Foot Locker (NYSE:FL), through its subsidiaries, operates as an athletic footwear and apparel retailer. The firm has been in the center of attention in the past weeks as its share price has tumbled from the low 40s to the mid 20s.

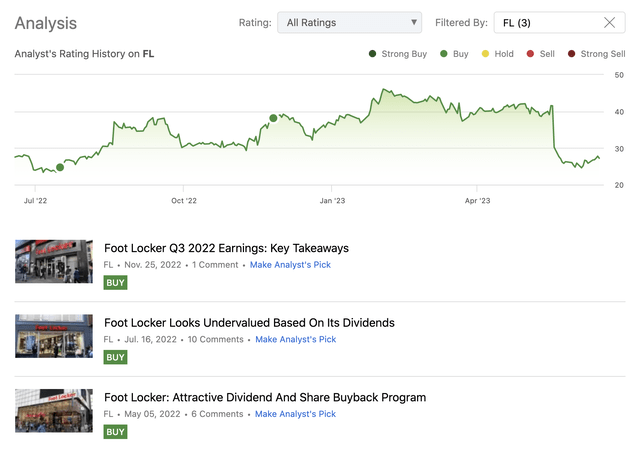

We have written three articles about Foot Locker in 2022, and today we are going to revisit our past thesis to give a fresh view on bullish arguments, in light of the new developments around the firm.

Analysis history (Author)

To recap, in 2022, we have been bullish on FL because:

- Attractive share buyback program coupled with sustainable dividend payments

- Undervaluation based on the dividends according to the Gordon Growth Model

We have also highlighted the challenging macroeconomic environment as a significant risk, primarily focusing on the low consumer confidence, the high inventory levels, the elevated costs and the unfavourable FX environment.

Let us start our discussion today by checking if there has been any change with regards to our fair value estimates.

Valuation

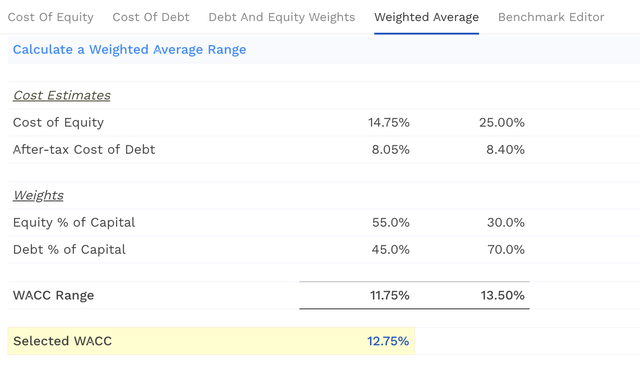

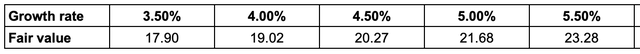

In July 2022, we have estimated a fair value range for Foot Locker’s stock between $26 and $37 using the Gordon Growth Model. The primary inputs for our calculations were a required rate of return of 9% – based on FL’s weighted average cost of capital at that time – and a perpetual dividend growth rate between 3.5% to 5.5%, based on historical dividend growth rates.

We believe that the dividend growth rate assumptions were already realistic back then and are still applicable today. However, due to the dynamic macroeconomic situation, the cost of capital has changed.

WACC (finbox.com)

Using an updated estimate of 12.75% for the required rate of return, we get a new range of fair values between $18 to $23 per share, substantially lower than previously.

Results (Author)

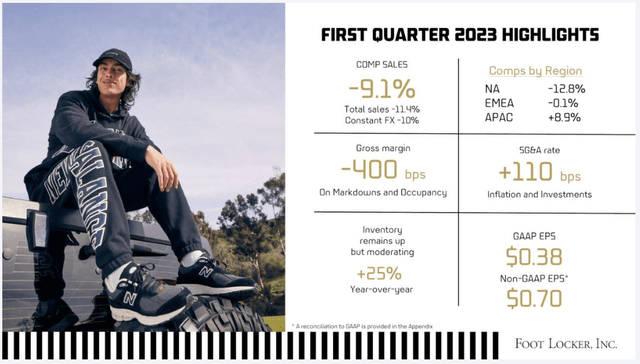

Not only the increase in the required rate of return, but also the first quarter results and the firm’s outlook warrant a downward revision of the fair value.

