In line with my prior coverage, Indian stocks have been on a tear in recent months, raising concerns about whether a breather may finally be overdue. To some extent, the rise has been driven by a P/E multiple re-rating, as disinflationary pressures pull forward monetary easing prospects. But earnings growth has also been key, with a solid Q2 reporting season boosting the 2023/2024 outlook for Indian large-caps.

Perhaps most importantly, the long-term thesis is as attractive as ever, supported by positive demographic tailwinds and an attractive geopolitical positioning, allowing Indian large-caps to capitalize on geopolitical tensions. Admittedly, valuations of the ultra-low-cost Franklin FTSE India ETF (NYSEARCA:FLIN) reflect the market’s growing understanding of the Indian bull case at over 20x forward earnings. Given the underlying earnings growth potential, though, I still see room for the FLIN portfolio to grow into its multiple over time.

Fund Overview – Still the Lowest Cost Vehicle to Ride the Indian Wave

The Franklin FTSE India ETF tracks Indian large-cap stocks (subject to concentration limits) via the market-capitalization weighted FTSE India Capped Index. Like most other Franklin international ETFs, the expense ratio is industry-leading at 0.2% gross and net and remains unchanged despite adding ~$148m to its net asset base over the last quarter (previously ~$200m).

Franklin FTSE India ETF

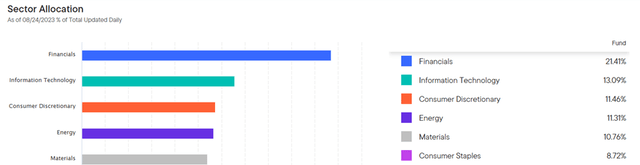

Helped by its concentration caps, FLIN remains relatively well-diversified across Financials (21.4%), Information Technology (13.1%), and Consumer Discretionary (11.5%). More cyclical sectors like Energy (11.3%) and Materials (10.8%), on the other hand, continue to see reduced allocations amid external headwinds. The top five sectors (all over the 10% threshold) are key contributors to the overall portfolio at 68%.

Franklin FTSE India ETF

The fund’s diversification shines through in its single-stock allocation, with the 210-stock portfolio maintaining only two holdings over 5% (conglomerate Reliance Industries (OTC:RLNIY) at 8.8% and tech services company Infosys (INFY) at 5.3%). The overall portfolio remains broadly unchanged, with notable Indian franchises like Housing Development Finance Corporation (4.9%) and information technology services and consulting company Tata Consultancy Services (OTCPK:TTNQY) (3.7%) topping the list, along with consumer goods company Hindustan Unilever at 2.7%.

Franklin FTSE India ETF

Fund Performance – On Track for Another Strong Year of Returns

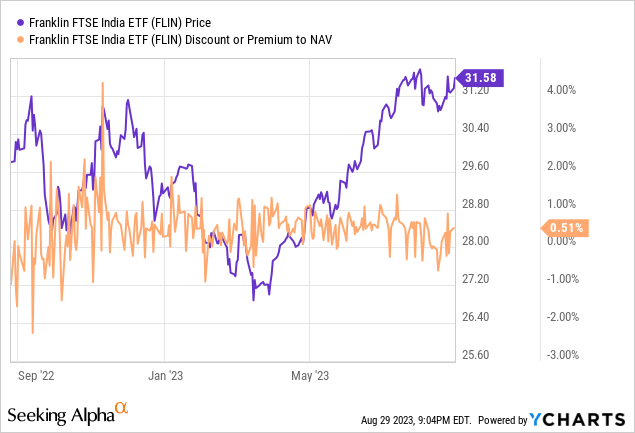

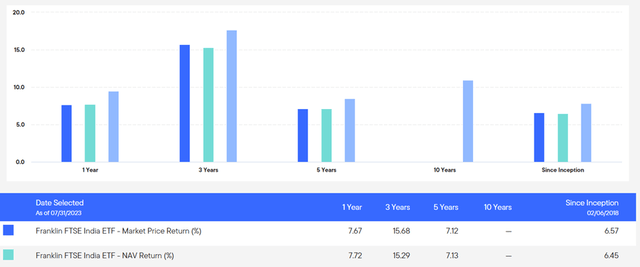

Following a blockbuster Q2, the ETF has now returned +7.2% in NAV terms (+7.3% in market price terms) this year. In aggregate, this means FLIN has compounded at an impressive +6.5% pace (in NAV terms) since its inception in 2018. Even after accounting for last year’s negative return, the fund has delivered three and five-year annualized figures of +15.3% and +7.1%, respectively.

Franklin FTSE India ETF

The main negative here is FLIN’s tracking error vs. its benchmark, which remains fairly high at over one percentage point (annualized) since inception. Also, the fund’s distribution generally runs below 1%, though FLIN’s portfolio of high-growth companies has more than made up for this with stellar earnings growth through the cycles.

