Fisker’s (NYSE:FSR) 78% collapse year-to-date has been dramatic with the Californian EV company joining the ranks of the 2020 and 2021 class of electric vehicle deSPACs in losing a ton of equity value since ZIRP ended on the back of the Fed struggle with inflation. It’s important to outline just how much carnage there has been. 2023 is about to close out with two Chapter 11 bankruptcy filings from Lordstown Motors (OTC:RIDEQ) and Proterra (OTC:PTRAQ), both deSPACs. Arrival (ARVL), Canoo (GOEV), Faraday Future (FFIE), and Workhorse (WKHS) are all trading below the standard $1 minimum listing requirement with a liquidity and free cash burn dynamic that’s unable to sustain more than 1 year of operations for the bulk of these. This solvency risk is what defines Fisker and forms a critical Achilles heel for the company whose cash and equivalents of $529.7 million at the end of its recent fiscal 2023 third quarter was down by $300 million from a year ago.

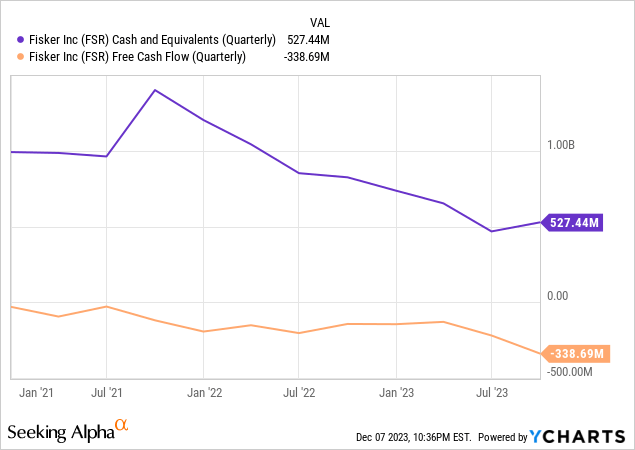

The company is collapsing because the market is extrapolating current free cash burn against its existing liquidity base to price in the probability of the type of liquidity gap that disrupted the fates of Lordstown and Proterra. Fisker’s free cash burn of $338.7 million during the third quarter was a sequential deterioration from a cash burn of $219 million. Critically, the company does not have the cash to sustain more than three quarters of operations against its current cash burn rate. To be clear, Fisker is unloved, collapsing, and currently on the precipe of moving below the NYSE’s $1 minimum listing requirement because the market has priced the probability of a Chapter 11 bankruptcy filing as the base case of 2024.

Ramping Operating, Reducing Costs, Raising Cash

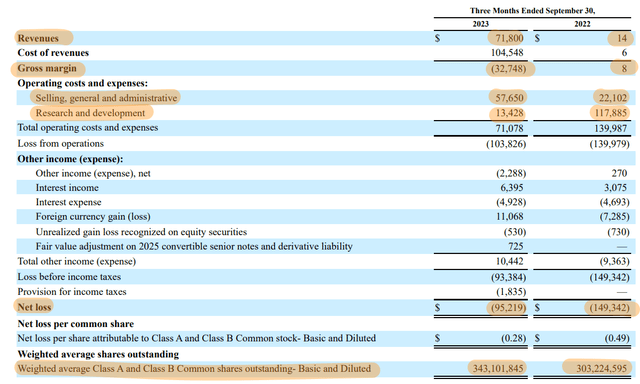

Fisker recorded revenue of $71.8 million during its third quarter as it delivered 1,097 Ocean SUVs against production of 4,725 vehicles. Deliveries are also ramping with post-period end deliveries in October alone at 1,200 vehicles outpacing the entire third quarter. This delivery ramp means that the third-quarter GAAP gross profit margin which was negative at 45.6% stands to improve more materially as Fisker benefits from scale. Gross profit margin was initially recorded negative at 17% with Fisker announcing an adjustment to earnings after incorrectly allocating $20 million to SG&A rather than to its cost of revenues and filing its 10-Q late to reflect this.

Fisker Fiscal 2023 Third Quarter Form 10-Q

The company also underperformed analyst consensus by a huge $64 million with the disparity between production and deliveries to blame. Fisker has been able to improve delivery, shipping 107 vehicles in a single day on 16 November. This came on the back of adding more transportation logistics providers and Fisker Direct, where customers within 60 miles of a fulfillment location can have their vehicle driven to them by a Fisker employee. Fisker has a production capacity of 300 vehicles per day from Magna Steyr’s expertise, hence, the company should see meaningful gains in revenue. I’d estimate fourth-quarter revenue of at least $284 million driven by 4,350 vehicle deliveries. A huge ramp, but unprofitability is guaranteed even with Fisker reducing its research and development budget. I was bullish when I last covered Fisker but the company’s third-party contractor model for production has failed to moderate its cash outlay.

Are The Commons Undervalued?

It depends. Fisker is currently trading at a $494 million market cap against an estimated full-year 2023 revenue of $355.8 million, a roughly 1.4x price-to-sales multiple. 2024 presents a quagmire for Fisker with a potential ramp to a $1 billion revenue rate set against continued free cash burn and a precarious liquidity base. The market and what’s now a 44% short interest in the common shares doubts that the company has the required funds to make it to the end of 2024. The situation is also made worse because Fisker needs a strong stock price to be able to raise cash more effectively. This has created a difficult situation for bulls where the shares have failed to broadly participate in the market rally over the last few weeks as any rally would be used as an opportunity for dilution by the EV upstart. I believe it needs this dilution to survive.

Dilution of its shareholders is certain in my view with its weighted average common shares outstanding at the end of the third quarter up 13% over its year-ago period. Fisker has another $100 million from restricted cash and is set to receive $50 million from VAT receivables. This forms an implied liquidity base of $678 million. The company also expects to be able to tap another $550 million from 0% coupon senior unsecured convertible notes due in 2025. Hence, the revenue ramp, a potential dovish Fed pivot, and the use of cheap convertible debt to potentially expand its runway to past 2024 could provide some leeway for bulls to recover. The short interest is high and the ticker is not a buy on the back of its free cash burn profile.

Read the full article here