Thesis

The Ford Motor Company (NYSE:F) is changing itself to become a key player in the growing electric vehicle (EV) market. This shift is marked by significant capital investments into manufacturing plants and the forming of strategic partnerships aimed at expanding its charging infrastructure. Despite risks posed by a competitive EV market and operational challenges in transitioning to EVs, Ford’s moves in the EV domain present a sizeable growth trajectory. Given that valuation, ratios suggest undervaluation and a forecasted 5-year target price points to an above-average market return, Ford seems to appear as a “buy” for the long run.

Introduction

The Ford Motor Company offers an exhaustive array of cars, trucks, and SUVs. The company focuses on the production, promotion, financing, and maintenance of a complete range of Ford cars, trucks, and SUVs, alongside Lincoln luxury vehicles. Currently, Ford is steering towards the increased production of electric vehicles. In response to increasing government efforts to cut down global emissions and the increasing consumer appetite for EVs, Ford is placing significant capital into electrifying its vehicle collection.

Industry Overview

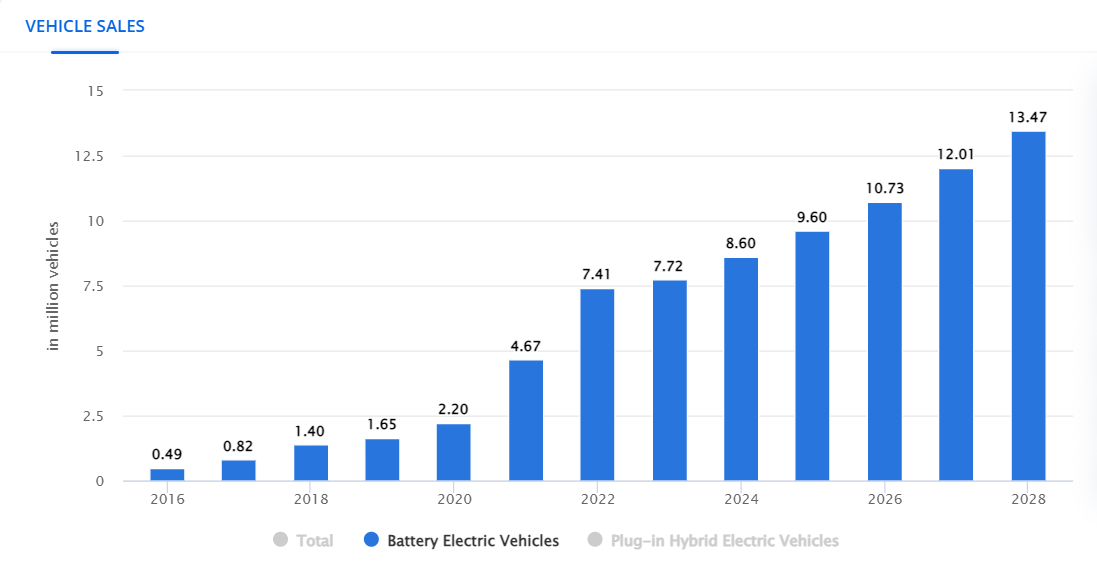

Ford operates in the automobile manufacturing industry, which is only expected to grow at a CAGR of 3% from now until 2028. This may seem disheartening, but this number is nowhere near in comparison to the rapid growth the EV market will experience at an expected CAGR of over 17%. This demand of course can largely be attributed to government initiatives to increase the amounts of electric vehicles to reduce global emissions. As such, with Ford shifting to producing more electric vehicles, they will have plenty of demand going forward.

Statista

Key Developments

Ford recently declared its intention to enter the Ranger Raptor T1+ in the Dakar Rally in 2024. This move is significant as it underscores Ford’s commitment to challenging conventional norms and broadening its international off-road racing pursuits. But that’s not the whole story. Ford has opened a new Electric Vehicle Center in Cologne, Germany. This production facility, backed by an investment exceeding $2 billion, is set to roll out Ford’s latest line of electric passenger vehicles. This initiative sends a strong message about Ford’s earnestness towards electric vehicles, with substantial capital commitments to this advanced technology. Such a strategic move could well position Ford favorably amidst the swiftly expanding EV market.

Growth Catalysts

One of the major catalysts is the rollout of Ford Drive, a unique lease pilot scheme in partnership with Uber. The purpose of this program is to encourage the use of electric rideshare by offering adaptable electric options to drivers using Uber’s platform in certain U.S. locations. This trial gives flexible access to Ford Mustang Mach-E models and has begun in San Diego, San Francisco, and Los Angeles. This effort marks the first collaboration of its sort between a car manufacturer and a rideshare network, further pushing both firms’ goals to go electric and cut emissions. The success of this project could possibly lead to a notable rise in the use of Ford’s electric vehicles, thus fuelling Ford’s growth.

