Introduction

Much like many other companies in the financial sector, the share price for Fulton Financial Corporation (NASDAQ:FULT) has fallen. The price is down over 20% YTD and was even more back in May when worries about regional banks peaked. This seems to have been unfair seeing as FULT doesn’t have any significant exposure to that meltdown. They haven’t been hurt in terms of the top and bottom line, in my view. The very recent Q2 report from them showed me their resilience to grow in a difficult environment. I think EPS up 17% QoQ is setting them up very well to benefit significantly from a higher interest environment it seems.

Apart from the suppressed valuation the dividend yield that the company has right now is also very decent at 4.7%. The p/e sits at just 8 and the p/b is under 1 which I think enhances a buy case further. FULT expired higher credit metrics in Q2 and credit losses returned to all-time lows. I think this is setting them up to have a very solid 2023 right now. I want to be a part of that, and I am rating FULT a buy now.

Company Structure

The history of Fulton dates back to 1882 when it was founded. Since then the company has grown immensely and now manages a deposit portfolio valued at over $28 billion. The primary focus of FULT is on providing customers and clients with consumer banking products and services related to it. The regions where FULT is operating are Pennsylvania, Delaware, Maryland, New Jersey, and lastly Virginia.

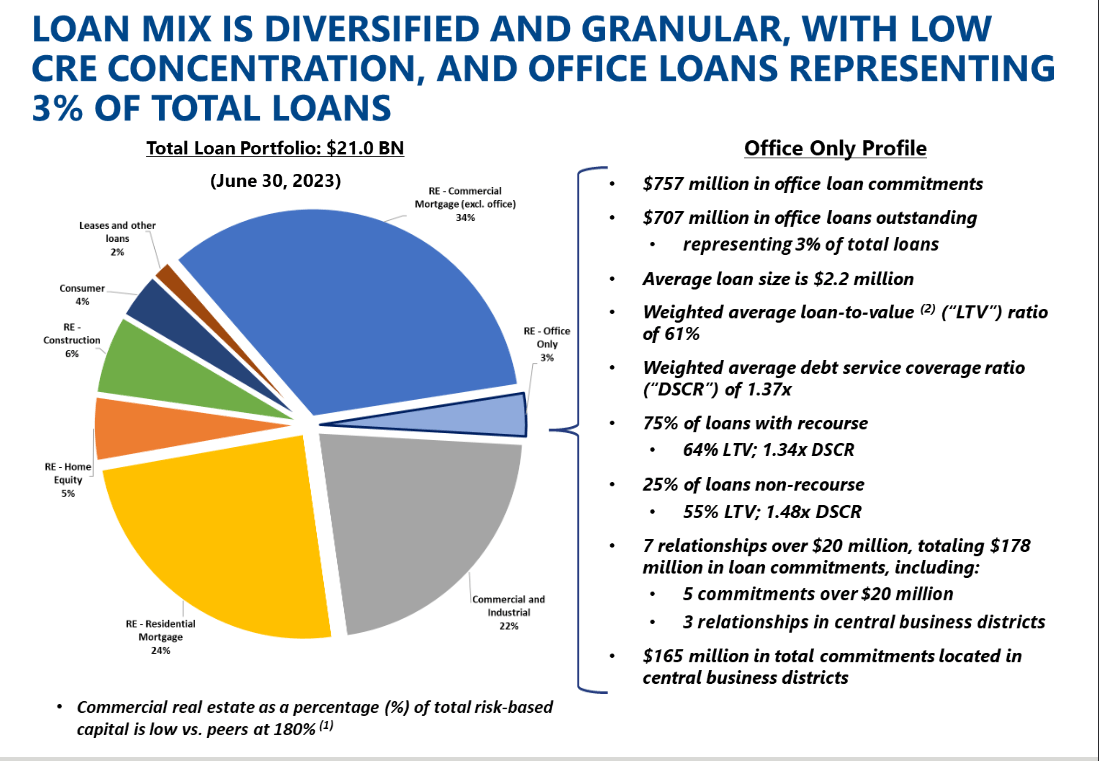

Portfolio Overview (Earnings Presentation)

FULT has been very successful in growing its loan portfolio during this time, and it now sits at over $21 billion. A large sum of this is made up of mortgage loans, around 34% to be exact. Mortgage rates remain quite high, but as inflation is slowing then the mortgage rate seems to be following as well. This is of course not that beneficial to the earnings of the loan portfolio. But it should increase activity instead.

