Real Estate Weekly Outlook

This is an abridged version of the full report and rankings published on Hoya Capital Income Builder Marketplace on May 3rd.

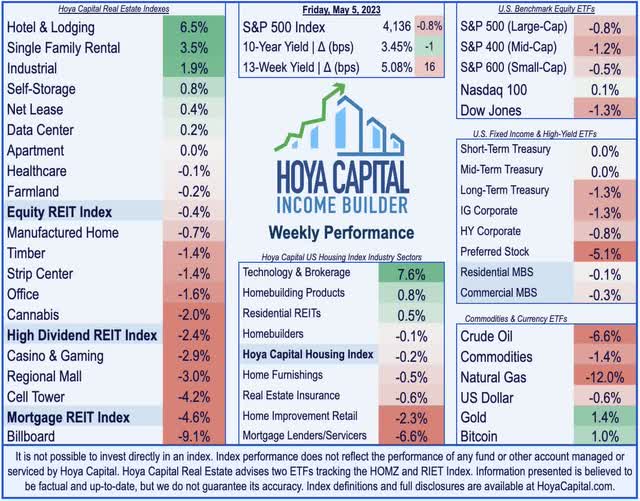

U.S. equity markets finished lower on a turbulent week after the Federal Reserve continued its historically-aggressive monetary tightening course, sparking renewed turmoil in the regional banking sector. In a unanimous decision that received “very strong across the board,” the central bank highlighted resilience in labor markets as it shrugged off recent real-time data showing a significant moderation in inflation and recent banking industry turmoil that has resulted in three of the four largest bank collapses in history over the past month, a decision that sent several other lenders to the brink.

Hoya Capital

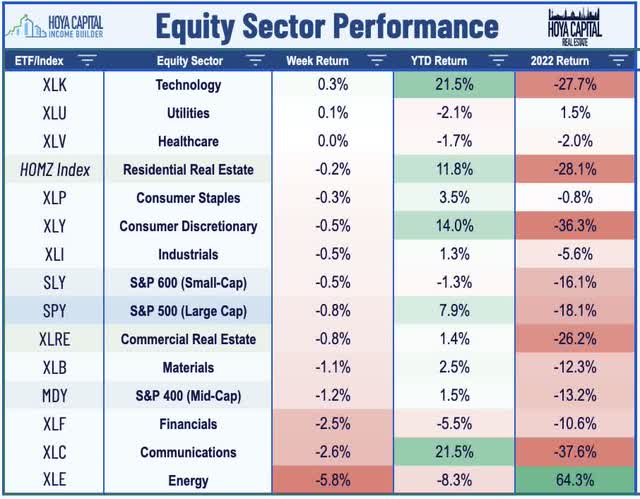

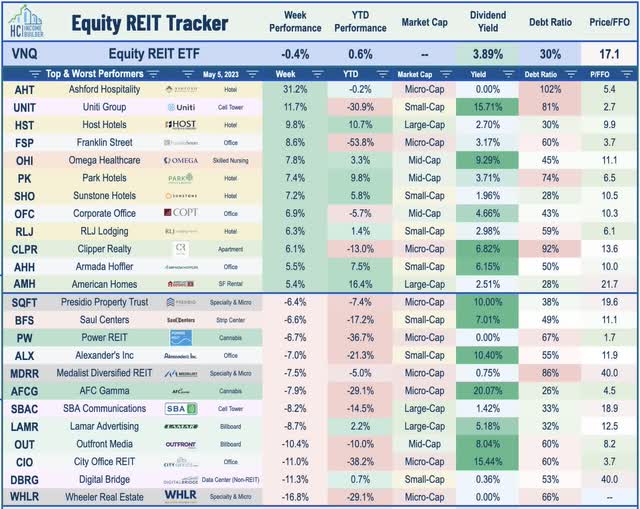

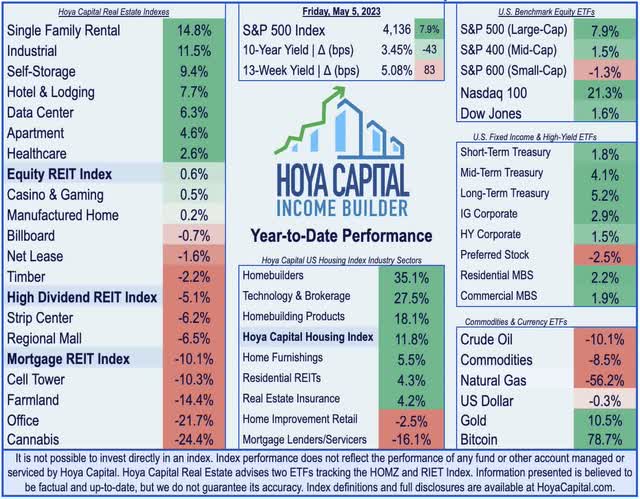

After closing at its highest levels since early February last week, the S&P 500 slipped 0.8% on the week, using a late-week rebound to pare its steepest four-day declines since the collapse of Silicon Valley Bank. While the tech-heavy Nasdaq 100 managed to eke out a weekly gain, selling pressure was stiffer among the smaller capitalization tiers, with the Mid-Cap 400 dipping 1.2% and the Small-Cap 600 declining 0.5%. Real estate equities were among the leaders for a third-straight week, as a solid slate of earnings reports and a retreat in benchmark rates offset renewed credit concerns. The Equity REIT Index declined 0.4% on the week, with 7-of-18 property sectors in positive territory, but the Mortgage REIT Index slipped over 4%. The Hoya Capital Housing Index continued its rebound after earnings reports showed buoyant rent growth and renewed life in housing demand.