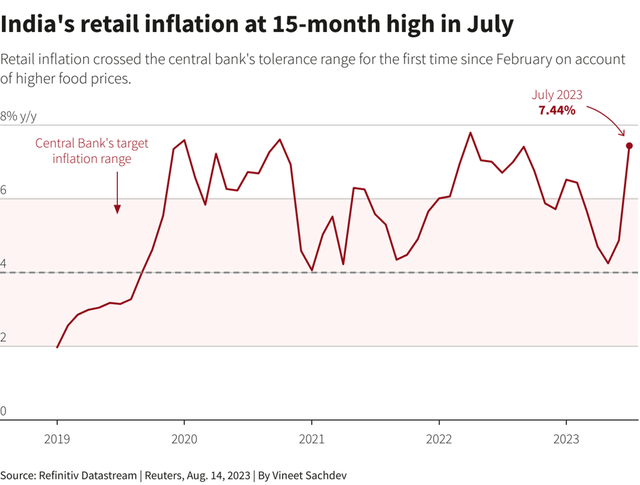

Look Past the Transitory Headline Inflation Spikes

Despite the strong economic data points, from credit to GDP growth (now tracking at ~8% for fiscal Q1 2024 per Reserve Bank of India estimates), much of the recent news flow has focused on higher consumer inflation. To recap, July headline numbers rose sharply to 7.4% YoY, well above the <5% print in June, as well as the Indian central bank’s 2-6% target range. But a closer look suggests the key culprit was higher food prices (mainly vegetables), which should normalize lower once monsoon-related headwinds fade. In contrast, core inflation has moderated to 4.9% YoY, so despite the risks from higher food inflation, a precautionary rate hike at the next policy meeting seems unlikely. This month’s meeting minutes confirmed as much, with the monetary policy committee citing a focus on underlying trend inflation over transitory shocks (in reference to food prices).

Reuters

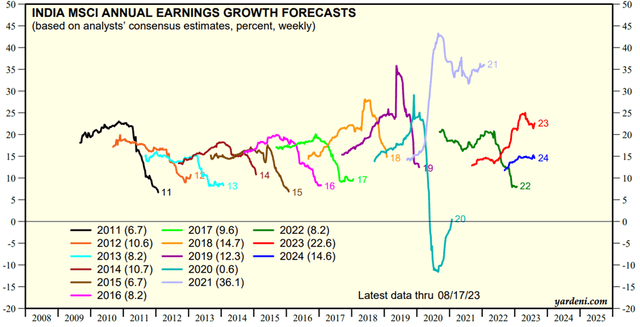

Assuming no monetary policy headwind, Indian corporate earnings look poised to continue growing strongly off a low base. The latest quarterly reporting, for instance, saw an earnings boost from both sides of the P&L (lower costs and higher revenue), with domestic-oriented sectors like banking, capital goods, and autos leading the way. The strength here more than offset weakness in export-oriented sectors like materials, where the ongoing Chinese slowdown is weighing on profits. As a result, the net earnings upgrade trend for Indian large-caps continues to trend in the right direction, underpinning consensus estimates for +22.6% and +14.6% growth in 2023 and 2024, respectively.

Yardeni

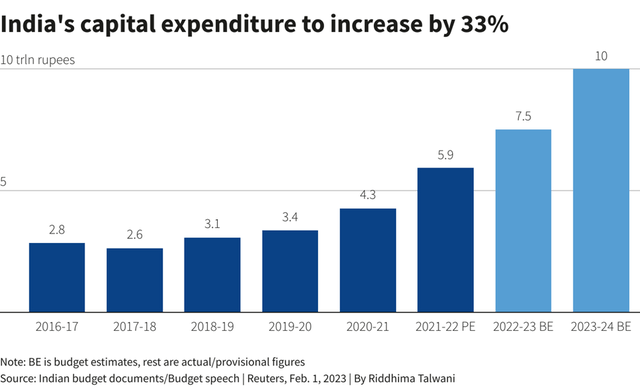

Alongside the longer-term building blocks being put in place (e.g., institutional reforms to formalize the economy and accelerate digitization), as well as the unwinding demographic dividend, all signs point to an Indian super cycle in the years to come. So even if we see some moderation in current valuations (now ~20x earnings using the MSCI India as a proxy), investors with longer time horizons should still be well rewarded. In the meantime, keep an eye out for the unfolding capex cycle (helped by the significant capex increases announced at this year’s budget meeting), as well as additional fiscal impetus ahead of the upcoming elections.

Reuters

The Indian Growth Story Keeps Going

Having endured a difficult start to the year amid governance concerns, Indian large-caps have since bounced back strongly. With a forward earnings multiple of around 20x, on the other hand, FLIN could be vulnerable to some profit-taking ahead of monsoon-related uncertainty in the coming months. I wouldn’t be selling anytime soon, though, given the compelling long-term bull case. Coming off a low GDP per capita base and with a massive ‘demographic dividend’ at hand (in contrast with China’s unfolding demographic headwind), India arguably has the best growth runway in the emerging markets universe. There’s optionality on the geopolitical front as well, given India’s favorable positioning on both sides of the multipolar divide. Ahead of the election cycle, maintaining Indian exposure via an ultra-low-cost fund like FLIN still makes a lot of sense, in my view.

Read the full article here