But to highlight the quality of the loan portfolio right now, the weighted average LTV is at 61%. This is a very healthy spot to be at and should provide some stability to the portfolio and don’t make FULT seem overleveraged.

Earnings Transcript

On July 19 we got the results from Q2 FY2023 for FULT. Solid growth was seen for the net incomes, up 17% QoQ as the company is recovering from the turmoil that happened when major regional banks went under. Reading through the earnings transcript some comments stuck with me. These quotes are from the CEO Curtis Myers.

-

During the second quarter, we saw loan growth of $374 million and deposit declines of $110 million. As a result, our loan-to-deposit ratio increased to 99%, right in the middle of our long-term target of 95% to 105%.

Momentum in loan growth despite the current climate is reassuring me further that FULT has the potential to grow their loan and deposit portfolios even more in the coming quarters.

-

During the quarter, we and the industry continue to experience the migration from non-interest-bearing balances into higher-cost deposit products. What is critically important is to continue to grow households and customer accounts. During the quarter, we grew 4,000 total net new households and 8,000 total net new deposit accounts. We believe those are meaningful increases in this environment.

I think these comments reflect very well on what the actual priority should be for the coming quarters to maneuver in the industry efficiently.

Valuation & Comparison

Share Price (Seeking Alpha)

The share price development hasn’t been that great for FULT in all honesty. It hasn’t beaten out the SPY in the last 3 years, many thanks to the drag down of the other regional banks’ failures it seems. But FULT is rebounding quickly, and I think this setting it up as a solid investment now in any way.

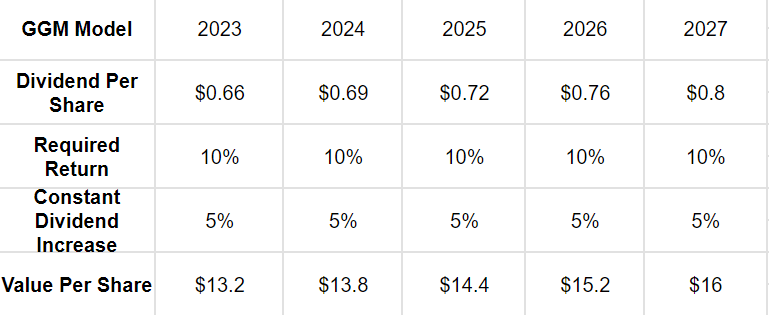

GGM Model (My Own Model)

My GGM model for FULT right would suggest that buying now would provide such a strong return. The target price for 2023 is $13.2 which FULT is trading above currently. But looking beyond that we see that by 2027 the target is $16 instead, around 19% higher in terms of share price, an annual return of 3.88%, but with the dividend yield staying at 4.7% we get a very satisfying return in my opinion. As far as I am concerned with the outcome of the model, despite trading slightly above the target price, I don’t want to wait to get into the company just to get a better entry point. The management has proven themselves very capable and that offsets some lost potential gains.

Risk Associated

In the aftermath of the failure of several regional banks, the banking industry faces a critical challenge of safeguarding deposit levels and mitigating credit losses. However, this task is becoming increasingly arduous due to prevailing high-interest rates, which are enticing individuals to explore alternative investment avenues such as money market funds and other financial instruments.

