Fiserv (NYSE:FI) recently reported earnings, and the results were good. As a long-term shareholder, it would be a good time to update our expectations and see where the company is going.

The company reported first-quarter results of:

- Adjusted earnings of $1.58

- Adjusted revenue of $4.2B

- 13% organic revenue growth

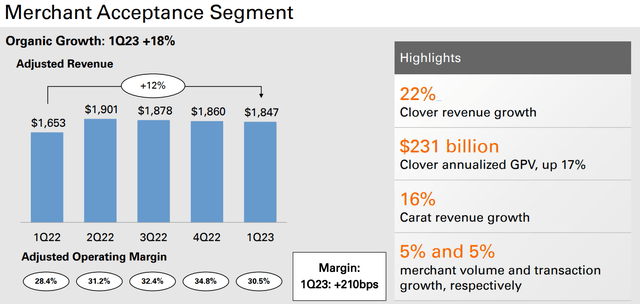

- 18% Merchant Acceptance growth

- 13% Fintech growth

These results surpassed Wall Street’s expectations and led the company to raise guidance for the rest of the year.

For Fiserv to continue to grow and exceed expectations, they are three factors they need to execute:

- Continued organic growth

- Revenue growth in the Merchant Acceptance segment

- Margin expansion

Let’s explore these a bit.

Continued Organic Growth

As mentioned, Fiserv had a good first quarter, with organic growth exceeding Wall Street’s expectations.

Fiserv had originally forecasted organic growth in the 7-9% range and was expecting results in the lower portion. However, after the strong results in the quarter, they upped their guidance to the 8-9% range.

Based on past results, there is a strong possibility the company is sandbagging this estimate and will likely surpass these expectations.

Fiserv has a long history of providing valuable solutions to merchants’ and banks’ customers. These add-on solutions help their customers grow their businesses, get more deposits, and run more efficiently.

As Clover and Carat expand across their platforms and bring on more solutions, it will make the platforms more appealing to merchants and customers.

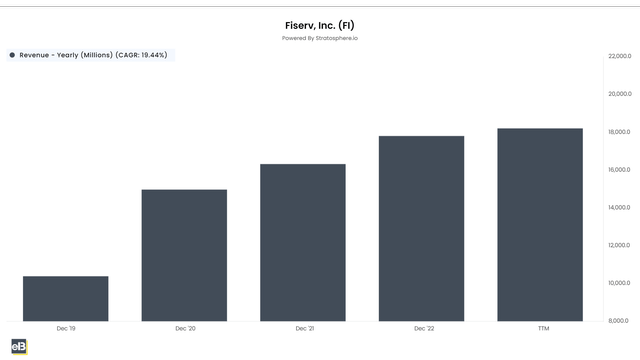

Stratosphere

Since acquiring First Data, the company has grown revenues at a 19.4% CAGR, not too shabby for a “boring” company.

Clover and Carat grew 22% and 16% last quarter, respectively. These are the platforms that are going to drive Fiserv into the future and bears-watching.

With the growing popularity of these platforms, organic growth will continue to follow. Clover saw $231B in annualized GPV (Gross payment volume), an increase of 17%. These numbers are consistent with the company’s 4th quarter performance.

As Clover continues to grow, at last, reported 27% for a total of $1.3B in March 2022. The company is a little tight on the details surrounding Clover, but the estimation for the Merchant Acceptance segment is to grow to $10B by 2025, an 11.5% CAGR from 2021.

The company is well on its way to achieving this goal, with Clover leading. At 15.3% of overall segment revenues in 2022 and at a growth rate of 20%+, it will continue to make a bigger impact on the organic growth and margins for the company.

Revenue Growth in the Merchant Acceptance Segment

According to Robert Hau, CFO, the company was able to roll out some pricing changes last year, which helped Fiserv see better revenue growth.

Fiserv 1Q 2023 Earnings

As with the rest of the world, Fiserv saw a price increase opportunity last year, largely due to inflation and increased costs. Fiserv had conversations with their customers before the price increases, trying to gauge the impact of their value-added services and whether customers could bear the price increases.

Robert Hau also acknowledged a gap in volume and revenue growth, which he attributed much of the gap to pricing but not all. Much of the company’s quarterly organic revenue was due to price increases, but they will ebb and flow across quarters.

As Fiserv continues to build solutions and capabilities in the Clover and Carat platforms, it will allow them to sell their add-value services.

The growth in their SMB business, Clover, and enterprise, Carat, will help with Fiserv’s retention rate. As each platform becomes increasingly important in its ecosystem, it will take longer for the customer to switch.