Hoya Capital

As expected, the Federal Reserve raised short-term interest rates for a 10th consecutive meeting, continuing the most aggressive rate hike course since 1980. Despite the 25 basis point rate hike by the Federal Reserve to a 5.25% upper bound, the 2-Year Treasury Yield dipped about 10 basis points on the week to 3.90%, while the 10-Year Treasury Yield declined 1 basis point to 3.45%. The Jekyll-and-Hyde dynamics continued this week, with corporate earnings season still on pace to be the best since at least 2021, per FactSet’s measure of earnings beats, while simultaneously, conditions in the U.S. banking sector remain highly unstable. Following the collapse of First Republic Bank early this week, two additional regional lenders experienced violent price declines this week, with PacWest (PACW) plunging more than 40% while Western Alliance (WAL) dipped nearly 30%. Contagion concerns were visible in commodities markets, with the WTI Crude Oil benchmark tumbling another 7% on the week back towards $70/barrel, now lower by about 10% from its mid-April highs and nearly 50% below its 52-week highs.

Hoya Capital

Real Estate Economic Data

Below, we recap the most important macroeconomic data points over this past week affecting the residential and commercial real estate marketplace.

Hoya Capital

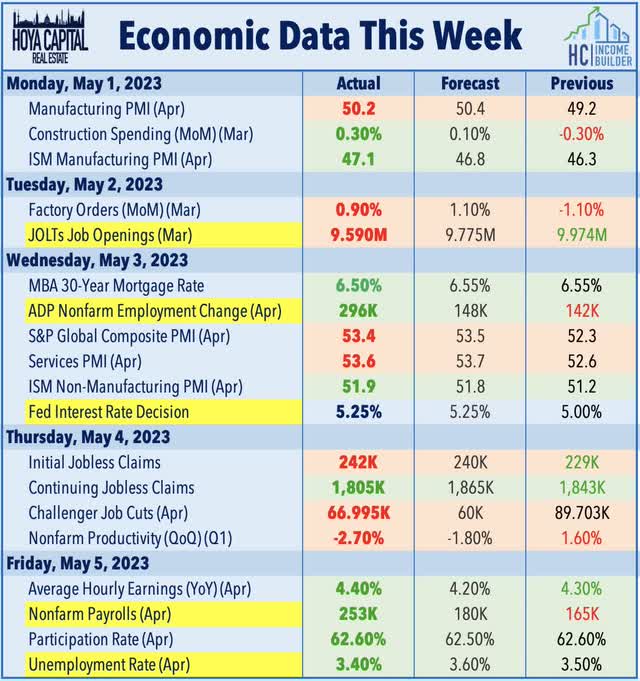

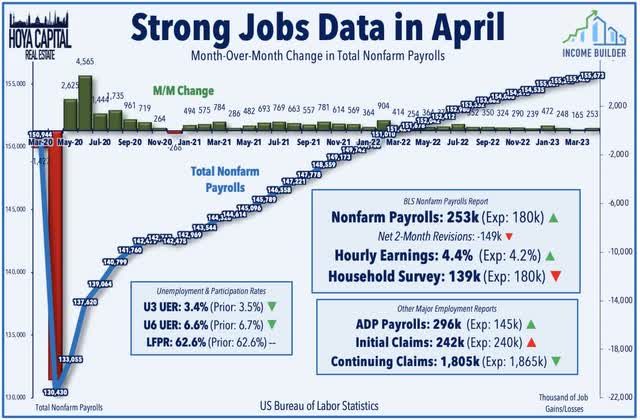

The critical BLS nonfarm payrolls report this week showed that the U.S. economy added 253k jobs in April – above expectations of 180k – which marked a modest reacceleration from a downwardly-revised March and February. Earlier in the week, ADP Research reported that private payrolls rose 296k, which was also well above the median estimate of 145k. The most relevant inflation-related metric in determining the path of Fed policy – Average Hourly Earnings – was slightly hotter-than-expected, rising at a 4.4% annual rate, which was above the forecast of 4.2%. Perhaps skewing these numbers on the upside, however, job gains in April were particularly strong in higher-wage industries, with the professional services and healthcare categories accounting or nearly half of the job gains, while hiring in the retail, hospitality, and temporary help categories has trended lower in recent months.

