The Q3 Earnings Season for the Silver Miners Index (SIL) is just around the corner and one of the first companies to release its preliminary results is First Majestic Silver (NYSE:AG). And while the reporting period started off with an impressive report from Fortuna Silver (FSM), First Majestic’s production results hardly matched up, with production down sharply year-over-year on a continuing (ex-Jerritt Canyon) and non-adjusted basis. Worse, production per share has rolled over further, with investors needing 48 shares of AG to get the same level of silver-equivalent ounce [SEO] production vs. ~40 in the same period of 2016. Let’s look at the Q3 results below and see if the stock has finally found itself in a low-risk buy zone after a seemingly never-ending 70% plus sell-off.

First Majestic Silver Operations – Company Presentation

All figures are in United States Dollars unless otherwise noted.

Q3 Production & Sales

First Majestic Silver (“First Majestic”) released its Q3 production results this week, reporting quarterly production of ~6.29 million SEOs made up of ~2.46 million ounces of silver and ~46,700 ounces of gold. This translated to a significant decline from the year-ago period, with SEO production down 28% year-over-year. In fairness, the bulk of the decline was because of lapping production from Jerritt Canyon in the year-ago period, which has since moved into care & maintenance. However, while the company can get a pass from a comparison standpoint, it wasn’t forced to make the Jerritt Canyon acquisition, and it’s certainly put a severe dent in its per share metrics given the dilution related to the deal (~26.7 million shares).

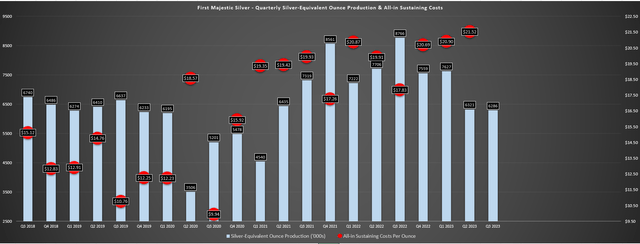

First Majestic Silver – Quarterly Production – Company Filings, Author’s Chart

Digging into the results a little closer, much of this decline came from the company’s lower cost San Dimas Mine which doesn’t paint a splendid picture for Q3 margins, especially when combined with the Mexican Peso which continued to trend higher for most of Q3 vs. the US Dollar (UUP) and averaged its lowest price in years at ~17.1 MXN/USD vs. ~17.7 in Q2 2023. The lower production at San Dimas resulted from much lower grades, with silver and gold grades slipping to 237 grams per tonne of silver and 2.71 grams per tonne of gold, respectively, down from 289 grams per tonne and 4.1 grams per tonne in the year-ago period. And while increased throughput offset this (~213,700 tonnes), I would expect much higher costs year-over-year at San Dimas with the asset up against tough comps, relying on higher tonnes to maintain the ~3.0 million ounce production level (Q2 2022: ~3.78 million SEOs), and higher labor costs.

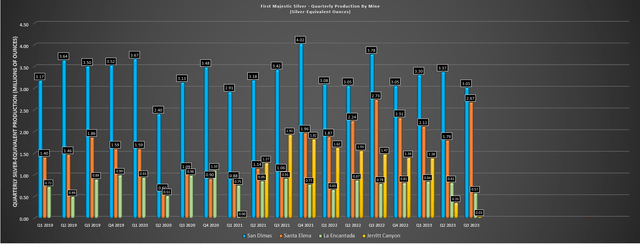

First Majestic Silver – Quarterly Production by Mine (SEOS) – Company Filings, Author’s Chart

Fortunately, the company’s #2 Santa Elena Mine had a solid quarter, benefiting from increased grades and throughput, plus a boost to gold recoveries which improved from 92% (Q3 2022) and 94% (Q2 2023) to 95% with the commissioning of its dual-circuit plant, a 300 basis point improvement. The result of the higher gold grades was that the mine saw a ~13% increase in silver production and ~6% increase in gold production despite being up against difficult comps in the year-ago period from the start of production at Ermitano. That said, while the mine will benefit from slightly higher production, I would still expect this to be a relatively high-cost quarter given the sticky inflationary pressures.

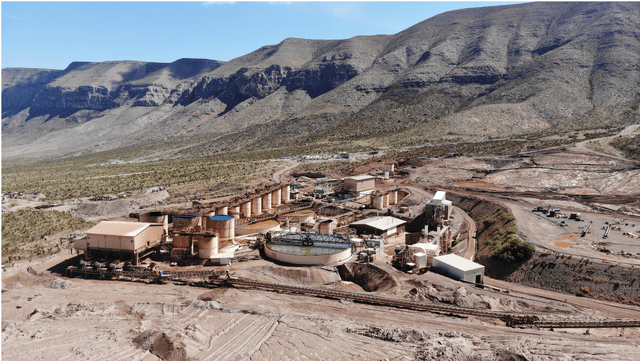

La Encantada Mine – Company Website

Finally, at the company’s smallest La Encantada Mine, there wasn’t much to write home about here either. This is because the mine saw a ~27% decline in silver production to ~566,000 ounces, down from ~779,000 ounces in the year-ago period. First Majestic noted that the lower production was related to the collapse of one well, which affected water availability, and that production would normalize once construction of the replacement well is complete, which began in September. On a positive note, First Majestic is still on track to meet downward revised guidance despite the weaker Q3 results year-over-year, tracking at ~75% of its guidance midpoint of 26.2 to 27.8 million SEOS.

