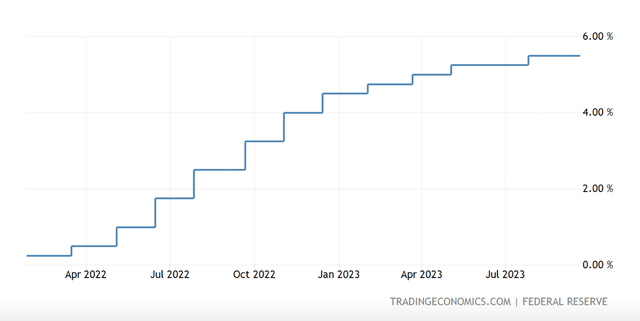

The Fed’s interest rate pause at its September meeting was widely expected by market participants, even as headline inflation inched up for the second consecutive month in August to 3.7%. The Fed has mentioned the potential lagged impacts of the monetary policy tightening, which likely held it back from raising the Fed funds rate from the 5.25-5.5% range. Let’s get into its statement to figure out more.

Fed funds rate (Source: Trading Economics)

It’s about the labor market

In its FOMC statement, it acknowledges that “economic activity has been expanding at a solid pace”, which is different from its July statement. At that time, it had said “economic activity has been expanding at a moderate pace”. If anything, this would actually indicate another rate hike.

So why not? The answer can be read in its perspective on the labor market, which is the only other change in its statement. It now says “Job gains have slowed in recent months but remain strong….” In contrast with “Job gains have been robust in recent months…” in its previous statement.

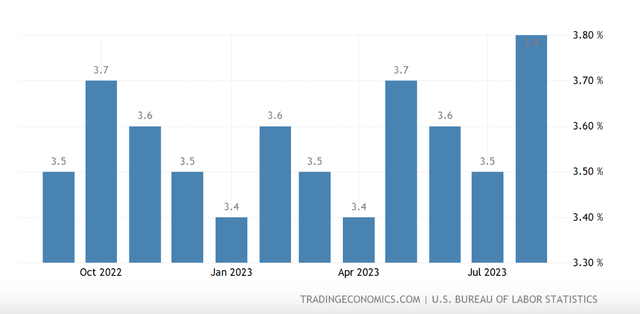

US Unemployment Rate (Source: Trading Economics)

The latest jobs market report for August showed a rise in the unemployment rate to the highest level in a year and a half of 3.8%, a jump of 0.3 percentage points from the month before, indicating softening in the labor market. There’s a sense of Deja Vu about this.

The Fed had left interest rates unchanged even in June this year when the unemployment rate had risen to 3.7% for May. Even though it was still at the outer limit of the 3.4% to 3.7% of the unemployment range seen since March 2022, at that time too, it had seen a 0.3 percentage point increase from April. This was the first such rise in the unemployment rate, until August, that is.

Is the Fed done?

Does this mean that it’s done with rate hikes, though? From the looks of it, it seems that incoming labor market data would be a good indication of what’s to come, assuming that there isn’t also a spurt in inflation or GDP growth or both in the meantime.

Slide back possible in unemployment rates

Focusing solely on the labor markets, there’s indeed a persisting possibility of a rate hike considering the slide back in unemployment rates that happened in the months following May. A survey of professional forecasters by the Philadelphia Fed shows expectations of a median projection of a 3.6% unemployment rate in Q3 2023.

To reach these rates, after coming in at 3.5% in July and 3.8% in August, a return to a 3.6% unemployment rate can be expected. This, in turn, has implications for inflation since lower unemployment can put upward pressure on wages.

Upward revisions to GDP forecasts

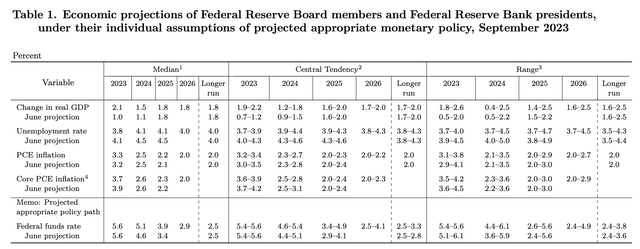

The survey also shows expectations of a softening in growth to 1.9% in Q3 2023, which is a bit below trend growth. So at least, on the growth front, there are unlikely to be any surprises. This is further confirmed by its full-year GDP growth expectations of 2.1%, which is also in line with the Fed’s latest upwardly revised economic projections (see table below).

