The Federal Reserve emphasizes the issue of transparency. The general belief is that for a central bank to be effective it must have credibility, and credibility comes with the public having trust in the central bank’s integrity when carrying out their mandate. This is accomplished through transparency of, and accountability for, their actions.

Former Fed Chairman Ben Bernanke once said “Transparency regarding monetary policy, in particular, not only helps make central banks more accountable, it also increases the effectiveness of policy.”

As recently as March 24, 2023 the New York Fed issued a statement saying “The Federal Reserve Banks are committed to transparency and accountability and each Reserve Bank has existing procedures for providing information to the public.”

Given this emphasis on transparency, it was surprising to review the just released Federal Reserve Banks Financial Report first quarter 2023.

I have been communicating in recent articles how the Fed’s rate hikes to contain inflation have had a significant impact on the Fed’s operations. Please see our Seeking Alpha Article “Fed Loses Money For The First Time In 107 Years – Why It Matters.”

Specifically, due to the Fed’s asset/liability mismatch, the income they are earning on their fixed rate assets is now lower than the cost they are paying on their variable rate liabilities. They have a negative net interest margin.

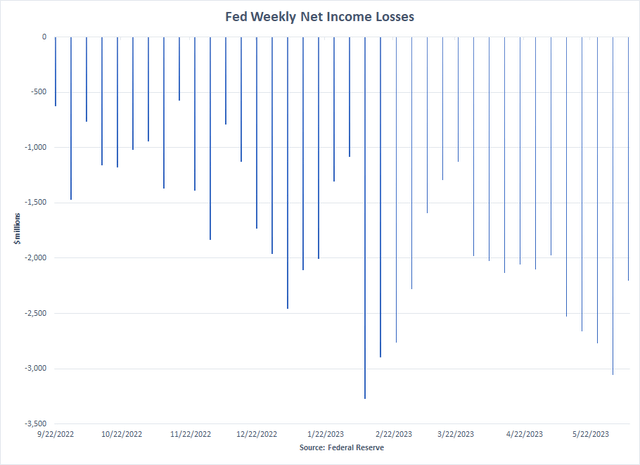

As a result, the Fed is losing money each and every week, and they have been since September 21, 2022, when their hike of the Fed Funds rate to 3.00 – 3.25% put the Fed’s cost of their liabilities above the breakeven rate of their income.

As can be seen in the below chart, the Fed’s weekly losses continue to grow as the Fed continues to raise the Fed Funds rate.

Federal Reserve

Yet, when I reviewed the Fed’s Financial Report for the first quarter, there was no discussion about losses.

Their only mention of this topic was covered in the last footnote on the last page and said “In the fall of 2022, the Reserve Banks first suspended weekly remittances to the Treasury because earnings shifted from excess to less than the costs of operations, payment of dividends, and reservation of surplus.”

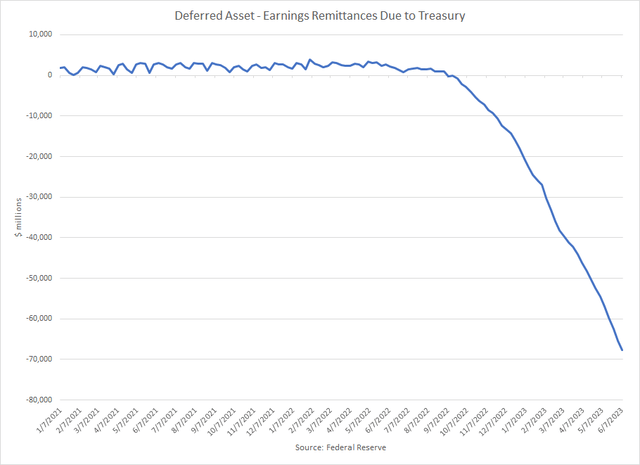

The report went on to state that “Reserve Banks began accumulating a deferred asset. At March 31, 2023 the deferred asset represents the net accumulation of costs in excess of earnings and is reported as “Deferred asset-remittances to the Treasury” in the Combined statements of condition.”

There is no explanation that the deferred asset represents the cumulative loss the Fed has experienced since their earnings turned negative.

At quarter end, March 31, 2023 the deferred asset was a cumulative loss of $44.7 billion. Since then, it has continued to grow and now is a cumulative loss of $67.7 billion.

Federal Reserve

The Fed’s Total Capital is only $42 billion, so the deferred asset is greater than the Fed’s Capital.

Due to the unique accounting rules as set by the Fed Board of Governors, the Fed’s operating losses don’t impact their capital account. Instead, the Fed’s significant operating losses are hidden on their balance sheet as a deferred asset. Please see the description of this policy in this FEDS Notes.