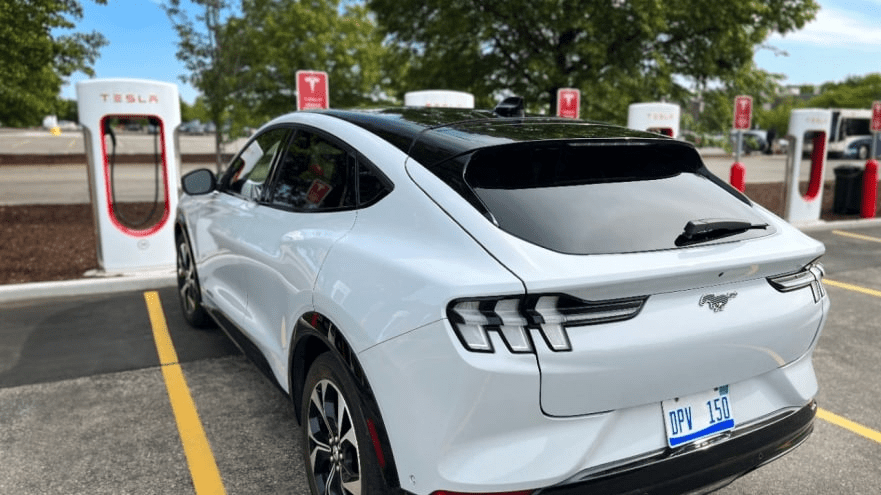

Another big growth driver for Ford is its deal with Tesla Motors which will give Ford electric vehicle customers access to over 12,000 Tesla Superchargers across the U.S. and Canada. This step effectively doubles the number of quick chargers open to Ford EV customers starting from Spring 2024. This massive agreement with Tesla, a frontrunner in the EV market, not only boosts Ford’s charging facilities but also significantly eases charge worries for Ford users, thereby making Ford’s EVs more appealing to possible buyers.

Ford

Financial Analysis

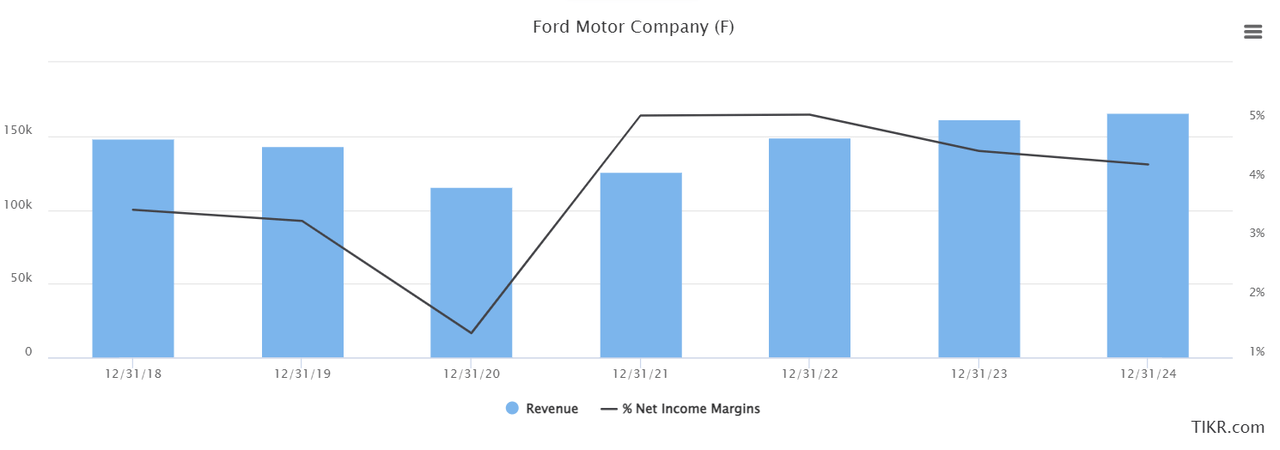

Now let’s dive into the numbers. Ford’s market cap of over $57 billion highlights its position as a well-established company with traction in the automobile manufacturing industry. Over the last 5 years, its revenue has largely remained stagnant but has grown at a CAGR of over 13% in the last couple of years. This recent trend is expected to continue with revenue expected to grow over 8% for next year with margins expected to decrease slightly. However, this is a short-term sacrifice for growth, which is feasible for a company that has been around for so long.

TIKR

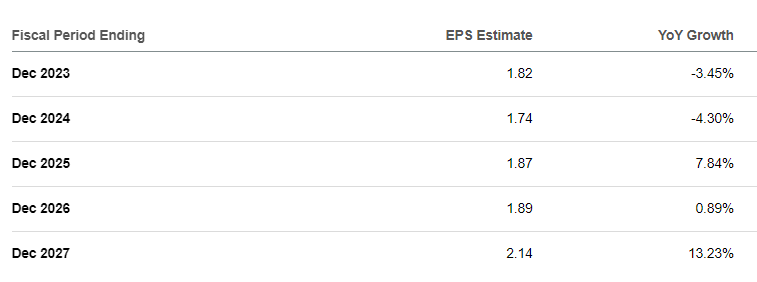

Although Ford may take a small hit to EPS in the next couple of years, their investments in electric vehicle production are expected to pay off with EPS expected to grow to $2.14 by 2027, a steady 4% average growth rate during the 4-year period.

