A Quick Take On Garden Stage Limited

Garden Stage Limited (WIN) has filed to raise $15 million in an IPO of its ordinary shares, according to an F-1 registration statement.

The firm provides a range of financial services operating through subsidiaries in Hong Kong, PRC.

Garden Stage Limited is a tiny, thinly capitalized, undifferentiated financial services company operating in an intensely competitive industry and generating negative comprehensive margin.

My outlook on the IPO is Bearish [Sell].

Garden Stage Overview

Hong Kong, PRC-based Garden Stage Limited was founded to develop a suite of financial services for individuals and businesses principally located in Hong Kong.

Management is headed by Chief Executive Officer Mr. Sze Ho, CHAN, who has been with the firm since December 2020 and was previously Senior Manager at CMBC Securities Company Limited and has over eleven years of experience in the financial services industry, including in the areas of securities trading, margin financing, wealth management and asset management.

The company’s primary offerings include the following:

-

Placing and underwriting

-

Securities dealing and brokerage

-

Asset management.

As of March 31, 2023, Garden Stage has booked fair market value investment of $2.0 million from investors, including Bliss Tone Limited, State Wisdom Holding Limited and Oriental Moon Tree Limited. The CEO is a controlling member of Oriental Moon Tree Limited, which owns 90% of the outstanding shares.

Oriental Moon Tree is seeking to sell 1.5 million shares into the IPO.

Garden Stage – Client Acquisition

The firm seeks customers among wealthy individuals and companies seeking its various placement, trading and management services.

For the most recent fiscal year, placing and underwriting services accounted for 48.31% of the firm’s revenue, while 47.55% was derived from its securities dealing and brokerage services.

Compensation & Benefits expenses as a percentage of total revenue have risen as revenues have increased, as the figures below indicate:

|

Compensation & Benefits |

Expenses vs. Revenue |

|

Period |

Percentage |

|

Year Ended March 31, 2023 |

64.5% |

|

Year Ended March 31, 2022 |

61.2% |

(Source – SEC.)

The Compensation & Benefits efficiency multiple, defined as how many dollars of additional new revenue are generated by each dollar of Compensation & Benefits expense, was 0.5x in the most recent reporting period. (Source – SEC.)

Garden Stage’s Market & Competition

According to a 2022 market research report by Hong Kong Trade Development Council, as of December 31, 2021, the Hong Kong stock market was the 4th largest in Asia and 7th largest worldwide.

Total market capitalization was approximately $5.4 trillion as of the end of 2021.

The Hong Kong stock market was also the 4th largest IPO fundraising market globally, with $42.3 billion raised via IPOs in 2021.

As of December 31, 2021, there were 638 Exchange Participants-trading and 64 Exchange Participants-non-trading in Hong Kong, representing very strong growth in the number of participants since 2012.

Major competitive or other industry participants include:

-

HSBC (HSBC)

-

Haitong International Securities (0665.HK)

-

Bank of China (Hong Kong)

-

Interactive Brokers (IBKR)

-

Bright Smart Securities (1428.HK)

-

Huatai Financial Holdings.

Garden Stage Limited Financial Performance

The company’s recent financial results can be summarized as follows:

-

Growing top line revenue from a tiny base

-

Increasing profit before income taxes

-

Reduced comprehensive loss and cash used in operations.

Below are relevant financial results derived from the firm’s registration statement:

|

Total Revenue |

||

|

Period |

Total Revenue |

% Variance vs. Prior |

|

Year Ended March 31, 2023 |

$ 3,259,296 |

41.3% |

|

Year Ended March 31, 2022 |

$ 2,306,436 |

|

|

Profit (Loss) Before Income Taxes |

||

|

Period |

Profit (Loss) Before Income Taxes |

EBIT Margin |

|

Year Ended March 31, 2023 |

$ (207,693) |

-6.4% |

|

Year Ended March 31, 2022 |

$ (510,113) |

-22.1% |

|

Comprehensive Income (Loss) |

||

|

Period |

Comprehensive Income (Loss) |

Comprehensive Margin |

|

Year Ended March 31, 2023 |

$ (207,171) |

-6.4% |

|

Year Ended March 31, 2022 |

$ (513,293) |

-22.3% |

|

Cash Flow From Operations |

||

|

Period |

Cash Flow From Operations |

|

|

Year Ended March 31, 2023 |

$ (1,876,296) |

|

|

Year Ended March 31, 2022 |

$ (6,920,029) |

|

|

(Glossary Of Terms.) |

(Source – SEC.)

