Investment Thesis

Nearshoring has been a prominent topic in discussions over the past year and a half. Still, it’s not always clear how investors can capitalize on this trend.

FIBRA Macquarie (OTC:DBMBF) is an industrial REIT, directly tied to these operations. Furthermore, the Mexican government has recently introduced a tax incentive plan for investments in sectors related to export and nearshoring. The company has also made substantial investments to expand its industrial portfolio and benefit fiscally.

In this article, we will analyze the company and provide context to illustrate why nearshoring appears to be more than just a trend-it’s a structural change that could benefit these companies for many years.

Business Overview

First and foremost, it’s important to clarify that the term ‘FIBRA’ is used to refer to a Real Estate Investment Trust (REIT) in Mexico.

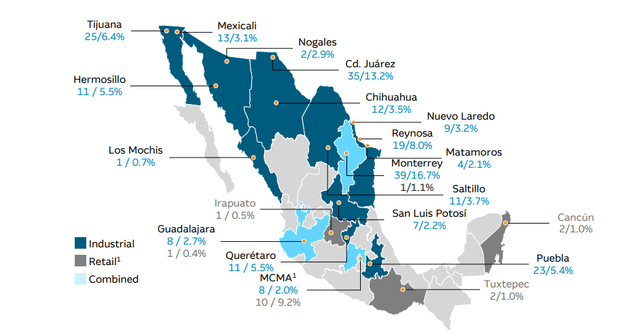

FIBRA Macquarie (BMV:FIBRAMQ12), also known as FibraMac, is a real estate investment trust that specializes in investing in and managing a diverse portfolio of real estate assets in Mexico. FIBRA Macquarie’s primary focus lies in industrial, commercial, and office properties. As of March 2023, 93% of its assets, or 238 properties, were industrial properties located in Northern Mexican regions like Chihuahua, Tamaulipas, Baja California Norte, and Nuevo León. This is particularly significant as there are many international companies that are deciding to move their operations to the north of the country due to its proximity to the border with the United States and the advantages that this has in terms of transportation.

FIBRA Macquarie

Currently, the company maintains an impressive occupancy rate of 97%. This is attributed in part to its significant exposure to the manufacturing sector, which typically demonstrates resilience during economic challenges. An illustrative example of this resilience is the period from July to September 2020 when the occupancy rate remained at 94%, even as the economy faced a complete shutdown due to the COVID-19 pandemic.

FIBRA Macquarie

Nearshoring as a Tailwind

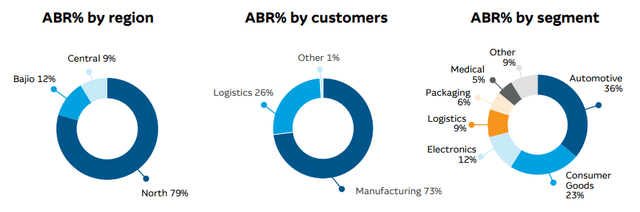

Previously, the alternative to nearshoring was offshoring, which involved sourcing suppliers in other cost-effective destinations such as Asia, aiming to reduce costs as much as possible. However, supply chain disruptions occurred during the war between Russia and Ukraine have highlighted that long distances and significant time differences between continents can sometimes have a detrimental impact on operations. Nearshoring seeks to mitigate these problems, and Mexico is strategically located for this purpose.

Manufacturing in Mexico vs China (The Nearshore Company)

The United States, as the largest world importer in the Americas, has for many years imported directly from China. However, with the strain in US-China relations, Mexico has gained ground and is now positioned favorably for more companies to concentrate their operations in the country. In addition to geographical proximity, Mexico benefits from the USMCA, which streamlines trade between Mexico, the United States, and Canada.

