I last covered the Fidelity High Yield Factor ETF (NYSEARCA:FDHY), an actively managed high-yield corporate bond ETF, in late 2022. In that article, I argued that FDHY’s above-average, growing 7.4% yield made the fund a buy. FDHY has outperformed its benchmark since then, as expected. On the other hand, dividends have been cut, and some of its peers have seen their yields increase due to lower share prices.

Right now, FDHY offers investors a below-average 6.1% dividend yield, an above-average performance track record, and a high 0.45% expense ratio. On net, I don’t find the fund’s value proposition to be all that compelling, so I would not be investing in the fund at the present time.

FDHY – Basics

- Investment Manager: Fidelity

- Dividend Yield: 6.06%

- Expense Ratio: 0.45%

FDHY – Overview and Analysis

Holdings and Portfolio

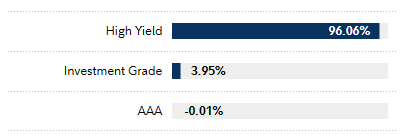

FDHY is an actively managed high-yield corporate bond ETF. The fund’s holdings are almost all non-investment grade corporate bonds, with these encompassing over 95% of the fund’s portfolio.

FDHY

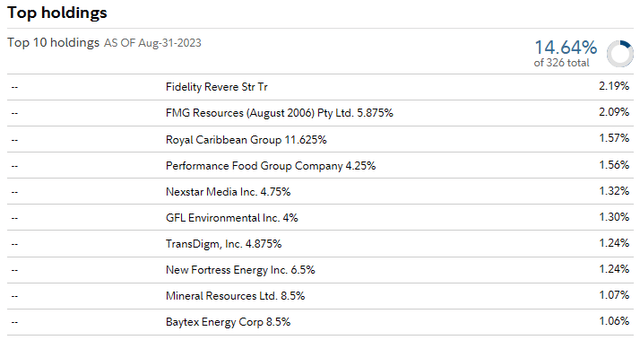

FDHY’s portfolio is quite diversified, with the fund investing in over 300 bonds from over 100 issuers. Concentration is quite low, with no issuer accounting for over 3.0% of the fund’s portfolio, and very few over 2.0%.

FDHY

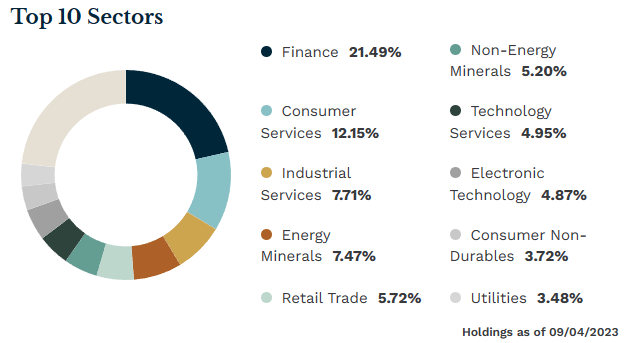

Industry exposures are quite diversified as well, with an overweight financials position, common for this investment niche.

ETF.com

Besides the above, nothing much else stands out about the fund’s portfolio. It is a simple high-yield corporate bond ETF, with the holdings and portfolio expected for such a fund.

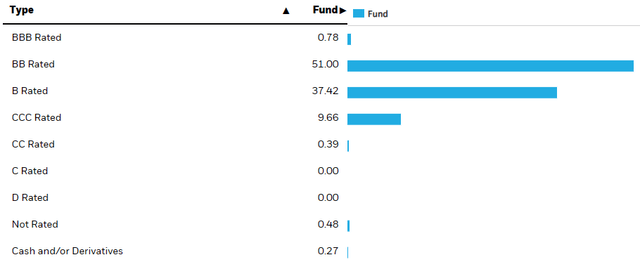

Credit Risk

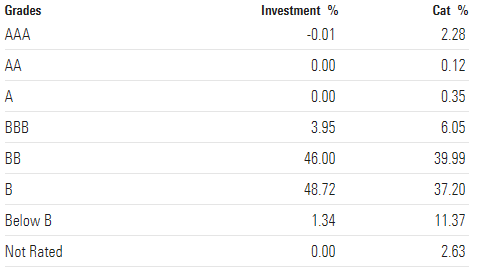

FDHY focuses on non-investment grade bonds. Said bonds are overwhelmingly issued by weaker companies, with comparatively low credit ratings. Latest data shows FDHY evenly split between BB and B-rated bonds.

