Young Ryan…Whoa, this chemistry stuff is pretty cool…wonder what its good for?

Introduction

I’ve been of the opinion recently that I think Flotek Industries, (NYSE:FTK) is a turnaround story. The company has had its ups and downs in recent years, mostly the result of bad management and a one-trick pony product line. The oil crash of 2014 didn’t help either. For details on their past performance, please have a look at my older articles. Things have been improving with new

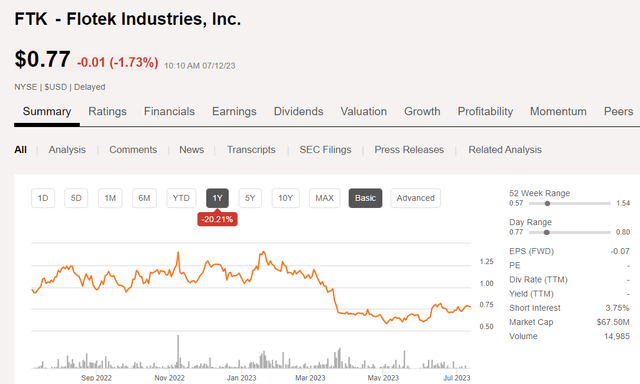

FTK Price chart (Seeking Alpha)

management that have raised my opinion about the company. A lot of this has to do with the 10-year supply agreement with ProFrac Holding (ACDC). This gives them a revenue and EBITDA base from which to build.

Recently I caught up with Ryan Ezell, the newly installed CEO and had a good chat with respect to a wide range of levers Flotek has to pull in the coming quarters. I came away impressed, and think if your portfolio has room for a high-risk microcap, you might find the company attractive at current prices.

The thesis for FTK

With about 270 frac spreads running nationally there is a strong market for stimulation chemistry that feeds in FTK’s bread and butter. I’ve said in the past management matters, and if you spend time talking with people you can get a sense if someone is in the right position at the right time.

Ryan Ezell is just the person FTK needs at this juncture. He’s a young guy with a lot of drive, and the training and experience to take their chemical portfolio into the marketplace and come back a winner more often than not. He also has an attribute rare in Ph.D. circles. He’s got the gift of explaining abstract and highly technical concepts to lay people, and can talk to anyone, like stock analysts and fund managers. Even old, rig rats, like me. Ryan has been hitting the capital and analyst circuit and soon I think the market will take notice.

The ProFrac deal gives them steady cashflow for a number years, and provides core business base that can then be scaled up as the business demands. They are not exclusive to ProFrac and can sell their chemical solutions to other frac providers. ProFrac has agreed to take a certain volume of chemistry from them that equates to their servicing 30 of ProFrac’s fleets.

As you will see in the interview there are a number of levers they can pull as their business builds and I think they are a classic turnaround story.

- Strong leadership.

- Proprietary chemistry backed with patents.

- Manufacturing capacity that is unencumbered by debt service.

- Rapidly improving financials, going from negative $2 mm in Gross Margin last year to perhaps $20 mm in positive Gross Margin this year. If that’s not a turnaround story, I don’t know what is.

Here’s the chat with Ryan.

An interview with FTK CEO Ryan Ezell

I had a chance to sit down with Flotek Industries, (FTK) CEO Ryan Ezell and CFO Bond Clement the other day. It was a wide-ranging discussion that focused on the growth opportunities the pair see for the second half of the year. Let’s get started.

Fluidsdoc: One of the things we should probably clear up is a near-term risk of a reverse split due to the company being below NYSE minimum. You’ve been under that for a good while now.

Ryan Ezell: We are hoping to resolve that organically with results. We have until October to meet the exchange requirements and are pretty confident we will be able to make the case. There is no plan for a reverse split at this time.

Fluidsdoc: Great. Now let’s catch up on the ProFrac contract. Anything you can tell us on the progress, say on the fleet count you are being allocated?

Ryan Ezell: We are seeing increased utilization from Q-1, with the fleet count in the high teens to low twenties. There is some white space due to operators seeing opportunities in the spot market, but we think we will hit volumes based on the activity levels in different basins, without being at the contractual 30 fleet level.

Fluidsdoc: How are the two of you working together? Any hiccups?

Ryan Ezell: Very collaboratively. In fact as the ProFrac team sees what we are capable of no NPT, no Service Quality issues, handling the ramp to higher utilization, seeing as how we are generating the lab data, they are letting us in some cases handle the chemical sales with the customer. It’s a new relationship, sort of like newlyweds, but I think things are going in the right direction.

Fluidsdoc: Let’s shift to novel chemistry. How are you differentiating Flotek from other suppliers in the market?

Ryan Ezell: We have novel chemistry in clay stabilizers, and scale inhibitors, and in our Complex Nano Fluids-CNF surfactants for flow enhancement. Friction reducers are another way. Many used today have formation damage impacts and we have been working with chemical companies on proprietary formulations to minimize damage. A couple are in field trials and as we introduce these to wider will be improving margins.

Fluidsdoc: Let’s hone in on the CNF’s for a second. These have the potential to improve flowback results and possibly improve production?

Ryan Ezell: Yes, you are modifying the capillary forces equation with these, effectively reducing these forces. For a long time there was so little data for comparison that it was hard to compare apples to apples, but in the last couple of years we have built out our data set to where we understand the impacts of proppant intensity on the design, and how CNF’s can reduce flowback pressures.

Fluidsdoc: What about the competition? Many companies seem to be in this space. How are you differentiating Flotek?

Ryan Ezell: Yeah, you have the big companies like Halliburton, and the smaller players that I call “Solutions Creators.” They run their business like a logistics company without a lot of technical support, which leads to commoditization in products. But what’s happening is end users, particularly the larger companies, are running their own head-to-head comparisons, and we always come out in the top two or three, and usually number one. Word gets around this way.

