Introduction

FibroGen, Inc. (NASDAQ:FGEN), a biopharmaceutical company, specializes in connective tissue growth factor (CTGF) and hypoxia-inducible factor [HIF] biology to develop innovative treatments. The company is testing Pamrevlumab, an anti-CTGF antibody, for pancreatic cancer and Duchenne muscular dystrophy. Roxadustat, already approved in several countries for anemia in kidney disease patients, is undergoing trials for chemotherapy-induced anemia. Additionally, FibroGen is expanding into immuno-oncology research

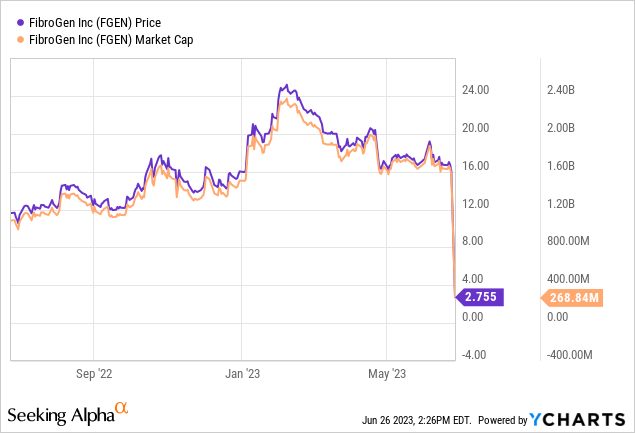

In March, my analysis of FibroGen revealed that Pamrevlumab, intended for IPF (Idiopathic Pulmonary Fibrosis) treatment, had potential for substantial market capture given the inadequacies of existing treatments. Despite a strong financial footing and diverse drug pipeline, uncertainty surrounding the Zephyrus I trial due to variant FVC thresholds posed a significant risk to investors. I also noted that although FibroGen’s $1.8 billion valuation and potential for long-term growth were promising, the uncertain trial results made it a risky investment. Hence, I classified FibroGen as a “Sell” based on these findings.

Today, FibroGen made an announcement regarding the topline results of Zephyrus I, which unfortunately failed to meet its primary endpoint. Consequently, FibroGen has made the decision to halt all further development endeavors related to IPF. As of the time of writing, FibroGen’s stock has experienced a significant decline of over 80%.

This article aims to examine FibroGen’s IPF data and offer investors an update on the company’s future direction.

FibroGen Q1 2023 Earnings

Let’s first review financials. FibroGen’s Q1 2023 earnings report revealed a 28% increase in net product revenue from Roxadustat sales in China, reaching $24.2 million, compared to $18.9 million in Q1 2022. Total Roxadustat sales in China jointly made by FibroGen and AstraZeneca surged by 47%, from $43.5 million in Q1 2022 to $64.1 million. Despite these gains, total revenue dropped to $36.2 million in Q1 2023 from $60.8 million in Q1 2022, due to the absence of a $25 million milestone payment. The company posted a net loss of $76.7 million or $0.81 per share, compared to a net loss of $63.2 million or $0.68 per share last year. As of March 2023, the company held $373.6 million in cash and investments and expects these funds to support operations through 2024. However, following the IPF failure, FibroGen plans to make efforts to extend their cash runway until 2026.

ZEPHYRUS-1 Trial: FibroGen’s Pamrevlumab Fails Primary Endpoint In IPF Study

FibroGen announced top-line results from its Phase 3 ZEPHYRUS-1 trial, testing pamrevlumab’s effectiveness and safety in IPF patients. However, the study failed to reach its primary endpoint, with no significant change in forced vital capacity [FVC] at week 48 (p=0.29). The mean FVC decline from the baseline to week 48 was 260 ml in the pamrevlumab group, compared to 330 ml in the placebo group. The trial also didn’t meet its secondary endpoint of time to disease progression. Despite this, pamrevlumab was generally safe, with most adverse events being mild or moderate. Serious adverse events were seen in 28.2% of the pamrevlumab group and 34.3% of the placebo group. Following these results, the company has discontinued the ZEPHYRUS-2 trial, with the ZEPHYRUS-1 results to be shared at an upcoming medical forum.

