By Dina Ting, CFA, Head of Global Index Portfolio Management, Franklin Templeton ETFs

Global investors might not be aware that Mexico’s stock market has been rising to new heights this year. Dina Ting, Head of Index Portfolio Management, Franklin Templeton ETFs, makes the case to consider adding some exposure.

Mexican stocks have reached new highs this year. The FTSE Mexico RIC Capped Index is up more than 26% year-to-date, with consumer staples and materials constituents leading the way higher.1

There are a few factors buoying the positive sentiment. We’ve seen reshoring and nearshoring booms that have taken advantage of the country’s geographical supply chain benefits and competitive rates for highly skilled labor, along with the country’s recent progress in increasing access to financial services.

With more international companies establishing manufacturing in Mexico or relocating manufacturing there, the country’s industrial park occupancy hit a record high last year. US firms accounted for approximately 45% of investments into such facilities,2 but global firms based in other regions have also contributed to the uptick. For example, out of 40 new industrial park projects managed by the Mexican Association of Private Industrial Parks, 52% are linked to China, followed by Italy at 13% and Germany at 8%.3

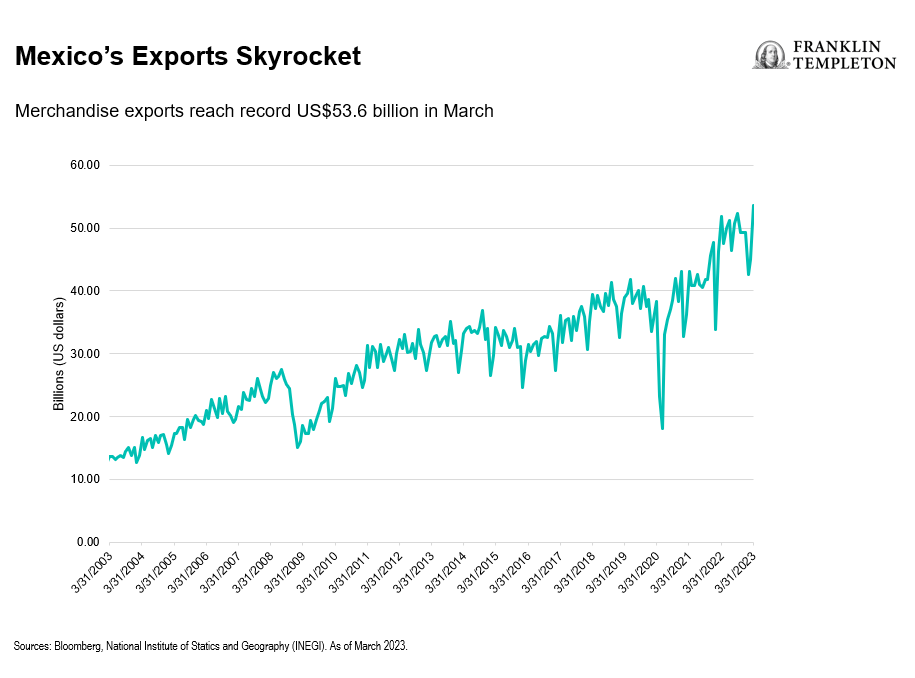

In addition, strong North American demand for Mexican goods has led to a better-than-expected trade surplus in March, when the country’s exports reached a record US$53.6 billion.

Investors seeking targeted exposure to a broad swath of companies in Mexico, including the notable fintech and retailing segments, can consider single-country exchange-traded funds (ETFs) for flexible and low-cost access to the country’s equities. ETFs, which have democratized the investing experience, allow access to strategies and entire asset classes that were previously only available to larger institutional investors. They also provide opportunities to target outcomes through tactical country allocations.

Democratizing financial inclusion

Some consumer staples firms in Mexico’s stock market have been recent standouts. Tapping into the change that is underway in the payments space, some retailers are now playing a greater role in financial inclusion efforts through the rollout of alternative payment methods. For example, one of Latin America’s largest beverage and retail giants based in Mexico is leveraging access to customers of its ubiquitous convenience store chains with new digital debit cards that may help financial services penetration – a central government priority.

The opportunity set is great, in our view. Mexico is the region’s largest economy to remain heavily cash-based. In 2021, only 20% of the country’s adults reported having a department store credit card, and that figure was double the percentage who reported owning a bank credit card.4

