There’s no real theatre without taking risks. – Haris Pasovic.

Before the “Magnificent 7” was a term everyone threw around, there was FANG. This acronym represents Meta Platforms (META) aka Facebook, Amazon (AMZN), Netflix (NFLX), and Alphabet (GOOG) (GOOGL) aka Google. These stocks haven’t just done well, but they, when expanded to Apple (AAPL) and other mega-cap stocks, drove the stock market. Why bother investing in anything else other than that? Because cycles still exist. That’s why I’d avoid the MicroSectors™ FANG+™ ETN (NYSEARCA:FNGS).

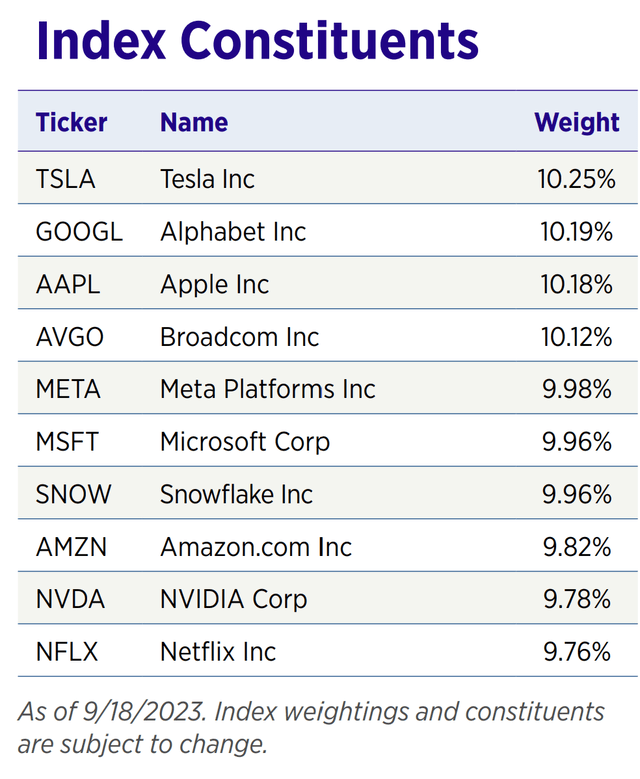

FNGS, an exchange-traded note (“ETN”) issued by Bank of Montreal, offers investors an opportunity to gain exposure to the NYSE FANG+™ Index. This index consists of 10 highly liquid stocks, including prominent technology and consumer discretionary companies such as Tesla, Inc. (TSLA), Alphabet, Apple, Microsoft Corp (MSFT), and Amazon. The underlying composition of the index is equally weighted across all stocks, ensuring a more representative portfolio compared to indices weighted by market capitalization.

Do you really want to have so much exposure to Tesla here? Nvidia? Netflix? All these names in the index, from a pure chart by chart standpoint, look like they aren’t just rolling over, but at the start of a hard downtrend.

bmoetn.com

Historical Performance: A Closer Look

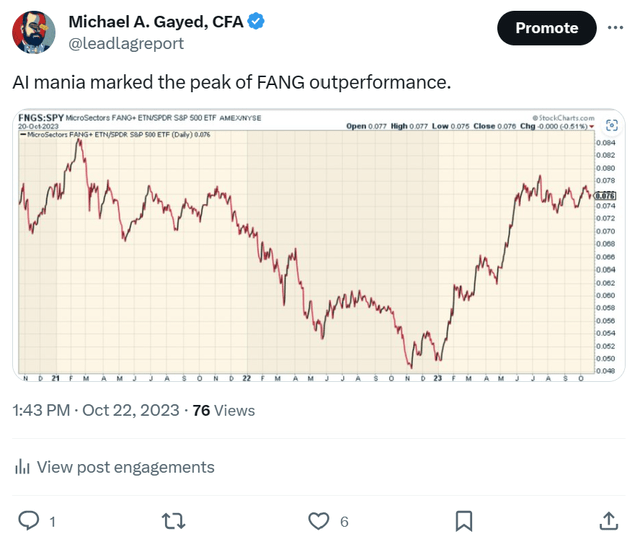

For all the coverage around the “Magnificent 7” and AI mania, when compared against the S&P 500 (SP500), the average FANG type name is no longer outperforming. As a matter of fact, the sideways price action relative to SPDR® S&P 500 ETF Trust (SPY) started at the end of May – just as AI mania and coverage in the media was at a fever pitch. Funny how that works, isn’t it?

x.com

Analyzing Risks: Understanding the Vulnerabilities

While the FNGS MicroSectors™ FANG+™ ETN presents an enticing trading opportunity given its volatility and the potential for another surge higher (which I’m personally skeptical of), it is important to acknowledge and evaluate the potential risks associated with this ETN. One significant risk is the credit risk posed by the issuer, Bank of Montreal (BMO). As an exchange-traded note, FNGS is not bankruptcy remote, meaning that investors would be fully exposed to the credit risk if Bank of Montreal were to experience financial difficulties or bankruptcy. It is crucial for investors to thoroughly understand the difference between an ETN and an exchange-traded fund (“ETF”) and assess their comfort level with the underlying issuer’s credit risk. Not sure that’s something you want to take on given potential credit risks rising broadly.

Additionally, the concentrated nature of the FNGS MicroSectors™ FANG+™ ETN, with its focus on a small number of stocks, can make it vulnerable to market volatility and broader stock market corrections. If there is a significant downturn in the technology sector or a broader market selloff, the performance of the FNGS ETN may be negatively impacted in an outsized way.

Conclusion: Is FNGS the Right Investment for You?

MicroSectors™ FANG+™ ETN is a hard pass for me, not just because I think the stocks this represents are vulnerable now, but also given the structure of this being a note. While its equal-weighted composition and historical performance make it an attractive option for those seeking concentrated exposure to this market segment, I just don’t think the risk is worth it.

Markets aren’t as efficient as conventional wisdom would have you believe. Gaps often appear between market signals and investor reactions that help give an indication of whether we are in a “risk-on” or “risk-off” environment.

The Lead-Lag Report can give you an edge in reading the market so you can make asset allocation decisions based on award winning research. I’ll give you the signals–it’s up to you to decide whether to go on offense (i.e., add exposure to risky assets such as stocks when risk is “on”) or play defense (i.e., lean toward more conservative assets such as bonds/cash when risk is “off”).

Read the full article here