Hoya Capital

Equity REIT Week In Review

Best & Worst Performance This Week Across the REIT Sector

Hoya Capital

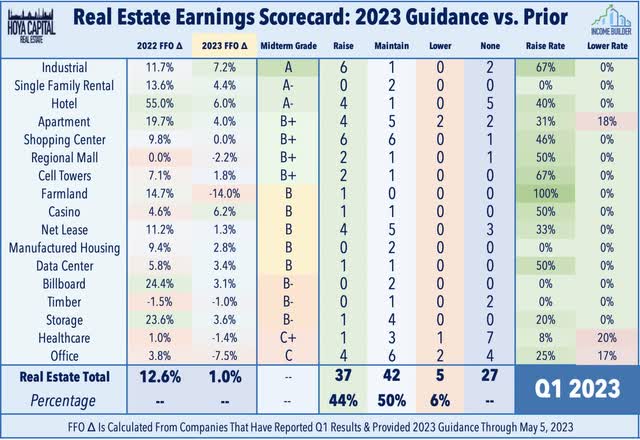

Real estate earnings season peaked this week with results from roughly 100 REITs. Consistent with the overall themes discussed in our Earnings Halftime Report published last week, results in the back half of earnings season have continued the strong trajectory with upward guidance revisions outpacing guidance cuts by roughly the same percentage. Of the 83 equity REITs that provide full-year Funds from Operations (“FFO”) guidance, 37 (44%) raised their full-year earnings outlook, while 5 (6%) lowered guidance. The “beat rate” for the critical property-level metric – same-store Net Operating Income (“NOI”) – was actually slightly better, with over 50% of REITs providing upward revisions. Surprisingly buoyant rent growth – particularly across the residential, industrial, hospitality, technology, and retail sectors – was the prevailing theme of these revisions. Expense pressures abated a bit for some sub-sectors – notably in the labor-heavy cold storage and full-service hospitality – but were otherwise “status quo” for most other sectors. We discuss the highlights of the busiest week of REIT earnings season below.

Hoya Capital

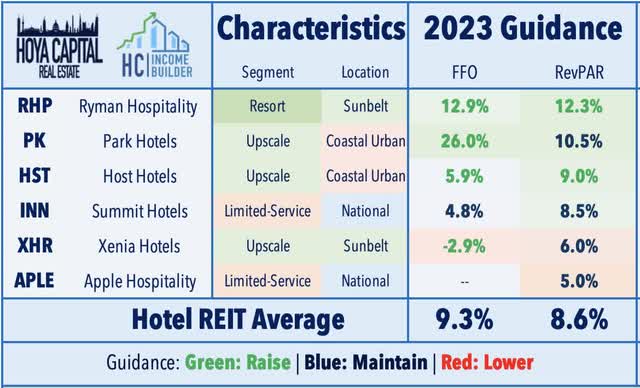

Hotels: Beginning with the upside standouts, the impressive slate of hotel REIT reports was highlighted by Host Hotels (HST) – the largest hotel REIT – which rallied nearly 10% after it significantly raised its full-year outlook. HST boosted its full-year guidance for Revenue Per Available Room (“RevPAR”) to 9.0% at the midpoint – up from its prior outlook for 2.5% growth – and now sees FFO growth of 5.9% this year, a 1,010 basis point increase compared to its prior outlook calling for a 4.2% FFO decline, citing “continued rate strength and increases in occupancy, with meaningful improvement in the group business segment.” Park Hotels (PK) gained over 7% after it also significantly raised its full-year FFO outlook, now projecting FFO growth of 26.0%, up from 16.6% last quarter, citing “ongoing improvements at our urban hotels and sustained strength in our resort markets, while an acceleration in group trends drove healthy margin gains during the quarter.” Sunstone (SHO) and RLJ Lodging (RLJ) also gained more than 5% on the week after reporting solid results. Apple Hospitality (APLE) gained 4% after affirming its outlook of 5% RevPAR growth and reporting that its Q1 RevPAR was 6% above its comparable pre-pandemic level from Q1 2019.