As of March 31, 2023, Garden Stage had $828,689 million in cash and $11.2 million in total liabilities.

Free cash flow during the twelve months ending March 31, 2023, was negative ($1.9 million).

Garden Stage Limited IPO Details

Garden Stage intends to raise $15 million in gross proceeds from an IPO of its ordinary shares, with the company offering 2.25 million shares and selling shareholder Oriental Moon Tree offering 1.5 million shares at a proposed price of $4.00 per share.

No existing shareholders have indicated an interest in purchasing shares at the IPO price.

Assuming a successful IPO, the company’s enterprise value at IPO would approximate $52.0 million, excluding the effects of underwriter over-allotment options.

The float to outstanding shares ratio (excluding underwriter over-allotments) will be approximately 25.0%. A figure under 10% is generally considered a ‘low float’ stock which can be subject to significant price volatility.

As a foreign private issuer, the company can choose to take advantage of reduced, delayed or exempted financial and senior officer disclosure requirements versus those that domestic U.S. firms are required to follow.

The firm is an “emerging growth company” as defined by the 2012 JOBS Act and may elect to take advantage of reduced public company reporting requirements; prospective shareholders would receive less information for the IPO and, in the future, as a publicly-held company within the requirements of the Act.

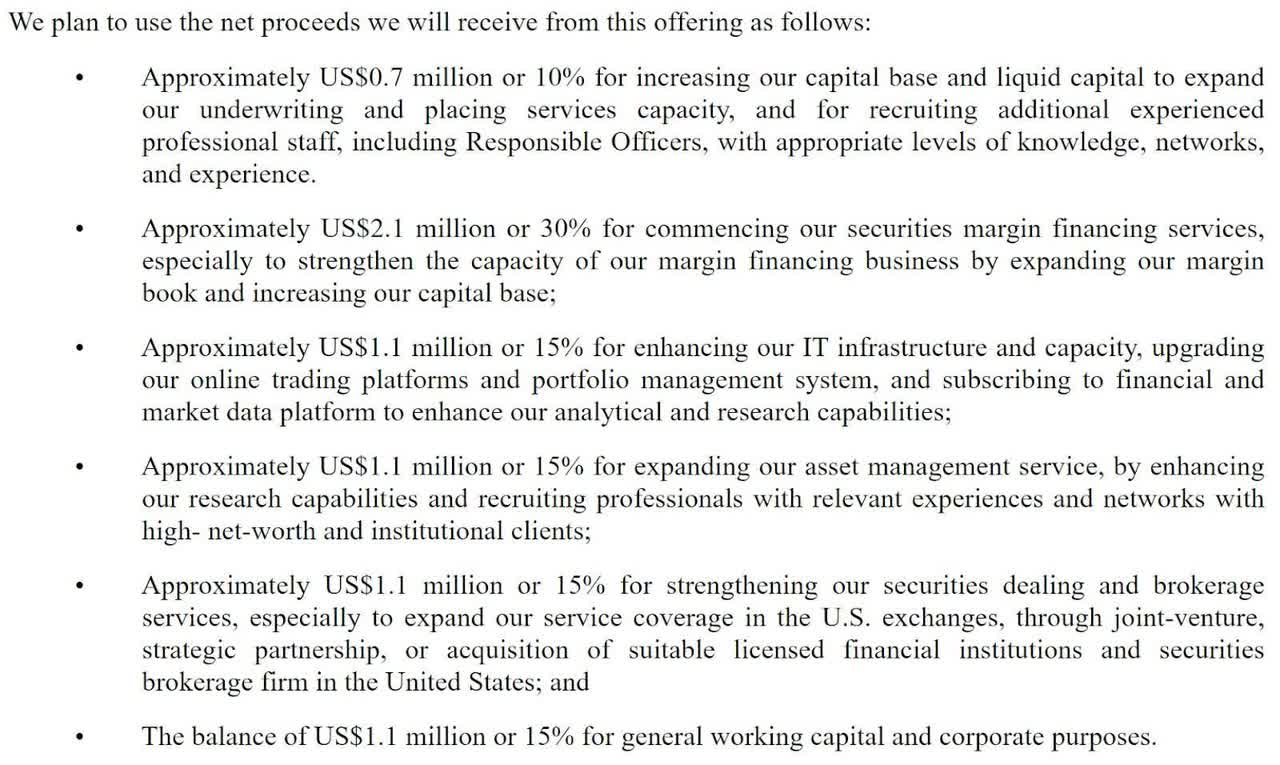

Management says it will use the net proceeds from the IPO as follows:

IPO Use Of Proceeds (SEC)

Management’s presentation of the company roadshow is not available.

