Introduction

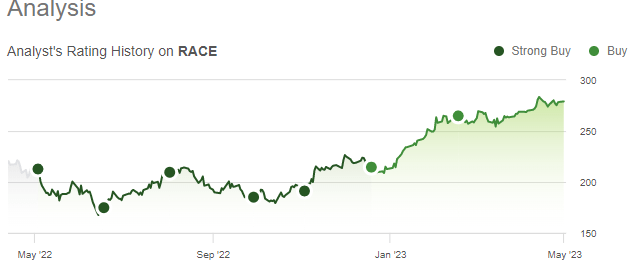

A year ago, on May 3rd Seeking Alpha welcomed me as a new analyst, publishing my first article. It was an in-depth analysis on Ferrari (NYSE:RACE) of what I was then buying as one of the cornerstones of my portfolio. Since then I covered it regularly with pleasant results. Since my first buy, the stock is up 30% and up 44% since I bought the dip back in June.

Seeking Alpha

In this article, I would like to celebrate this anniversary going over what I wrote a year ago while sharing what I expect from the upcoming earnings Ferrari will report on May 4th.

Before we move on, allow me to share a few thoughts on my SA journey. So far, it has been a very instructive experience. When I started writing the outcomes of my research, I also improved the quality of my thought process and of my research itself. In addition, SA members have more than once given me high-quality suggestions or objections in the comment section. This, too, is extremely valuable. In the meantime, some SA readers started following me and we have had the chance to get to know each other a bit better while working together to clarify our thought process when investing. This is why I would like to thank all my readers and my followers. When I write I think about each one of you and this make me write with a sense of responsibility to share the best possible content I can produce. And, of course, a big thanks to all SA editors who have helped me improve throughout this year.

But the biggest thank you goes to everyone who starts a business and who made it publicly traded. Without entrepreneurs and businesses and the people working there, there would be no stock market and no opportunity for us to invest and run our own portfolios. Truly, I admire each one of these people.

Why I am invested in Ferrari

What I wrote in my first article on Ferrari is still fundamentally true. The only thing that changed is that Ferrari has beat expectations as it could actually do €6 billion in revenue by the end of this year. Last year, when I wrote in May, Ferrari was still providing a 2022 guidance of €4.8 billion in revenue. Therefore, I assumed it would break the €5 billion barrier in 2023. Ferrari is actually firing on all cylinders and revenue came in at €5.1 billion at the end of 2022. With Purosangue order books full, Ferrari released a 2023 guidance of €5.7 billion in net revenues. Given Ferrari’s strong track record, I now believe we will not see a 2023 number that far away from €6 billion.

Anyways, I came across Ferrari as the market was in turmoil and investors were seeking strong and reliable companies that could deliver results in any economic environment. In particular, I was after highly profitable companies. It is during 2022 that I slowly learned that it is not always a problem to pay a premium for a stock, if there are reasons to support it. In particular, up to that moment, I had stayed away from Ferrari because of its high-valuation. However, as I studied it more in depth, I realized why investors were willing to pay a higher multiple for this company.

First of all, Ferrari is not only a car manufacturer, but its products are actually luxury items. Therefore, it has completely different economics from other car manufacturers (Porsche included).

Secondly, Ferrari has a unique business model that is restrictive on volumes. As Enzo Ferrari used to say: “Ferrari will always deliver one car less than the market demand”. This fosters exclusivity, demand and, as a consequence, pricing power.

This business model makes it easy for investors to predict future earnings and cash flows. Therefore, risk is somewhat reduced and valuation gets bid higher. However, Ferrari has also gotten investors used to see their expectations being often beat.

The number of high-net-worth individuals is increasing worldwide and this creates a larger addressable market for Ferrari.

Ferrari has been able to surprise the market over and over again with its technological innovations. While it is working on the first all-electric Ferrari that will be unveiled by 2025, it has recently brought to the market the new Purosangue, a four-door, four-seater luxury sports car whose average selling price is above €400k. Needless to say, demand was so high Ferrari filled its order books quickly and had to repeatedly state it will not allow Purosangue to be above 20% of the overall number of vehicles sold.

Finally, Ferrari is also a perfect fit for a dividend growth portfolio. Though its starting yield is low, it has been able to raise the dividend aggressively while keeping its payout ratio in check. In addition, Ferrari is coupling it with buybacks.

Q1 earnings preview

I expect shipments to be picking up speed and to increase between 15%-20% YoY. This leaves us with a number around 3,800 units. At an average selling price of €390k, we are close to net revenues of €1.5 billion. Now, if this target is met, I will be more convinced Ferrari can do €6 billion this year because usually Q1 is the softest one in the year.

I expect EBITDA and EBIT margin to improve a bit YoY as Q1 in 2022 was one of the hardest hit by inflationary pressure. Therefore, I think EBITDA margin will be up at 36.5% while EBIT margin will be around 25%. This translates into an EBITDA of roughly €550 million and an EBIT of €375 million. In any case, I expect EBITDA to be at least around €500 million and EBIT close to €350 million.

This makes me think Ferrari can deliver a YoY EPS growth of at least 20%, coming close to €1.55 per share, which would be equal to $1.71 per share. Current consensus sees Q1 EPS at $1.56. Let’s be conservative and make an average between the two and we could have quarterly EPS around $1.62.