FibroGen’s Daunting Road: DMD And Pancreatic Cancer Trials Post-IPF Failure

Following the IPF trial failure, FibroGen anticipates several key milestones. These include releasing topline data from Phase 3 studies of pamrevlumab for ambulatory DMD patients (3Q 2023) and for LAPC (1H 2024). Data from a Phase 3 study on metastatic pancreatic cancer is also expected. FibroGen plans to file up to two INDs: FG-3165 (1Q 2024) and FG-3163 (4Q 2023). Additionally, the company expects to initiate a Phase 2 trial of FG-3246, targeting metastatic castration-resistant prostate cancer, in 2H 2024.

Developing effective drugs for Duchenne muscular dystrophy (DMD) and pancreatic cancer is notoriously challenging. Both conditions are characterized by high clinical trial failure rates, due to their complex nature and our limited understanding of their underlying biology. DMD is a rare genetic disorder with currently no cure, making effective treatments difficult to develop. Similarly, pancreatic cancer is often detected late and is highly resistant to existing therapies, making it one of the deadliest forms of cancer.

Given this context, the prospects for FibroGen’s drug candidates for DMD and pancreatic cancer are, regrettably, dim. The intrinsic difficulties associated with these diseases make the successful development and approval of treatments a formidable task. As such, investors and stakeholders should be aware of the high risk and challenges involved in this arena.

My Analysis & Recommendation

The recent disappointing results of the Zephyrus I trial have cast a shadow over FibroGen’s prospects. While the company’s financials reveal a positive trajectory for Roxadustat sales in China, the failure to meet the primary endpoint in the IPF trial has triggered a significant stock drop and has undoubtedly shaken investor confidence. The company’s future now relies heavily on its remaining drug pipeline, specifically focusing on treatments for DMD and pancreatic cancer. However, it’s important to note that these are areas fraught with challenges and uncertainties.

The inherent complexity and limited understanding of these diseases, paired with traditionally high clinical trial failure rates, indicate that these are unsteady waters to navigate. Although innovation and progress should always be encouraged in biopharmaceuticals, particularly for conditions as devastating as DMD and pancreatic cancer, we must also consider the stark realities and risks. The challenges faced by FibroGen are emblematic of the wider biotech sector, where potential high rewards are offset by high risks and frequent failures.

As it stands, FibroGen plans to shore up its financial reserves until 2026, suggesting it has ample runway to continue its research and development efforts. The company’s long-term viability will be tested over the coming years as it navigates the inherent complexities and uncertainties tied to developing new treatments. But, in light of the recent setback with the IPF trials and the challenging road ahead in the areas of DMD and pancreatic cancer, I maintain my “Sell” recommendation for FibroGen at this time.

There is no denying that FibroGen’s work is important, particularly its forays into areas of unmet medical need. However, for the risk-averse investor, this may not be the right time to back FibroGen. The company’s journey demonstrates the precarious nature of biopharma investment, where substantial gains hinge on successful trial outcomes. The pathway to drug discovery and approval is long, winding, and fraught with uncertainty, a factor that investors must weigh heavily in their decision-making processes.

Risks to Thesis

When the facts change, I change my mind.

Here are some potential threats to my “Sell” stance on FibroGen:

-

Unexpected Trial Success: If FibroGen’s clinical trials for Duchenne Muscular Dystrophy (DMD) and pancreatic cancer turn out successful, my thesis could take a hit. In biotech, a single trial can change everything.

-

Roxadustat’s Rising Sales: If Roxadustat sales keep growing, especially in big markets like China, it could overshadow the IPF trial failure. Any future approvals in more countries or for new uses could also change the narrative.

-

New Partnerships or Buyouts: If FibroGen gets into strategic alliances or gets acquired, it could boost their resources and chances for success, challenging my thesis.

-

Other Pipeline Drugs Make Progress: FibroGen has more drugs in its pipeline. Any positive developments with these could alter the company’s prospects.

-

Longer Financial Runway: With a solid financial position, FibroGen might weather the IPF trial storm. If they stretch their cash runway to 2026 as planned, it may give them more time to score wins with their other drugs.

-

More Funding Secured: If FibroGen successfully raises additional capital, this could provide them with more resources to mitigate the high-risk nature of the sector, thus testing my thesis.

Read the full article here