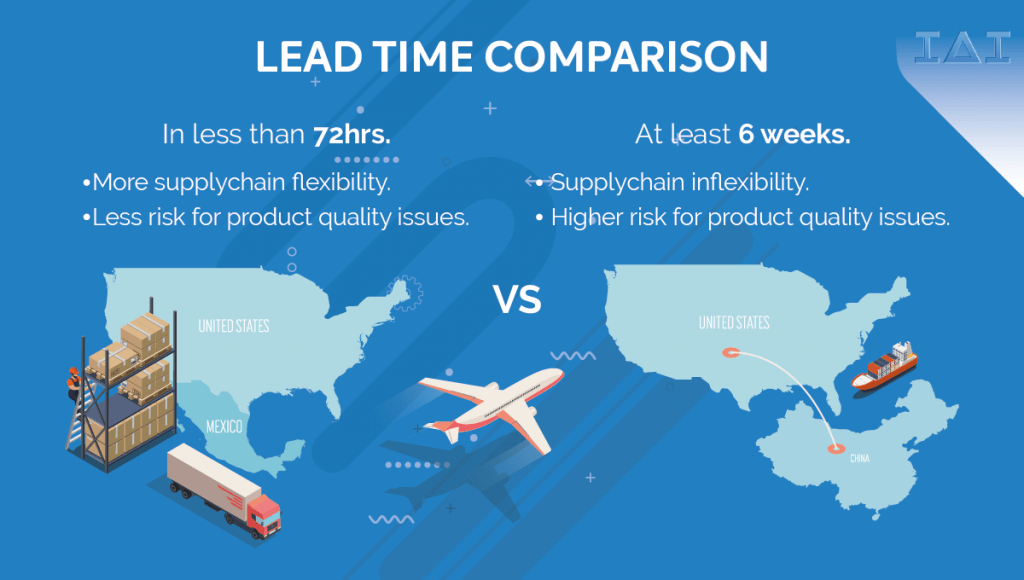

Moreover, Mexico’s cost of labor has been lower than that offered by China, making it a key factor in attracting investments across various industries, including machinery manufacturing, automotive, aerospace, electrical, and electronics. Statista estimates that labor costs can be up to 26% lower, with workers earning $4.8 per hour, well below the $6.5 charged in many regions of China.

Labor Costs: China vs México (Statista)

As a result, an increasing number of companies are relocating their production centers to Mexico to reduce risks, lead times, and costs. In January 2023 alone, 23 announcements of new nearshoring investments in Mexico, totaling approximately $2.5 billion USD, were registered. Additionally, around 400 companies have expressed their intentions to join this trend. Notable names like BMW, Nestlé, BIC, and even Tesla are planning to develop manufacturing ecosystems by establishing manufacturing points in various states of the country.

To further support this trend, Mexico, Canada, and the United States established an Import Substitution committee in January 2023 with the goal of shifting production of products currently imported from Asia to North America. The objective is for 25% of what is presently produced in Asia to be manufactured and utilized on the continent. Together, the three North American countries surpass the GDP of the European Union, and fostering economic growth to create a robust continental economy could significantly benefit Mexico.

All this industry relocating to the country will prove highly advantageous for industrial REITs with a substantial presence in Mexico’s key regions. As we discussed earlier, FibraMac is among these REITs poised to benefit significantly.

Key Ratios

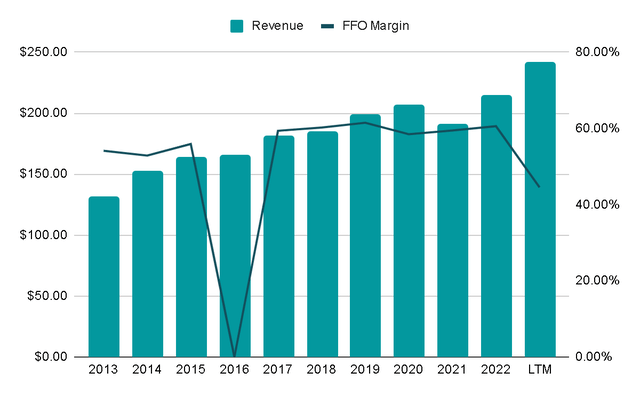

The company’s revenues have grown 5.6% annually in the last decade, maintaining average Fund From Operations (FFO) margins of 60%, although in LTM this margin has decreased to 45% because the company is investing heavily in increasing its industrial portfolio and currently They are building 5 projects to take advantage of the nearshoring trend.