Regarding outstanding legal proceedings, management says the firm is not subject to any legal proceedings that it believes would have a material adverse effect on its financial condition or operations.

The sole listed bookrunner of the IPO is Revere Securities.

Valuation Metrics For Garden Stage

Below is a table of relevant capitalization and valuation figures for the company:

|

Measure [TTM] |

Amount |

|

Market Capitalization at IPO |

$60,000,000 |

|

Enterprise Value |

$51,971,311 |

|

Price / Sales |

18.41 |

|

EV / Revenue |

15.95 |

|

EV / EBITDA |

-250.23 |

|

Earnings Per Share |

-$0.01 |

|

Operating Margin |

-6.37% |

|

Net Margin |

-6.36% |

|

Float To Outstanding Shares Ratio |

25.00% |

|

Proposed IPO Midpoint Price per Share |

$4.00 |

|

Net Free Cash Flow |

-$1,898,490 |

|

Free Cash Flow Yield Per Share |

-3.16% |

|

Debt / EBITDA Multiple |

0.00 |

|

CapEx Ratio |

-84.54 |

|

Revenue Growth Rate |

41.31% |

|

(Glossary Of Terms.) |

(Source – SEC.)

Commentary About Garden Stage’s IPO

WIN is seeking U.S. public capital market investment to fund its services expansion efforts and general working capital requirements.

The firm’s financials have produced increasing topline revenue from a tiny base, growing profit before income taxes but comprehensive loss.

Free cash flow for the twelve months ending March 31, 2023, was negative ($1.9 million).

Compensation & Benefits expenses as a percentage of total revenue have increased as revenue has grown; its Compensation & Benefits efficiency multiple was 0.5x in the most recent reporting period.

The firm currently plans to pay no dividends and to retain any future earnings for reinvestment back into the company’s growth and working capital requirements.

WIN’s recent capital spending history indicates it has spent lightly on capital expenditures despite negative operating cash flow.

The market opportunity for providing various financial services in Hong Kong is large but intensely competitive, fragmented and without a dominant player.

Revere Securities is the sole underwriter and the three IPOs led by the firm over the last 12-month period have generated an average return of negative (41.9%) since their IPO. This is a bottom-tier performance for all major underwriters during the period.

Like other companies with Chinese operations seeking to tap U.S. markets, the firm operates within a WFOE structure or Wholly Foreign Owned Entity. U.S. investors would only have an interest in an offshore firm with interests in operating subsidiaries, some of which may be located in the PRC. Additionally, restrictions on the transfer of funds between subsidiaries within China may exist.

The Chinese government’s crackdown on certain IPO company candidates combined with added reporting and disclosure requirements from the U.S. has put a damper on Chinese or related IPOs resulting in generally poor post-IPO performance.

Also, a potentially significant risk to the company’s outlook is the uncertain future status of Chinese company stocks in relation to the U.S. HFCA act, which requires delisting if the firm’s auditors do not make their working papers available for audit by the PCAOB.

Prospective investors would be well advised to consider the potential implications of specific laws regarding earnings repatriation and changing or unpredictable Chinese regulatory rulings that may affect such companies and U.S. stock listings.

The Chinese government may intervene in the company’s business operations or industry at any time and without warning and has a recent history of doing so in certain industries.

Additionally, post-IPO communications from the management of smaller Chinese companies that have become public in the U.S. has been spotty and perfunctory, indicating a lack of interest in shareholder communication, only providing the bare minimum required by the SEC and a generally inadequate approach to keeping shareholders up-to-date about management’s priorities.

As for valuation expectations, management is asking investors to pay an Enterprise Value/Revenue multiple of approximately 16x.

WIN is a tiny, thinly capitalized, undifferentiated financial services company operating in an intensely competitive industry and generating negative comprehensive margin.

My outlook on the Garden Stage Limited IPO is Bearish [Sell].

Read the full article here