Thesis

With most market analysts asserting that a recession is coming, retail investors are rightfully pondering ways to correctly position their portfolios so that they do not experience significant losses and also maintain upside. As per the National Bureau of Economic Research, a recession is represented by two consecutive quarters of negative real GDP. Most market participants though, recognize a recession by the negative reaction it causes in the equity market:

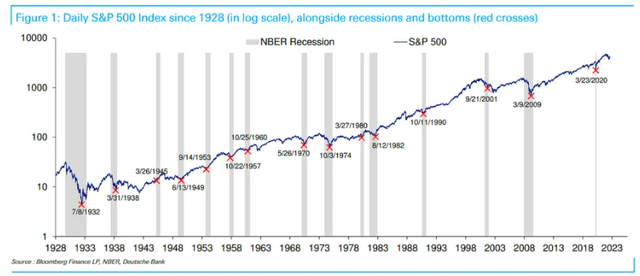

Recessions and Equities (Deutsche Bank)

We can see from the above graph, courtesy of Deutsche Bank, that there are no recessions in the past century that were not accompanied by a substantial sell-off in the equity market.

It is not impossible to recognize the traits of an incoming recession, thanks to leading economic indicators, which are predictors of where the economy is headed:

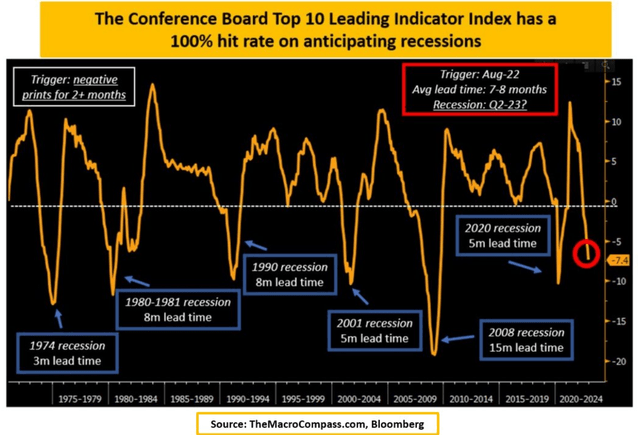

Leading Indicators (TheMacroCompass)

We can see from the above graph that LEIs have already gone into negative territory and continue to decrease. As highlighted by the Macro Compass team, the top-10 conference board leading indicator index has a 100% hit rate on anticipating recessions, pretty much guaranteeing we are going to have one this year.

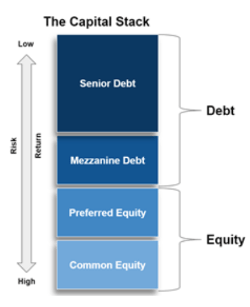

An investor also needs to remind themselves on why equities sell-off in a recession – stocks represent the most sensitive slice of the capital structure, and they are first to get impacted by the lower profitability that a recession brings to the corporate world:

Capital Structure (Rod Khleif)

Historically, credit risky debt also sells-off in a recession, but not as much as the equity slice since the debt portion is senior in a bankruptcy. One also has to make a distinction here between the various forms of debt – credit risky debt (i.e. below investment grade) is more sensitive to a recession from a price perspective, while government bonds and investment grade bonds less so.

Back to Negative Correlations with Equities

2022 was a banner year for many reasons. One of them being the positive correlation observed between Treasuries and equities:

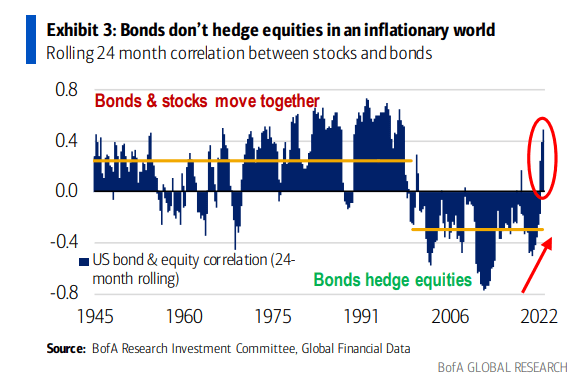

Bond / Equity Correlation (BofA)

Historically, for the last two decades, equity and bond prices have moved in opposite directions. But in 2022, bonds and equities sold off in tandem due to the aggressive monetary tightening undertaken by the Federal Reserve.

As rates rose aggressively bond prices collapsed. Equities declined as well due to fears of the damage to be done to the economy by such an aggressive move. We have seen recently through the regional banking crisis, that those fears were accurate, with the violent rise in rates last year creating substantial accounting losses in banks’ held to maturity portfolios.