Seeking Alpha

Ford also has a generous dividend yield of over 4% for those looking for stable and sure returns, although I wouldn’t count on this too much since Ford’s dividend has fluctuated greatly in the past.

Valuation and Target Price

Evaluating several valuation ratios, Ford seems to match up with its competitors in some ways and appears even more appealing in others. For example, its EV/Sales (ttm) of 1.02 is just below the sector’s median of 1.18, hinting at Ford being undervalued compared to its peers. Furthermore, Ford’s forward P/E sits at 7.94, which is substantially lower than the sector’s median of 14.29. This forward P/E ratio implies that Ford might be undervalued when considering its future earnings growth, presenting an attractive investment opportunity.

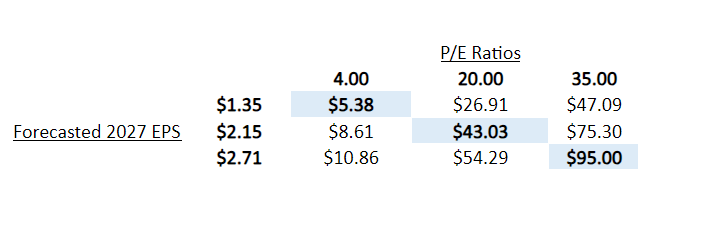

I like to think in the mid to long term. As such, I calculated a five-year target price for Ford by examining analyst predictions for the company’s earnings per share in 2023 and 2024. Through analyzing the low, average, and high estimates, I built conservative, base, and optimistic scenarios. I then increased each EPS prediction at rates of 4%, 5%, and 6% respectively yearly until 2027. Next, to estimate the price-to-earnings (P/E) multiple at which Ford might trade in 2027, I used a value of 4 for the conservative scenario, given that this was one of the smallest values from the past 5 years. Meanwhile, I used its current P/E of 20 as the base case. For the optimistic scenario, I selected a value of 35 as this is Ford’s 5-year average P/E and is much higher than its current value. Thus, it’s very probable that its P/E in 2027 will land within this range.

By combining the base case projected EPS and the projected P/E ratio, I came up with a 5-year target price of roughly $43 for Ford. This calculation produces an average return of over 24%, which substantially beats the S&P 500’s average yearly return of about 10%.

Author’s Material

Risks

Like any other company, Ford also has multiple numerous risks that might affect its future success. One of the most substantial risks is the fierce rivalry in the car industry, specifically in the EV market. Given the ambitious expansion of EV line-ups by competitors such as Tesla, General Motors, and Volkswagen, Ford needs to constantly innovate and enhance its vehicles to keep its competitive advantage. Lastly, Ford encounters operational challenges as it shifts towards EVs. Producing EVs requires different talents, tech, and supply networks compared to conventional cars. Any problems in these sectors, for instance, shortages of vital parts like batteries, could impede Ford’s capacity to manufacture and distribute its EVs.

ESG

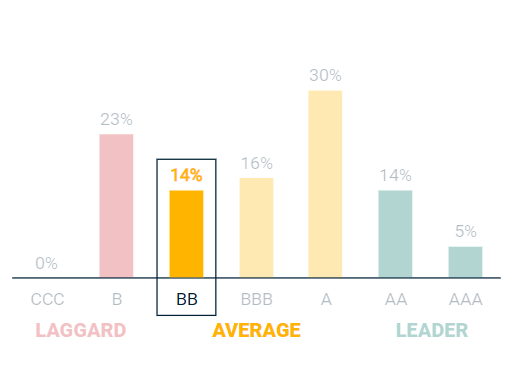

With an MSCI ESG rating of BB, Ford’s ESG is close to average among companies in its industry.

MSCI

It is a leader in opportunities in clean tech. However, they are considered a laggard in product safety and quality. Additionally, Ford is considered to be aligned with the UN Sustainable Development Goals of gender equality, affordable and clean energy, and responsible consumption and production.

Conclusion

Despite stiff rivalry and operational challenges in shifting to EVs, Ford’s strategic moves in the field of EVs hint at bright prospects. With significant strides like the Ranger Raptor T1+ for the Dakar Rally, the fresh Electric Vehicle Center in Germany, and the pioneering Ford Drive scheme in collaboration with Uber, Ford is building its standing in the rapidly expanding EV arena. From a financial standpoint, while short-term earnings per share might drop slightly due to heavy spending, the long-term forecast is promising. Taking into account Ford’s reasonable valuation and a five-year target price of $43 which suggest a promising average yield of more than 24%, Ford comes across as an appealing investment choice with considerable growth potential. Therefore, it’s a definitive BUY for investors.

Analyst Recommendation by: Vayun Chugh

Read the full article here