Fluidsdoc: Let’s switch gears and talk about diversification and perhaps M&A. It may be down the road a bit, but can you give us an idea what areas you might be looking in?

Ryan Ezell: So we are just coming out of the stage where we were talking to the investment community about how we were going to repair the main revenue drivers, so now we’ve done that. Then there is JP3 which we’ve just barely scratched, and is a lever for us moving into machine learning and data analytics space. We believe long-term JP3 will help us sell more chemistry and diversify the EBITDA side. So when you think about our core chemistry competence in surface tension modification and thermodynamically stabilized chemicals, they play great in production water chemistry and even in agricultural chemistry, which has a lot of commonality with oilfield chemistry. So there are a lot of ways we are looking to diversify our revenue streams. The goal is to be seen as a more advanced chemistry company combined with our data analytics business, rather than just an oilfield service company.

Fluidsdoc: Ok, now let’s talk in more detail about JP3. What are you thinking of with this piece of kit?

Ryan Ezell: We are pretty excited about JP3. Thinking of just the oilfield let’s separate out Upstream, Downstream and Midstream. The biggest market is probably Midstream which is now serviced by legacy gas GCMS type chromatographic tools that require sampling. With a digital AI sort of tool like JP3 you get around all of that, so in vapor pressure testing, blending, distillation stack monitoring we can do it more accurately and faster in real time. TAs we begin to scale up this technology and lower manufacturing costs, we can begin to move it into the Upstream where there are hundreds of thousands of applications. We can look production chemical treatment or at fuel gas, or flare gas or the Holy Grail would be Chain of Custody from resource owner to buyers. We’ve even put JP3 in blending tanks to monitor chemical reactions to completion. So bottom line, we are focused on the energy sector right now, but down the road see a wide array of applications for JP3.

Fluidsdoc: Here’s a tricky one. I think I remember from your Q-1 call that you expect to go EBITDA positive on the year. Are you maintaining that outlook at this point?

Ryan Ezell: We’ve got a good shot at it. We have a path to positive cash flow going into the second half here, so we feel good about it, but aren’t giving firm guidance at this point.

Bond Clement: Yeah, we haven’t really given specific guidance but we’ve been pretty clear the goal was to generate positive gross margin. We ticked that box in Q-1. We were going to improve G&A, and then achieve positive adjusted EBITDA. We feel good all those things will happen this year without getting locked into a firm timeline.

Fluidsdoc: Your balance sheet was pretty clean as I recall. Any thoughts on capital allocation priorities you can share?

Bond Clement: The good news is our business is fairly capital light. We have plenty of production capacity, so there isn’t a huge need to turn cash flow into capex. Our main priority now is funding working capital priorities, and then once we are cash flow positive we can think of potentially returning cash to shareholders.

The macro picture for chemistry

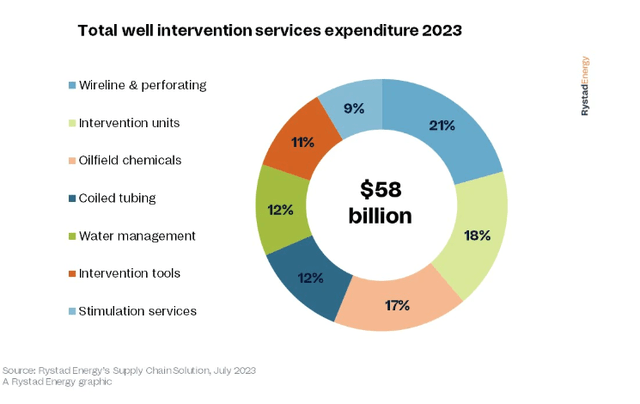

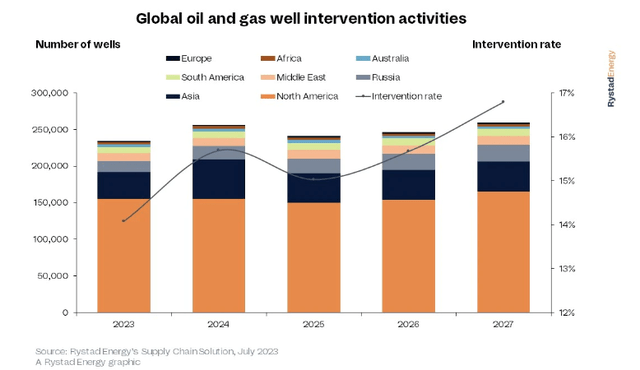

Rystad tells us that investment in upstream technology and intervention are accelerating. The graphs below show that billions will be spent on chemistry for intervention or stimulation this year, and the great preponderance of it will be in North America where FTK is strong.

Rystad Intervention market (Rystad) Rystad intervention by geomarket (Rystad)

Risks

There are two main risks for FTK. The first is the market is extremely fragmented. The big colors go after this work, but fall short of the level of expertise and customer focus that Flotek can bring to bear. There is also the concern about the commoditization of chemistry from the smaller outfits.

Down the road if the company is successful, one of the big colors will buy them out. They will only allow a competitor to get so big before they write a big check, hire the top guys, and then proceed to run the business into the ground. Fortunately shareholders exit in the buyout stage before the implosion happens.

Your takeaway

I think FTK is a solid prospect for a higher share price after earnings are released in August. They are currently near the mid-point of their recent $0.80-1.54 range, making an entry at this level a reasonable shot for a double.

Long term I think they have room to run with chemistry and the JP3 instrumentation. Investors with a few shekels to spare might join me while understanding this company is just getting its legs under it after a near death experience.

I am putting a buy on FTK at current prices.

Editor’s Note: This article covers one or more microcap stocks. Please be aware of the risks associated with these stocks.

Read the full article here