The allure of higher returns from these alternatives poses a threat to traditional bank deposits, making it essential for banks to devise strategies to retain and attract customers seeking better returns on their investments. This calls for innovative approaches to tailor deposit products and services to cater to customers’ evolving financial needs and preferences.

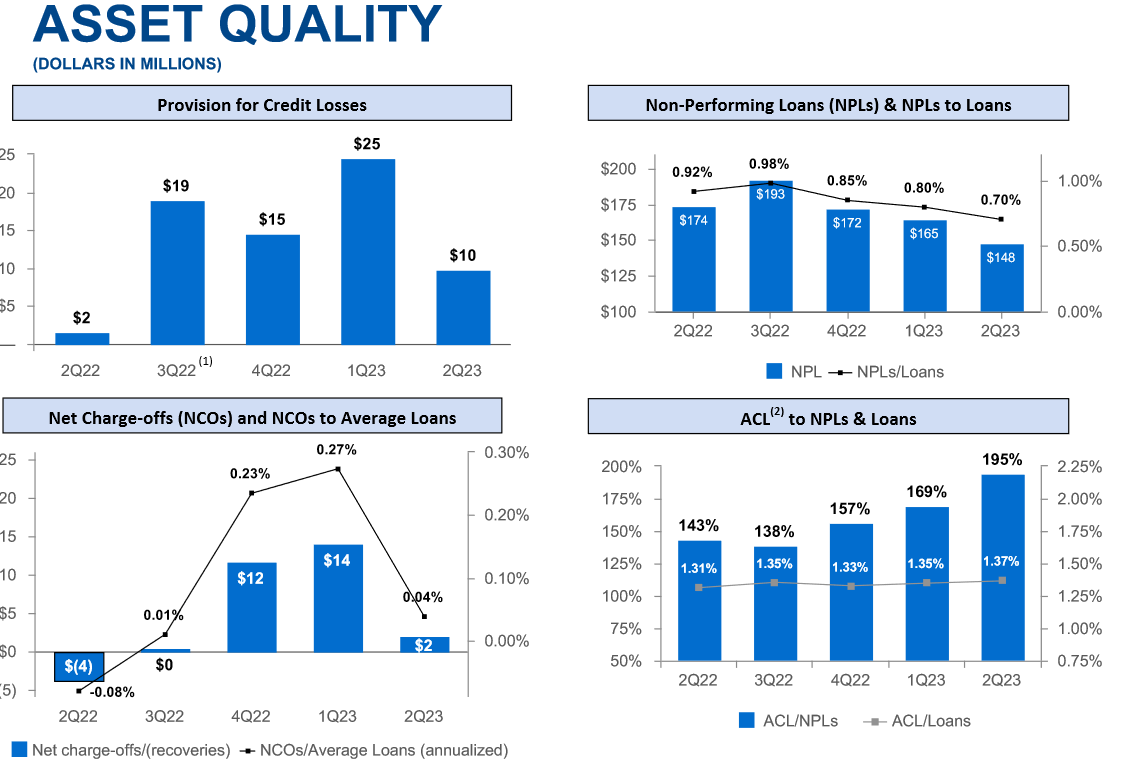

Asset Quality (Earnings Presentation)

In my view though, as far as FULT is concerned they have done a very good job with this. ROE remains very high at 12.28%. Supporting that argument is the fact that FULT keeps a very healthy asset base where only 0.55% of total assets are classified as non-performing, which is a decrease of 0.62% a year prior. In valuation currently, that is $151 million which hasn’t had any noticeable effect on the results from the last quarter.

Investor Takeaway

I think FULT has in its many years of operation grown into a fantastic state where it managed a larger deposit and loan portfolio. ROE is solid at over 12%. For dividend investors, it’s worth considering FULT. The payout ratio is not that large and still leaves room for increases in the coming years. The worst from the meltdown in the financial sector back in May seems to have passed and FULT is coming out ahead. In conclusion, rating FULT a buy now.

Read the full article here