Author’s Representation

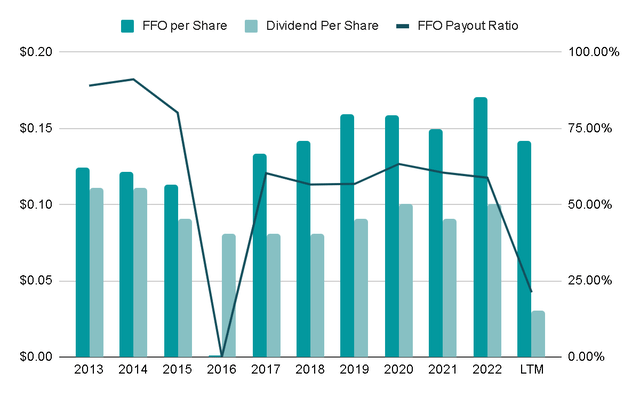

We can observe that the FFO effectively covers the dividend paid, with a historical Payout Ratio of around 60%. Nevertheless, this ratio has decreased this year for the reasons previously discussed. The idea is that, following investments, the FFO will experience growth, and if the Payout remains at 60%, the dividend yield could potentially increase significantly.

Although we currently lack specific guidance on the expected FFO growth, it is worth noting that for this fiscal year, they anticipate a 5% decrease in FFO, with an estimated dividend payment of approximately $2.1 Mexican pesos. This implies a dividend yield of 7% based on current prices.

Author’s Representation

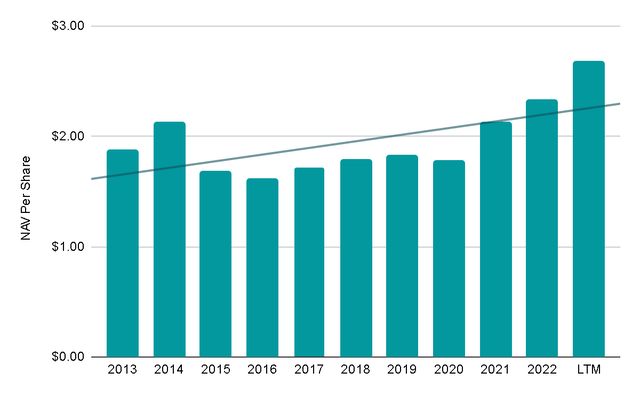

Net Asset Value (NAV) per Share represents the estimated value of the REIT’s assets minus its liabilities. This has been growing year after year at rates of 7% annually in the last decade and is currently $46 MXN compared to the price per share of $30 MXN (on the Mexican Stock Exchange).

Author’s Representation

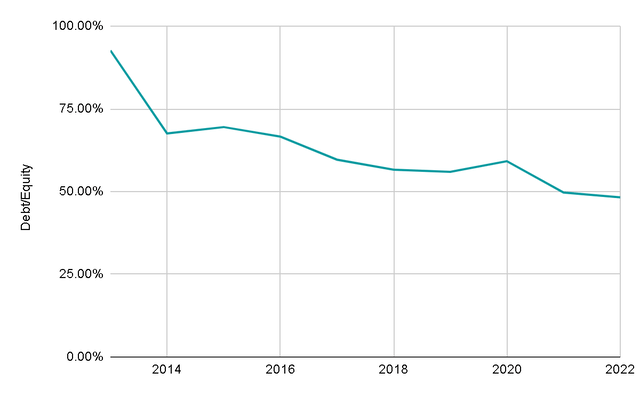

The company has consistently maintained a Total Debt to Equity ratio of 55%, which can be considered moderate for a REIT. Given the quality of its assets, it suggests that the company enjoys a reasonably strong financial position.

Additionally, the maturity dates of its nearest debt obligations are set for 2026, and they represent only 35% of the total debt. Furthermore, the company has acquired debt at an average interest rate of 5.5%, which is advantageous, particularly in a market where Mexican interest rates currently stand at 11%. If FibraMac had debt maturing in 2023 or 2024, it would have faced the challenge of either significant deleveraging or accepting these higher interest rates.

Author’s Representation

Final Thoughts

The company’s heavy investments have temporarily decreased its Funds From Operations, but the nearshoring trend presents a substantial opportunity for these investments to yield excellent returns, ultimately reflecting in the share price.

I don’t view nearshoring as a passing fad; rather, it represents a structural change that the North American continent is undergoing and may extend for several years, benefiting all parties involved. This is why I believe that FIBRAs like FIBRA Macquarie have a promising future ahead. While dividends are what REITS investors are most interested in (and the current 7% dividend yield is attractive), the potential for capital appreciation makes it an outstanding opportunity.

Considering these factors, I have chosen to assign it a ‘buy‘ rating.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

Read the full article here