Q1 highlights (FL)

While the firm appears to be overvalued based on the Gordon Growth Model and the current share price of $27, we cannot forget that this calculation ignores the positive impact of the company’s share buyback program, which is expected to be a significant chunk of the shareholder returns in the near term and also the potential for growth opportunities. Here we would like to underline the word “potential”. Although FL has outlined how they are aiming to grow in the coming years, we would like to see these ideas effectively implemented, before we could take them into account with confidence.

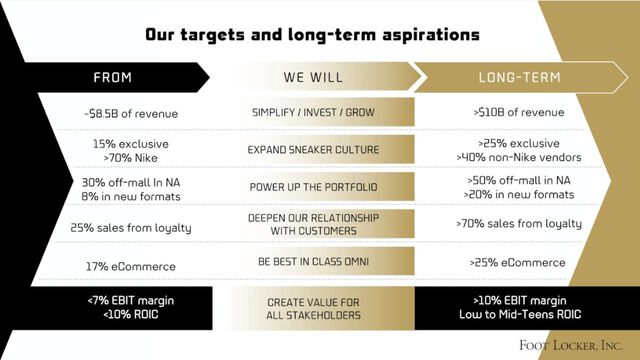

Growth opportunities (FL)

All in all, we believe that the estimated fair value range using the Gordon Growth Model may be slightly too conservative and for this reason, in our view, the stock at the current price remains attractive. Also worth mentioning here that the partnership with Crocs (CROX) announced in May, might also help FL’s financial performance in the near term.

Macroeconomic environment

Since our last writing in 2022, the macroeconomic environment has not shown meaningful signs of improvements.

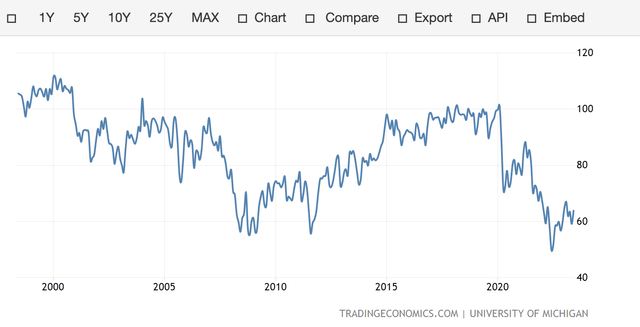

Consumer confidence has somewhat improved since 2022, but the readings remain around the 2008 – 2009 lows, which is still far below the pre-pandemic levels.

U.S. Consumer confidence (tradingeconomics.com)

Poor consumer sentiment is likely to keep resulting in softer demand for non-essential, discretionary items, like the ones FL is selling.

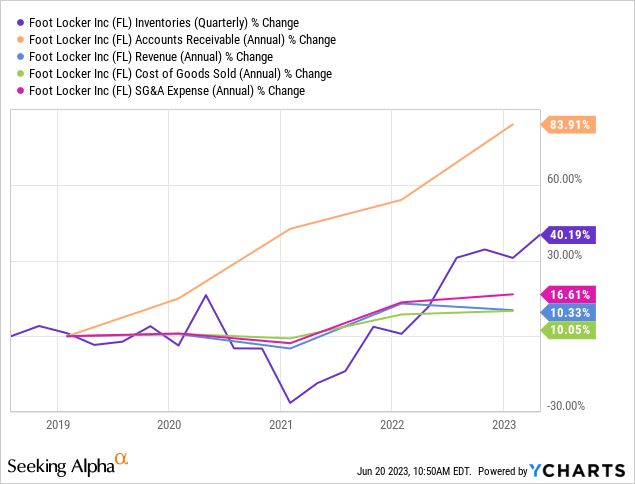

This tendency has been confirmed already in the previous quarters and directly reflected by the firm’s results. The following chart illustrates some key metrics. We can see that inventories and accounts receivable have been rising at a much faster rate than revenue, which is not a particularly good sign. SG&A expenses have also grown somewhat faster.