Morningstar

Most high-yield corporate bonds tilt towards BB-rated bonds, however. For reference, credit quality for the iShares iBoxx $ High Yield Corporate Bond ETF (HYG), the largest fund in this niche.

FDHY

FDHY’s credit quality seems to be a bit lower than average for a high-yield corporate bond fund, but portfolio turnover for the fund is quite high, so I’m not confident that the figures above are up-to-date / reflective of the fund’s current or future portfolio.

Morningstar

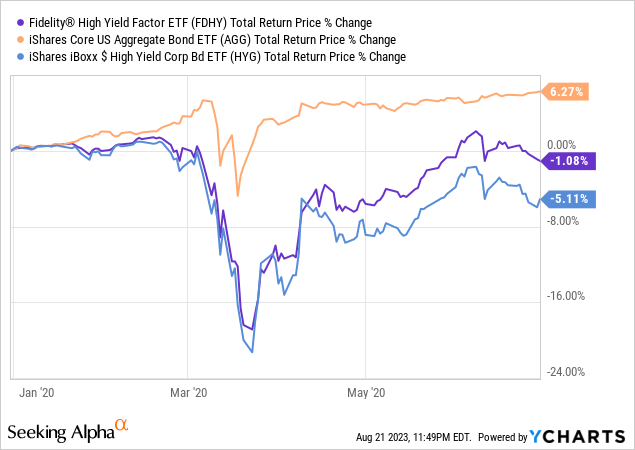

Although the specifics are unclear, it does seem certain that FDHY focuses on relatively risky bonds, with above-average default rates. Default rates are somewhat dependent on underlying economic conditions, which means prices are too. As such, investors should expect sizable losses during downturns and recessions.

FDHY did post some losses during the last recession, in early 2020, in line with expectations. On the other hand, the fund recovered faster than benchmark high-yield corporate bonds, exceeding expectations: credit quality being weak should lead to higher, longer-lasting losses, not the opposite. I’m guessing high portfolio turnover explains the discrepancy, the fund’s portfolio was probably of higher quality in prior years.

Data by YCharts

FDHY’s relatively risky holdings are a negative for the fund and its shareholders. Due to high portfolio turnover, it is unclear just how risky these are.

Dividends

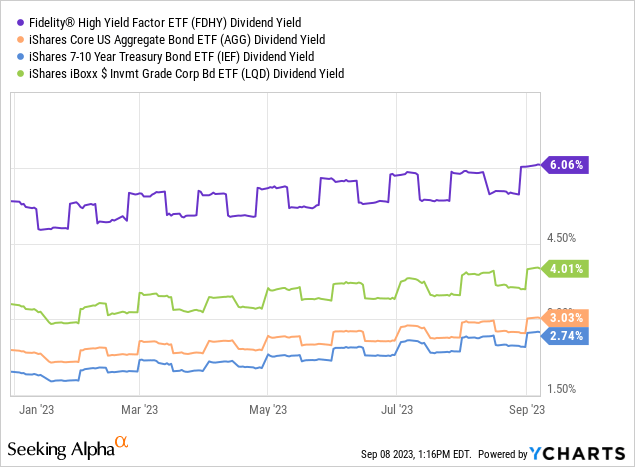

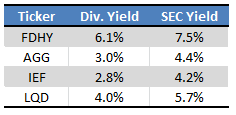

FDHY focuses on non-investment grade corporate bonds, with weak credit ratings but competitive, above-average dividends. The fund currently yields 6.1%, a reasonably good yield, and higher than that of the average bond, treasury, and corporate bond.

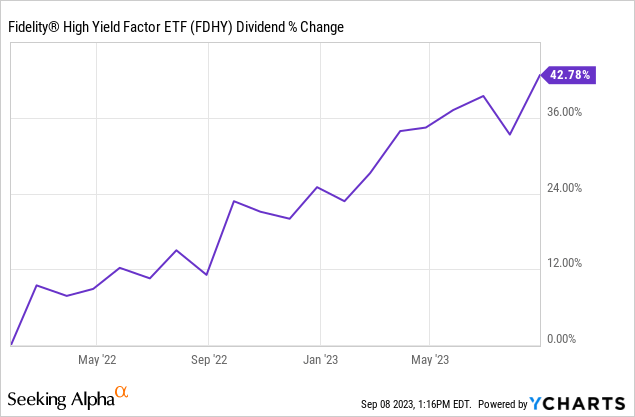

FDHY’s underlying generation of income has grown since early 2022, due to Federal Reserve hikes. Income growth has led to strong dividend growth, with the latter increasing by 42.8% since early 2022.

