Do you know the only thing that gives me pleasure? It’s to see my dividends coming in. – John D. Rockefeller

Let me start off by saying I like dividend plays now. There are cycles that favor capital appreciation stocks and cycles that favor dividends, and I think we are at the point where dividend stocks really outperform. And while I’m concerned about equities broadly, I do think there’s some real potential for momentum on a relative basis in dividend stocks.

To that end, one fund that is worth considering is the First Trust Morningstar Dividend Leaders Index Fund (FDL), which seeks investment results that correspond to the price and yield of the Morningstar® Dividend Leaders Index℠, before considering the fund’s fees and expenses. The index is compiled and maintained by Morningstar, a reputable provider of independent investment research. The selection criteria for the index focuses on high dividend yield and sustainable dividend policies, offering a distinctive approach for income-seeking investors.

The Dividend Leaders Strategy

FDL adopts a specific strategy that emphasizes dividend leaders – companies that have consistently paid dividends over a prolonged period. Companies with non-qualifying income dividends, such as Real Estate Investment Trusts (REITs), or those with a negative five-year dividend growth, or a projected payout ratio above 100%, are excluded from consideration. The remaining stocks are ranked by indicated dividend yield, and the top 100 are selected for inclusion in the index.

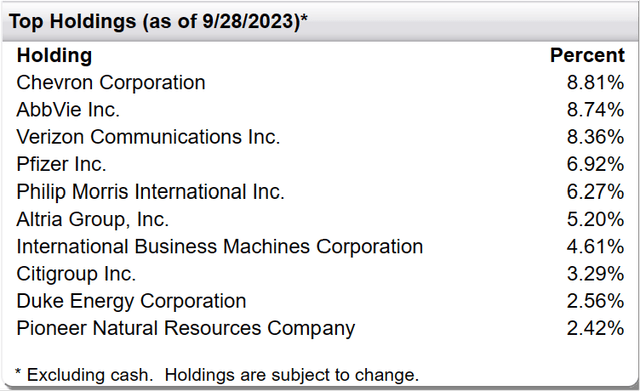

One of the noteworthy attributes of the FDL ETF is its portfolio concentration. Despite having 100 holdings, the ETF’s portfolio is significantly skewed by its selection and scoring criteria. The top 10 stocks comprised about 57% of the portfolio. This level of concentration signifies that while no single stock’s performance can greatly affect FDL, the collective performance of the top 10 can have a substantial impact on the ETF’s overall performance.

ftportfolios.com

Sector Exposure

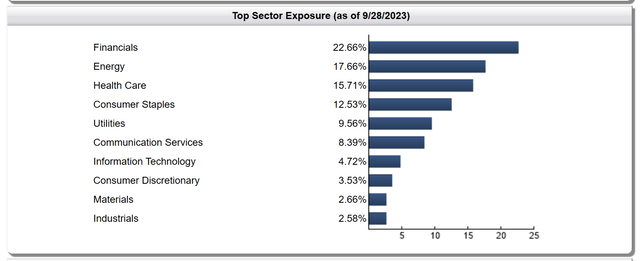

FDL’s sector exposure is heavily skewed towards financials and energy, which together constitute nearly 40% of the ETF’s holdings. This is considerably higher than the average sector allocation in many core stock ETFs, making FDL a unique proposition for investors seeking exposure to these specific sectors.

ftportfolios.com

Performance Analysis

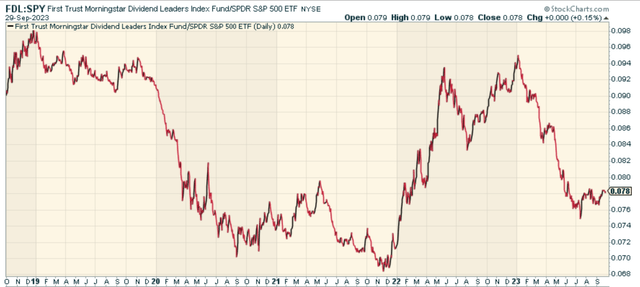

When we compare FDL relative to the S&P 500 (SPY), we can see the downtrend and relative underperformance seems to be reversing. I’d like to see a bit more here, but this is an encouraging sign that the pendulum is swinging back towards dividend plays perhaps longer term.

StockCharts.com

Peer Comparison

Now – there are plenty of competitors in the space. Direct competitors include other U.S. large-cap dividend funds like the Schwab U.S. Dividend Equity ETF (SCHD), the iShares Select Dividend ETF (DVY), and the First Trust Value Line Dividend Index Fund (FVD). While each of these funds offers a unique value proposition, FDL stands out for its focus on dividend leaders and it’s a more concentrated portfolio. The large sector positioning to Energy is also a differentiator which I find appealing from a longer-term perspective.

The Verdict

This is a solid fund. It follows a unique strategy of targeting dividend leaders and its concentrated portfolio differentiates it from its peers. However, like any investment, it carries risks and potential downsides that investors need to consider carefully. I would favor this over large-cap core averages at this stage in the cycle.

Markets aren’t as efficient as conventional wisdom would have you believe. Gaps often appear between market signals and investor reactions that help give an indication of whether we are in a “risk-on” or “risk-off” environment.

The Lead-Lag Report can give you an edge in reading the market so you can make asset allocation decisions based on award winning research. I’ll give you the signals–it’s up to you to decide whether to go on offense (i.e., add exposure to risky assets such as stocks when risk is “on”) or play defense (i.e., lean toward more conservative assets such as bonds/cash when risk is “off”).

Read the full article here