While these metrics are not particularly appealing, the risks associated with them are likely to be priced in already at the current $27 level. But, of course, as investors or potential investors, we would like to see inventory levels falling and revenue growth outpacing accounts receivable growth in the coming quarters.

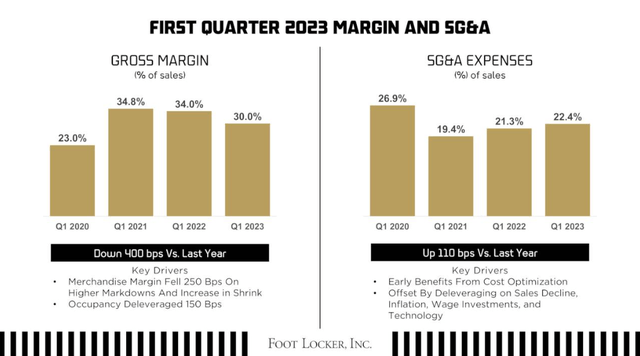

FL has also presented a slide during their latest presentation, showing the development of the margins and SG&A expenses over time

Results (FL)

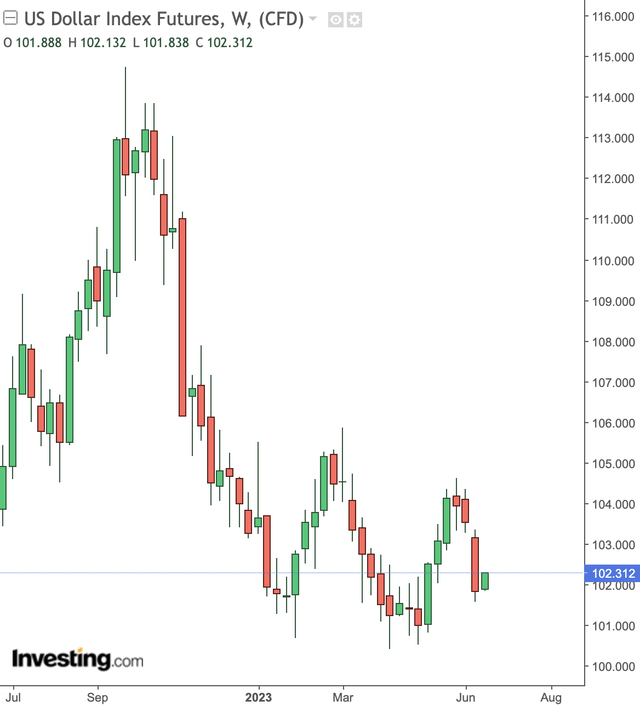

On the other hand, the FX environment has substantially improved since 2022. The strength of the USD compared to other currency has declined, which is a positive for FL’s financials. The USD index has come off of its 2022 peak by about 10% and has been fluctuating around the current levels in the past quarters. We do not expect the USD to gain substantial strength as seen in the past year, in the coming quarters.

USD index (investing.com)

To sum up

Due to the continuing macroeconomic headwinds, we have revised our fair value estimate downwards to a range of $18 to $23 from our previous $26 to $37 per share. We have noted that these ranges do not consider the positive impacts of the share buyback programs and the potential near- and mid-term growth opportunities, presented for example by the Crocs partnership deal.

Inventory management needs to improve and accounts receivable growth compared to sales growth needs to slow.

On the other hand, the weakening of the USD in the past months are likely creating slight tailwind for the firm.

All in all, we believe that both the macroeconomic- and company specific challenges are already priced into the current share price.

For these reasons, we maintain our “buy” rating.

Read the full article here