As Fiserv builds out these services and software, it will increase its value proposition and provide great pricing power.

Fiserv expects 10-13% growth for the Merchant Acceptance segment, which includes both Clover and Carat, and they believe this will be a reasonable expectation in the future for the business.

Margin Expansion

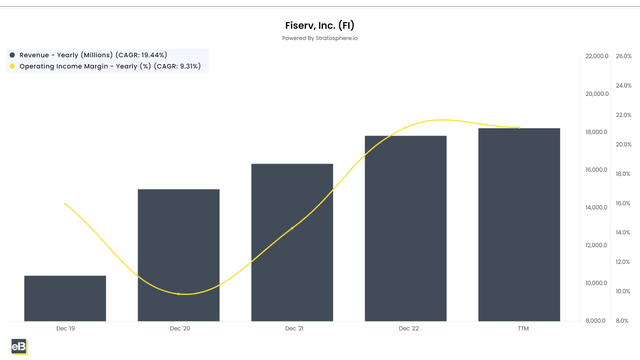

Fiserv’s operating margin for the overall business hover in the 21.5% range, with growth of 9.3% CAGR since the acquisition of First Data.

Stratosphere

But if we dig into the Merchant Acceptance adjusted margins, we see:

- 4Q21 – 31.3%

- 1Q22 – 28.4%

- 2Q22 – 31.2%

- 3Q22 – 32.4%

- 4Q22 – 34.8%

- 1Q23 – 30.5%

These margins grew QoQ in 2022 before falling slightly in the first quarter of 2023.

Digging into the financials, we can see several things. One, Fiserv is amortizing acquisition-related intangible assets from the First Data purchase; these impact the company’s overall margins by approximately 5% annually. According to the company’s investor relations, these intangibles will be written off in the next 7-15 years. In the next few years, we should see this line item decrease, opening up margins for the company.

Next, if we look, we can see the Merchant Acceptance segment is becoming a bigger and bigger part of Fiserv revenues:

- 2022 – 41.1%

- 2021 – 39.9%

- 2020 – 37.1%

And while the segment grows as a bigger part of Fiserv, the segment has also grown its margins within the segment, for example:

- 2022 – 31.8%

- 2021 – 30.8%

- 2020 – 25.8%

The growth of the Merchant Acceptance segment within Fiserv will allow the company to expand operating margins and increase free cash flow.

The margins within the segment are growing as Fiserv builds out more value-adds for customers and as customers embrace those value-adds, giving them better margins. These value-added services have a better margin than the Clover platform in itself. And Fiserv intends to continue building more capabilities for the platform and increasing the retention rate.

All of these will help Fiserv grow the profitability and margins for the company, with both Clover and Carat leading the way.

Valuation

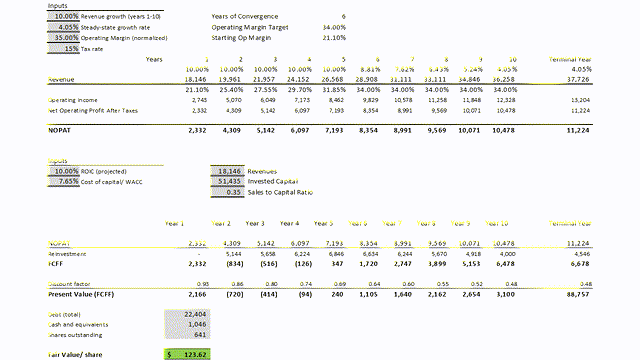

To value Fiserv, we will use a Free Cash Flow to the Firm model with the following inputs:

- Revenue growth – 10%

- Operating margins – 34%

- WACC (discount rate) – 7.65%

- Sales to Capital ratio – 0.35

Author

This gives us a fair value of $123+, which is close to fair value now.

If we look at a range of revenue growth rates:

- 8% – $115

- 10% – $123

- 12% – $132

There isn’t much range between the growth rates, indicating that the company is fairly valued now.

Investor Takeaway

Fiserv is a strong company with a good position in the payments/banking space. With Clover and Carat, they have two great platforms to help them grow.

The company continues executing its plan to become a one-stop shop for customers and work with as many vendors and providers as possible. The continued growth of the Merchant Acceptance segment will go a long way toward the overall success of Fiserv.

I am long the company and was lucky to get in around $98 and will continue to hold. As for now, I rate Fiserv a hold until a better opportunity presents itself to new investors or there is another catalyst in the future.

Read the full article here