Investment Thesis

Forward Air Corporation (NASDAQ:FWRD) is well positioned for long-term profitable growth within the premium LTL services segment, although it is struggling with short-term headwinds as the freight business tries to emerge from a recession. The long-term outlook is strong and the company has plans to grow market share through acquisitions and greenfield startups. That said, the stock looks overvalued by about 8%. At the same time, I see no reason to dump the stock at the moment because it is a high quality company with a decent dividend that might exceed expectations when the headwinds stop blowing.

Positioned for Long-Term Growth, but Fighting Headwinds

Forward Air, which provides expedited freight and intermodal services to customers in the U.S., Mexico, and Canada via a network of 200 locations, markets itself as an “airport-to-airport” ground transportation provider and reliable alternative to air transportation. Forward has 900 fleet power units, 6,700 trailers, and 6.1 million square feet of warehouse space, and moves more than 55 million tons of freight each week.

And, by the way, the company owns almost none of these trucks, facilities or equipment. Forward Air utilizes an “asset-light” strategy to minimize investments and reduce capital expenditures. Capex was only 2% of total revenue last year.

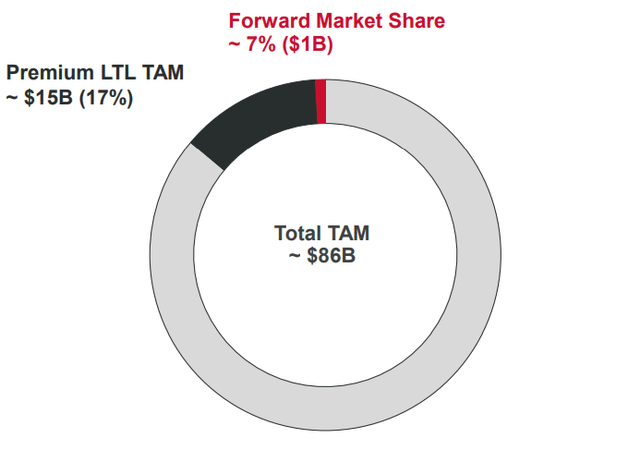

The expedited freight segment, which accounts for about 78% of the company’s $1.97 billion in sales last year, primarily provides expedited regional, inter-regional and national LTL services. Forward is focused on capturing a larger portion of the “premium” LTL segment, which drove about $1 billion of last year’s revenue. Premium services typically require precision execution, expedited transit, tight time windows, and special handling. The company estimates that it has about a 17% share of the premium LTL market, which it sizes at about $15 billion.

Forward Air Market Share (Forward Air May Investor Presentation)

The global LTL market is expected to grow at a CAGR of 7% during the next four years, according to a Technavio research firm study. Forward Air appears unlikely to simply float with the market. The company is focused on growing its LTL and final mile geographic footprints through greenfield start-ups as well as through acquisitions. Moreover, the company is also looking to penetrate new markets and has plans to invest in terminals to more efficiently handle freight in these regions.

The stock has delivered 144% in total returns for investors over the past three years, outperforming the market big time as well as its closest peers. Meanwhile, its price is up over 20% in the past twelve months, also beating both the market and its main rivals.

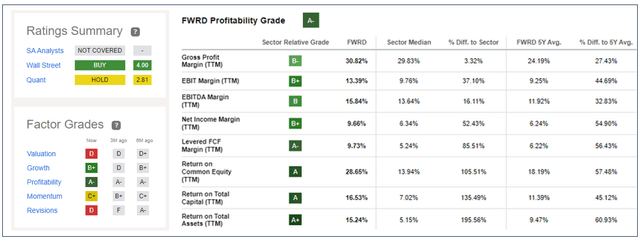

Overall, it has a hold rating according to Seeking Alpha’s quant scores, which appear driven by poor valuation and revisions grades, and despite sound growth numbers and rock solid marks for profit. Forward’s Levered free cash flow margin of 9% and ROTC of 16 percent are 85% and 135%, respectively, above the industrial sector medians.

Forward Air Ratings (Seeking Alpha)

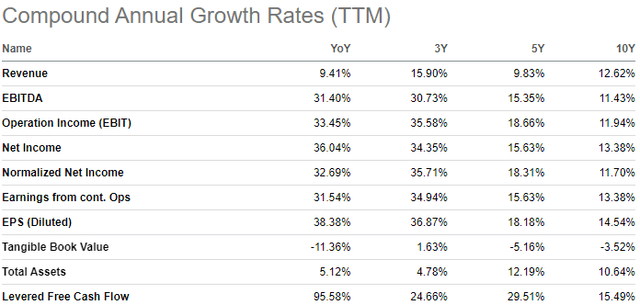

Over the past five years, Forward saw sales grow at a CAGR of 10%, EBIT at 18%, and EPS at nearly 15 percent. In addition, the company’s levered free cash flow rose at a five-year CAGR of 30 percent.

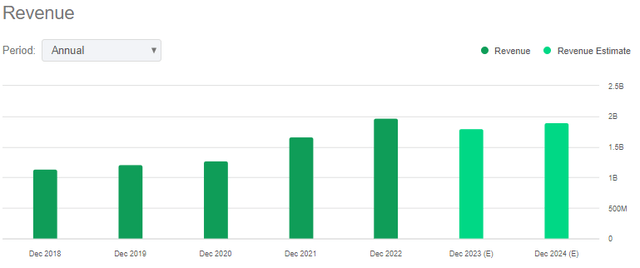

Forward Air Sales (Seeking Alpha) Forward Air Growth Rates (Seeking Alpha)

Although the long-term trends are solid, the company had a rough first quarter, with revenue down 9% due to softer than anticipated demand, while EBITDA fell 6% and net income by 15 percent.