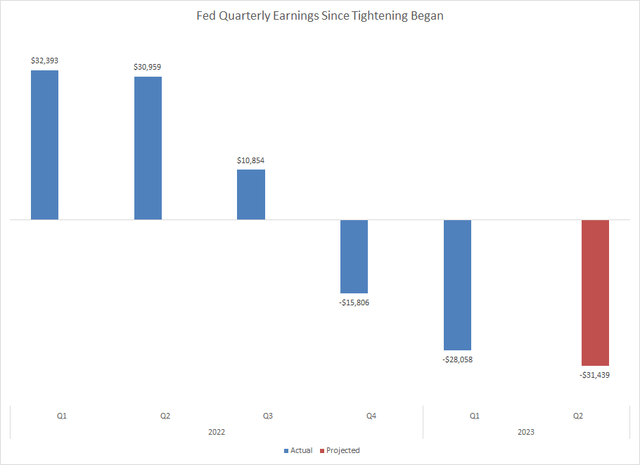

Fed’s Quarterly Earnings Since They Began Tightening

In 1Q22 the Fed had their largest quarterly net income on record of $32.4 billion. Then they began tightening and caused their net interest margin to first decline, then turn negative. Consequently, quarterly earnings began to shrink.

Federal Reserve and Author

The Fed lost money for the first time in 4Q22, to the tune of -$15.8 billion. The loss grew in 1Q23 to -$28.1 billion. The losses have since continued to increase. I project that the net loss in 2Q23 will be almost as large as the largest monthly gain in 1Q22, and will be -$31.4 billion.

If the Fed again raises rates, either in June 2023, or July 2023, the quarterly losses will continue to set new records.

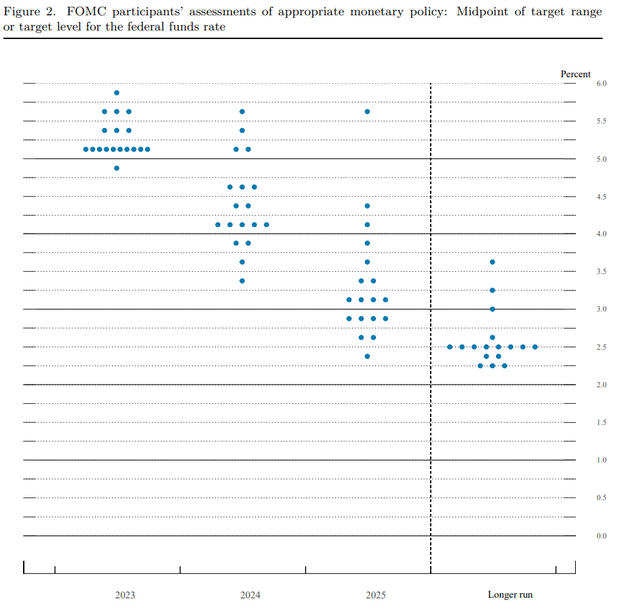

The Fed will regularly lose money on a weekly basis until the cost of their liabilities drops below their 2.75% breakeven rate, which according to the Fed’s Summary of Economic Projections (SEP), won’t happen until 2026.

Federal Reserve

We will get an updated SEP at the FOMC meeting on June 14th, but if anything, the Fed’s time frame for returning to profitability will only be extended.

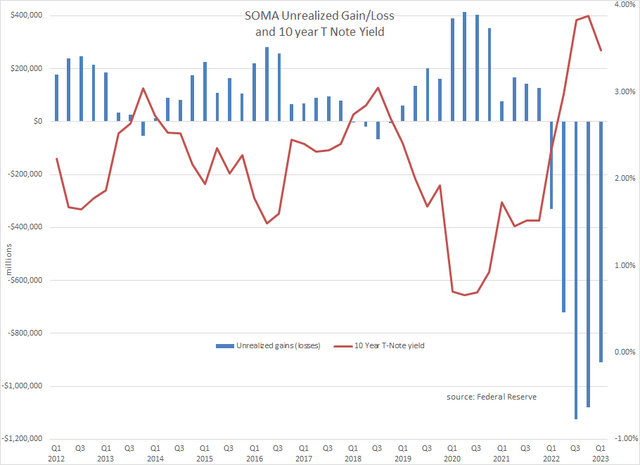

SOMA Portfolio Unrealized Loss

On a slightly positive note, the Fed’s unrealized loss in their SOMA portfolio declined to -$910.8 billion at quarter end, down from -$1,080.4 billion at year end. This $169.6 billion improvement was due to the rally in bond market in the first quarter. The yield on the 10- year UST dropped 40 basis points from 3.88% to 3.48%.

Federal Reserve

This significant, unrealized loss in the Fed’s bond holdings is buried in a footnote on their financial statements.

Conclusion

On an operating basis, the Fed has been losing money regularly for nine months.

Their weekly losses, currently averaging -$2.6 billion per week since their last Fed Funds rate hike in May, will continue for the next three years!

The Fed’s huge SOMA portfolio has a market value that is almost $1 trillion below its cost.

Yet the Fed can not acknowledge these losses in a straightforward way.

Perhaps the Fed could be more transparent.

Read the full article here