Hoya Capital

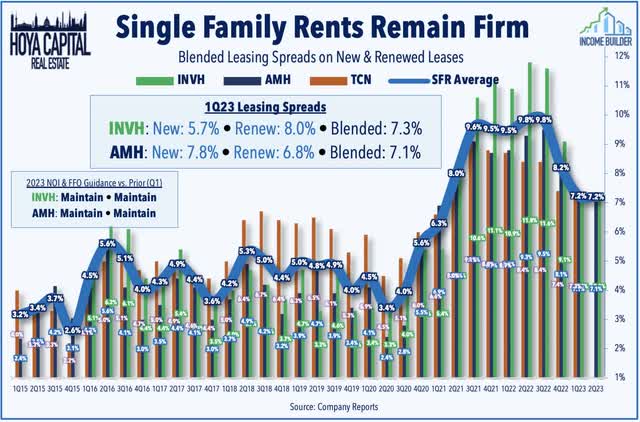

Single-Family Rental: Buoyant rent growth was the prevailing theme for residential REITs this earnings season, particularly these SFR REITs, which aren’t facing the same supply headwinds as multifamily REITs. American Homes (AMH) rallied over 5% after reporting impressive rent growth trends in Q1, achieving blended rent spreads of 7.1% in Q1, and commented that its “seeing some real encouraging leasing results from the early spring leasing season with March and April new leases, in particular, accelerating above 9%.” AMH reported preliminary blended April spreads of 7.1%. Invitation Homes (INVH) rallied 3% after it reported similarly solid results and also maintained its full-year outlook, which calls for FFO growth of 4.3% and NOI growth of 4.8% – roughly in-line with AMH’s outlook for FFO growth of 4.5% and NOI growth of 4.0%. Rent collection was better than expected at 99% of the company’s historical average – steady with Q4 – as concerns of significant rent loss in its California markets haven’t materialized. INVH reported blended rent growth of 7.3% in Q1 and noted that its preliminary spreads were also 7.3%.

Hoya Capital

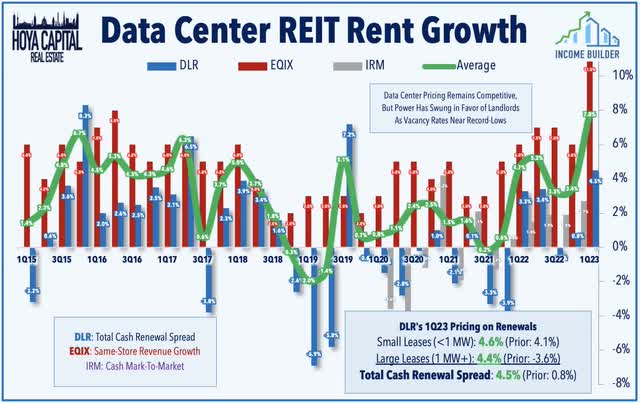

Technology: Impressive pricing power was also on display in the data center space. Equinix (EQIX) gained 2% on the week after it raised its full-year revenue and FFO outlook while also recording its strongest quarter of same-store revenue growth on record at 11%. EQIX now projects full-year revenue growth of 13.2% – up 20 basis points from its prior outlook – and sees FFO growth at 6.9% – up 130 basis points. While some of this revenue growth was attributed to power price increases (“PPI”), EQIX notes that even without these pass-through expenses, the increase was still impressive at 7%, commenting that “Pricing is definitely firm…we’ve raised pricing both on the retail side, space, power and on the interconnection units.” Fiber-focused Uniti Group (UNIT) surged nearly 12% after maintaining its dividend and reiterating its intention to remain a REIT, noting that any savings from reducing its dividend as a non-REIT would be offset by higher taxes. UNIT slightly increased its FFO outlook for 2023 after finalizing several debt restructuring deals and commented that it expects to be cash-flow positive after dividends by the end of 2025.

Hoya Capital

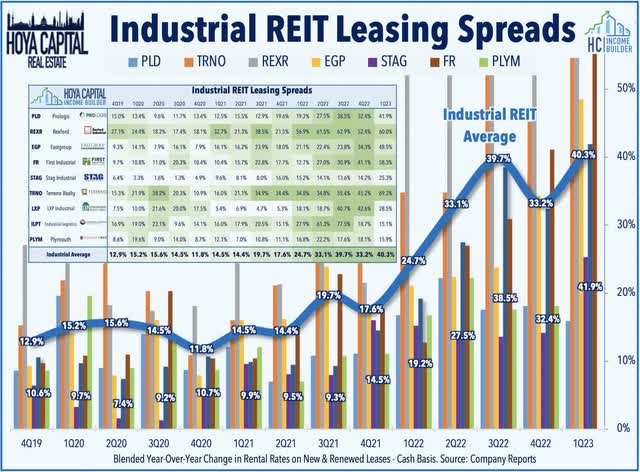

Industrial: The impressive first-quarter earnings season for industrial REITs continued this week as well. STAG Industrial (STAG) – which reported strong results in the prior week – gained nearly 4% this week after being added to the S&P Mid-Cap 400, an important milestone for the relatively young REIT. Cold storage operator Americold (COLD) rallied 3% after significantly raising its full-year outlook, driven by a significant rebound in occupancy rates due to improved staffing conditions at food distributors. COLD now expects to report full-year same-store NOI growth of 14.5% – up from its prior outlook of 6.6% growth – and raised its full-year FFO target to 9.0% – up 180 basis points from last quarter. Plymouth (PLYM) rallied 4% after reporting solid results and maintaining its full-year FFO and NOI outlook. Terreno (TRNO) – which released preliminary results last month – gained about 1% after releasing its full earnings report, highlighted by incredible leasing spreads of 69% in Q1 – its strongest on record. This week, we published Industrial REITs: We Love Logistics, which noted that after the worst year of performance on record in 2022, Industrial REITs have rebounded this year after earnings results showed a surprising re-strengthening of property-level fundamentals. Rent growth reaccelerated in Q1, with rental spreads averaging over 40%, while occupancy rates climbed to fresh record highs. Each of the six largest industrial REITs raised their full-year FFO and NOI growth outlook.