Industrial FCF was €300 million in the first quarter of last year. At the end of 2022 it came in at €760 million. Ferrari is guiding for €900 million in 2023. I bet some insiders are aiming at €1 billion, though it may be achieved only in 2024.

In any case, I believe industrial free cash flow generation will not be particularly exceptional this quarter due to inventory increases driven by volume growth. We know Purosangue deliveries are ramping up, but they will still need a few quarters to be at full speed. Therefore, I think we will see industrial free cash flow still around €300 million. If we see a big surprise here we will need to dig deeper and understand what is going on, both negatively or positively.

I expect Ferrari to keep is 2023 guidance unchanged. As usual, I believe Ferrari tries to be cautious and then overdeliver. Q1 is not the right time for bold assumptions, even though at the end of Q1 Ferrari likely has perfect knowledge of what the full year will be, given its backlog covers well into 2024.

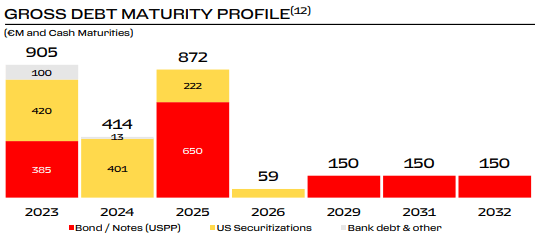

One note on Ferrari’s debt and liquidity position. First of all, Ferrari has managed its financial leverage well, with a net industrial debt/adj. EBITDA ratio that moved down from 0.8 in 2016 to 0.1 at the end of 2022.

In 2023, we have €900 million of debt maturities. It will be interesting to see what Ferrari will say about its financing needs. I actually don’t expect Ferrari to finance all its debt that has come to maturity again, as it has on hand almost €1.4 billion which could be well spent in a high-interest rate environment.

Ferrari FY 2022 Results Presentation

In any case, I will look at the quarterly balance sheet update to check the financial leverage and see any sign of what Ferrari wants to do with these maturities.

Conclusion

Overall, I think Ferrari will just cruise through this earnings season with no particular issue. There are some areas of concern in racing, where Ferrari is not performing up to expectations in Formula 1. However, the whole racing team is undergoing some major changes and we may consider this as a season of transition.

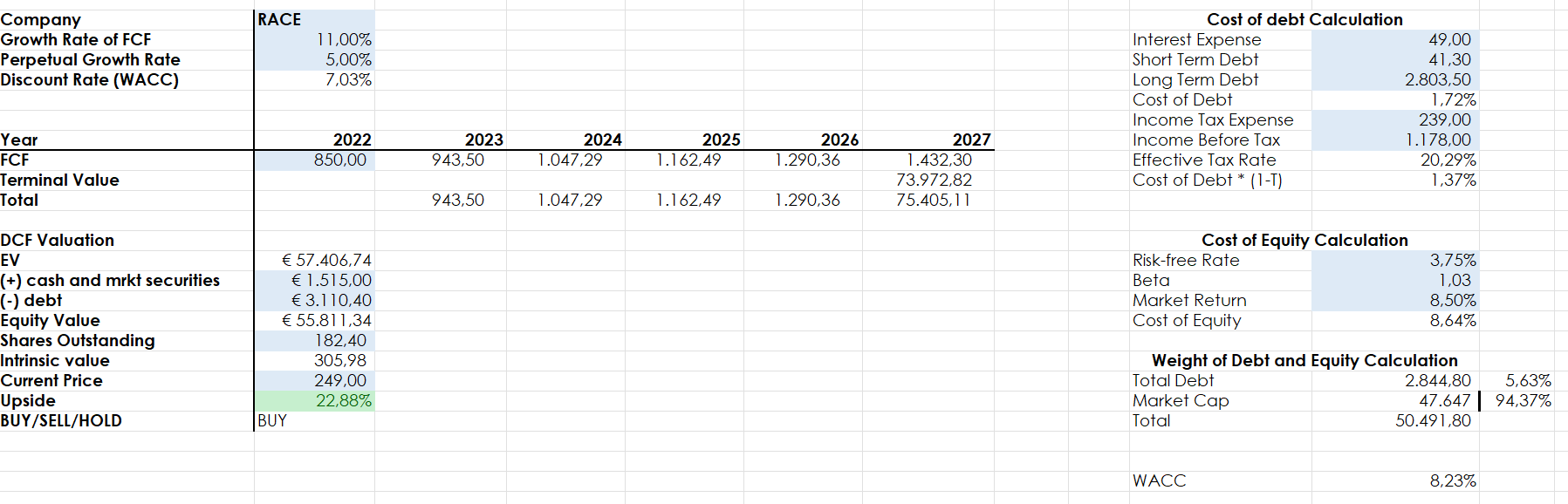

Overall, I don’t see any reason to change my buy rating on the stock, and consider my last discounted cash flow model I shared after FY 2022 results were reported still valid.

As we can see, I acknowledge Ferrari deserves a premium and thus use a discount rate of 7% instead of 8.23% (Ferrari’s WACC).

Author, with data from Seeking Alpha

I still believe the stock can reach €300 per share if investors come to realize Ferrari can deliver in 2023 the financial results many were forecasting to see in 2024.

Read the full article here