Source: Federal Reserve

The Fed also now sees the unemployment rate at 3.8% for 2023, compared to 4.1% earlier. Interestingly, inflation forecasts are virtually unchanged, indicating that it now believes that lower inflation is compatible with even firmer activity data.

The door is still open

However, it still holds that if activity data turns out stronger than its revised expectations, there may well be another hike. It has indeed kept the door open, maintaining that it “would be prepared to adjust the stance of monetary policy as appropriate if risks emerge that could impede the attainment of the Committee’s goals”. The committee’s key goal right now is the return of inflation to 2%.

By the time the Fed meets next between October 31 and November 1, it will have another inflation print, labor market report, and the first estimate for Q3 GDP. If the data turn out to be strong, another rate hike really cannot be ruled out.

That said, the increase is not cast in concrete either, considering that the central tendency for the Fed funds rate is at 5.4%-5.6%. This measure excludes the highest and lowest values of all the projections, giving a moderate range. The current range of 5.25-5.5% leaves little room for another rate hike.

Where to invest in the stock markets now

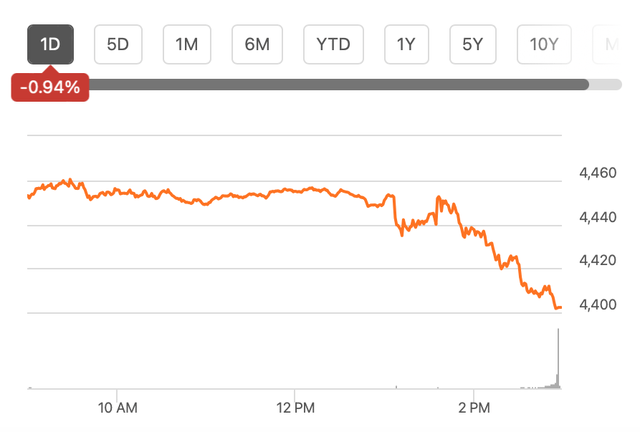

The next question is, what does this mean for the stock markets? Though the S&P 500 (SP500) hasn’t exactly seen the sharpest change so far, it’s hard not to ignore that it dropped after the Fed’s announcement came through, and as I write is down by 0.94%.

S&P 500 (Source: Seeking Alpha)

It bears mentioning here that the economic projections for next year at the revised 1.5% from 1.1% earlier still show a slowdown in the economy. Even as GDP growth is expected to pick up in 2025 to 1.8%, that’s still lower than the number we are seeing currently.

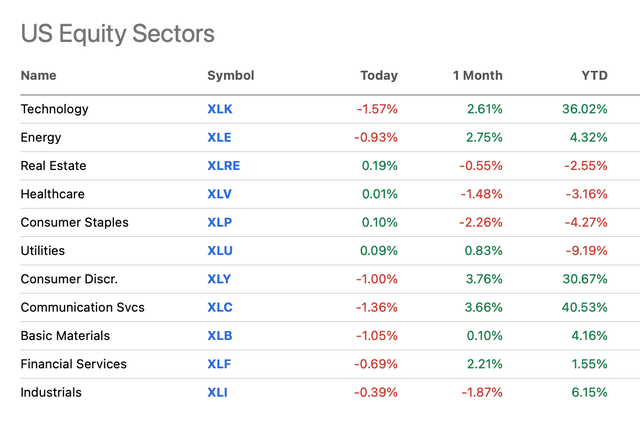

With this in mind, even with much smaller inflation, I think it’s time to focus on defensives for the next year or so. There can be exceptions to this, but in general, it would be wise to consider the likes of utilities and healthcare ETFs and stocks. It’s no coincidence that these were among the few sectors in the green today (see chart below).

Source: Seeking Alpha

Among utilities, one to consider is the Utilities Select Sector SPDR ETF (XLU), with assets under management of USD 14.75 billion. It has weakened this year, but that’s probably a good opportunity to buy the dividend-paying fund, dominated by energy utilities, especially as oil and gas prices are on the rise again. My pick among healthcare ETFs would be the VanEck Pharmaceutical ETF (PPH), which too pays a dividend and has seen an uptick over the past year.

In sum

The Fed’s pause might have been expected, but going by the market reaction, it can be speculated that the possibility of another rate hike and still muted growth projections for 2024 disappointed investors. If inflation firms up further, in combination with a slowdown, the next year looks challenging indeed. As a result, defensive sectors were the natural gainers today, and are likely to continue being so over the next year.

Read the full article here