Hoya Capital

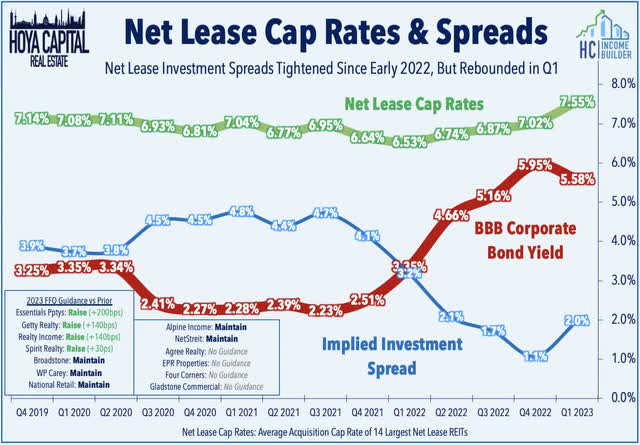

Net Lease: A busy slate of results from the net lease sector showed that cap rates – and investment spreads – have trended meaningfully higher in recent months as private market pricing has finally started to adjust to the higher interest rate environment. Spirit Realty (SRC) gained 2% after reporting strong results and raising its full-year FFO growth outlook to 0.3% – up from its prior outlook for flat growth. SRC acquired seven properties for $239M in Q1 at a capitalization rate of 7.9% – up from its cap rate in Q4 of 7.3%. Realty Income (O) – the largest net lease REIT – finished last after it raised its full-year FFO outlook to 1.0% – up 75 basis points from its prior guidance – and reported that it acquired $1.7 billion of properties in Q1 at a cap rate of 7.0% – up from 6.1% last quarter. Broadstone (BNL) gained 1% after it maintained its full-year outlook calling for FFO growth of 0.7% and reported that it was actually a net seller in Q1, selling $94.3M of properties at a 5.4% cap rate while acquiring $20M of assets at a 7.0% cap rate. Agree Realty (ADC) finished flat after raising its full-year acquisitions target from $1 billion to $1.2 billion, noting that it acquired 95 properties in Q1 for $314 million at a weighted average cap rate of 6.7% – the lowest cap rate of any net lease REIT this earnings season. ADC observed a “lack of competition amongst both public and private buyers” at the prices it was willing to pay.

Hoya Capital

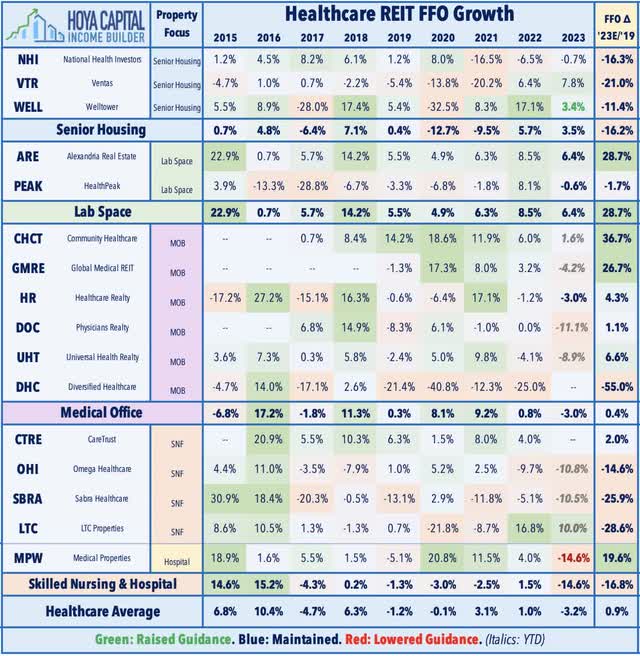

Healthcare: Skilled nursing REIT Omega Healthcare (OHI) rallied nearly 8% after reporting better-than-expected results highlighted by positive progress in operator lease restructurings. OHI noted that “the operating backdrop continues to improve, with occupancy increasing, the tight labor market moderating slightly, and federal and state reimbursement increases providing much-needed support.” OHI reiterated confidence in its current dividend as well, noting that “Barring additional unforeseen restructurings, this should result in both our dividend payout ratio and our leverage rapidly improving as the year progresses.” Senior housing REIT Welltower (WELL) finished flat despite raising its full-year FFO outlook, the only healthcare REIT to raise its FFO guidance thus far this earnings season. Driven by a continued recovery in its senior housing operating (“SHOP”) portfolio, WELL now expects FFO growth of 3.4% for full-year 2023, up from its prior outlook of 2.7%.