We believe we are nearing the top in rates as anticipated by the SOFR futures curve and what many market participants are penciling in. It is safe to assume that the top range for Fed Funds will be 5% to 5.5%. Once the Fed pauses, the only place for rates to go is down. We have already started to see a negative correlation between bonds and equities during the recent intermediary market sell-offs, in stark contrast to the actions witnessed in 2022.

Firstly bonds are no longer paying ‘chump change’, but actually yielding almost 5% for AAA credit-risk free securities. That is a sea of change from 1% levels for long duration bonds not so long ago. Secondly, when we layer in a bit of credit risk via corporate spreads we can get all-in yields in excess of 6% for extremely robust investment grade bonds.

FBND Holdings

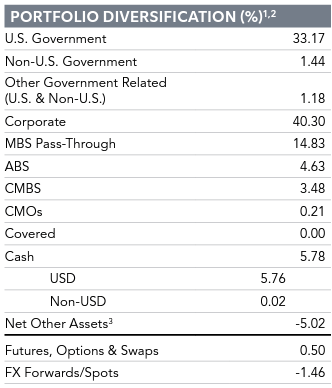

The fund contains a mix of Treasuries, Agency MBSs and corporate bonds:

Holdings (Fund Fact Sheet)

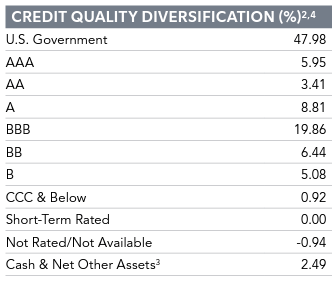

Treasuries and MBS bonds account for the majority of the portfolio at an aggregate of 47.98%. This sectoral allocation drives the overweight AAA credit rating positioning:

Ratings (Fund Fact Sheet)

To note the fund segregates AAA Treasuries and MBS securities as “U.S. Government”, while the AAA bucket present above encompasses just AAA Corporates and ABS slices.

The vehicle is overwhelmingly investment grade, with only a roughly 12% allocation to below investment grade credits. This translates into rates being the driving risk factor in this fund, rather than credit spreads.

From a duration perspective, the fund falls in the intermediate duration bucket:

Duration (Fund Fact Sheet)

Weighted average maturity is the average time until the principal in repaid for a security, while duration addresses the portfolio’s sensitivity to changes in interest rates. Investors should focus on duration.

Why should you buy FBND to prepare for a Recession?

The Fidelity Total Bond ETF (NYSEARCA:FBND) is an exchange traded fund with ample liquidity. The vehicle has a build which is overweight AAA assets, which compose over 47% of its portfolio. The rest of the fund is allocated to corporate issuers, mainly investment grade. Junk bonds represent only roughly 12% of this fund. The fund’s main drivers are going to be rates, with a very low sensitivity to credit spreads.

We think we are going to witness peak rates soon, with the Fed pausing. As the higher rates environment percolates through the economy we are going to experience a recession which is going to put downward pressure on equity prices. The Fed will be forced to lower rates in 2024 as a result of the impeding recession, action which will result in higher bond prices.

We feel AAA Treasuries and MBS bonds are a great store of value during 2023, especially given their all-in yields in excess of 4.5%. The same securities will provide for a nice bump-up in 2024 as rates decrease.

FBND currently provides for a 5.14% 30-day SEC yield from a portfolio of mainly AAA assets, all obtained with a 3-year historic standard deviation of only 6.5%.

Conclusion

FBND is an exchange traded fund overweight AAA assets. Treasuries and Agency MBS bonds compose over 47% of the portfolio here. The rest of the fund is mainly invested in investment grade bonds, with only a 12% allocation to junk credits. The ETF provides for a high 5.14% 30-day SEC yield, and its returns are going to be mainly driven by interest rates.

With economic leading indicators going into negative territory and decreasing, retail investors should prepare themselves for a recession. During the past century, all recessions have resulted in equity market sell-offs, stocks being the most sensitive part of a company’s capital structure. We believe Treasuries, Agency MBSs and highly rated investment grade bonds are a great store of value in today’s environment, especially from the lens of peak rates. We are of the opinion that the Fed will pause soon, and the historic negative correlation between equities and AAA bonds is set to resume this year. An equity market collapse on the back of lower profitability prints for corporates should see investors migrate to Treasuries and MBSs, which are actually providing substantial yields in today’s environment. If you are worried about a potential recession, don’t be. Just sell equities and buy bonds.

Editor’s Note: This article was submitted as part of Seeking Alpha’s Best Investment Idea For A Potential Recession competition, which runs through April 28. This competition is open to all users and contributors; click here to find out more and submit your article today!

Read the full article here