paid to employees. Talking profitability, it has been beating EPS consensus estimates for the last four quarters and expects non-GAAP earnings to grow by 7% to 11% for FY’23.

Thus, it deserves better, considering that its forward P/E of 22.75x (valuation grade table above) is undervalued relative to the sector median of 24.83x. Adjusting accordingly, I have a target of $157.7 (144.5 x 1.0914) based on a share price of $144.5. Still, I have a hold position on the stock in view of deteriorating macros. Noteworthily, these could result in lower demand because of the uncertain economic environment, which could be exacerbated in the event of a mild recession.

Consequently, it does not seem like F5 will be able to sustain the growth acceleration it has recently enjoyed, despite the supply-related issues addressed. This could be the cause of a stock downside when the third quarter results are announced in July, especially after high market expectations after last quarter’s double-digit expansion.

This said, despite medium-term downside risks, its competitive position remains strong as customers stick to its product and multi-cloud protection architecture. Finally, with above-average free cash flow margins, F5 remains more of a long-term investment for those who can stomach volatility.

Read the full article here