Hoya Capital

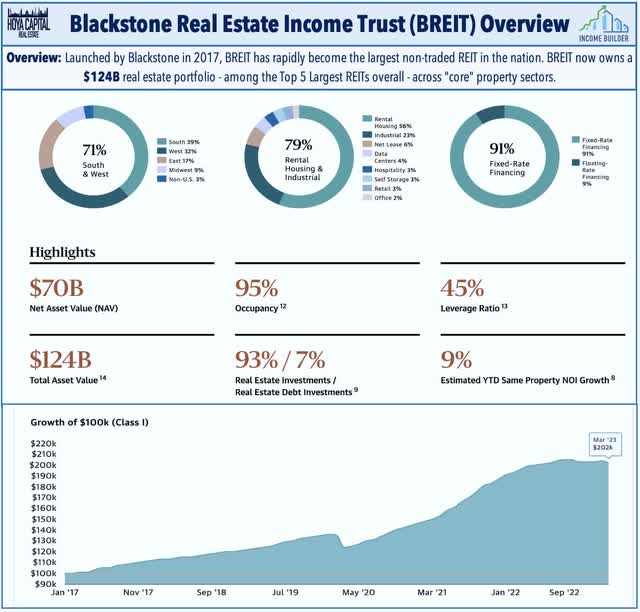

Moving onto the losers of the week, asset manager Blackstone (BX) declined nearly 10% on the week after it disclosed that it again had to limit withdrawals from its $70 billion non-traded real estate platform in April – the sixth straight month that the firm’s flagship fund limited redemptions. Total redemption requests for April were $4.5B – flat from the prior month – and Blackstone fulfilled just 29% of these requests – or $1.3B. BREIT has paid out $6.2B to redeeming shareholders since November 30, 2022 when redemption limits began. BREIT noted that an investor that requested their money back beginning in November – and did so in every month since then – has received 84% of their money back – which BREIT claims as evidence that “the semi-liquid structure is working as intended.” Blackstone has been exercising its right to block investor withdrawals from its privately-traded fund BREIT since November after requests exceeded its cap set at 2% of net asset value (“NAV”) in any month and 5% of NAV in a calendar quarter. As noted in our Casino REIT report last week, analysts have questioned BREIT’s self-reported NAV, and investors have seized on the opportunity to redeem shares at these premium NAV valuations and redeploy into cheaper publicly-traded REITs.

Hoya Capital

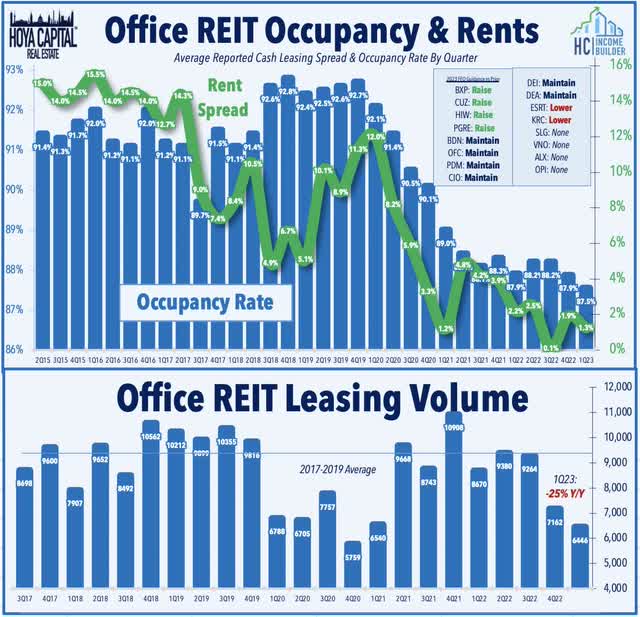

Office: Small-cap City Office (CIO) dipped more than 10% after reducing its dividend by 50%, becoming the sixth office REIT and 14th REIT overall to lower its dividend this year. Vornado (VNO) – which plunged last week after suspending its dividend until Q4 – dipped another 5% after reporting softer results, noting that its FFO was down 24.1% from last year, resulting from higher interest expense, but also recording decent leasing performance in its core NYC market with 777k SF of activity – its best quarter since Q4 2021. Douglas Emmett (DEI) declined 6% after lowering its property-level guidance, with occupancy rates now expected to average 82% this year – down from its rate of nearly 92% in the last quarter of 2019 before the pandemic. There were some bright-spots in the office space this week, however. Paramount Group (PGRE) gained 4% after raising its full-year FFO outlook and reporting decent leasing activity. Piedmont (PDM) was also among the better performers after reporting decent results highlighted by solid leasing metrics, noting that it leased 544k SF in Q1 – of which 270k was new leases, which was the largest quarterly amount since 2018. Underscoring the relative Sunbelt strength over the Coastal metro markets, PDM noted that the two largest leases completed during the quarter were both for new tenants in its Dallas portfolio.