It generally takes years for Fed hikes to fully impact investment markets, and months for changes in economic conditions/income generated to be reflected in ETF dividends and dividend yield. Due to this, the fund’s 6.0% dividend yield might not necessarily reflect the income that investors can expect moving forward. The fund’s 7.4% SEC yield, which measures its underlying generation of net investment income for the past 30 days, seems like a more informative figure, in my opinion at least.

FDHY’s dividends compare favorably to those of the average bond and most bond sub-asset classes.

Fund Filings – Chart by Author

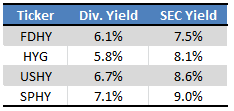

FDHY’s dividends generally compare unfavorably to those of its high-yield bond peers, including the benchmark HYG, and some of the cheaper funds in this niche. Its SEC yield is particularly low, indicating much lower income in the recent past than average.

Fund Filings – Chart by Author

FDHY’s comparatively low dividends are a disadvantage relative to its high-yield corporate bond peers.

Total Performance

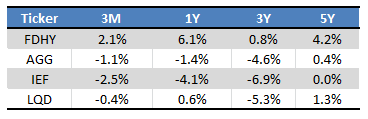

FDHY’s total performance track record is good, although not outstanding. The fund has outperformed most other bonds and bond sub-asset classes since inception/long-term, due to its strong dividends. Outperformance has been particularly significant these past few years, owing to the fund’s low-interest rate risk and higher rates.

Seeking Alpha – Chart by Author

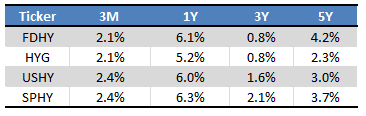

FDHY’s performance seems somewhat stronger relative to its high-yield corporate bond peers, but this does vary from fund to fund, and time period to time period.

Seeking Alpha – Chart by Author

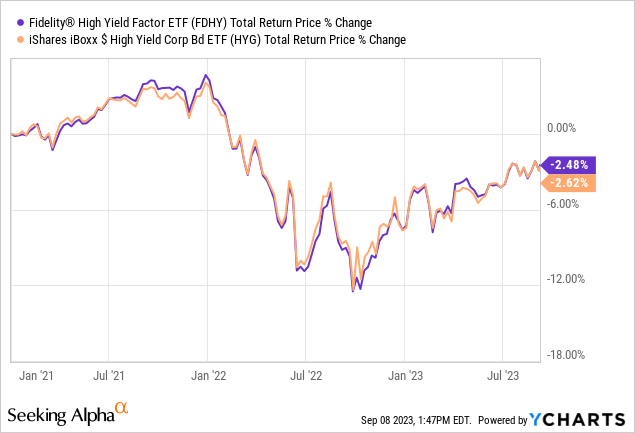

An issue not reflected in the figures above is the fact that the fund’s performance has almost perfectly matched the performance of its benchmark, HYG, since early 2021. The graph is quite striking.

Although the fact that FDHY so closely tracks its benchmark is not a negative per se, it does severely diminish the fund’s investment thesis. Looking at the graph above, I see a few reasons to choose FDHY over HYG. Bear in mind, this does not apply to other high-yield corporate bond funds. The SPDR Portfolio High Yield Bond ETF (SPHY) has a strong 7.1% dividend yield, while the VanEck Fallen Angel High Yield Bond ETF (ANGL) has significantly outperformed its benchmark since inception, for instance.

Conclusion

FDHY is an actively managed high-yield corporate bond ETF. Although there is nothing inherently wrong with the fund, I don’t find its overall value proposition compelling. Relative to peers, dividends are generally lower. Performance is identical to that of its benchmark for the past 2 years and counting. Credit quality seems lower, but turnover makes it difficult to know for certain. Expenses are higher. I see a few reasons to invest in FDHY over other high-yield corporate bond funds, so would not be investing in the fund at the present time.

Read the full article here