Recent Developments

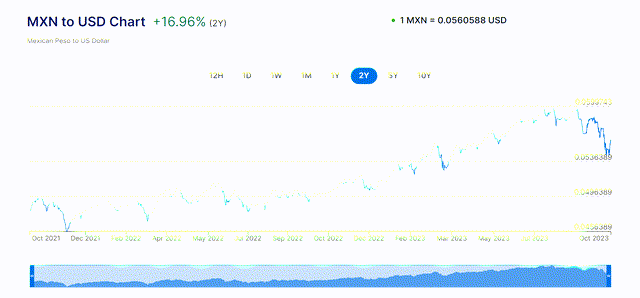

As for recent developments, the weakness in the silver price certainly doesn’t help the outlook for Q4, especially when the company’s costs are likely to remain elevated year-over-year despite turning off its highest-cost operation, Jerritt Canyon. This is because while the Mexican Peso has finally given up some ground vs. the US Dollar after a near parabolic rally from December 2022 through August 2023, it’s still sitting at ~10% higher levels year-over-year. Meanwhile, the outlook for profit-sharing and wages has arguably worsened, with Newmont (NEM) caving in to an 8% raise for the National Union of Mine, Metal and Allied Workers of the Mexican Republic earlier this month. And while this doesn’t mean that wages must go up for other mines, it certainly isn’t an ideal development for mining companies in Mexico hoping for easing pressure from a labor standpoint.

MXN/USD Chart – XE.com

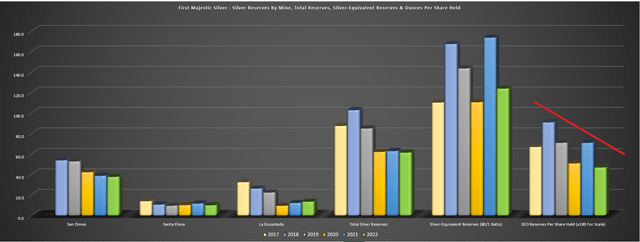

Meanwhile, from a reserve growth standpoint, First Majestic continues to have some of the shorter mine lives among its peer group and especially when compared to Hecla (HL) and the combination of a weaker silver price, sticky inflationary pressures and rising Mexican Peso certainly isn’t ideal. This is because the company may need to increase cut-off grades yet again at year-end 2023, providing a greater hurdle to moving ounces into mine plans. Adding insult to injury, reserves per share will likely decline yet again, with it being hard to be optimistic about reserve growth this year and the company seeing further share dilution with ~13 million shares sold under its ATM in H1 2023 alone. So, with it being hard to rule out further M&A after the disappointment at Jerritt Canyon, which didn’t give AG its desired diversification/production boost because of being shut down temporarily and declining per share metrics already, I continue to see AG as an Avoid.

First Majestic Silver – Reserves, SEO Reserves & Reserves Per Share – Company Filings, Author’s Chart

Valuation

Based on ~302 million fully diluted shares and a share price of US$5.00, First Majestic trades at a market cap of ~$1.51 billion. This continues to leave it as one of the highest capitalization producers in the silver space despite it having most of its NAV tied to Mexico, a jurisdiction that is dropping in ranks from an investment attractiveness (Jerritt Canyon in care & maintenance) and it being one of the lower-margin producers sector-wide. And if we compare this to an estimated net asset value of ~$640 million, leaving it trading at over 2.0x P/NAV. Not only is this a premium to other Mexican silver producers like Endeavour Silver (EXK) at ~0.80x, but also more expensive than Hecla Mining (HL), which trades at ~1.20x P/NAV with better margins and operates out of more attractive jurisdictions (Idaho, Alaska, Yukon, Quebec).

If we look out across the universe of gold producers, AG’s premium makes even less sense, with the stock trading at nearly double the P/NAV multiple of names like Alamos Gold (AGI) that have the bulk of their NAV tied to Canada (a top-tier jurisdiction) and will be one of the lowest-cost producers post-2025 once its P3+ Expansion is complete at Island. Hence, even if AG may be down ~70% from its highs, it’s hard to argue for owning the stock from an investment standpoint with it still sitting at over 2.0x P/NAV and ~20.0x FY2024 free cash flow estimates (~$75 million).

Summary

First Majestic Silver had a disappointing quarter in Q3, with lower production at two of three operations and a significant decline in production per share on a year-over-year basis with Jerritt Canyon moved into care & maintenance. And while this might not be as much of a blow if Jerritt Canyon had multiple ore sources nearby and could sit be a toll-treater for refractory ore while the company explores the property, it’s off the beaten path from a haulage standpoint relative to other roasters like Gold Quarry and Goldstrike. This means that the company can’t generate revenue toll-milling revenue while it works to explore the asset, and it also had to let go of several of its skilled workers when it moved the asset offline.

Assuming the company had an exceptional asset in its portfolio to stomach this blow like Iamgold (IAG) which may have lost Rosebel but it has ~60% of Cote, this wouldn’t be as big of a deal. However, none of First Majestic’s assets are what I would consider world-class and one of the major benefits of the Jerritt Canyon (assumed it worked out) was that it diversified the company from a cash flow/NAV standpoint, and this is no longer the case, making the move into care & maintenance a double whammy that makes it even harder to justify the stock’s premium multiple. To summarize, I continue to see AG as an inferior buy-the-dip candidate, and I continue to favor other names elsewhere in the sector trading at deeper discounts to fair value that are also hated.

Read the full article here