Hoya Capital

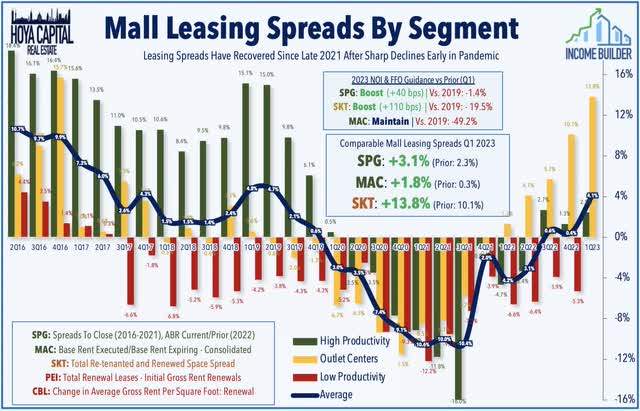

Mall: Simon Property (SPG) dipped about 3% this week despite reporting decent first-quarter results and hiking its dividend, while also raising its full-year outlook. Questions over SPG’s plans to spend $1.5B on mixed-use redevelopment and expense headwinds offset strong leasing results. One of 48 REITs to raise its dividend this year, SPG declared a $1.85/share dividend – an 8.8% year-over-year – and bringing its dividend closer to its $2.10/share level before the pandemic. SPG now expects its FFO to be flat with last year – an upward revision of about 40 basis points from last quarter – which would bring its FFO to within 2% of full-year 2019. Total portfolio occupancy stood at 94.6% in Q1 – down 30 basis points sequentially but up 130 bps from a year earlier. While SPG no longer discloses leasing spreads, it noted that average base rents rose 3.1% from a year earlier, its strongest growth since Q1 2020. Macerich (MAC) finished flat this week after maintaining its full-year outlook – which calls for an 8.2% decline in FFO due to higher interest expense – and reporting a continued stabilization in rental rates and occupancy rates.

Hoya Capital

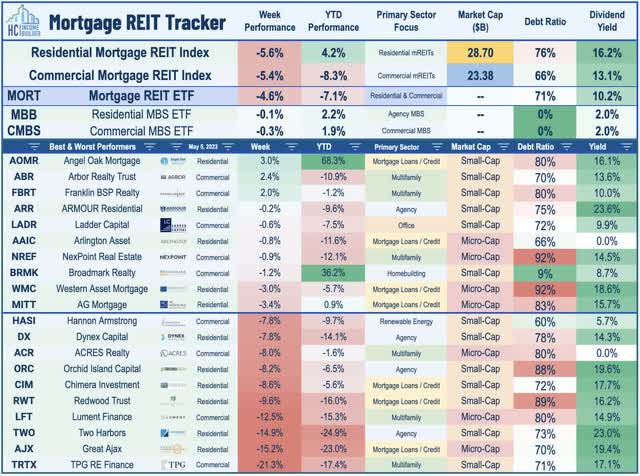

Mortgage REIT Week In Review

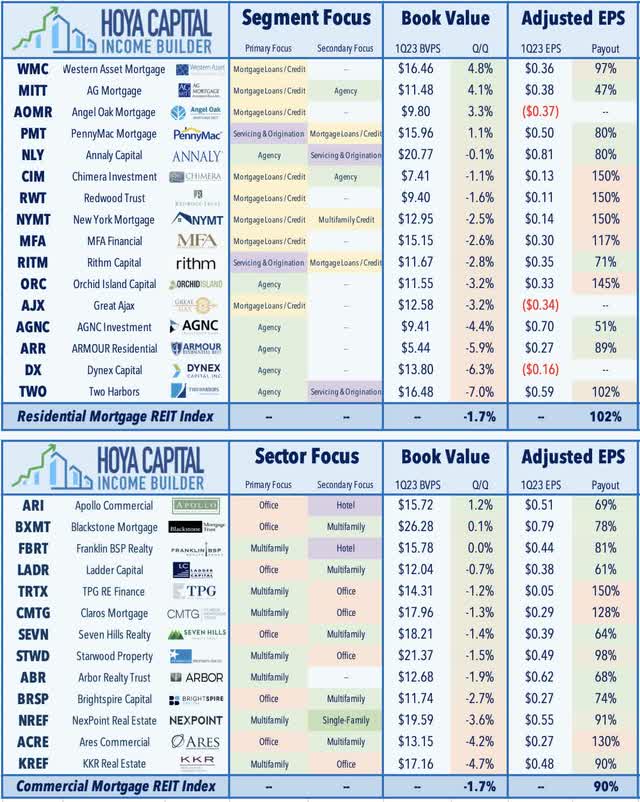

Mortgage REITs finished lower on the week as the fallout from renewed regional bank instability overshadowed a decent slate of earnings reports. Arbor Realty (ABR) was among the leaders this week after reporting strong results and raising its dividend by 5%, the fourth mortgage REIT to raise its dividend this year. A trio of small-cap mREITs – Angel Oak (AOMR), Western Asset (WMC), and AG Mortgage (MITT) – were also among the leaders this week after reporting increases in their Book Value Per Share (“BVPS”) in Q1, continuing a relatively strong quarter for residential credit-focused mREITs. Rithm Capital (RITM) was among the better performers after it reported adjusted EPS of $0.35/share – covering its $0.25/share dividend – but noted that its BVPS slipped about 3%. While agency mREITs have reported an average decline in BVPS of 4%, non-agency mREITs have reported a slight increase in BVPS in Q1. On that note, agency-focused Two Harbors (TWO) dipped 15% after reporting disappointing results, citing interest rate volatility resulting from the regional bank turmoil, noting that its BVPS declined 7% in Q1 to $16.48 – the weakest in the sector thus far.