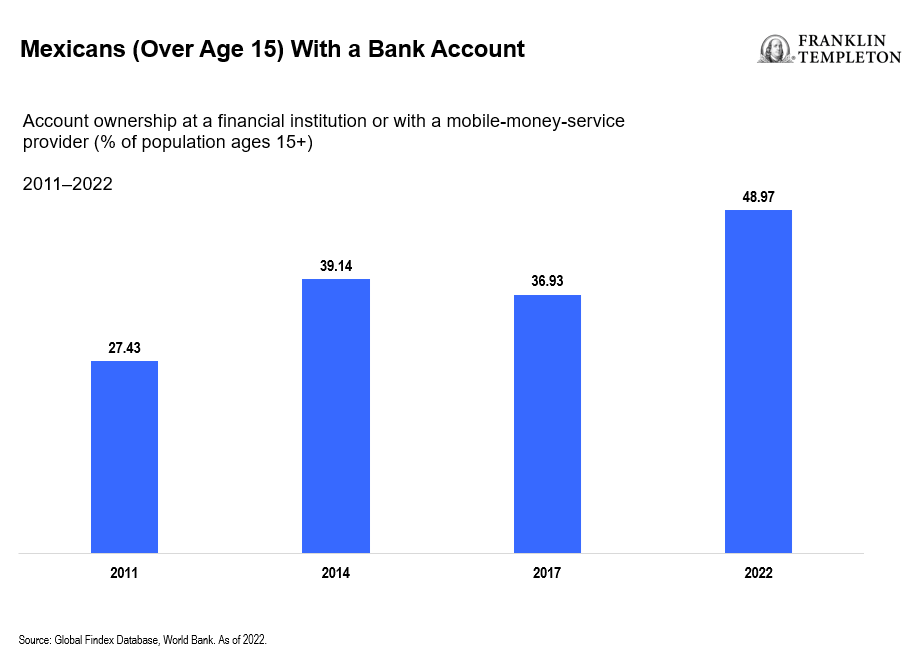

Other new programs from Mexico’s retailers may offer products for remittances, loans to small businesses, and other traditional services. These efforts are widely seen as a positive for the country’s nascent digital economy. There is much room for growth, in our assessment, as only about 49% of individuals over the age of 15 held a bank account in 2022, up from 37% in 2017, according to the World Bank.

Mexico is part of a free-trade area that allows its industry to integrate into North American supply chains. Yet its challenges still include a stubbornly high poverty rate of roughly 40%,5 along with more than 55%6 of its workforce and many businesses making up its informal labor force, which means, they do not fulfill tax obligations or make social-insurance contributions.

Certain analysts point to other hefty challenges that remain, particularly among Mexico’s smaller cities and rural areas. “Citizens in three-quarters of Mexico’s municipalities do not have even one access point for financial services within a two-kilometer walk,” said former International Monetary Fund (IMF) Director Christine Lagarde during a 2019 speech in Mexico City. “When it comes to replacing cash as a means of payment, Mexico lags . . . . ”7

Mere months before the COVID-19 pandemic began, however, Mexican officials made strides in modernizing the country’s financial systems and regulations. They passed new legislation to promote and enhance fintech solutions and launched initiatives to bolster financial literary education in schools. By many accounts, Mexico’s fintech ecosystem is flourishing, owing to the country’s market attractiveness, high smartphone and internet penetration, and improvements in debit card and digital wallet usage.

In mid-May 2023, Mexico’s central bank joined other Latin American central banks in halting their monetary tightening cycles, and its efforts to tame inflation have been helped by the peso, a top-performing currency against the US dollar among emerging markets this year. Given this backdrop and the current global market environment, we believe Mexico may offer good potential opportunity for investors, particularly for those looking to add emerging market exposure to their portfolios.

WHAT ARE THE RISKS?

All investments involve risks, including the possible loss of principal. The value of investments can go down as well as up, and investors may not get back the full amount invested. Stock prices fluctuate, sometimes rapidly and dramatically, due to factors affecting individual companies, particular industries or sectors, or general market conditions. Investments in foreign securities involve special risks including currency fluctuations, economic instability and political developments. Investments in developing markets involve heightened risks related to the same factors, in addition to those associated with their relatively small size and lesser liquidity.

Any companies and/or case studies referenced herein are used solely for illustrative purposes; any investment may or may not be currently held by any portfolio advised by Franklin Templeton. The information provided is not a recommendation or individual investment advice for any particular security, strategy, or investment product and is not an indication of the trading intent of any Franklin Templeton managed portfolio.

Past performance is not an indicator or guarantee of future performance. There is no assurance that any estimate, forecast or projection will be realised.

Links to External Sites

Franklin Templeton is not responsible for the content of external websites.

The inclusion of a link to an external website should not be understood to be an endorsement of that website or the site’s owners (or their products/services).

Links can take you to third-party sites/media with information and services not reviewed or endorsed by us. We urge you to review the privacy, security, terms of use, and other policies of each site you visit as we have no control over, and assume no responsibility or liability for them.

1 Source: Bloomberg, as of May 16, 2023. Indexes are unmanaged and one cannot directly invest in them. They do not include fees, expenses or sales charges. Past performance is not an indicator or guarantee of future results.

2 Source: Grupo Financiero Banorte, February 15, 2023.

3 Ibid.

4 Sources: CNBV; Scotiabank GBM. As of 2021.

5 Source: International Monetary Fund.

6 Source: Statista. “Informal employment as percentage of total employment in Mexico from 1st quarter 2015 to 4th quarter 2022.”

7 Source: International Monetary Fund, “Mexico: An Opportunity for Financial Inclusion,” May 29, 2019.

Original Post

Editor’s Note: The summary bullets for this article were chosen by Seeking Alpha editors.

Read the full article here