Near-zero interest rates and trillions of asset buying by central banks (QE) enabled twelve years of increasingly deranged financial behaviour between 2011 and 2023. In the process, gambling became an international preoccupation, and investable assets were traded to uneconomically high valuations.

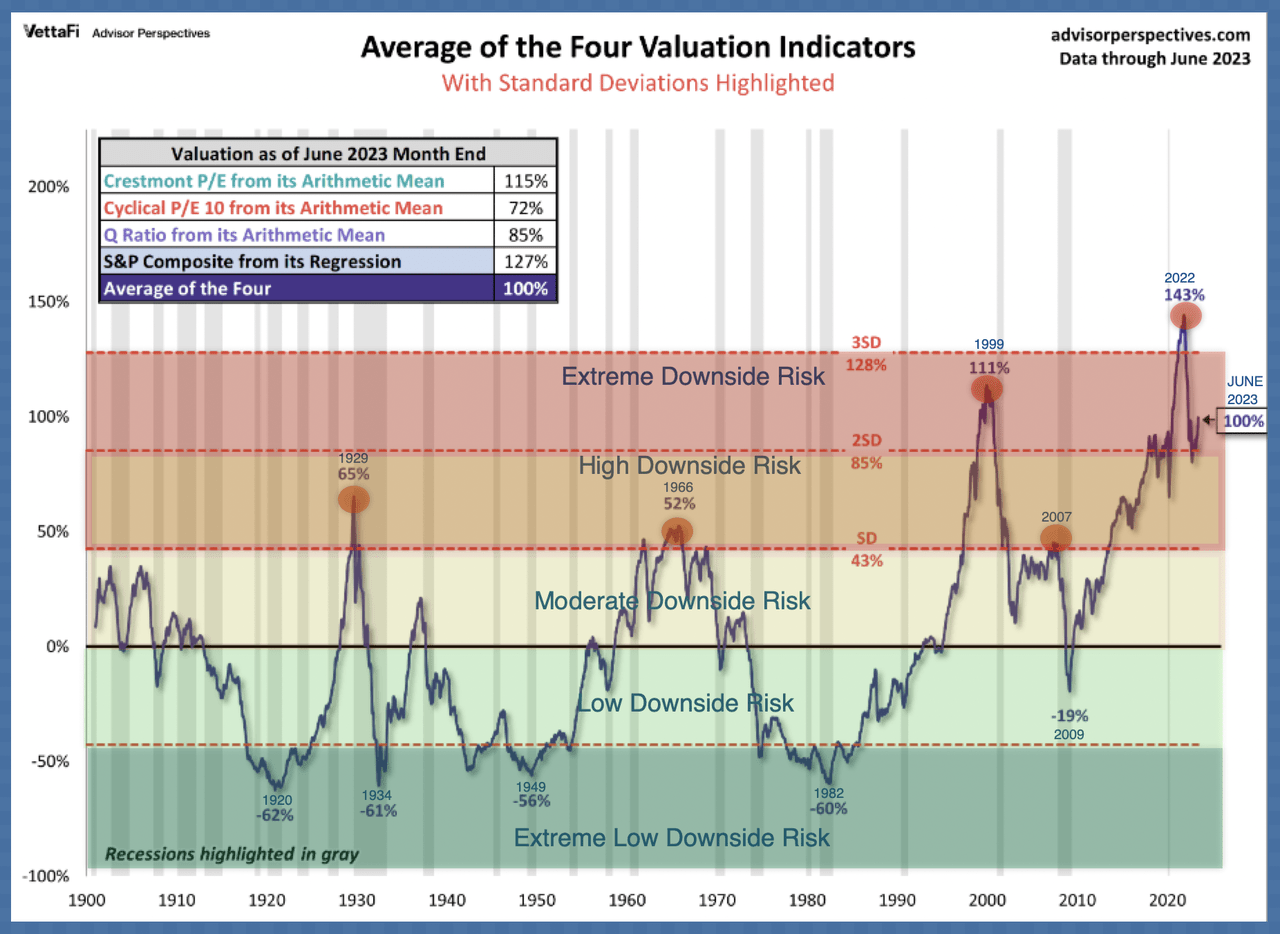

A global standout, at the market peak in 2022, the S&P 500 Index (shown below since 1900) traded at 143% of a historical valuation mean composite (above three standard deviations) and surpassed the 111% top seen in the 2000 cycle and the 65% zenith reached in 1929. You can read more about the components here.

As in the 2007 and 2000 cycle tops, the US and Canadian central banks are now holding base rates in the banking system at around 5%. Different this time, they are contracting liquidity even more by rolling billions off their balance sheets (QT) monthly.

While mean reversion began in 2022, so far, equity valuations remain 100% (more than two standard deviations) above the historical mean and still within the extreme capital risk zone (red band above) – don’t take it from me; look at the chart with your own eyes. While the pandemic-inspired freefall in March 2020 was dramatic, it was too short and shallow to crush speculative mania and restore longer-term investment prospects.

From past valuation extremes, normalized interest rates sparked protracted market loss cycles that finally resulted in buying opportunities with income yields above 8% and capital risk low/extremely low on the historical scale (yellow and green bands above).

To repeat: It’s not just that avoiding bubbles and buying near cycle lows locks in rich-income yields for years after that; it also dramatically reduces the likelihood of capital losses and years of gut-grind trying to recover.

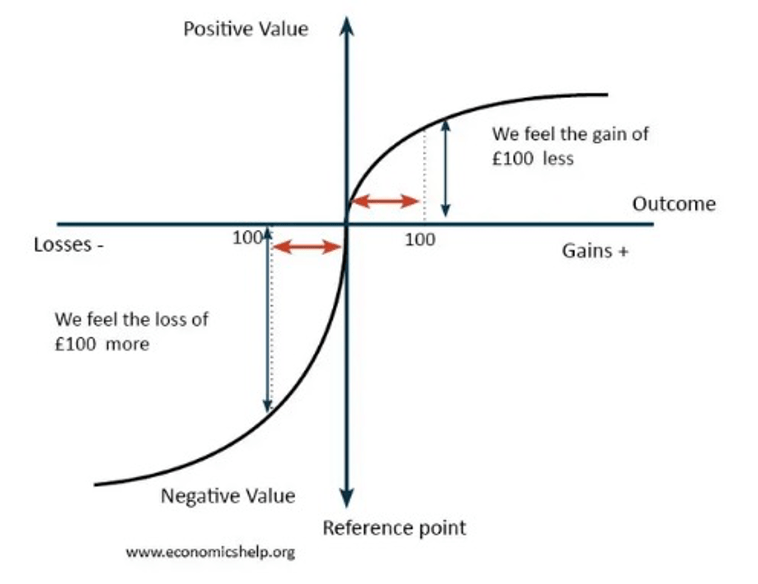

It’s essential to realize that psychological studies and life experience confirm we humans feel the pain of loss much more acutely than the joy of a fleeting gain. Most of us will bail after extended losses and never make them back.

Buying extremely-overvalued assets is too expensive in every way. Fat pitches take time to materialize, but not waiting for them makes no sense.

Disclosure: No positions

Original Post

Editor’s Note: The summary bullets for this article were chosen by Seeking Alpha editors.

Read the full article here