Hoya Capital

Also on the downside this week, TPG Real Estate (TRTX) dipped over 20% after it reported adjusted EPS of $0.05 – short of its $0.24 dividend – and noted that six loans with a total balance of $550M are now in nonaccrual status, up from two loans totaling $190M last quarter. Ares Commercial (ACRE) – which has the highest office exposure of any mREIT – dipped 6% after reporting adjusted EPS of $0.27/share – short of its $0.35/share dividend – and noting that its BVPS declined 4.2% in Q1 to $13.15. ACRE noted that it collected 99% of interest payments but has five loans on non-accrual status. ACRE increased its loan loss reserves by about 30% in Q1 to 4.2% of our outstanding principal balance. Starwood Property (STWD) also dipped 6% after increasing its loan loss reserves by over 30% in the quarter and reporting that its BVPS declined 2% to $21.37. Back on the residential side, Great Ajax (AJX) slid 15% after reporting soft results, including a 3% decline in its BVPS to $12.58/share and trimming its dividend by 20%.

Hoya Capital

2023 Performance Recap & 2022 Review

Through eighteen weeks of 2023, the Equity REIT Index is now higher by 0.6% on a price return basis for the year, while the Mortgage REIT Index is lower by 10.1%. This compares with the 7.9% gain on the S&P 500 and the 1.5% advance for the S&P Mid-Cap 400. Within the real estate sector, 9-of-18 property sectors are in positive territory on the year, led by Single-Family Rental, Industrial, and Self-Storage REITs, while Office REITs have lagged on the downside. At 3.45%, the 10-Year Treasury Yield has declined by 43 basis points since the start of the year – well below its 2022 closing highs of 4.30%. The US bond market has stabilized following its worst year in history as the Bloomberg US Aggregate Bond Index has gained 3.5% this year.

Hoya Capital

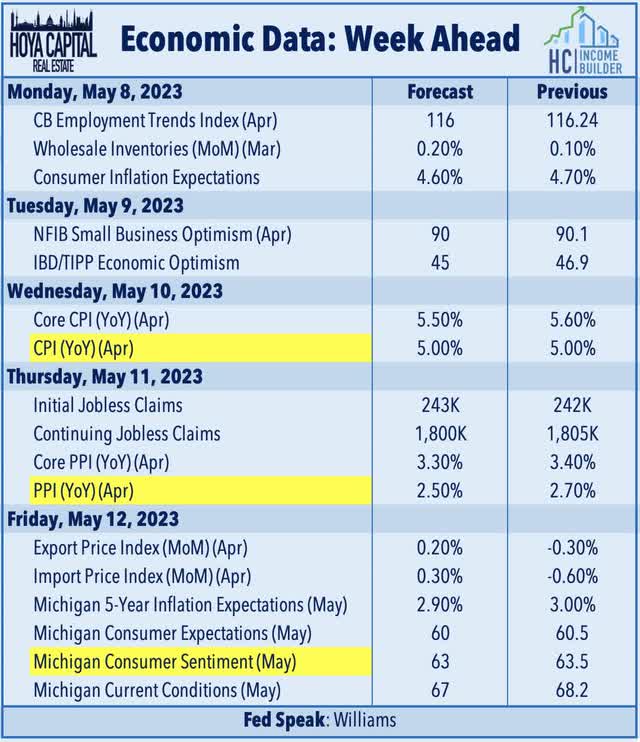

Economic Calendar In The Week Ahead

Inflation is in the spotlight in another jam-packed week of economic data in the week ahead. The main event comes on Wednesday with the Consumer Price Index for April, which investors and the Fed are hoping will show a cooling of inflationary pressures. The headline CPI is expected to moderate to a 5.0% year-over-year rate, while the Core CPI is expected to decelerate to 5.5%. As with recent months, the metric we’re watching most closely is the CPI-ex-Shelter Index. On Thursday, we’ll see the Producer Price Index, which is expected to show an even more significant cooling of price pressures with the headline PPI expected to slow to a 2.5% year-over-year rate – down from the recent peak last March at 11.8%. On Friday, we’ll get the first look at Michigan Consumer Sentiment for May, a report which includes the closely-watched inflation expectations survey.

Hoya Capital

For an in-depth analysis of all real estate sectors, check out all of our quarterly reports: Apartments, Homebuilders, Manufactured Housing, Student Housing, Single-Family Rentals, Cell Towers, Casinos, Industrial, Data Center, Malls, Healthcare, Net Lease, Shopping Centers, Hotels, Billboards, Office, Farmland, Storage, Timber, Mortgage, and Cannabis.

Disclosure: Hoya Capital Real Estate advises two Exchange-Traded Funds listed on the NYSE. In addition to any long positions listed below, Hoya Capital is long all components in the Hoya Capital Housing 100 Index and in the Hoya Capital High Dividend Yield Index. Index definitions and a complete list of holdings are available on our website.

Hoya Capital

Editor’s Note: This article covers one or more microcap stocks. Please be aware of the risks associated with these stocks.

Read the full article here