In a mid-quarter update, the company said, despite early signs of emerging from a down freight environment, it expects softer demand to persist through the rest of Q2, before turning around in the second half of the year. The company projects Q2 could see revenue decline by 7% to 17%.

Meanwhile, analysts’ consensus estimates have revenue falling about 8% to $1.8 billion in 2023 before bouncing back by 5% next year. EPS is expected to drop 20% to $5.68/share before rising by 15 percent in 2024.

Intrinsic Valuation

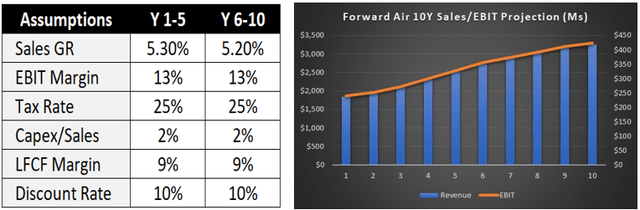

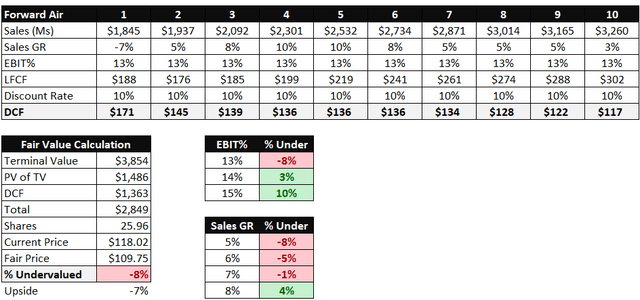

The sales growth rate in the DCF model was driven by analyst estimates as a guide for the first two years before pushing them toward the company 5-year historical CAGR of 10% for years 3-5. Then, I gradually lowered the growth rate toward 3% by year 10.

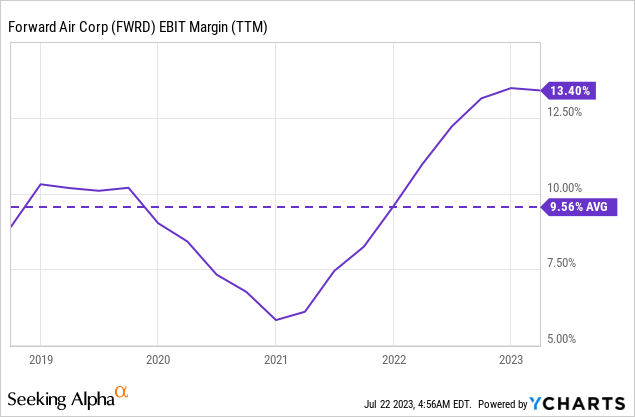

I used 13% for operating margin based on the last twelve months, and could not bring myself to go much higher given around 9.5% is the company’s long-term historical average, the sector median is 9.6%, and the median of the top nine expedited and LTL freight peers is 10 percent.

My using 13 percent is also not “conservative” but what to me seems like the best number to use based on all the data available. Besides, being conservative is not “safe” in my opinion, but knowingly inserting a figure that you know is not really the best number. We are talking on average over ten years. So, some years the firm could see 15% operating margins. But, I suspect it will also see years with 10% operating margins.

The below table summarizes all the key input assumptions divided in two: the average used in years 1-5 and the average for years 6-10.

Forward Air DCF Inputs (MH Analytics)

The DCF analysis found the stock overvalued by 8%. In terms of sensitivity, if one did move the EBIT up to 14% on average over ten years, the stock would be undervalued by 3%, while a 15% ten-year operating margin would put the stock at 10% undervalued. Below table provides the DCF basis and sensitivity figures for both EBIT and sales growth rates (both average over ten years).

Forward Air DCF analysis (Seeking Alpha)

As a long-term value investor, I have an eye on where I think the stock price will be in the next 6 months to a year, sometimes even more, under the assumption that a market correction will take place and the stock’s price will converge with its intrinsic value.

On the other hand, I think it would be premature to sell the stock because the company is well-positioned in the market, profitable, and could return on its growth path. To be sure, the headwinds have been tough and will continue to hurt the top and bottom lines, but a turnaround is expected in the second half of 2023 and into 2024.

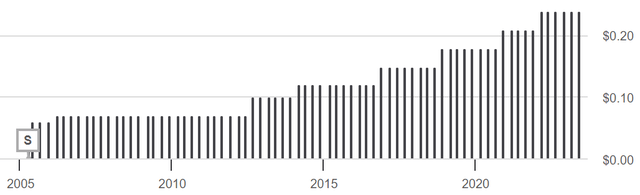

Plus, although the yield is less than exciting, the dividend is safe and consistent and has never gone backwards since 2005, with the annual payout now at nearly $1.00/share ($0.24/share per quarter).

Forward Air quarterly dividend since 2005 (Seeking Alpha)

Risks

Some of the assumptions underlying the valuation should be carefully considered, especially the projected sales growth rates and EBIT margin predictions. If the LTL market continues to be soft throughout the remainder of the year and into 2024, the stock will likely lose even more value. So holding onto the stock does present risks.

Conclusion

Although it is fighting through near-term headwinds, Forward Air is well positioned for long-term profitable growth within the premium LTL services segment. The long-term outlook is strong beyond 2023, and the company will not be content in simply floating with the market. It has plans to grow market share through acquisitions and greenfield startups. That said, the stock looks overvalued by about 8%. I do not recommend selling the stock because it is a high quality company with a safe and consistent dividend.

Read the full article here